We get a lot of questions about people’s EPF claims rejected. In this article, we have discussed some of the common reasons why EPF claims are rejected and how you can fix those.

Table of Contents

Govt Notice with Email details for EPF

In view of the recent spike in the number of Covid-19 cases, all Subscribers/Pensioners/PF members are requested to make use of online services to enquire about their Provident Fund claim related matters. PF Members and Employers coming under the jurisdiction of Regional Office, Chennai (North) can send e-mails to ro.chennai1@epfindia.gov.in while those within the jurisdiction of Regional Office, Chennai (South) are requested to send emails to ro.chennai2@epfindia.gov.in. The landline numbers 044-28139200, 201, 202 and 044-28139310 are also available on working days for raising grievances. Moreover queries can also be communicated to whatsapp number 09345750916 for matter relating to Regional Office, Chennai (North). Subscribers working in establishments under jurisdiction of Regional Office, Chennai (South) can send queries to the whatsapp number 06380366729.

It is appealed to the PF members to make use of the on line facilities keeping in view the prevailing pandemic situation.

This is stated in a press release issued by Shri. Rituraj Medhi, Regional Provident Fund Commission-I, Regional Office, Chennai North & Chennai South.

Common Reasons why EPF claims are Rejected and Solutions

I worked in 2 companies and after leaving the second company I withdrew my EPF. Not when I try to transfer my 1sr company EPF my claim is rejected. The rejected reason is the claim already settled what to do now?

To withdraw from the first employer you would have to approach the first employer and do it offline. This becomes time-consuming.

One has to transfer the old PF account to the new account. Only then will you be able to withdraw from both accounts online. Linking of PF account with UAN is not sufficient

If you don’t transfer your PF account from the old to the new employer?

- Then you would have two separate EPF accounts.

- If you leave 2nd organization and withdraw then you will be able to withdraw from only the last employer.

- To withdraw from the first employer you would have to approach the first employer and do it offline. This becomes time-consuming.

- The old EPF account will be considered inactive. It will earn interest but you will have to pay tax on it. It will also show in Form 26AS.

Our article Why should one transfer an old EPF account to the new employer? explains it in detail.

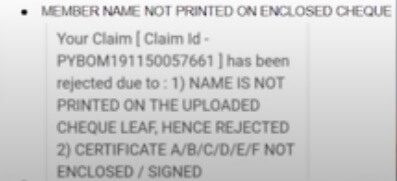

Name not Printed/Different in Cheque

As per the new process of PF withdrawal, you need to upload a copy of the cheque or passbook during your PF withdrawal. This is done to cross-check whether your submitted bank details match the details of your bank account or not. If it does not match then the PF claim is rejected.

Solution: You have to upload cheque/passbook that has your name printed as the account holder. When you go to the bank and get the chequebook, the name is not printed on the cheque book. To get cheque book with name in the order cheque book online/SMS.

EPF Claim rejected as Your name in UAN account differs from bank record

Your PF claim can get rejected because of the difference of your name in the bank account and in UAN.

Solution 1: Make sure that your first name, middle name, and last name match in both the UAN and bank account. Submit an application to Bank to update your name. They may require to submit the one and same person affidavit. Once you complete the bank formalities, order a new cheque book or passbook. Upload your correct passbook/bank details followed by the approval of the same from your employer

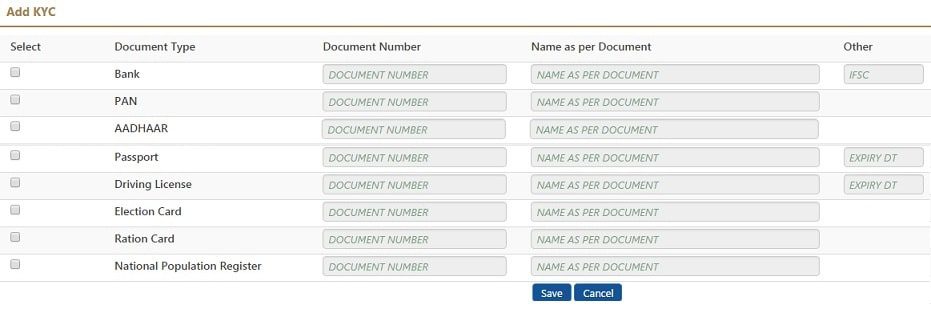

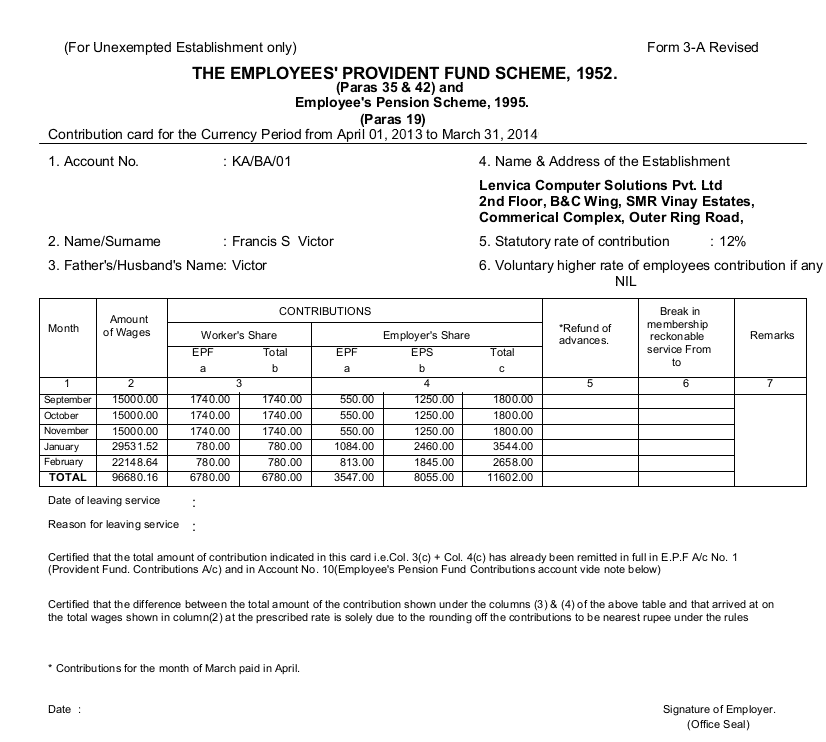

Solution 2: Change your bank account in UAN. You need to add new bank account details in KYC of UAN. You employer has to approve it. Explained in detail in our article UAN KYC : Add Details PAN,Aadhaar, Bank Account

Name in UAN account differs from Aadhaar

Solution: You need to fill the Joint Declaration Form. Along with that, you need to write an application stating that your Aadhaar is already linked but still your name is different. It might be because you have already linked it in the past.

Number of digits in Bank account number, esp SBI

Many account numbers start with Zero(0) and while adding bank account details many people ignore these. Hence PF claim gets rejected as bank account details do not match.

This issue is usually faced by the SBI bank account holders. SBI passbook shows 11-digit account number. But in Internet Banking, you will see a 17-digit account number.

Solution: You need to update the bank details by giving all the digits including 0s. So for SBI give the 17-digit account number. You need to update Bank details in KYC, get it approved by your employer. Then again claim online.

EPF Claim rejected as Bank Details are Incorrect

Incorrect bank details issue could occur due to the change in the IFSC Code due to the mergers of banks or it could be due to the use of the joint account in the PF KYC.

The PF department may accept the bank account if the joint account is with your spouse. However, in the cases of friends, relatives, or anyone else, the PF department usually rejects the claim.

Solution: You can redo the Bank KYC and get it approved by your employer. Then apply for the PF claim.

EPF is Settled but returned

In this scenario, the PF department initiates for the settlement of your PF claim, however, due to the incorrect bank details or the IFSC Code, the amount is sent bank to the PF department.

Solution: To fix it, you can either correct your KYC details and apply for your PF again. Followed by this, you need to also upload an application to the PF department that you have updated your KYC details, please re-authorize my details.

Or, you can also do it through offline means by filling up the reauthorization form and submitting it to your nearest PF office with your correct bank details and a copy of your passbook and Aadhaar.

EPF Claim rejected as Certificate A/B/C/D/E/F not signed or enclosed

This is one of the common reason why PF claim is rejected. This is because of the EPFO officer while processing the claim while entering the reason for rejection chooses this. The EPFO office can select 2 reasons from the dropdown-others and Certificate A/B/C/D/E/F. If Epfo officer selects the ‘others’ they have to manually enters the details. Whereas if often they select the first option from the dropdown i.e. Certificate A/B/C/D/E/F and then they don’t have to enter the details.

However, in some cases like for advance, the reason may be genuine. Such scenarios usually take place in the cases of advance. Sometime, you may claim your advance due to the reasons like natural calamity, factory lockdown, strike, etc. For such reasons, you need to fill the certificate and send it to the PF department along with a copy of your passbook.

Solution: If you are claiming advance, then we would suggest you not to use such reasons. Instead, you can use the illness reason or any other genuine reason so that your PF is not rejected.

PDF not opened Re-Submit

Sometimes the uploaded PDF is corrupted and it does not open.

Solution: Please validate the PDF file on your local computer before uploading it. Also, make sure that the file follows the size restriction.

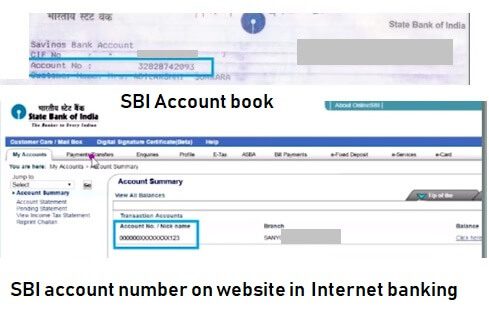

Wages less than Rs. 15000 eligible for pension membership but establishment not remitted pension contribution. Or,

Member DOJ after 01/09/2014 wages more than Rs. 15000 Please confirm if the previous service any.

