The ITR forms for FY 2017-18 and AY 2018-19 were notified by the Central Board of Direct Taxes, the policy-making body of the income tax (I-T) department, on 5 Apr 2018. The last date for filing I-T returns for FY18 is Aug 31 July 31, 2018. This article gives an overview of the ITR forms for FY 2017-18 or AY 2018-19 and explains the changes in the new ITR forms.

Invalidation of Offline ITR utilities & Removal of Saved Online ITR-1 & 4 Computations

If you started filling tax return using offline excel/ java utility & have also saved it, but haven’t filed it before 31st July, then such excel/ java file will no longer remain valid. As some changes have been made in the ITR forms, like Sec 234F, Sec 234A etc, you’ll have to download the new forms from the income tax e-filing website.

In case of online ITR-1 Form Sahaj, if you have saved a draft & did not file it before 31st July 2018, then such draft will no longer be available for you. You will have to fill a new ITR-1 & 4 Form from the beginning

Table of Contents

Overview of ITR forms for FY 2017-18 or AY 2018-19

Financial year (FY) is the year in which you have earned the income. Assessment Year (AY) is the year in which your income is assessed i.e one file returns. For example, if you have had an income between 1st April 2017 and 31 March 2018, then 2017-18 will be referred to as FY and 2018-19 as Assessment Year.

The new ITR forms in PDF format have been made available, while the excel utilities (or) Java Utilities for AY 2018-19 will soon be made available on incometaxindia e-filing website.

According to the tax department, all the new ITR forms are to be filed electronically. The CBDT said that individual taxpayers of 80 years or more at any time during the previous year or an individual or HUF whose income does not exceed Rs 5 lakh and who has not claimed any refund, can file ITR in the paper form, using the ITR-1 or ITR-4.

