With Money comes Great responsibility!

Personal Finance is no Rocket Science. But we are not taught this basic life Skill

An uneducated financial individual armed with a credit card and easy access to loans, with no proper knowledge of investing, savings, financial record keeping can be just as dangerous to themselves and their community as a person who is given a car to drive without training

We are on Mission to make 1 crore Indians to be aware of Money and Personal Finance.

Money, like emotions, is something you must control to keep your life on the right track-Natasha Munson

- Money touches everything

- We have half cooked knowledge of finance

- Lack of financial knowledge has painful consequences

- Financial literacy leads to a Happier life

- soaptoday

Ignore if you don't Love Your Family

When a person dies who will get his money from bank accounts, mutual funds, property, etc? What happens to the Mobile Number, Aadhaar after the death of the person. What happens to credit cards, home loans after death.WHAT IF something happens to you? Can your family live the way you wanted them to live

Income Tax Workbook

With Examples and Worksheet explains what is Income, Income Tax slabs, Types of Income, the tax on different types of Income, dates related to Income Tax, tax cut i.e TDS, how to see TDS, how and when to pay self-assessment tax, how to pay the tax due, how to File ITR More details of the workbook here

Lets Learn Money : Book

Let’s Learn Money Book is for young adults aged 10 and above

Book covers the concepts such as Needs and Wants, How do People Earn, Credit and Debit Cards, Banks, Currency, Mythology and Money. More details and excerpts of the book here

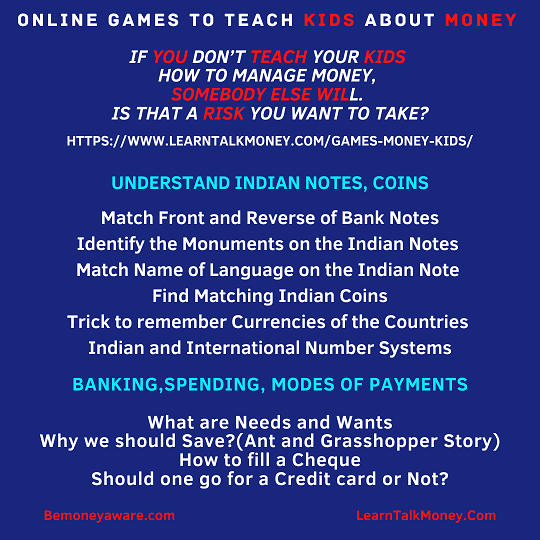

Lets Learn About Money WorkBook

It has activities for young adults aged 8 and above such as matching, fill in the blanks, crossword, identifying on Know your money, Indian currency, the currency of the world, Earning money how do people earn money, different professions, the skills required, how much money, Business, Profit and Loss, Spending money, Saving money and Credit Cards. More details and excerpts of the workbook here

What an Employee Should Know?

CTC, Salary, Leaves, EPF, RSU,Stock Options

All about Income Tax

Income Tax slabs, Types of Income, TDS, Form 16, Form 26AS, How to File ITR

How to Make Investing Portfolio

Understand various Investing options, Fixed Deposits, PPF, Stocks, Mutual Funds,NPS

What Women Should Know about Money

How financially prepared a Woman as she faces situations in life that men don’t such as relocation due to marriage, career disruption, long life?

Books and Workbooks Written by Bemoneyaware

We have written many books and workbooks such as on

A to Z of PaperWork after death

Hello Income Tax Workbook on basics of Income Tax and Filing ITR. Details here

Let’s Learn About Money Workbook with activities for young adults aged 8 and above.

Let’s Learn about Money, Book for Children available on Amazon

1.A to Z of PaperWork after death

When a person dies who will get his money from bank accounts, mutual funds, property, etc? What happens to the Mobile Number, Aadhaar after the death of the person. What happens to credit cards, home loans after death. When a member of the family dies, a gap is left but life goes on and the family needs to pick up the financial pieces. Especially in the case of the bread earner of the family.

2. Hello Income Tax: A Workbook

A workbook on Income Tax which explains the various concepts related to Income Tax with examples and worksheets, We also go through the filing of ITR1 for sample data. Read More

Money Workbook for Children

A workbook to make the future generations aware of money with hands-on money activities on Currency, Needs & Wants, Banks. Read More

4. Money Book for Children on Amazon

Teach your kids how to handle money now with interesting stories. Children will learn about Ways to Earn Money, Credit & Debit Cards, Banking. Read more

5.How to make Investment Portfolio

Understand different investment options like PPF, FD, Stocks, Mutual Funds and make an Investment Portfolio. Read more

About Us

Since 26 Mar 2011, bemoneyaware is working to simplify, remove the jargon, explain the money concepts that ordinary Indian faces, to make them money aware as Awareness Empowers.

The blog is mostly handled by Kirti, Shoobha, Sona, all professional women managing careers with family.

We are not financial experts but have learned about finance the hard way

Testimonials

Bemoneyaware helped our Women in understanding the basics of Personal Finance.

The session was well received and Women would take their first steps towards “investing” without the fear of not knowing

Your session for us women was an eye opener. Despite me knowing a fair bit about investing, you brought up so many points that even I was not aware of such as the fact that one can invest in one’s job, family, etc –

Great book! Simple, relevant, and has stories that make understanding finance easy!!

My kids loved it and I wished I had while growing up