After 1st September 2014 PF Department said if any person starts his new job with a salary more than Rs. 15000 then his pension contribution would be nil. Often employer not being aware of it cuts the EPF. This was introduced through an official notification called GSR 609(E). The GSR 609(E) has however been rejected by the Supreme Court and there has been no update about it since then.

Solution

The Employee needs to follow up for no fault of his. Yes, it sucks but you need to fight out to get your money. For your next job make sure that your entire Employer contribution is going towards EPF

The solution suggested by EPFO is “You are advised to approach the employer for rectifying the same by submitting the revised return to the EPFO for merging the EPS contribution to EPF”

Known as a member’s annual contribution card, Form 3A depicts the month-wise contributions made by the subscriber/member and employer towards E.P.F and Pension Fund in a particular year. The data is calculated for every member who is a part of the scheme

Check out details at Basic Salary More than 15000, EPS Contribution, Rejection of Transfer or EPF Claim

EPF Claim rejected due to DOJ/DOL Reasons

This error might have occurred because your employer might have entered your wrong date of joining or the date of leaving. As a result, if your return is not filed for a particular month, you would not be able to process the claim.

Solution: To fix the date of joining, you need to fill a joint declaration form along with new employer correcting the date of joining or

To fix the issue of date of leaving, you need to fill a joint declaration form along with old employer correcting the date of leaving.

Insufficient Service

Insufficient Service rejection means that you have not served your service for a min. duration of 6 months. In such scenarios, you would be able to apply for EPF Withdrawal using Form 19 but cannot apply for EPS(pension) withdrawal using Form 10C.

Solution: Please note that pension withdrawal can be done only after 6 months of service.

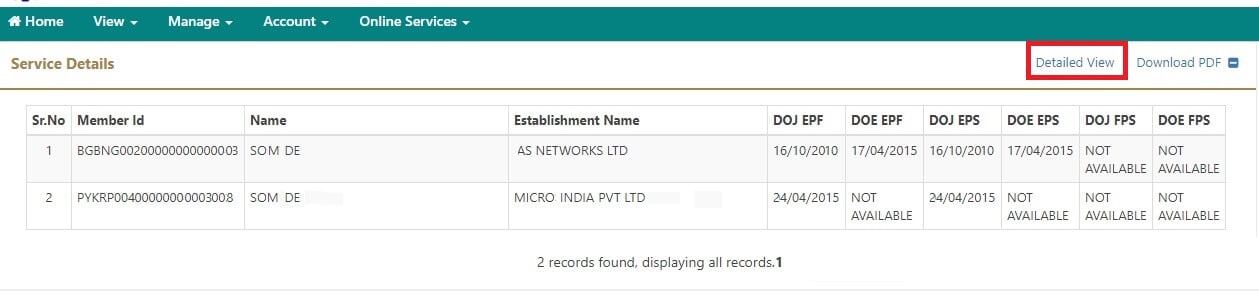

You can check your service details by Logging in to UAN Portal at Member Home and click on View->Service History and it would show details as shown in the image below.

Please note that it is important to transfer your old EPF account when you change jobs as explained in the article Why should one transfer old EPF account to new employer?

Our article How to check Member Ids or PF accounts linked to UAN covers it in detail.

Submit Form 19 and 10C both

Form 10C is used only for Pension withdrawal whereas Form 19 is only for the PF. However, based on the reviews of the claimants it has been found that if you are just filling up Form 10C then the PF department is rejecting the claim.

Solution: You need to fill both Form 19 and Form 10C to withdraw your complete amount i.e. Pension + PF.

Multiple PF Numbers

If you have made a withdrawal from your latest PF number and made a transfer from your old PF number then you would still be having some amount in your PF. However, the claim is rejected and the reason is being stated that your claim is already settled.

Solution: You write an application to the PF department stating that you still have some amount in your PF account due to which you are applying for the PF claim. And send details about passbook

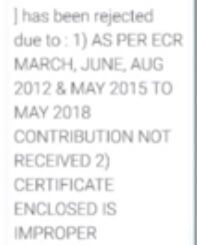

Contribution not Submitted

In this case, your employer has not made the contribution of the PF due to which the PF department cannot process your claim.

Solution: You must check and update your passbook on time to make sure that there is no discrepancy. If you find any discrepancy then connect with your employer and ask them about you not getting the contribution of your PF.

Father Name Different

The rejection may be due to the presence of the wrong/different father’s name in your PF records and bank passbook. Often it happens when you

Solution: You can upload your cheque in which your name is written. In this scenario, there would be more chances of acceptance of your PF claim. Or, if you are unable to do it then you would have to fill a joint declaration form and correct your father’s name through that.

Changing the father’s name cannot be done online. This is explained in our article How to Correct EPF Details like Name, Father Name, Date of Joining

HIGH VALUE CASE CONFIRMATION MAIL NOT RECEIVED AS PER APPROVER

If you receive this remark – It means that they sent an email to your employer or payroll management company to verify that this withdrawal is initiated by you.

This rejection reason is given when they don’t get a reply on that mail within 4 – 5 days,

The employer has to reply to the email.

Thanks, Parikshit for the details.

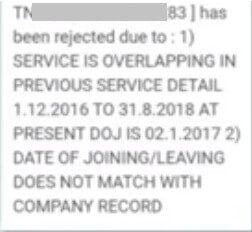

Service Overlapped

Service overlapping cases occur due to the overlap of your service. For example, you might have worked full time and part-time together in some company. In such a situation, you may get a PF rejection issue.

Solution: As per an official in the PF department, you have to go to the PF office and get your PF merged. In such scenarios, it may happen that you won’t be able to apply for the claim through online means and you would have to apply for the offline claim. In such a scenario, you may feel certain troubles while you apply for the claim.

Video on EPF Rejection Reasons

This video explains all the EPF Rejection Reasons.

Related Articles:

List of articles for an Employee: Earning, EPF, UAN, Study

- Basics of Employee Provident Fund: EPF, EPS, EDLIS

- Understanding Employee Pension Scheme or EPS

- Basic Salary More than 15000, EPS Contribution, Rejection of Transfer or EPF Claim

Claim got Rejected for remark

Contribution not remitted as per doe pls check

Kindly help anybody

Claim Rejected due to PROMOTER/ AGENCY DETAILS NOT AVAILABLE . APPLY UNDER ANOTHER PARA

I have submitted 2 claims and both got rejection, with following comments.

1) YOU JOINED AFTER SEP 2014 AND YOU ARE A PENSION MEMBER PL CLEARIFY IF YOU HAVE ANY OTHER SERVICE PL 2) FATHERs NAME DIFFERS

2) PLEASE PROVIDE PREVIOUS SERVICE DETAILS ANN K COPY FOR UPDATING EPS SERVICE DETAILS 2) FATHERs NAME DIFFERS

My query is where and to whom I have to provide these details and how?

Thanks!

hello sir, i have raised a claim for one pf – one account but claim is rejected stating that “EQUAL SHARES REMITTED FOR A EPS MEMBER. KINDLY CLARIFY”. what should i do know?

I got error ‘Claim Rejected PLZ RESUBMIT FORM-10C CLAIM ALONG WITH FORM-19’

Where I have form 10C and form 19 separately so how to submit it together.

My PF claim rejected with below reason :

MEMBER REQUESTED TO RESUBMIT THE CLAIM AFTER SETTLEMENT OF PREVIOUS SERVICE

Claim Rejected NOT ELIGIBLE AS ESTABLISHMENT IS WORKING PL SUBMIT CLAIM FOR WITHDRAWAL/TRANSFER – may i know the reason for this ?

I got the below comment from the case officer. “The said f13 was rejected due to pension contributions not received so whether pension member or not .. clarification called from company”

Sir

I have claim for total amount, close my account, in this regard i have applied to EPF.

but our claim rejected for the following reason, what will do.

Claim Rejected WAGES HUGE FLUCTUATIONS FROM DOJ TO DOL BUT NCP DAYS NOT FURNISHED

Claim Rejected SERVICE LESS THAN 6 MONTHS.

Please guide how we can withdraw the pension amount.

Applied for Pension Rejected with a reason like…..

Claim Rejected WARNING-520360 MEMBER_ID HAVING PENDING CLAIMS, KINDLY VERIFY THE DETAILS USING MEMBER LEDGER BEFOR

Anybody kindly guide

Claim Rejected AS PER RC AND COMPLIANCE INSTRUCTION THE CLAIMS CAN NOT BE PROCESSED UTPO ESTABLISHMENT VERIFICATION

means what , what to do now .

Hi Sir – I get the below note for PF claim rejection,

Claim Rejected APPLY FOR SETTLEMENT/TRANSFER SINCE DATE OF EXIT UPDATED

Kindly help.

My claim got rejected because of “GOVERNMENT CERTIFICATE REQUIRED”

what does it means?

I have applied for a monthly pension but it is showing

”Claim Rejected PREVIOUS SERVICE DETAILS DATE OF JOINING MEMBER AGE (48 YEARS) ”.

DATE OF JOINING SERVICE: 01-04-2013

DATE OF LEAVING SERVICE: 31-03-2023.

WHAT IS THE SOLUTION NOW ?

THANKS IN ADVANCE

I have applied for a monthly pension but it is showing

”Claim Rejected PREVIOUS SERVICE DETAILS DATE OF JOINING MEMBER AGE (48 YEARS) ”.

DATE OF JOINING SERVICE: 01-04-2013

DATE OF LEAVING SERVICE: 31-03-2013.

WHAT IS THE SOLUTION NOW ?

Claim Rejected MEMBER SERVICE IS MORE THAN 10YRS, HENCE APPLY FOR 10C(SCH CERTIFICATE)

can you please explain the reason?

thank you in Advance

What is the solution if the reject reason is ‘Claim Rejected NOT AN EPS MEMBER’ In my passbook It shows I have some funds left in the pension section however when I applied through 10C it was rejected.