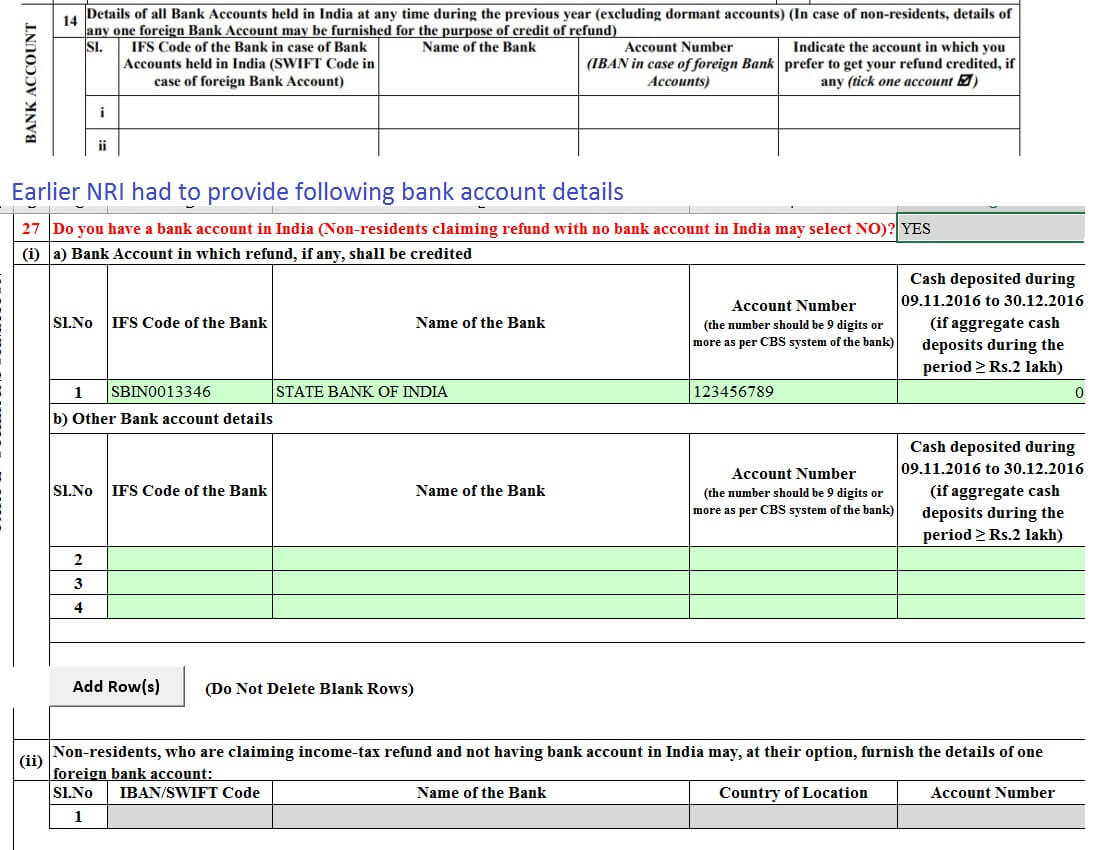

The requirement of furnishing details of cash deposit (in bank account part) made during a specified period (in the wake of the note ban of 2016) as provided in ITR form for the Assessment Year 2017-18 has been done away with this time.

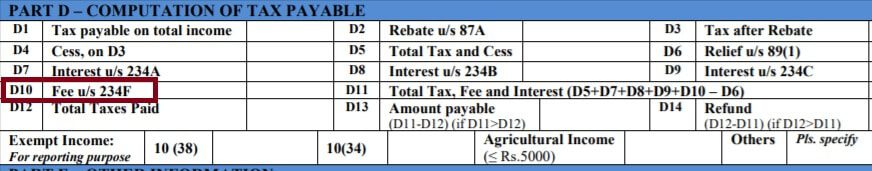

The penalty for not Filing Tax Returns on Time: If you do not file income tax returns on time It was proposed in Budget 2017 and is effective from AY 2018-19 as you can see from the image below.

These new forms for various categories of taxpayers are

- Sahaj (ITR1):

- ITR1 can be filed by an individual who is resident other than not ordinarily resident and having income of up to Rs 50 lakh and who is receiving income from salary, one house property or other interest income.

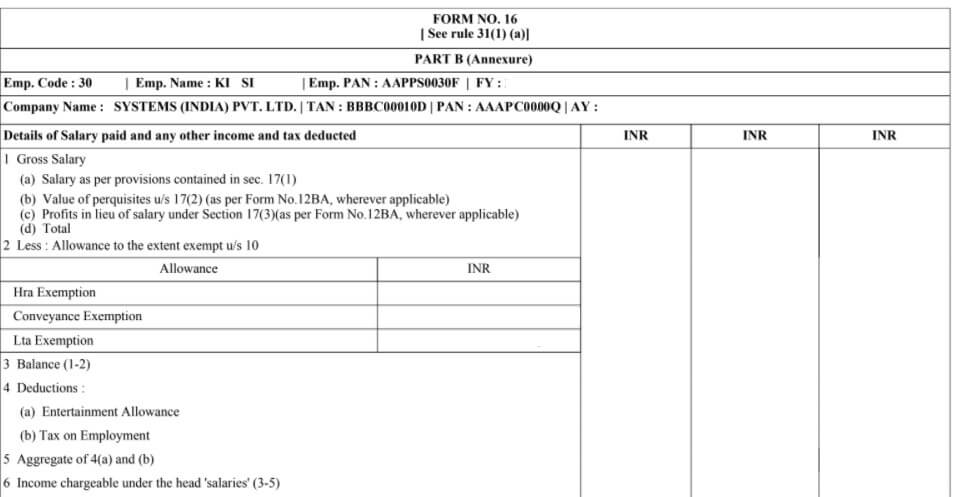

- The new Sahaj form wants you to disclose specific details about your salary. It seeks an assessee’s salary details in separate fields and in a breakup format such as allowances that are not exempt, the value of perquisites, profit in lieu of salary and deductions claimed under section 16. Though these details are provided in Form 16 of a salaried employee, now they have to be mentioned on the tax return for clarity of deductions.

- Sahaj form ITR1 was used by over 30 million taxpayers last year.

- Form ITR2:

- The ITR-2 has “also been rationalised” for individuals and HUFs (Hindu Undivided Families) having income under any head other than business or profession.

- The ITR2 form is no longer applicable to individuals who have profits and gains from any business or profession (unlike last financial year where details of partnership firm could be reported)

- Form ITR3, Form Sugam -ITR4: The individuals and HUFs having income under the head business or profession shall file either ITR-3 or ITR-4 in presumptive income cases, Under the ITR-4, assessees who have presumptive income from business and profession will have to furnish their GST registration number and its turnover.

