When you buy and hold Mutual Funds, if you get dividends, then what are the taxes associated with Dividend from Mutual Funds. When you sell Mutual Funds, whether Equity or Debt you need to consider if you have to pay taxes on the profit earned or loss. Are Mutual Funds tax-free or taxed? , what are taxes associated with Mutual Funds, what factors affect tax on Mutual Funds. Are taxes the same for all kind of investors? This article explores Mutual Fund Dividends, Tax, Capital Gain in depth.

Table of Contents

Income earned from Mutual Funds: Dividends, Capital Gain

In mutual funds, you can earn income in the form of dividends and capital gains.

- The dividend is paid during the time one is invested in the fund. Dividends are tax-free in hands of investor and are exempt income but still has to be shown in Income Tax return. The Mutual Fund pays Dividend Distribution Tax based on the type of fund. Mutual funds usually offer three options to investors: Growth, Dividend payout and Dividend Reinvestment. Our article Growth and Dividend Option in Mutual Funds discusses it in detail but an overview is given below

- Capital gains come into play when one redeems the Mutual Fund Units. If one sells an asset such as bonds, shares, mutual fund units, property etc, one must pay tax on the profit earned from it. This profit is called Capital Gains. The tax paid on this amount of capital gains is called Capital Gains Tax.

- Conversely, if you make a loss on sale of assets, you incur a Capital Loss. Gains, which arise from the transfer of capital assets, are subject to tax under the Income-tax Act. For the purpose of Income Tax, income is classified under the following heads: Salary, Income from house property, Profits and gains of business or profession, Capital gains, Income from other sources.

- Capital Gains can be further classified as Long Term Capital Gain and Short Term Capital Gain. depending on the type of asset and period of holdingOur post Income tax overview deals in detail on what is the type of income and calculation of Income tax. Capital Gains from Mutual Funds come under the category of Income from Capital Gains.

Video on Income Tax on shares & Mutual Funds: Dividend, Trading

This video explains with examples and Questions:

Types of Income, Income Tax Slabs, Tax on dividend from Shares and Mutual Fund, Capital gain on Mutual Funds both Debt/Equity, Tax based on Types of Mutual Funds,Capital gain tax on Mutual Funds, Indexation(CII), How to use, Capital Gain Statements from Mutual Funds, Joint account, Nominee, Will, Things to be careful while filing ITR for FY2020-21

Capital Gains, Tax on Selling Mutual Funds

The table below lists the Capital gain tax for an Individual based on Type of assets and Time of holding, indexation used or not(along with Stocks & Real Estate). Following changes have been significant:

- In Aug 2014 long term capital gain holding period for debt mutual funds and Fixed Maturity Plans(FMP) was increased from 1 year to 3 years and calculation of Tax without indexation at the rate of 10% was removed.

- From 1 Apr 2018, one needs to pay 10% tax, without indexation, for capital gains exceeding one lakh for stocks and equity mutual funds. However, all capital gains until 31 Jan 2018 will be grandfathered. If you sell stocks and equity mutual funds after 31 Mar 2018 the LTCG will be taxed as follows:

- The cost of acquisition of the share or unit bought before Feb 1, 2018, will be the higher of :

a) the actual cost of acquisition of the asset - b) The lower of :

- (i) The fair market value of this asset(highest price of the share on the stock exchange on 31.1.2018 or when the share was last traded. NAV of the unit in case of a mutual fund unit) and

- (ii) The sale value received/accrued when the share/unit is sold.

- Our article Budget 2018: Long Term Capital Gain on Stocks & Equity Mutual Funds explains it in detail.

- The cost of acquisition of the share or unit bought before Feb 1, 2018, will be the higher of :

- SIP: for the purpose of the calculation of the time period for investments through SIPs every investment has to be considered separately and time period calculation has to be done from the date of SIP investment.

- One can get Capital Gain Statements from R&T agents such as CAMS, Karvy or the fund houses.

Our Capital Gain Calculator can be used to find Capital Gains on different kind of assets. Our article Redeeming Mutual Funds : Check Exit Load,Taxes talks about things one need to consider when one redeems Mutual Funds.

Long term Capital Gains of Debt Mutual Funds, Tax and ITR talks about What are Debt Mutual Funds from a tax perspective, what are the Short Term Capital Gain and Long Term Capital Gains of Debt Mutual Funds, Computation of Long-Term Capital Gains with an example, How to show the Long Term Capital Gain in ITR.