My PF partial claim request was rejected with, following reason, “Claim Rejected CONTIBUTIONS MISSING FOR FEW MONTHS B/W DOJ&DOE. REASON FOR NCP REQ.CLARIFY THROUGH ER”

Not sure what are my next steps, where I have to provide the requested details.

Check your service history!

Check your pass back!

where do we need to clarify? how do we do it

Claim got rejected with message “Claim Rejected PREV EPS SERVICE NOT ACCOUNTED . RESUBMIT THE CLAIM AFTER ACCOUNTING THE SAME. IGNORE F/N DIFFRS”.

My service history is updated and even DOJ N DOE of EPS and EPF are also updated.

But while claiming, service history do not match with actual and service history in “service history tab” . Due to which my claim is getting rejected.

Raised grievances and every time response is different 😀

Sir can you please help me with this

claim rejected less than ten years service of member not eligible this advance

My claim was rejected with below reasons

Claim Rejected ESTT IS LIVE, SO YOU ARE NOT ELIGIBLE UNDER THIS PARA

What does this mean?

sir one pdf document not uploaded pl help higher pension correction option

My claim got rejected multiple times with the below reason:

1) SUBMIT LEDGER COPY FROM XXXX/XXXXX/XXXX (oldest PF account) TO XXXX/XXXXX/XXXXXXX (previous PF account) 2) FATHERs NAME DIFFERS

They are asking me to provide ledger copy of my previous PF transfer in-order to process the current transfer.

Do you know what is ledger copy and from where can i get it and where should i submit it?

Any inputs would be highly appreciated.

claim rejected warning-520668 neft transfer in credited after compilation of annual accounts, kindly verify the de. Please let me know what is the this issue

After fillup form 10c for eps-95 withdrawal the amount as service 6-7years . Message was rejected as already settled but fact is not getting any amount for eps

I have submitted Form 10c pension withdrawal, I have total 5 years of service in PF.

Got the below rejection message.

Claim Rejected PL SUBMIT YOUR PREVIOUS EPS PASSBOOK SO AS TO PROCESS ALONGWITH CANCELLED CHEQUE FOR VERIFY THE DET

I applied for partial withdrawal against “Purchase of Dwelling House/ Flat from a

Promoter” but the following rejection reason was given — “Claim Rejected NOT ELIGIBLE UNDER THIS PARA DUE TO PAYMENT CAN NOT GIVEN TO AGENCY.”

What does this mean and how to seek claim again to avoid this rejection reason.

HI,

My claim rejected with below reason:

1) in previous mhban is eps member but present compnay not eps member pl clearfy not eps member 2) PHOTOCOPY OF BANK PASSBOOK NOT ATTESTED BY THE AUTHORIZED SIGNATORY

what is this mean?

I moved to foreign country permanently and trying to withdraw full amount.

Regards

Raj

Hi All,

PF Transfer claim rejected due to please submit previous eps service details copy on Annexure K.

Claim Rejected EPS CONTRIBUTIONS NOT REMITTED , ADVISED TO VERIFY THE SAME IN UAN PASSBOOK BEFORE SUBMIT

Your Claim [ Claim Id – XXXXX ] has been rejected due to : 1) SUBMIT LEDGER COPY OF XXXX/XXX/XXX (oldest PFAccount) TO THIS OFFICE TO VERIFY WAGES.IGNORE 2ND POINT. 2) FATHERs NAME DIFFERS

can any one please let me know what needs to be done for this. To THIS OFFICE MEANS Which address i need to send the copy. kindly help me in this matter.

hi Koteshawara Reddy G,

My claim is also rejected with a similar reason as below

1) SUBMIT LEDGER COPY FROM XXXX/XXXXX/XXXX (oldest PF account) TO XXXX/XXXXX/XXXXXXX (previous PF account) 2) FATHERs NAME DIFFERS

They are asking me to provide ledger copy of my previous PF transfer in-order to process the current transfer.

Do you know what is ledger copy and from where can i get it and whom should i submit it to?

Any inputs would be highly appreciated.

Hi,

My claim has been rejected twice:

Your Claim has been rejected due to : CONTRIBUTIONS MISSING FOR A FEW MONTHS IN BETWEEN DOJ AND DOE. KINDLY CLARIFY

While in my previous company, I was in the USA on an H1B visa( once in 2010, second time in 2014), in this period, there was no PF deposit in my account as I was in USA payroll.

Can you please explain, what to do?

Hi Abhijit

I am also facing the same issue. Did you get any solution?

Your Claim has been rejected due to : 1) MEMBER ELIGIBLE FOR PENSION CONTRIBUTIONS BUT EMPLOYER NOT REMITTED PLEASE CONTACT EMPLOYER FOR CLARIFICATION AND REVISED ECR/FORM-3A 2) CLAIM ALREADY SETTLED

Pls let me know what needs to be done.

Hi,

When i try to online claim my PF after the job tenure of 1 year, i am getting below rejection message

1) as settlement amt is >= rs 1000000.genuineness certificate is required through employer.pl contact employer 2) FATHERs NAME DIFFERS

What should I do for this?

Claim Rejected REQRD FORM 4/5/7/8 PS TO VERIFY EPS CONTRIBUTION. IGNOR F/N DIFFERS

Had submitted Employee pension fund certificate request after 11 years of service

Above is not clear as what is rejection reason, your thoughts

Had submitted an EPS Certificate claim after 11 years of service, however this was rejected stating below, can we have a pointer to exact reason what exactly is the issue

Claim Rejected REQRD FORM 4/5/7/8 PS TO VERIFY EPS CONTRIBUTION. IGNOR F/N DIFFERS

“Claim Rejected MEMBER IS ELIGIBLE FOR EPS MEMBERSHIP BUT EMPLOYER ERRONEOUSLY MERGED TILL DATE CLARIFY THROUGH ER”- im don’t understand what kind of error i made to correct my self. can anyone help me

Hi

I claimed my PF and the claim is rejected.

Reason: CONTRIBUTION MISMATCH EE,ER AND PENSION.

Any idea about this rejection reason and how to resolve it.

wait for few month and then apply. lot of time pf contribution amount submitted by the organisation 10 to 15 days late . so it will reffelect in UAN no. almost 1 month or 2 Month late. and during Financial year ending it will be delaid more then 90 days. so keep in mind at least 90 days.

can you please explain this PF advance “Claim Rejected ESTABLISHMENT STATUS CHANGED FROM EXEMPTED TO UNEXEMPTED. PA STATEMENT UNDER RECONCILIATION.” I have submitted the transfer claim before the PF advance claim for COVID.

Firstly I have submitted an online Transfer Claim thru my previous employer to current employer. after a few days, I submitted Form-31 of PF advance for the COVID reason. It was rejected due to “Claim Rejected ESTABLISHMENT STATUS CHANGED FROM EXEMPTED TO UNEXEMPTED. PA STATEMENT UNDER RECONCILIATION”. The transfer claim status showing Accepted by employer -> pending at field office” I couldnt understand the scenario here. Can you please help?

Claim Rejected WARNING-520362 MEMBER_ID HAVING PENDING TRANSFER-IN DETAILS, KINDLY VERIFY THE DETAILS USING MEMBER

Have you transferred some EPF account?

The transfer is not complete..

Please follow up

Sir im als same reason what to do?

Claim Rejected UNDER Verification OF ABRY BENEFITS HENCE THIS CLAIM CANOT BE PROCESSED

Yes

My claim got rejected for same reason. I verified my passbook, PF balance of old organisation is transferred to new organisation. I can see the credit date also. Any idea what can be done next?

Hi,

In this case who do we follow up with. There is closing balance amount which reflects in the passbook. Which means the transfer is complete right?

Yesh bro I’m also getting same issue can you tell me how can we solve this problem

Claim Rejected WARNING-520362 MEMBER_ID HAVING PENDING TRANSFER-IN DETAILS, KINDLY VERIFY THE DETAILS USING MEMBER

Now once again apply pf withdrawl at the presence of 15g form and form 19

Did you got any answer for this

Hi yall, I was having multiple member ID and I transferred all PF money to one memeber ID then i claimed form 19 and 10c but still got rejected with reason- Claim Rejected WARNING-520362 MEMBER_ID HAVING PENDING TRANSFER-IN DETAILS, KINDLY VERIFY THE DETAILS USING MEMBER.

I dont know what to do please if someone Who has knowledge on this, I kindly request to connect with me through my email (chaitanya28v@gamil.com) or reply to this comment

The transfer is not complete..

Please follow up on the transfer..

When did you apply for transfer?

Hi Sir, well the transfer request was sent on 11 February 2023,and in transfer claim status also its shown “Accepted by field officer” ,I dont know from which memeber ID there is pending amount. Is this company internal problem? do I have to talk to my previous company ? But I checked memeber ID passbook the closing amount shown 0 amount.

Hi, brother. I too have the same issue. Could you please help me if you got any solution. My email: saikumar.ganigipenta@gmail.com

I have same issue and same error. Transfer claim status shown accept by field officer.

Please help. My mail id ckrunal92@gmail.com

Claim Rejected WARNING-520362 MEMBER_ID HAVING PENDING TRANSFER-IN DETAILS, KINDLY VERIFY THE DETAILS USING MEMBER

Sir ab mene dubara apply Kia online portal pe is baar 15g or form 19 kya is baar bhi reject hoga or Pehle reject ka reason kya hai sir

Aapka claim settle ho gaya kya. ।।merabhi same problem dikha raha he.

Pless ans dejiye

Claim Rejected UNDER Verification OF ABRY BENEFITS HENCE THIS CLAIM CANOT BE PROCESSED

Once accepted by field office DO NOT claim on the same day it usually take 8 to 15 days afterward to actually update on the passbook , thats why its says pending transfer INDETAILS . so just wait check passbook which show us the exact date of updation then apply for claim

for example in my case acceptance by the field office was done on 24 may then i checked the passbook it was showing the full amount i applied the claim it got rejected because the date and the full credit was not done and it happened after 8 days on 2nd june ..then re claim …hope this will help u people .