- Businesses with a turnover of less than Rs2 crore can do away with the requirement of maintaining books of accounts and instead pay a tax on the basis of a certain percentage of their turnover. However, the government fears that there has been the misuse of the scheme.GSTIN number now has to be mentioned in ITR-4 filled by businesses and professionals claiming presumptive income. They also have to quote gross receipts as per GST returns

- Form ITR-5,

- Form ITR-6,

- Form ITR-7,

- Form ITR-V.

Before you file your Income Tax returns, verify your Form 26 AS and Form 16.

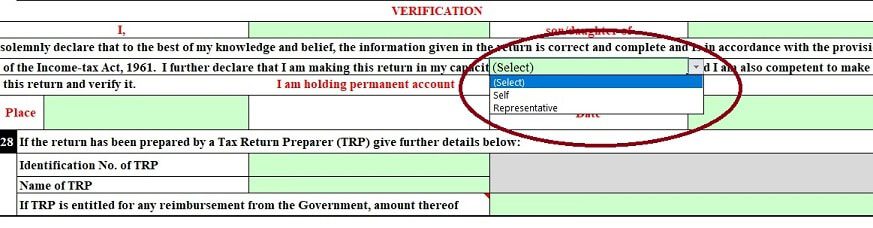

Verification Box

While filing tax return online/ offline, a verification is required to be made by the taxpayer under the head “Taxes Paid & Verification.” After the extension of due date for ITR filing, a new option of selecting the capacity of filing return has been provided. One can either file the return in the capacity of “Self” or in the capacity of “Representative”. This option wasn’t provided before. Further, in case of ITR -4, you will find 4 options, i.e. “Self or Representative or Karta or Partner.”

Penalty for not Filing Tax Returns on Time under section 234F

A new section 234F has been inserted by the government in the Income Tax Act. As per this section, an individual would have to pay a fee of up to Rs 10,000 for filing income tax return after the due dates specified in section 139(1) of the Act. This is over and above the Penalty or interest for not paying advanced tax in time under section 234A,234B and 234C.

The last date for filing I-T returns for FY18 is Aug July 31, 2018.

The fee to be levied is based on the time period of delay which is as follows:

- A fee of Rs 5,000 in case returns are filed after the due date but before the December 31 of the relevant assessment year

- Rs. 10,000 in case it is filed after December 31 of the relevant assessment year.

- However, as a relief to the taxpayers earning not more than Rs 5 lakh the maximum penalty will be Rs. 1000

- After March 31 2019, the returns for FY 2017-18 or FY 2019-20 cannot be filed.

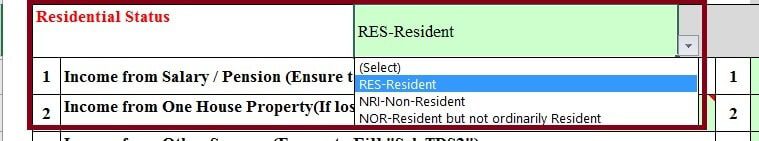

ITR and NRI

Non residents Indians or NRIs will no longer be able to file returns using the simple income tax return (ITR)-1 form, which can now only be used by residents. NRIs will have to use ITR-2, which seeks more information. The ITR1 form earlier allowed one to select the Residential status as shown in the image below, which is missing now.

To ensure that capital gain tax exemption / beneficial rate is claimed only in genuine cases, additional details are required to be furnished where a non-resident is claiming the beneficial provisions of the Double Taxation Avoidance Agreement (DTAA).

Also, Section 50CA was introduced by Finance Act 2017 provides that in case of unquoted shares, fair market value shall be considered as full value of consideration if it is higher than consideration received. In light with this, full value of consideration, fair market value determined in the prescribed manner needs to be reported and accordingly, computation shall be made.

Where a non-resident is claiming concessional tax under Section 115-H, he shall be required to furnish additional details to substantiate the claim.

In case of non-resident taxpayers, the requirement of furnishing details of any one foreign bank account has been continued like the last time for the purpose of credit of refund. But there is change in the way details are asked as shown in Image below.

ITR1 and changes in FY 2018-19

ITR1 can be filed by an individual who is resident other than not ordinarily resident and having an income of up to Rs 50 lakh and who is receiving income from salary, one house property or other interest income.

NRIs will no longer be able to file returns using the simple income tax return (ITR)-1 form, which can now only be used by residents.

The new Sahaj form wants you to disclose specific details about your salary.