Short Term Capital Gains of Debt Mutual Funds,Tax, ITR talks about Debt Mutual Funds from a tax perspective, what are the Short Term Capital Gains of Debt Mutual Funds, Computation of Short Capital Gains with examples, How to show the Short Term Capital Gains in ITR.

| Type of Asset | Short Term Capital Gain | Long Term Capital Gain | Tax on Short Term CG | Tax on Long Term CG |

| Non-Equity Mutual Funds

(Effective 1 Aug 2014) |

Selling before 3 year |

Selling after 3 year |

Added to income and taxed as per tax slab. |

If indexation used 20%

|

| Equity Mutual Funds with STT paid | Selling before 1 year | Selling after 1 year | Taxed at 15% | NIL if capital gains are less than one lakh

10% if capital gains exceed one lakh |

| Fixed Maturity Plan(FMP) | Selling before 3 year | Selling after 3 year | Added to income and taxed as per tax slab. |

If indexation used 20% |

| Stocks with STT paid | Selling before 1 year | Selling after 1 year | Taxed at 15% | NIL if capital gains are less than one lakh

10% if capital gains exceed one lakh |

| Real Estate, Gold & Others | Selling before 3 years | Selling after 3 years | Part of total income and normal tax rates are applicable. | Indexation benefit is available and tax rate is 20% |

Types of Mutual Funds

Tax on Mutual Funds depends on the type of Mutual Funds. There are various kinds of Mutual Funds such as Equity Funds(Large Cap,Mid Cap), Balanced Funds,Sector Funds, Debt Funds, Gold Funds, Exchange Traded Funds etc. For tax purposes, Mutual funds are divided into two categories Equity Funds and Non Equity Funds.

- The Mutual Funds where equity holding is more than 65% of the total portfolio are categorized as Equity Funds. Securities Transaction Tax (STT) is levied on redemption of Equity Mutual Funds irrespective of the holding period

- Other Mutual Funds come under Non Equity category Examples: Debt Funds, Liquid Funds, Fund of Funds (mutual funds which invest in other funds), International funds (funds which have more than 35% exposure to international equities)

- Exchange Traded Funds (ETF) are treated as equity or non-equity fund depending upon the underlying security. If it invests in domestic equity it will be equity fund, otherwise non-equity.

Mutual Funds Tax and type of Investor: Individual, Company, NRI

Your Tax Status is also important to determine the tax implication on your investment in a mutual fund. The various kinds of investors in Mutual Funds are

- Resident Individual

- Hindu Undivided Family (HUF)

- Partnership Firm / Association of Person (AoP) / Body of Individual (BoI)

- Domestic Company

- Non-Resident Indian (NRI)

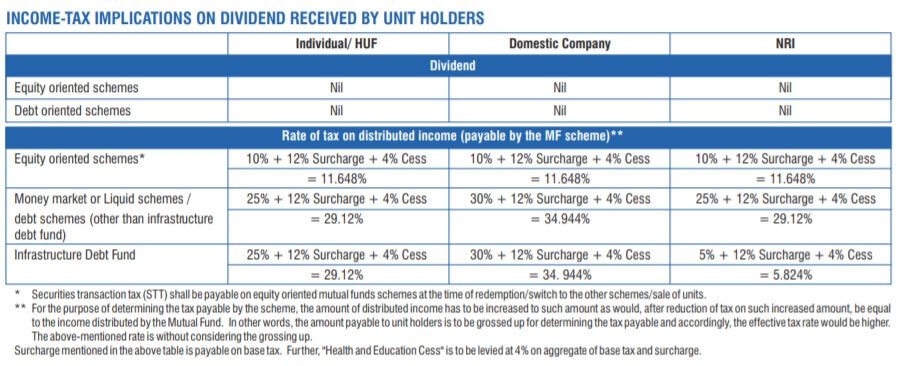

Mutual Funds, Dividends, DDT and Tax

Typically dividend is associated with stocks. A dividend is a portion of a company’s earnings that is returned to shareholders. But with Mutual Funds dividends are different. A mutual fund does not declare a dividend from its own pocket but the dividend is drawn from the Net Asset Value or NAV. If the fund has a NAV of 50 and declares a 20% dividend ( 2 on a face value of 10), the NAV will fall to 48 after paying the dividend. The amount of dividend that is declared will be reduced from the Net Asset Value (NAV), so effectively your net wealth does not change. So basically Dividend in a mutual fund is your own money coming back to you.

Under dividend option, the mutual fund will pay you from the profits made by the scheme at periodic intervals. However, these dividends are not guaranteed and the mutual fund is not under any obligation to announce a dividend. Dividend amount or when it will be declared is also not fixed.

Dividends are not taxable at the hands of investors, well not directly, but Mutual Fund companies have to pay Dividend distribution tax or DDT based on the type of Mutual Funds, such as non-equity-based schemes, and the NAV will come down that much. For example, if you hold a fund with a NAV of Rs. 22, and it paid out Rs. 2 per unit as a dividend, it will pay a DDT of Rs. 0.5 (25% of dividend) and the NAV will fall down to Rs. 9.5. For individual investors, the DDT is 29.12 per cent (inclusive of surcharge).