My uncle is unable to withdraw his EPF amount. He sent a request to withdraw 6 times in last year and few rejections (based on incorrect father’s name), they have sanctioned the partial amount to withdraw. He then sent again a claim to withdraw full amount, they it keep getting rejected. Here are the last claim status date wise:

Rejected date: 13-APR-2021 (Form-19)

Reasons: 1) FATHER NAME DIFFER ON UPLOADED BANK PASSBOOK 2) FATHERs NAME DIFFERS

Rejected date: 13-APR-2021 (Form-10C)

Reasons: 1) OK 2) NOT ELIGIBLE FOR WITHDRAWAL BENEFIT

Rejected date: 16-DEC-2022 (Form-19)

Reasons: 1) father name differ in multipayment 2) FATHERs NAME DIFFERS

SETTLED date: 19-DEC-2022 (Form-10C)

Reasons: Partial withdraw

Rejected date: 29-DEC-2022 (Form-19)

Reasons: 1) photocopy of bank passbook not attested by the authorzed signatory/bank manager 2) PHOTOCOPY OF BANK PASSBOOK NOT ATTESTED BY THE AUTHORIZED SIGNATORY

Rejected date: 13-JAN-2023 (Form-19)

Reasons: 1) doe is not as per contribution 2) WAITING PERIOD OF 2 MONTHS NOT COMPLETED

Rejected date: 13-MAR-2023 (Form-19)

Reasons: 1) father name differ in multipayment 2) FATHERs NAME DIFFERS

Now, we are unable to figure out my last rejection ( 13-MAR-2023 (Form-19) ) was given by them as it seems to us everything is good. All details of EPF are good like father’s name, DOE, KYC, details are verified as well on epf portal.

Any advice is much appreciated.

Many Thanks

Claim Rejected KINDLY SHARE PF PASSBOOK OF PREVIOUS COMPANY FOR PROCESSING CLAIM FORM. SERVER IS UNDER MAINTAINANCE.how to resalow pls telme

My Bank KYC is pending with employer for approval. However my employer is not able to approve because of no digital signature.

what should I do. I raised multiple grievances and no solution yet

Hi bemoneyaware,

13 months before I joined the new company, 2 times I tried to transfer the PF amount from my previous company, but it got rejected for the below reasons, both my present and previous companies are not supporting/guiding me, pl guide me to transfer my PF amount.

Your Claim [ Claim Id – xxxxxxxxxxx ] has been rejected due to: 1) EPS NOT REMITTED. PL. CLARIFY. 2) CLAIM ALREADY SETTLED

The transfer is received, but it is subject to verification. Already raised a complaint regarding this transfer since it has been more than 2 months that I made the PF transfer. What to do next ?

Raise the complaint again

Claim Rejected WARNING-520362 MEMBER_ID HAVING PENDING TRANSFER-IN DETAILS, KINDLY VERIFY THE DETAILS USING MEMBER

pls help me

hi prasanth, i do have the same reason stated for my pf rejection

Hi All,

Below is the message i have received for my claim.

“Claim Rejected PREVIOUS EPS MEMBER .EPS DECDUCTION NOT DONE IN THIS ESTT”

Please help me understand. Thanks in advance.

My PF Transfer to current/new employer claim is rejected for the following reason.

Your Claim has been rejected due to : 1) FPF ACCOUNT NO. NOT CORRECTLY MENTIONED IN ONLINE CLAIM AND FPS ACCOUNT NO. NOT MENTIONED 2) ACCOUNT NUMBER DIFFERS

But, I copied pf account information from my pay slips. The account numbers are correct as per my knowledge. What I’m missing here. Thanks

Sad to hear.

Are you doing a Family Pension withdrawal?

Please file a EPF complaint as explained in the article..http://bemoneyaware.com/epf-grievance-complaint-online/

Form-10C 17-Mar-2023 02:58 PM 19-Mar-2023 04:54 AM Claim Rejected DUE TO TECHNICAL REASON PREVIOUS SERVICE PENSION AMOUNT IS NOT SHOWN IN SYSTEM. APPLY AGAIN

Hi

I am getting this reason for claim rejection”Claim Rejected EPS MEMBER BUT NOT REMITTED EPS CONTRIBUTION,CLARIFY”

Can i know how to solve this issue…..

Thanks in Advance.

Hi

I am applying pf withdraw so many times, there are rejecting me everytime by saying a new thing and help desk number also not working at all..

1) Recently i applied for advance FORM – 31 where i get rejected because of the reason “Claim Rejected EPS MEMBER BUT NOT REMITTED EPS CONTRIBUTION,CLARIFY”.. Please help me how to solve this issue..

2) Before that i applied for FORM 19 AND 10C and got rejected because of the reason “Claim Rejected EQUAL SHARE REMITTED FOR MEMBERS CONTRIBUTION,CLARIFY”..

Please someone help me how to solve the issue…and thanks in advance.

Sad to hear about it.

Check your EPF passbook.

Check your EPS contribution.

When did you start working before or after Sep 2014? EPS depends on joining date

I Joined after sep 2014 only..i mean i joined in december 2017.

My PF claim is rejected with the reason – 1ST REQUESTED AVAIL PARA 68B(1)(C) & THEN AVAIL THIS ADVANCE & TANSFER EPS. Not able to understand the rejection comments

Which PF claim did you apply for?

Para 68B: Purchase of House/flat, construction of House including acquisition of site.

Para 68B(1C) : for Purchase of House

For purchase of site:

One needs to be member of EPF for 5 (FIVE YEARS)

One can get 24 month’s basic wages and DA/for purchase of house/flat/construc tion: 36 month’s basic wages and DA OR Total of employee and employer share with interest OR Total cost. Whichever is least

One can only make 1 claim

Hello,

Thanks for sharing more details on PF through this video. My PF is rejecting again and again! Earlier they were not giving any reason but now they have mentioned below reason for rejection. Could any of you please let me know what mistake I am doing ?

Your Claim has been rejected due to : 1) FORM 15G NOT SIGNED BY MEMBER. RESUBMIT ONCE SIGNED 2) FORM 15 G / 15H, PAN CARD NOT SUBMITTED BY MEMBER.

I did digital sign for Form 15G. Should I sign manually through print copy and resubmit along with PAN Card copy ?

Many thanks in Advance,

Manu

Yes, your should sign manually through print copy and resubmit along with PAN Card copy

my claim is rejected by saying insufficient service but in current organisation i have complited 11 month then why calim is rejected

Which claim are you applying for?

@magnesh Tayade,

Did you resolve the issue. My claim also rejected for the same reason. but I have completed 1 year. Have you resolved this?

Please suggest how can we proceed in this case

My fathers death claim is rejected due to:

1. Contributions for the wage months 12/2021 and 01/2022 were not remitted and NCP days were also not updated. Submit a proper clarification along with muster rolls and attendence registers.

2.Submit breaks/NCP days statement from date of joining to date of leaving, moreover neither contributions nor NCP days were furnished for the period 12/2016 to 03/2017.

3.Please update members date of exit and reason in the epfo portal

My father was hospitalised in november december and died on jan 09 2022 he did not get salary. we applied for medical leave but have no info about that. from 12/2016 to 03/2017 he was tranfered to another district in 11/2016 worked there untill 2018 but dont know anything about these 4 months paticularly.

please sugget me how to respond my fathers establishment is not helping they say they dont know anything about these rules.

Sad to hear about your father demise.

Check your father’s EPF passbook and check for months of Dec 2021 and Jan 2022.

Ask your father’s company for form 3A.

Known as a member’s annual contribution card, Form 3A depicts the month-wise contributions made by the subscriber/member and employer towards E.P.F and Pension Fund in a particular year. The data is calculated for every member who is a part of the scheme

You can check out Form 3A here http://bemoneyaware.com/wp-content/uploads/2020/06/PF-Form-3A.png

Hi, Hope you are doing good.

MY PF online claim has been rejected due to

1) NO ECR CONTRIBUTION FROM 07/17 TO 07/19. CONTACT ESTT FOR CLARIFICATION.

2) MEMBER NAME NOT PRINTED ON CANCELLED CHEQUE

Firstly I think I can ignore the second reason as my name is definitely printed on the cheque provided. First reason is where I need some help.

Their point is correct because I continued working for the same employer but in a different country and no contribution was made. Therefore my Indian employment was frozen but I continue to be the employee of the same company.

When I looked at my passbook I see “No Cont. for Due-Month 072017” for each month in particulars.

Interestingly I worked outside India for the same employer outside of the mentioned dates as well but I see “Cont. For Due-Month 082019” with 0 in all other columns in my passbook. Does this mean my employer didn’t file my EPF returns even though it was 0 contribution for those 2 years?

Could you please help me understand what actions do I have to take to get my claim accepted.

Hi Mahaboob, did you find a resolution for your problem? Facing the same issue here.

I moved abroad and submitted form to withdraw all my PF. My claim got rejected twice and on raising grievance for the reason, this is the reply I got. “ Sir/mam, as date of joining and date of exit of eps updated by establishment and no contribution received for eps, kindly update accordingly and then reapply claim form”. Can you please explain what needs to be done here.

Claim Rejected MEMBER IS EPS MEMBER IN TRANSFER SERVICE BUT THIS SERVICE EPS CONTRIBUTION WAS NOT DEDUCTED CLARIFY

AM GETTING THIS COMMENT ANY SOLUTION

Claim Rejected MERGER FROM 4/20 TO 8/22 DOE PENSION TO UPDATED AS 05/03/2020 SUBMIT AFTER COMPILATION OF ANNUAL ACC

My claim is rejected with comments “Claim Rejected ECR IS UNDER PROCESS” .Could you please share reason for it and how to resolve it ?

my claim is rejected with the reason Claim Rejected CONT NOT REC FOR 022017 OMNWARDS , I am guessing /decoding this in English as (Claim Rejected CONTRIBUTION NOT RECORDED FOR 022017 OMNWARDS).

could you please share more info if anyone is aware of this reason?