It seeks an assessee’s salary details in separate fields and in a breakup format such as allowances that are not exempt, the value of perquisites, profit in lieu of salary and deductions claimed under section 16. Though these details are provided in Form 16 of a salaried employee, now they have to be mentioned on the tax return for clarity of deductions.

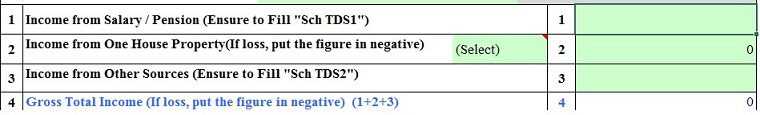

The images below show the excerpt of ITR1 for income in FY 2017-18

The ITR1 form last year (i.e FY 2017-18 or AY 2018-19) just asked for total amount of Income from Salary and Income from House Property, as shown in the image below.

The image below shows the details in Form 16 which shows the salary break up.

ITR2 Changes for FY 2017-18 or AY 2018-19

The new ITR-2 form requires tax payers to furnish the PAN of the tenant while providing details of income from house property, if available. Providing this detail was optional till FY 2016-17. This move should give more data to the Revenue Authorities to enable them to reconcile the PAN of the tenant and the landlord, where an exemption for House Rent Allowance (HRA) is claimed, since employees need to furnish PAN of their landlord to the employer.

The new ITR-2 form seeks details in line with the new clause introduced by Finance Act 2017, for taxing any sum of money or property received (in excess of Rs 50,000) without consideration under specified circumstances [i.e. Section 56(2)(x)]. This will enable the Revenue Authorities to collate details of such income and ensure that the same have been offered to tax.

Changes in Income Tax Rules for FY 2017-18

- The applicable slab rate with respect to an individual having taxable income between Rs 2.5 lakh to Rs 5 lakhs has been reduced from 10% to 5%. However, there has been no change in the tax rates for other slabs.

- The tax rate for those earning up to 5 lakh has been reduced from 10% to 5%, a move that will affect nearly two crore taxpayers.The tax rebate enjoyed by this segment of taxpayers under Section 87 has been reduced from 5,000 to 2,500 and will apply only to incomes up to 3.5 lakh.

- NO RGESS Tax exemption from FY 2017-18 Tax exemption under section 80CCG for RGESS (Rajiv Gandhi Equity Scheme) would NOT be available from FY 2017-18 on wards. The deduction was introduced in Budget 2012 to encourage retail participation in stock market but failed to take off as desired.

- Tax-exemption to partial withdrawal from NPS Partial withdrawal up to 25% of the contribution made by an employee would be exempted from tax.

- Interest deduction on rented property capped at Rs 2 Lakh.Tax break due to interest paid on rented homes (whether first or second) will now be capped at 2 lakh.

- For Loan of amount 35 lakh or less sanctioned for the first-time buyer between 01.04.2016 to 31.03.2017 with the value of house of 50 lakh or more. You can claim the additional interest of Rs 50,000 over and above 2 lakh (under section 24 of the income tax act) for FY 2017-18 or AY 2018-19 under section 80EE.

- Capital Gains for FY 2017-18 AY 2018-19

- Change of Base year for Indexation: For calculation of indexation in case of Long Term capital gains for all assets, the base year has been changed from April 1, 1981 to April 1, 2001.

- Budget 2017 changed the holding period for property to 2 years (from 3 years earlier) to qualify for Long Term Capital gains. This would lead to lower taxes.

- Long term capital gains on shares would only be available if securities transaction tax (STT) was paid while acquisition of shares. This will apply to all shares acquired after October 1, 2004. However this does not include bonus shares or shares allotted during IPO (initial public offer) or FPO (follow- on public offer). It would impact ESOPs, etc.

- Taxpayer, who has sold a house, has the option to invest the gains to buy or construct a new property or invest it in 54EC bonds to save tax on those gains within the specified time period. LTCG tax will not be payable on the amount of gains so invested.

- All the bonds specified under section 54EC issued on or after 1 April, 2018 will come with a tenure of five years. If the bonds are redeemed before the completion of five years, then you will lose the tax benefit.

- Until AY 2017-2018, there was no restriction on the setting off of losses on the rented property or a deemed to be let-out property (arising on account of claiming interest payable on loan taken) against other income arising in the same financial year. Now with effect from AY 2018-2019, such losses can be set off only up to Rs 200,000 against other income. Any excess loss can be carried forward for set-off against income from house property over the following eight tax years.