Dividend Payout & Dividend Reinvestment

- Dividend Payout Option: Dividend is paid out to the investor. NAV of Mutual Fund is reduced.

- Dividend Reinvestment Option:

- Under this option, the dividend is not paid to the investor but is used to buy more units of the scheme on his behalf. In dividend reinvestment option too instead of giving profit as cash, they are allotted to you as units at the prevailing NAV. Hence, indirectly, by adding more units, you simply stay invested in the fund. Conceptually, the dividend reinvestment option is the same as the growth option for all equity funds.

- As with dividend payout, the NAV of the scheme falls after the dividend is paid.

- Though the dividend reinvestment option does not effectively make any difference in the value of the investment, Please note that reinvested dividend is treated as a new investment. This means in the case of tax-planning funds, ELSS a fresh lock-in period comes into effect. So in Jan 2015 AMFI, the governing body of Mutual Funds asked the Mutual Funds not to give Dividend Reinvestment option under the equity-linked savings schemes (ELSS).

Growth option of Mutual Funds

- Under the growth option, the Mutual Fund does not pay any dividend but continues to grow. You will not get any payout in between, However, the NAV may fluctuate depending on how the markets behave from time to time.

- You will get your returns only on selling the units.

- Tax liability arises only when you decide to redeem your holdings and depends on the period for which you remain invested in that scheme and is classified into Long Term capital gain/Short Term Capital Gains

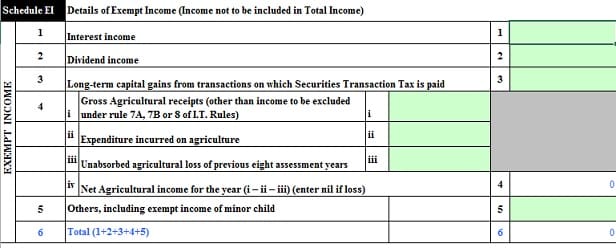

Dividend Income and Income Tax Return or ITR

Though Dividends are not taxable in hands of investors they need to be shown in the Income Tax Return Form as Exempt Income as shown in the image below, Row 2. Our article Exempt Income and Income Tax Return explains it in detail.

What is Long Term Capital Gain & Short Term Capital Gain?

There are 2 types of capital gains Short Term Capital Gain and Long Term Capital Gain, based on how long the asset was held. Immovable property and unlisted shares become long-term assets when held for more than 36 months; in case of listed shares, the period of holding is just 12 months for the categorisation. Our article Basics of Capital Gain explains Capital Gain in detail. Our article Cost Inflation Index,Indexation and Long Term Capital Gains explains how to use indexation for Long term Capital Gains.

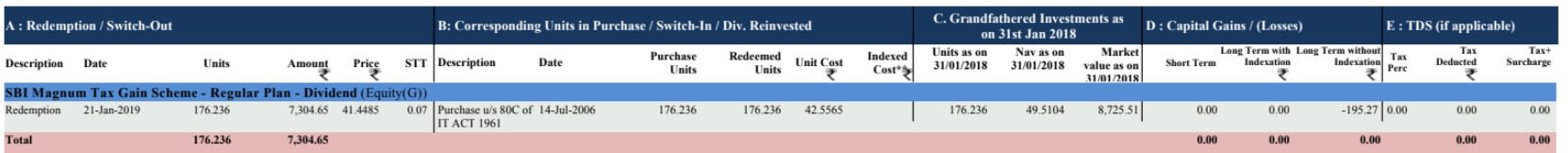

Capital Gain Statement for Equity Mutual Funds

The image below shows Capital Gain Statement for Equity Mutual Funds

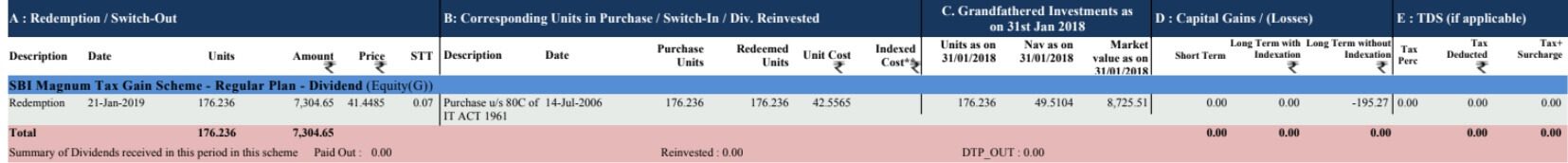

Capital Gain Statement for Debt Mutual Funds

The Image below shows Capital Gain Statement for Debt Mutual Funds

SIP, Lump Sum and Mutual Fund Tax

Systematic Investment Plan or SIP is when a regular sum of money is invested each month on a fixed date. This gives various benefits including that of regular investment as well as rupee cost averaging and hence experts and financial planners prefer this route. This however often leads to some confusion when it comes to calculating the tax on the gains earned on the investment.