It is really frustrating with EPF portals,5 out of 10 times the server is busy and the reason of rejection is not clear. appreciate someone helping here. Many thanks in advance.

Sad to hear Venkat.

You have decoded the message correctly, except that REC is Received, not recorded.

When did you leave your old company.

THe message says that they have not received any EPF contribution since 02 2017 which is 2nd Feb 2017.

CHeck is your date of exit is marked in Service History

Hi,

My PF Claim Rejected with comments “Claim Rejected WARNING -520362 MEMBER_ID Having Pending Transfer-In Details,Kindly Verify the details Using Member

Did you transfer your EPF?

Is the transfer complete?

Similar mentioned I am facing where by merging process of account has done. Now what can I do for the same

Same scenario was occurred with me also, when I have claimed for form-19.

My pf amount is also transferred from my old member Id to current ID.

Please help me ASAP on this situation.

Claim Rejected WARNING-520362 MEMBER_ID HAVING PENDING TRANSFER-IN DETAILS, KINDLY VERIFY THE DETAILS USING MEMBER

Did you find a solution for this?

Claim Rejected SERVICE IS LESS THAN 05 YEARS AFTER UPDATION OF YOUR PREVIOUS SERVICE ALSO.

how can check transfer completed, my claim also rejected

what is the solution for this error? Please help.

Hi,

My PF claim got rejected with below status

“Claim Rejected WARNING-520361 MEMBER_ID HAVING PENDING APPENDIX-E, KINDLY VERIFY THE DETAILS USING MEMBER LEDGER B”

Where do I need to complete Appendix-E and verify the details using Member Ledger B ?

The Appendix E is for the purpose of making any adjustments in the Member balances for genuine reasons on record and also for making entry of NCP days in respect of the member Service history

This is seen by the EPFO authorities when they want to approve.

Best is to file a complaint asking for details as explained in http://bemoneyaware.com/epf-grievance-complaint-online/

Happy New Year.

If you find the answer helpful can you share it on https://twitter.com/bemoneyaware

Same scenario was occurred with me also, when I have claimed for form-19.

My pf amount is also transferred from my old member Id to current ID.

Please help me ASAP on this situation.

Claim Rejected WARNING-520362 MEMBER_ID HAVING PENDING TRANSFER-IN DETAILS, KINDLY VERIFY THE DETAILS USING MEMBER

Did you get solution?

Your Claim [ Claim Id – TNMAS230250001752 ] has been rejected due to : 1) eps cont in trasfer in service

What to do

didyou got solution

I first applied for PF withdrawal which happened smoothly as I am not at a job now. Then i tried applying for the Pension Fund amount via Online form 10C. Thrice it has been rejected with this reason “Claim Rejected PLEASE MENTION THE FAMILY PARTICULAR AND RESUBMIT CLAIM FORM”. When filling the online form there is no such field to add family particular. Please assist.

Check the nomination

file a complaint asking for details as explained in http://bemoneyaware.com/epf-grievance-complaint-online/

Hello,

Thank you for your response.

Even the iGMS is not working properly. After filling in all details when I click Submit, it shows success message but does not provide any Tracking ID for checking status later. neither do I receive any email or sms confirmation about the registered grievance.

Hi,

My PF Claim Rejected with comments “Claim Rejected VERIFICATION NOT RECEIVED IN TWO DAYS “ .

Please help.

Message is not clear

Good Morning

MY PF online claim has been rejected due to

1. Contribution not remitted from 06/2010 to 09/2010. Please clarify through employer.

2. UAT Claim – Cancelled Cheque not as per KYC Bank details.

Please would some one help what it means. What i should do now as next step to resubmit.

In EPF employer contribute everymonth.

Did you leave your job agyer 2010 Sep or before Jun 2010.

From the message it seems you left job after Sep 2010(Check DOE in Service history).

Pt 1 is asking you to check that

2. Cancelled Cheque not as per KYC Bank details.

Bank details in UAN site are different from Cancelled cheque you have uploaded

Hello, Kindly respond to my query on 18th December as well. It is in the comment previous to this one. Thank you in advance.

I first applied for PF withdrawal which happened smoothly as I am not at a job now. Then i tried applying for the Pension Fund amount via Online form 10C. Thrice it has been rejected with this reason “Claim Rejected PLEASE MENTION THE FAMILY PARTICULAR AND RESUBMIT CLAIM FORM”. When filling the online form there is no such field to add family particular. Please assist.

I had worked for almost 12 years in different companies and all pf is shows in epfo portal but last company i serve only 3 month now i want to withdrawal my pension amount from old pf account how can i withdrawal it please reply with proper solution

One has to transfer the old PF account to the new account. Only then will you be able to withdraw from both accounts online. Linking of PF account with UAN is not sufficient.

Our article Why should one transfer old EPF account to new employer? explains it in detail

Hi,

I have transferred my old PF to my current account via online and it was successful. With Form 31 I requested to withdraw 75% advance from my current PF. I am currently 2.6 years employed with my current employer. My claim got rejected “Claim Rejected INSUFFICIENT SERVICE”

Please help and advise

Sad to hear that?

What did you apply for?

Advance or Withdrawals may be availed for the following purposes after putting in at least 5 years of service. The amount that can be withdrawn depends on the purpose, depends on the number of years of service. How many times can one withdraw for the same reason depends on purpose, for example, one can withdraw for the marriage of self, son or daughter, brother or sister 3 times after one has completed 7 years of service. For marriage purpose, one can withdraw 50% of employee share but for treatment, one can withdraw up to 6 times of Wages

Please check our article http://bemoneyaware.com/epf-partial-withdrawal-or-advance/ for more details

Claim Rejected REJECTED AS PER MODULE 5/10

I recently lost my Job in August after working for 2 companies back to back.

When I tried to withdraw PF after 2 months of leaving the job, I can only view the recent company, not the previous company in the list.

So, I requested to transfer the account of the previous company to the recent company after which I thought of withdrawing both funds.

It got rejected at the field office with the below error.

Your Claim [ Claim Id – AP************846 ] has been rejected due to: 1) AFTER 11/2014 MEMBER HAS FULL WAGES SO NOT ELIGIBLE FOR PENSION ADVISED TO CLARIFY MEM HAS PREV SERV 2) FATHERs NAME DIFFERS

What should be done in this case?

Check your passbook and look at EPS contribution.

Were you working before 2014 or you joined After Sep 2014?

After 1st September 2014 PF Department said if any person starts his new job with a salary more than Rs. 15000 then his pension contribution would be nil.

claim rejected APPLIED FOR SC PLS PROVIDE FAMILY MEMBERS DETAILS IF ANY

My claim was rejected like this what should I do in as further?

Hi

My PF transfer request got rejected with below reason.

1) EPS details PF previous not recd and EPS deduction not done from 06/2021

2) Fathers name differs

Please help.

CHeck your EPF Service history..

Check your EPS passbook…was EPS deducted from 06/2021?

My Pension withdrawal claim Form 10C rejected with following reason. What is Schema certificate? how to get it?

Date of Joining service 02-Sep-2013

Date of Leaving Service/ – 30-Jun-2020

Reason of Leaving Service/ CESSATION (SHORT SERVICE)

————————————-

Claim Rejected SERVICE IS MORE THAN 10 YEARS HENCE ELIGIBLE FOR SCHEME CERTIFICATE.

————————————-

Did you work in the job before 2013?

Because for calculating pension earlier job history is also counted.

As discussed in our article What is EPS Scheme Certificate?

How to apply for EPF FORM 10C (Scheme Certificate) online?

First of all install the Umang app and open it.

Open EPFO Services in it.

Click on Raise Claim option

Enter your bank account number and click on Next button.

In the next page select your PF account and click on the next button.

Enter your address in the next page and click on the next button.

Select FORM 10C (scheme certificate) in Claim type.

Upload your bank account passbook or check book photo.

Click on the check box below and click on Get aadhaar OTP button.

After submitting the OTP, your FORM 10C (scheme certificate) will be submitted.

After this, after cross-checking by EPFO office, you will get the scheme certificate.

I have moved to USA on 11/2016 and resigned in USA on 27/1/2020, I have filed the PF withdrawal online on PF site, and it got rejected stating ‘ Claim Rejected CONT NOT REC FROM 12/2016 ONWARDS’. Please do help me what is the process to withdraw the PF.

Check your service history, Is date of leaving your old EPF marked in EPF?

you need to send following details to RO.CHENNAI2@EPFINDIA.GOV.IN

SEND ONSITE ORDER,Passport,VISA,BANK DETAIL ,

Hello Please help me to find the reason for the PF claim rejection:-

CLAIM STATUS Rejected

REMARKS :- Your Claim [ Claim Id – TNMAS220950107183 ] has been rejected due to : 1) IF MIG SEND ONSITE ORDER,PPORT,VISA,BANK DETAIL RO.CHENNAI2@EPFINDIA.GOV.IN,DELAYED SUB LETTER WITH 2) FORM 15 G / 15H, PAN CARD NOT SUBMITTED BY MEMBER

Have you moved out of India?

If yes, you need to send the details to RO.CHENNAI2@EPFINDIA.GOV.IN

SEND ONSITE ORDER,Passport,VISA,BANK DETAIL ,DELAYED SUB LETTER WITH

also submit FORM 15 G / 15H, PAN CARD

Hi,

I had resigned from my current company in Apr 2022.

I am working abroad.

I have applied for my pf settlement but it got rejected giving the following reason

Claim Rejected SEEKING CONFIRMATION FROM THE EMPLOYER REGARDING GENUINITY

can you please suggest a solution.

I am trying to transfer from previous company to present company it got rejected

Your Claim [ Claim Id – XXXXXX ] has been rejected due to : 1) EPS DETAILS NOT RECEIVED FROM PREVIOUS EST XXXX 2) FATHERs NAME DIFFERS

please help us to resolve the same.

i am facing same issue, did you find any solutions for this

Claim Rejected DATE OF EXIT ALREADY UPDATED IN SYSTEM. SUBMIT PF/FPF CLAIM FOR FINAL SETTLEMENT

My PEF transfer got rejected many times.