Article Capital Gain Calculator from FY 2017-18 with CII from 2001-2002 talks about Capital Gains in detail.

Income Tax Slab Rates for FY 2017-18 or AY 2018-19

In AY 2017-18 or FY 2016-17, there were three slabs — 10 percent income tax for annual income between Rs 2.5 lakh and Rs 5 lakh, 20 percent on annual income from Rs 5 lakh to Rs 10 lakh, and 30 percent on income above Rs 10 lakh. This will be applicable, if passed, from 1 Apr 2017 to 31 Mar 2018. Our article Income Tax for AY 2017-18 or FY 2016-17 discusses Income Tax for income earned between 1 Apr 2016 to 31 Mar 2017.

| TAX | MEN and WOMEN below 60 years | SENIOR CITIZEN(Between 60 yrs to 80 yrs) | For Very Senior Citizens(Above 80 years) |

| Basic Exemption | 250000 | 300000 | 500000 |

| 5% tax | 250001 to 300000 | – | – |

| 5% tax | 300001 to 500000 | 300001 to 500000 | – |

| 20% tax | 500001 to 1000000 | 500001 to 1000000 | 500001 to 1000000 |

| 30% tax | above 1000000 | above 1000000 | above 1000000 |

|

|||

Income Tax for FY 2017-18 or AY 2018-19 covers the Income Tax for FY 2017-18 in detail.

All about Income Tax has all our income tax-related posts in 1 place.

7 responses to “Income Tax Filing and ITR Forms For FY 2017-18 or AY 2018-19”

A really Great article, taxpayer understand the whole just by reading your article.

Hello Sir,

I migrated overseas on 25th of August 2017. What would be my residential status for FY 2017-2018. Which ITR form I need to use?

Thanks,

Ramana

sir kindly inform me that how will know how much taxess paid. and not any return flat 2017 ITR FILE.BUT AGAIN FILLED. HOW WILL KNOW HOW MUCH TAXES. ALWAYS FILLED OUR GOVERNMENT. I AM SIMPLE PERSON AND WHICH FUND OR SELF DEPOSIT USE AND EXPENSE. I THINK IF I AM DOING JOB AND AS PER TAXES DEPARTMENT RULE TAXES SLAB IF ABOVE THAN FILE TAXES.WHICH ANY AMOUNT NOT EXPENSE AND NOT EARN SINGLE AMOUNT EARN.HOW WILL TAXES PAID NOT KNOW.KINDLY INFORM AND SUGGESTED ME. AND SIR WHEN NOT DOING JOB BUT I WAS ITR FILING. so kindly help me.because this is burden for me. in my life not any falt for filled taxes return as indian people.

MY SALARY INCOMEIS 72 LAC WHICH FORM IS APPLICABLE IN ASSESSMENT YEAR 2018-19?

Hi, I am a software engineer and working with 30% tax. I am also a IT consultant for another company as a part time employee.

The part time employer is doing TDS at 10% then do I still need to pay taxes at 30% as my salary from first employer is more than 10 lakh ? Can you please help me. Thank you.

Ok you would have to pay tax on the consultant salary but this salary will be considered as Income from Business or Profession.

Your income from consultancy is the sum of receipts from the work you do for your clients. Your clients may be based in India or outside of India. You can use your bank account statements to add up all the receipts that have been credited to your account by clients.

You can deduct expenses that you have incurred directly to earn your freelancing income. These could be your phone bills, internet bills, travelling expense, conveyance, etc.

The Income Tax Department mandates that anybody earning income from business and profession must maintain books of account and get their books audited if they earn beyond Rs. 1 crore (for business) or Rs. 50 lakhs (for profession). To offer relief to small taxpayers, the presumptive income tax scheme was introduced. In this, instead of claiming businesses expenses against receipts and then paying tax on the balance, a certain percentage of your receipts is taken as your net income and you’ll pay tax on that income.

This cuts down all the effort of having to maintain profit and loss statements and estimating taxes over and over again.

Hi,

My wife is a housewife and has earning from Share trading (short term gain of about Rs. 12500) , Mutual fund selling (Long Term Capital Gain) and FD Interest income, Total income not exceeding Rs. 2.5 lacs). However, the bank has deducted TDS for FD interest. So please advise which ITR form she should use while filing income tax return.

Thank you.