In a lump sum investment buying of mutual funds happen on a single day and selling of mutual funds on another day. Period of holding is time between sale date and purchase date. So if Mr Verma bought mutual fund units on 1 st June 2013 and sold it on 12 May 2015 his period of holding of Mutual fund was 710 days. If he had invested in Equity Mutual Fund this would be long term capital gain. If Mr Verma had bought non-equity debt mutual funds then as it is less than 3 years it is short term capital gain.

For tax purposes, units of mutual funds schemes should be considered as separately date-stamped. That is, every unit will carry a date of allocation that would be the exact date of net asset value (NAV) allocation for that unit. This means that for the purpose of the calculation of the time period for investments through SIPs every investment has to be considered separately and time period calculation has to be done from the date of SIP investment. When it comes to the Systematic Investment Plan one has to look at the individual cost for each of the transactions and then this will have to be compared to the sale price to arrive at the final capital gains that have actually been earned.

For example, An investor, Mr Sharma, started a SIP in equity fund from the 5th of April 2018 for a year. If he sells on 20 May 2019 then

- On 20 May 2019 only two investment, one made in 5th Apr and one made in 5th May have completed 1 year. For these two investments, as it is equity fund and 12 months are over, long term capital gain will come into play. For non-equity funds, 3 years are required for calculation of long term capital gains.

- Rest of monthly investments from Jun 2014 to Apr 2015 have not completed the year. So for these investments, short term capital gain will apply. For non-equity funds, 3 years are required for calculation of long term capital gains.

- Please note that the NAV of each instalment will be different. While on Selling, the Selling price would be NAV for all instalments sold on the same date

Capital Loss and Mutual Funds.

What if I sell a fund that is performing badly? If you sell your holding within a one-year period /3 year period for non-equity funds and you make a loss, this is a short-term capital loss. You can set off this loss against any other short or long-term capital gains that you make. You can also carry the Capital Loss if you file your returns on time.

But if you make a long-term capital loss on an equity fund, for instance, you cannot avail the set off as the gain itself is originally exempt from tax.

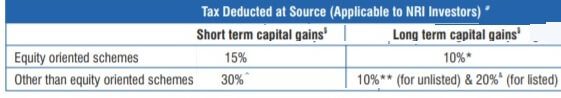

TDS and Mutual Funds for NRI

There is no TDS or Tax Deduction at Source for Domestic Investors on redeeming any Mutual Fund.

But TDS is applicable to NRI investors. Our article NRI : TDS,Tax and Income Tax Return explains who is NRI, Tax and TDS on various kinds of income for NRI, example bank accounts, fixed deposits, mutual funds, stocks etc. How to use DTAA? When should NRI file Income Tax Return?

Surcharge, Education Cess and Mutual Funds Tax

The surcharge is levied on the individuals or companies if the income exceeds some limit. For example

- Surcharge is levied at the rate of 5% for domestic companies having total income exceeding INR 1 crore but not exceeding INR 10 crores.

- Surcharge at the rate of 12% to be levied if the total income of the domestic company exceeds INR 10 crore.

- In case of Individuals / HUFs / Firms / AOP / BOI having total income exceeding INR 1 crore, surcharge to be levied at the rate of 12%.

Secondary and Higher Education cess is levied at the rate of 4% calculated on tax payable plus applicable surcharge

Quiz on How Gains & Dividends from Mutual Funs & Stocks are taxed

Our Book on Capital Gains

If one sells an asset such as shares, mutual fund units, property, etc, one must pay tax on the profit earned from it. This profit is called Capital Gains and tax paid is called Capital Gains Tax.

This book of 172 pages explains the various Capital gain in detail with examples and pictures. You can buy it from here

Related Articles:

- Investing in Equities: Stocks vs Mutual Funds

- Investing in Mutual Funds for Beginner

- TDS, Form 26AS and TRACE

- Understanding Form 16: Part I

- Income Tax for Beginner, Income Tax For Beginner – Part II

Our new Constitution is now established, and has an appearance that promises permanency; but in this world, nothing can be said to be certain, except death and taxes,” Benjamin Franklin, one of the founding fathers of the United State of America, wrote in a 1789 letter. Benjamin Franklin is on the 100 dollar US note.

Hope it helped you to understand taxes on Mutual Funds? Do you go for the Dividend option or Growth option of Mutual Funds?

How to save money on BY investing in Mutual funds and the money earned via Mutual funds ? Which are best tax saving mutual funds with high returns?