Reason is “Your Claim [ Claim Id – GNGGN220950023586 ] has been rejected due to : 1) PREVIOUS EST EPS SERVICE IS NOT EFFECTED IN PRESENT EST. 2) CLAIM ALREADY SETTLED”.

how to proceed for this reason

Claim Rejected PENSION CONTRIBUTIONS RECEIVED AFTER 58 YEARS NOT ELIGIBLE FOR 10C How can i retrieve this pf.

EPS CONTRIBUTION NOT REMITTED FROM DOJ TO DOL PLEASE CLAIFY WITH SUPPORTING DOCUMENTS 2) MEMBER NAME NOT PRINTED ON CANCELLED CHEQUE

what does REJECTED 1. A Drawing Error Occured mean for House Repair Advance

I have withdrawn PF money in Jun 2021 for purchase of flat which got settled.

I have applied for another withdrawal on Sep 16, 2022 giving “additions and alterations of house” as reason. This claim was rejected with the following reason ” has been rejected due to : 1) AFTER 5 YRS FROM DATE OF ADVANCE OF PURCHSE OF HOUSE FLAT 30/06/2021 ELIGIBLE FOR THIS ADVANCE 2) NOT ELIGIBLE-INSUFFICIENT SERVICE”

can i reapply for withdrawal stating a different reason like ” illness” since I’m very much in need of money and i dont want to go for a loan.

Please advise.

I have withdrawn PF money in Jun 2021 for purchase of flat which got settled. I have applied for another withdrawal on Sep 16, 2022 giving “additions and alterations of house” as reason. This claim was rejected with the following reason ” has been rejected due to : 1) AFTER 5 YRS FROM DATE OF ADVANCE OF PURCHSE OF HOUSE FLAT 30/06/2021 ELIGIBLE FOR THIS ADVANCE 2) NOT ELIGIBLE-INSUFFICIENT SERVICE”

can I reapply for withdrawal stating a different reason like ” illness” since I’m very much in need of money and I don’t want to go for a loan.

Please advise.

You can try under EPF Partial Withdrawal For Addition/Alteration of the house

Details at http://bemoneyaware.com/epf-partial-withdrawal-or-advance/

I have withdrawn PF money in Jun 2021 for purchase of flat which got settled. I have applied for another withdrawal giving “additions and alterations of house” as reason. This claim was rejected with the following reason ” has been rejected due to : 1) AFTER 5 YRS FROM DATE OF ADVANCE OF PURCHSE OF HOUSE FLAT 30/06/2021 ELIGIBLE FOR THIS ADVANCE 2) NOT ELIGIBLE-INSUFFICIENT SERVICE”

can i reapply for withdrawal stating a different reason like ” illness” since I’m very much in need of money and i dont want to go for a loan.

Please advise.

I have applied two times for my PF withdrawal . But it is rejected both times and showing the Reason rejected due to : 1) INSUFFICIENT DATA AN IMAGE.

What will I do for it so that i can withdraw my amount.

What data have you uploaded?

Is the image clear?

Hello, I have submitted an EPF withdrawal claim, but got rejected with the following reason:

Claim Rejected EPS CONTRIBUTION NOT RECEIVED FROM DOJ TO DOE, BUT EPS TRFIN RECEIVED, CLARIFY REG EPS ELIGIBLITY

Any idea what could be the reason for this and how can I rectify this?

Thanks,

Ramesh

Hello,

MY PF transfer got rejected due to the below reason:

“has been rejected due to 1) EPS CONTRIBUTIONS MERGED PLEASE CLARIFY 2) FATHERs NAME DIFFERS”

But when I contacted the PF office via email, they mentioned like below

“Your transfer in received with EPS service from the previous office. But current employer merged EPS with PF. Therefore claim was rejected seeking clarification for the same”

And when contacted Previous and Present employer neither of them are replying and nor even PF office.

Can you please let me know how to solve this issue. And its been struck around from 1 Year.

Request you to respond for the solution asap.

Regards,

Ravi

Hi Sir,

My wife’s PF claim is rejected for below reasons

“Rejected TR IN PENDING RESUBMITTED THE CLAIM” for Form 10 C and

” Claim Rejected HIGHER WAGES NEEDS CLARIFICATION” for Form 19 .

what is the reason and solution.

Thanks in advance

After 1st September 2014 PF Department said if any person starts his new job with a salary of more than Rs. 15000 then his pension contribution would be nil

For father name differs, raise a complaint in the EPFO office as explained in the article http://bemoneyaware.com/epf-grievance-complaint-online

Hello,

I worked in two companies. When I resigned from second company, I applied for PF transfer from first establishment to second establishment. PF Transfer was successful.

Now, after 5 months I applied for PF withdrawal(Currently I am not working), but it was rejected with a reason “Claim Rejected PREVIOUS ESTABLISHMENT EPS SERVICE DETAILS NOT UPDATED KINDLY PROVIDE ABSTRACT ANEXURE K”.

As I transferred from Exempted establishment to Unexempted establishment, I can get Annexure K from EPFO portal. Could you please suggest me how to proceed further?

Hello,

I worked in two companies. When I resigned from second company, I applied for PF transfer from first establishment to second establishment. PF Transfer was successful.

Now, after 5 months I applied for PF withdrawal(Currently I am not working), but it was rejected with a reason “Claim Rejected PREVIOUS ESTABLISHMENT EPS SERVICE DETAILS NOT UPDATED KINDLY PROVIDE ABSTRACT ANEXURE K”.

As I transferred from Exempted establishment to Unexempted establishment, I can get Annexure K from EPFO portal. Could you please suggest me how to proceed further?

Thanks in Advance

Claim Rejected WAGES SHOWS BLANK

How to slow this issue

Did you check your EPF passbook?

What does it show?

Dear,

I am also facing same issue, did you issue fixed ?

Hi,

I was working from 2015 till November 2021 after which I quit my job.

Now I want to withdraw my PF and raised a claim on 24-Apr-2022.

The claim was rejected with status “Claim Rejected MEMBER EPS SERIVCE FROM PREVIOUS EMPLOYMENT NOT RECEIVED(PYKRP).”

Please help me understand the reason for the claim rejection and how to fix this.

Hi,am also having same issue…

Hi,

My Claim got rejected with below reason

Claim Rejected SUBMIT JD ATTESTED BY EER&EEE FOR REMITTING HIGHER WAGES U/P 26(6) UNDER CONFIRMATION OF ADM CHARGES

Could you please help me in understanding what it is.

Thanks in advance

Dear Sir,

I have submitted for EPF claim as i have worked more then 10 yrs and now i am not working naymore.

After 10 days i received SMS that EPF calim is under process but when i checked in system it is showing as below

Claim Rejected ENCLOSE CHEQUE LEAF OR PASSBOOK COPY NAME PRINTE ON IT WITH SEAL AND ATTESTATION

But i have attached the cheque leaf with my name and acount number clearly also in my Acknowdgement they have attched my Cancelled Cheque picture then why they rejected and asking to attach Cheque with name printed on it.

Thanks

Arjun K

claim rejected less than 5 yrs, more than 50 000, pancard and 15g has to be furnished

i have got this issue but i have uploaded g form what to do next

Hi, Thanks for reply,

I have joined my first job in 2015, location India (Amazon 3+exp, Oracle 3+exp), in both the company pension not deducted, and i successfully transferred my entire PF from Amazon to Oracle through online.

Currently, i work in other company location India, here they are deducting pension. Hence i have tried to transfer my entire oracle pf to current company pf same through online, but no luck EPFO has rejected stating “kindly clarify EPS service”.

looking for best solution to over come this. Thanks in advance

You need to check with your latest company and ask why are they deducting the pension.

My aim has rejected as reason “please check date of joining of EPS” however DOJ is correct everywhere as 13 Sept 2013

Best is to raise the grievance as explained in the article

http://bemoneyaware.com/epf-grievance-complaint-online/

Hi, this is have tried through online,

1st company no eps contribution deducted

2nd company eps contribution deducting, so i have tried to transfer through online, but no luck, EPFO has rejected stating “PLEASE CLARIFY EPS SERVICE 2) FATHERs NAME DIFFERS”.

hence, kindly let me know in which medium(if its offline which form or online GRIEVANCE) i can clarify eps service, and also let me know the current procedure for father name differs

Why was the first company not deducting any EPS?

After 1st September 2014 PF Department said if any person starts his new job with a salary of more than Rs. 15000 then his pension contribution would be nil

For father name differs, raise a complaint in the EPFO office as explained in the article http://bemoneyaware.com/epf-grievance-complaint-online/

Thank your response,

I have started my first job in 2015, location India, 2015-2018 years in MNC no eps deducted, 2018 – 2020 no eps deducted, however in these company’s EPS is not deducted, and also I have successfully transferred my entire PF from 1st company to 2nd company without any rejection.

Currently, I am working in 3rd company, here they are deducting EPS from my EPF, Hence as usually I Have tried transferring my PF through online, but no luck EPFO rejected stating “PLEASE CLARIFY EPS SERVICE”.

Just i want to know, what should i confirm in EPS service specifically and how i should reply them, through online or offline, if its offline which form i should proceed with.

I am trying to withdraw my PF (Form 10c and 19) but it was rejected stating that:

“Claim Rejected CONTRIBUTION OF EPS DEDUCTION MORE THAN 1250 PER MONTH AND ALSO PENSION WAGES MORE THAN 15000”

What do I need to do in this case?

Please Advise.

Thanks,

Joy

Getting this mesage-

Your Claim [ Claim Id – ORBBS220850010935 ] has been rejected due to : 1) NOT ELIGIBLE DUE TO INSUFFICIENT MEMBER SERVICE. 2) NOT ELIGIBLE-INSUFFICIENT SERVICE

please advise what is to be done as service has been transfered to new member ID and and claim status shows settled. I had requested claim from the new memebr ID.

