Use the HRA Exemption Calculator to calculate your HRA.

As per income Tax act, for calculation House rent allowance least of the following is available as the deduction. Our article HRA Exemption,Calculation,Tax and Income Tax Return explains it in detail

- Actual HRA received

- 50% / 40%(metro / non-metro) of basic salary. Basic Salary for the purpose of HRA Calculation is Basic pay + Dearness Allowance + Commission based on fixed percentage on turnover and excludes all other allowances and perquisites.

- Rent paid minus 10% of basic salary.

- Number of months one has paid rent for.

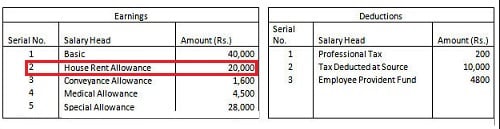

Basic Salary and HRA received one can get from Salary Slip ,an example of which is shown in image below.

Please enter the details for calculating HRA. You can enter annual or monthly values of inputs such as Rent, HRA from Payslip.

| Details (Rent,HRA,Basic Salar) entered are | AnnualMonthly |

| Rent that you pay (Rs.): | |

| Basic Salary (Rs.) : | |

| Dearness Allowance(DA) (Rs.) : | |

| HRA (Rs.) : | |

| Do you live in metro city of Delhi,Mumbai,Kolkata,Chennai | Yes No |

| Num of months claiming HRA for: | |

HRA Exemption :

Overview of HRA Exemption

Employees generally receive a house rent allowance (HRA) from their employers. An employee can claim exemption on his HRA under the Income Tax Act if he stays in a rented house and is in receipt of HRA from his employer. House Rent Allowance so paid by the employer to his employee is taxable under head Income from Salaries , but it can help you save taxes under Section 10(13A) of the Income Tax Act.

-

- You must be an employee. Self-employed professionals cannot be considered for HRA exemption under this act, as they do not earn a salary. However, they can claim benefits on the house rent expenses incurred under section 80GG, which resembles section to 10 (13A) but is subject to certain conditions.

- You must live in a rented residential accommodation, and pay rent for the same. If you stay in your own house, or in a house where you don’t pay rent, you cannot claim the exemption.

- If you pay house rent to your spouse, this does not qualify for exemption. But you can claim exemption on rent paid to others including parents, brother, sister in-laws etc. Our article Claim HRA while living with parents talks about it in detail.

- If you rent the house for only part of the year, the HRA exemption is allowed only for that period. HRA is available only for the period during which the rented house is occupied by the employee. So if you stayed in the house for 5 months and then moved to your own house, you can claim HRA only for the 5 months.

- You must actually pay the rent to claim the exemption. If rent is due but unpaid, the benefit of tax exemption on HRA is not available.

- If both husband /wife are working and living in same house on rent both can claim HRA subject to rent is shared/paid by both and individually,both can claim exemption up to share of rent paid actually paid by you.

- From fiscal year 2011-12 You need to give PAN details of landlord if rent exceeds Rs. 1.0 lakh year or Rs. Rs 8,333 per month. According to the CBDT circular, if your landlord does not have a PAN, he is required to write a declaration signed by him with his complete name and address. The landlord needs to identify himself by attaching valid identification proofs. In the declaration, the landlord has to specify that he does not hold a PAN card.

- Tax benefits for home loans and HRA are two separate aspects and have no direct bearing on each other. If your own home is rented out or you work from another city etc then As long as you are paying rent for an accommodation, you can claim tax benefits on the HRA component of your salary, while also availing tax benefits on your home loan. Please account for any rental income you receive from the property you own under income from House Property.

- You need to submit Proof of Payment or Rent Receipts to Employers. To allow you exemption on HRA, it is mandatory for the employer to collect proof of rent payment ie rent receipt. The employer will give you exemption on HRA based on these rent receipts. TDS will be adjusted so you don’t have to pay tax on HRA. Your tax liability will be calculated accordingly.

- Employer issues Form 16 to his employees for each of the financial year (April to March of next year). Form 16 provides details of the salary income of the employee along with the Tax deducted at Source (TDS). This has details of HRA deducted as shown in image below.

Related Articles:

- HRA Exemption,Calculation,Tax and Income Tax Return

- How to show HRA not accounted by the employer in ITR

- Claim HRA while living with parents