Please guide what needs to be done.

I want to withdraw my PF account as full and final settlement. My EPF money is transferred from old pf account but on the current passbook. its still showing as subject to verification. Can you please confirm if i apply for PF withdraw whether i will get full pf money or partial. SOme people say dont do untill full amount credit to current PF. I rasied grivenace thet said submit form 10 and 19. Please help i need moeny. is i apply online for withdraw will i get full money or partial at this situation

I was working till Aug 2020, then I left job and not working anymore.

Recently I filed the online PF claim and got rejected with below comments. Can you please help me to understand them.

Your Claim [ Claim Id – MHBANXXXXXXXXXXX ] has been rejected due to : 1) IN PREVIOUS ESTABLISHMENT EPS MEMBER AND IN CURRENT ESTABLISHMENT NOT AN EPS MEMBER PL CLARIFY 2) MEMBER NAME NOT PRINTED ON CANCELLED CHEQUE

Sad to hear.

Is the date of leaving marked in your Service history?

When did you join your first job? Before 2014

Looking at the comment

IN PREVIOUS ESTABLISHMENT EPS MEMBER AND IN CURRENT ESTABLISHMENT NOT AN EPS MEMBER PL CLARIFY

After 1st September 2014 PF Department said if any person starts his new job with a salary of more than Rs. 15000 then his pension contribution would be nil

It seems you were working in 2 organizations

in 1st company EPS was deducted.

in 2nd company EPS was not deducted.

Second reason MEMBER NAME NOT PRINTED ON CANCELLED CHEQUE

check the cancelled cheque that you uploaded while withdrawing

I have similar issue, please let me know if you issue was solved and how.

I have made a transfer request from one PF a/c to another PF a/c but on EPF portal Claim status says “Settled” but no money received in second PF a/c when i approached the receiver PF A/c office, They have Rejected transfer with below comment

The transfer claim received from SRO-NOIDA with details has been reason as mentioned rejected due to bellow

“MEMBER IS A NON EPS MEMBER WHERE AS EPS SERVICE IS RECEIVED HENCE REJECTED.”

Accordingly, you may initiate necessary corrective action to re-credit the amount (since no actual transfer of money has been received in this office in the above case) concerned and process a fresh to the member account transfer claim with correct details to the beneficiary/trust as the case may be.

I have raised many grievance request to sender PF a/c but issue still not resolved as re credit of the amount has not happed it is showing Rs. 0 balance.

Any help much appreciated… Thanks in advance.

Hi,

I got the update claim rejected with below message

Claim Rejected SUBMIT JD UNDER PARA26(6) ALONGWITH CONFIRMATION ON PAYMENT OF ADMIN CHARGES FOR HIGHER WAGES

I was working till Aug 2020, then I left job and not working anymore.

Recently I filed the online PF claim and got rejected with below comments. Can you please help me to understand them.

Your Claim [ Claim Id – MHBANXXXXXXXXXXX ] has been rejected due to : 1) IN PREVIOUS ESTABLISHMENT EPS MEMBER AND IN CURRENT ESTABLISHMENT NOT AN EPS MEMBER PL CLARIFY 2) MEMBER NAME NOT PRINTED ON CANCELLED CHEQUE

My PF transfer online claim got rejected with reason “SUBMIT JOINT DECLARATION UNDER PARA 26(6) FOR HIGHER(MORE THAN RS 15000/-) CONTRIBUTION TO EPF WAGES”

Please let me know what needs to be done from my end.. Kindly help on this?

Which claim did you make?

When did you start working? Before or After 1 Sep 2014.

Was your basic wage more than 15,000 per month

Was EPS deducted?

After 1st September 2014 PF Department said if any person starts his new job with a salary of more than Rs. 15000 then his pension contribution would be nil

Did you resolved this issue? I also face same issue.

Hi,

I was working from 2015 till November 2021 after which I quit my job.

Now I want to withdraw my PF and raised a claim on 24-Apr-2022.

The claim was rejected with status “Claim Rejected MEMBER EPS SERIVCE FROM PREVIOUS EMPLOYMENT NOT RECEIVED(PYKRP).”

I worked for three companies and when I check my service history, DOJ EPF and DOE EPF are marked correctly. But DOJ EPS and DOE EPS is not marked for one company (PYKRP).

I have reached out to the company explaining this and they say that I am not applicable for EPS, hence no need to update the DOJ and DOE.

Please help me understand the reason for the claim rejection and how to fix this.

That helps a lot , I could see ro.chennai2@epfindia.gov.in is right mail id ..

how many days they took to respond ? did they refund your claim amount ?

PF Office CHENNAI-2 Address Details.

Regional Office, CHENNAI-II

No. 37, Royapettah High Road,

Opposite Swagat Hotel, (TN).

Chennai – 600 014

Email ID: ro.chennai2@epfindia.gov.in

Name of the Commissioner:

Shri Rituraj Medhi

Regional P. F. Commissioner (Gr.I)

Appellate Authority, RTI

Claim Rejected – Please Update Reason of Leaving

The portal as well as the form had the reason of leaving clearly mentioned – Cessation Short Service Any Other Reason

Which is auto filled by the form. All other details have been verified and filled in with the previous employer, yet my claim was rejected with the above reason. Can anyone please help guide me ?

raise a complaint in the EPFO office as explained in the article http://bemoneyaware.com/epf-grievance-complaint-online

Claim Rejected NO PROVISION TO PAY TO AGENCY OR PROMOTER

My claim rejected with above reason. Could you let me know what it actually means? Has any one came across such rejection before.

Which claim did you make?

Is it partial withdrawal?

Did you able to resolve this issue? I am also getting the similar issue?

Please guide me on this?

Yes, I’m mine too will be the same => Claim Rejected PROVISION FOR PAYMENT TO AGENCY NOT AVAILABLE.

I went with the purpose of “Purchase of House/Flat”

HI Mine was rejected due to below reasons can you please check and confirm

MEMBER EPS STATUS NEED TO BE CLARIFIED CONSIDERING HIS FIRST MONTH WAGES

When did you start working? Before or After 1 Sep 2014.

Was your basic wage more than 15,000 per month

Was EPS deducted?

After 1st September 2014 PF Department said if any person starts his new job with a salary more than Rs. 15000 then his pension contribution would be nil

I had submitted my online claim on 8th july and it got rejected. Following reason was mentioned:

1. Claim Rejected ERROR WHILE PROCESSING CLAIM KINDLY RESUBMIT.

Only this can someone specify what this means and what needs to be done.

Claim again

Submit Joint declaration under para26(6) for higher (more than 15000 )contribution to EPF wages.

Thanks

I have submitted for the claim of 1st company PF. what next i did is i found some correction is required in the address so canceled and resubmitted but will the claim happen here ? how many times i can claim in a year or month?

Transfer Claim Status

now its only showing for the 1st submission. not the 2nd submission. what to do now?

MEMBER JOINED AFTER SEPT 2014 STILL EPS PAID. EMPLOYER MAY CLARIFY THE SAME. FATHER NAME NOT DIFFERS 2) FATHERs NAME DIFFERS

Hi, my previous employer made an EPS account even though i was not applicable as my salary was above Rs 15000 pm. SO while transferring from one account to new one, my claim got rejected stating the reason below –

Your Claim [ Claim Id – ********] has been rejected due to : 1) MEMBER IS NON EPS MEMBER, BUT RECIEVED CONTRIBUTIONS, PLEASE CLARIFY 2) CLAIM ALREADY SETTLED

Can anyone know how to close EPS account or help me out here. Thanks.

You have to provide clarification and then submit a Joint Application for regularising membership/Provident Fund Contributions deducted on Salaries over & above Rs.

15000 per month or at a higher rate.

For details check our article http://bemoneyaware.com/basic-salary-15000-eps-rejection-claim-transfer-epf/

Hi All,

I tried applying for PF Advance through the EPFO portal for the reasons below.

Claim Rejected CLARIFY ALONGWITH JOINT DECLARATION U\P 26(6) FOR REMITTING HIGHER WAGES IN PF.

Can anyone help me with this?

Are you making a Voluntary contribution to EPF?

Is your basic salary above 15,000 rs?

The employees are also required to make an equal and matching contribution of 12 % (twelve percent), which makes the total monthly percentage contributed to 24 % (twenty-four percent).

The member can pay a voluntary contribution in excess of the normal contribution of 12% (twelve percent) of INR 15000/- (Indian Rupees Fifteen Thousand only). The total contribution i.e., voluntary plus mandatory can be up to INR 15000/- (Indian Rupees Fifteen Thousand only) per month. The employer may however restrict its own share to the statutory rate. The member can also contribute on higher wages i.e., more than INR 15000/- (Indian Rupees Fifteen Thousand only) after getting permission from APFC/RPFC as per the provisions of para 26(6) of the EPF scheme.[1]

You have to provide clarification and then submit a Joint Application for regularising membership/Provident Fund Contributions deducted on Salaries over & above Rs.

15000 per month or at a higher rate.

Hello,

I too got the rejection due to 26(6). Yes my basic salary was higher than 15000. But at the moment, (since last 2 years), I’m not working. So there is no employer.

Who is going to file the joint declaration in this case?

Hi

I left job in 31st March, and applied for PF and Pension withdrawal – form 19 and form 10c on 12th June and 17th June respectively but today ie 30th June i checked status as rejected

For Form 19

Rejected due to 1) Genuiness Letter to be submitted by Employer, then resubmit claim form

For Form 10C

rejected due to 1) Genuiness Letter to be submitted by Employer, then resubmit claim form 2) Not eligible for withdrawal benefit

I am just 43. Please advice way out, i need it the money urgently for my existing medical treatment committed and started

Claim Rejected WARNING-520461 THERE IS MISMATCH BETWEEN SUMMARY AND DETAIL TRANSACTIONS IN MEMBER LEDGER. KINDLY ……what is the solution

CLAIM STATUS Rejected

CLAIM REJECTED DUE TO WRONG TRANSFER IN OF EPS SERVICE , MEMBER IS NOT EPS MEMBER, PLEASE CONTACT PR

Please do let me know how do I find a solution to this problem.

Hi ,

My PF withdrawal was rejected due to the below reason

Your Claim has been rejected due to : 1) CONT RECVD UPTO 09/14 DELAY SUBMSN CLARIFY,ONSITE ORDER,PASSPORT,RESIDNTRO.CHENAI2@EPFINDIA.GOV.IN

I was employed on a company in India till Sept, 2014 and moved to USA with the same company (my PF contribution stopped after i moved to USA).i left that company in USA in 2018 and now i want to withdraw my PF amount(accumulated till 2014) from that company and submitted a claim which was rejected.

Can you please let me know what i need to do to clear this rejection and get my PF amount withdrawn

That is exactly what EPF is asking clarification for.

EPFO has received the contributions till Sep 2014.

You need to provide your Onsite order, Passport details to EPFO.

You can email these details to CHENAI2@EPFINDIA.GOV.IN

HELLO Sir,

My case also same as above, i emailed to RO.CHENNAI2@epfindia.gov.in

Is this correct email id?

Regards,

Vasanth.

Hi, After sending all details to that above Email ,did they processed the claim?

Can you please respond

Hello,

First of all, my sincere appreciation for writing this post. I tried to claim the full amount & I don’t see any other issues. But claim rejected due to “CONT MADE ON HIGHER WAGES. ER TO CLARIFY IN JD AS PER PARA 26[6] OF EPF SCHEME 1952”

Could you please clarify ?

Hi,

My PF Advance under Covid was rejected with “Claim Rejected TRANSFER OF PF AMOUNT IS PENDING AT BOMMASANDRA OFFICE”.

I don’t see any reason for this rejection.

Your Claim [ Claim Id – PYKRP220550082507 ] has been rejected due to : 1) MEMBER IS EPS MEM AS PER TR IN MHBAN0048475000059424 EPS CONTRIBUTION NOT REMITTED BY EMPLOYER CLAR 2) CLAIM ALREADY SETTLED

Can you please help me in understanding the issue? How to resolve this?

Thanks in advance.

What claim were you trying to claim?

Is your current employer not deducting EPS? Check your EPF passbook?

Did you do any claim before?

Your Claim ID has been rejected due to : 1) EPS MEMBER AS PER TRANSFER IN ABCXY/XXXX/XXXXXX. PL CLARIFY THRU EMPLOYER 2) CLAIM ALREADY SETTLED

Can you please help me what issue it could be and what can I do to resolve this?

Claim rejected pension contribution (8.33%) has been deposited in employer share contribution, employer clarify

Can you please help me what is the issue

Is your basic salary above 15,000 rs?

The EPFO field office rejected my claim with reasons:

1) MEMBER PREVIOUS EST EPS MEMBER NOW PRESENT EST NON EPS MEMBER CLARIFY THE SAME

2) PHOTOCOPY OF BANK PASSBOOK NOT ATTESTED BY THE AUTHORIZED SIGNATORY

I worked in ESTABLISHMENT A from 06/2014 – 01/2021. Resigned A and joined another ESTABLISHMENT B and worked there from 02/2021 – 08/2021. Resigned B and doing business now till date 06/2022. I had applied for EPF and EPS withdrawals since I have now been out of salaried employment for 6+ months now.

For #1, I checked with ESTABLISHMENT B and they said that they did not contribute to EPS as my Basic+DA was more than Rs.15,000 and the entire sum was contributed to my PF. Now, how can I clarify this information to EPFO field office on my already rejected claim? Should I apply for a fresh claim again and will they consider if I send them an email clarifying the reason on why ESTABLISHMENT B did not contribute any EPS OR should I get a written statement letter from ESTABLISHMENT B and submit it to EPFO with a fresh claim?

For #2, the bank seal is already present. Will it be enough if I just get it attested by the bank branch manager?

Thank you in advance for your response.

The general rule is Once you start contributing to EPS then you cannot stop contributing to it.

Yes, you can get the bank passbook attested by the bank manager.

Don’t you have a cheque which shows your name and bank details

Did you transfer your EPF from the first job to the second one? it is important as explained http://bemoneyaware.com/why-transfer-old-epf-account-new-account/

Please file a complaint at EPFO as explained in the article http://bemoneyaware.com/epf-grievance-complaint-online/

Hi, thank you for the response. You are doing a really great work!

I did raise a grievance, and my PF balance was transfered from Employer A to Employer B before I went ahead with final EPF withdrawal claim.

As a follow-up on my question, my employer B produced a clarification letter to the EPFO office and I re-initiated the full final EPF withdrawal claim second time. This time again, they have rejected it for the same reason as the first one. On further raising them a grievance, this was their reply.

What should I do to resolve this and get the withdrawal. I am really stuck and any guidance will be very greatly appreciated.

Response from EPFO Grievance:

This is to clarify that your claim application rejected twice due to non deducting of EPS contribution from DOJ to DOE under BGBNG1234567898765437. Though you are a compulsory eps member as transfer in has been received on 27/04/2022. At the date of membership is 18/07/2014. Your employer misunderstood the notification and the notification applies to those members,who are members on or after 2014. In this regard the employer has submit request for ECR revision along with copies of ECR challan,Text files. This is for your kind information and you are requested to Ex employer in this regard.

After 1st September 2014 PF Department said if any person starts his new job with a salary of more than Rs. 15000 then his pension contribution would be nil

You started working from 18 Jul 2014 so this rule does not apply to you.

Hence your withdrawal has been rejected.

You need to contact your ex employer and he has to submit ECR revision

Thankyou!

Hi,

I joined new company in 2014, and left in Oct2020. Previous co. was exempted, and managed its own PF trust. My PF amount was also transferred to new co., but previous service history was not updated. My claim for full withdrawal was rejected due to –“1) PREVIOUS EPS SERVICE DETAILS NOT MENTION IN LEDGER SUBMIT ABSTRACT OF ANNEXURE K, JOINT BANK ACCOUNT 2) UAN CLAIM � CANCELLED CHEQUE NOT AS PER KYC BANK DETAILS”. Annex K on epfo portal is ahowing blank. KYC bank details is joint a/c where I have received salary since 2005.

q-1. How do i get EPS service history updated in Annex k

q-2. Do i need to open new account in single name?

Sad to hear.

Now an EPF member can update his date of exit(DOE) on the UAN website without the help of an employer after 2 months of leaving the job. The date of exit gets updated instantly. No employer approval, No EPFO approval is required

You can try it by following the steps explained in our article, http://bemoneyaware.com/epf-employee-update-date-of-exit-uan/

You can ask your previous employer for Annexure K and submit to EPFO by raising a grievance.

Is the cheque you submitted the same as mentioned in the KYC bank details of EPFO. Please login to UAN and check it.

Check our article http://bemoneyaware.com/uan-kyc-pan-aadhaar-bank-account/ for more details.

Best of luck.

Hope your EPF problem is solved soon.

Keep us posted

Hi Bewarmoney – I submitted an online claim for PF withdrawal and the claim was rejected because of the below reason:

Your Claim [ Claim Id – XXXXXXXX ] has been rejected due to : 1) OK 2) WAITING PERIOD OF 2 MONTHS NOT COMPLETED

I left my Job in 2019 and haven’t worked since. Please could you help me understand what i need to do.

Sad to hear.

Check your service history.

Is the end date marked?

Check the section about Insufficient Service http://bemoneyaware.com/epf-claim-rejection-pf/#Insufficient_Service

Hello Sir,

– I left company A in 2019 and later withdrew EPF amount but EPS claim got rejected with reasons: 1) EPS PARTICULARS HAS NOT BEEN RECEIVED FR0M PREVIOUS ESTABLISHEMENT

2) PREVIOUS PF ACCOUNT NO IS NOT CORRECT/MENTIONED

Have checked with previous establishments that EPS was shared. Also PF account details were also correct, that’s why EPF got settled.

– Joined company B in 2021 after a break, and wanted to transfer EPF/EPS but EPF claim got rejected stating that its already settled (did in previous step)which is understood, but want to transfer pension & service history from A to B. Kindly suggest me what to do in this case. Recently have joined company C, not sure how to transfer EPF & EPS along with service history and how to check if service history is transferred

– Whenever I raise grievance, they say to get the scheme certificate, which I don’t want and just want it to be transferred to my current establishment.

claim rejected pl submit f/19 first for pf balance and then submit f/10c

Thanks

Hello Adi, Did you manage to find a solution? as I am also facing same issue.

They say that – EPS SERVICE FOR PREVIOUS EST NOT RECD – Do you know how to solve / approach this?

dear sir,

I am getting this error while submitting my withdrawl form 19 & 10c “Claim Rejected TECHNICAL ERROR MEMBER IS ADVISED TO REAPPLY THIS CLAIM”.

Please help me out as its third time this error is coming.

Sad to hear that.

Problem in the EPF site, you need to apply for a claim again

Your Claim [ Claim Id – TNMAS230250002456 ] has been rejected due to : 1) MEMBER ONE MORE ID HAVEING NCP DAY NOT FURNISHED TR IN 2) NOT ELIGIBLE FOR WITHDRAWAL BENEFIT

Pls provide solutions to widraw

please help to solved following rejection reason

Your Claim [ Claim Id – KDMAL22045008489 ] has been rejected due to : 1) PLEASE SUBMIT PREVIOUS SERVICE PENSION DETAILS TO CALCULATE PENSION AMOUNT 2) FATHERs NAME DIFFERS

Sad to hear.

To help we need the following info

Were you getting any pension?

What claim did you make?

File a complaint for getting details about Father’s name as explained in the article http://bemoneyaware.com/epf-grievance-complaint-online/

Pf withdraw claim rejected

Reason: EQUAL SHARES REMITTED FOR A EPS MEMBER, CONTACT EMPLOYER AND GET IT CORRECTED.

please suggest a way forward