In order to ensure faster credit of policy moneys with greater security and privacy, L.I.C of India will be crediting all payments ( Survival Benefit, Maturity, Loan, Surrenders, payments of Pension & Group Schemes etc., ) directly to the Bank Account of the Policyholder / Beneficiary. All our valued policyholders / Master Policy holders / Annuitants / claimants are requested to give the Bank Account details by downloading the Policy e-payments NEFT mandate form or P&GS mandate form. This article talks about the NEFT Form of LIC, what are advantages of using LIC NEFT Form,what are advantages of using LIC NEFT Form. Sample image of LIC NEFT form with download information.

LIC NEFT

In order to ensure faster credit of policy moneys with greater security and privacy, L.I.C of India will be crediting all payments ( Survival Benefit, Maturity, Loan, Surrenders, payments of Pension & Group Schemes etc., ) directly to the Bank Account of the Policyholder / Beneficiary. This has been effective from 01/Oct/2011. This is also in accordance with the transparency drive of the Government of India. Please submit the NEFT mandate along with necessary enclosures to settle the payment under your LIC policy through NEFT. LIC will not settle the policy payment in any other mode of payment like cheque.

Policyholders / Master Policy holders / Annuitants / claimants are requested to give the Bank Account details by downloading the Policy e-payments NEFT mandate form or P&GS(Pension and Group Scheme) mandate form . The completed mandate forms have to be handed over to any Branch office servicing at least one of the policy/policies listed in the mandate. P&GS Master policyholders/beneficiaries/annuitants are requested to complete the mandate form and hand them over to the servicing P&GS Unit.

.

Before submitting the LIC NEFT Form, please check

- The account of the policy holder / annuitant should be operational at the time of receipt of policy payment.

- Policy holder’s/ claimants’ name under the policy should match with that of Bank A/c, else it is likely to be rejected.

- Before submitting the mandate form, the policyholder/ claimant should confirm from his bank that it is NEFT enabled.

- Note: NRI accounts are guided by FEMA regulations; LIC has decided not to include NRI accounts for fund transfer. So policy holders / annuitants are requested not to submit their NRI account details.

- After submission of NEFT details, if there is any change in bank details then fresh mandate form will have to be submitted.

If you are getting the annuity payments through ECS mode, you may opt for payment by NEFT by submitting the mandate or continue to receive the annuity payment in the existing ECS mode.

One NEFT Form / mandate can be used for 6 different policy numbers of the same policyholder.

- a) All the items mentioned in the enclosed mandate form should be filled correctly.

- b) The completed mandate for NEFT should be sent to LIC Branch, servicing at least one of the policies, listed in the mandate.

- c) The policy holder / claimant should also submit a cancelled blank cheque leaf having name and account number printed over it. If name and account number is not mentioned on the cheque leaf then photo copy of the page of the passbook where details of the Bank account are mentioned, is to be submitted along with the cancelled cheque leaf.

- d) If within two days of the due date, the amount is not credited to your Bank Account, then you may contact the branch where you have submitted the NEFT mandate.

- After the NEFT mandate is submitted you should get a SMS/email from LIC regarding NEFT updation.

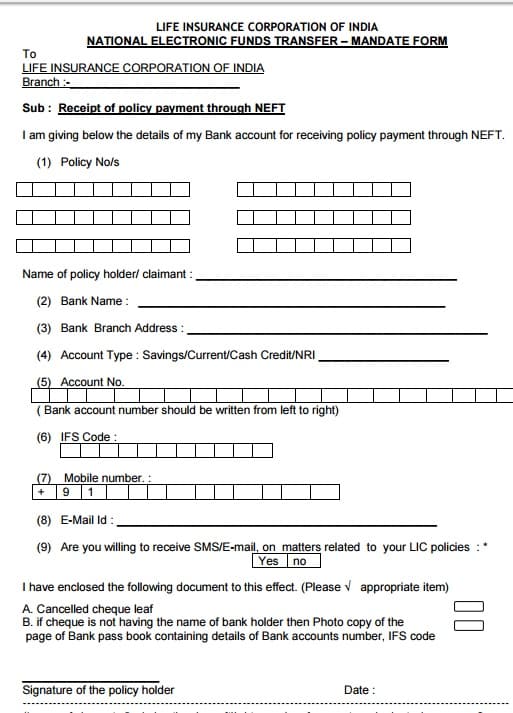

The NEFT mandate form is shown below. You can download the Form from LIC website, Find Download Forms and download NEFT Mandate.

It requires policy number, bank details and IFSC Code, Mobile Number & Email (if you require SMS, email alerts). It has to sent along with Cancelled cheque to the serving branch.

What is a NEFT ?

It is a nationwide system that facilitates to transfer a fund from one account of any bank branch to another account of any bank branch. NEFT or RTGS is used for transfer of funds to other banks. This system is operated by Reserve Bank of India or RBI. Almost all the banks support NEFT but you can still check for your bank and branch at RBI website.

Speed that is the biggest advantage of electronic fund transfer (real-time gross settlement or RTGS and national electronic fund transfer or NEFT). A cheque usually takes two to three days to clear. In electronic transfers, money is transferred directly from the bank account of the person sending or remitting the money to the bank account of the receiver within the same day. There are no charges for receiving the funds to your account through NEFT but there are minimal charges if you transfer funds from your account.

Our article Third Party Fund Transfer : NEFT,RTGS explains NEFT in detail.

What are Advantages of NEFT system for LIC Policy holders / Annuitants :

- a) The policy holder / claimant will get the credit in his own account on the due date of payment irrespective of the location of his bank.

- b) NEFT will ensure speedier and secure mode of payment.

- c) There will be no extra charges to the policy holders / claimant.

- d) SMS and E-mail alerts may also be provided wherever the policy payment is made to the policyholder/ claimants’ account through NEFT.

- e) Each payment from LIC through NEFT will create one UTR(Unique Transaction Reference) number. If there is any problem in credit to the account, policy holders / claimant can confirm from their bank by quoting this UTR no. In other words it is easy to track a transaction of NEFT, using UTR number.

Related articles:

- LIC Bonus Rates, Special Bonus,Calculation,Returns from Bonus

- How to Register Online at LIC e-Services

- Mixing Insurance with Investment

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- LIC Jeevan Shikhar Insurance Policy

- Revive Lapsed Insurance Policy, LIC Revival Camp

- What is Electronic Insurance Account or eIA

- LIC Jeevan Shikhar Insurance Policy

- LIC Jeevan Labh : Is it profitable for you? Should you buy it

8 responses to “Submit LIC NEFT Form for faster settlement”

How long does it takes for Amount to be credited in account after submission of NEFT form , cancelled cheque copy and other required documents at the LIC branch.

I only got a reciept of form submission but no SMS

If your maturity is on 11/03/2020 then you will be required to submit the bond, passbook details and id proofs a month before.

The officially stated time is 30 days from the date of submission of required formalities.

Usually, for an amount below 20 lakhs, it will take a time period of 1 day to 7 days (working days ) to get amount to be deposited in our bank accounts.

If it is above 20 lakhs, 1 week more means 10 days to 15 days maximum.

HOW TO DOWN LOAD THE MATURITY CLAIM FORM OR SHOULD

I WAIT FOR LIC TO SEND THE SAME?

Typically LIC sends it in advance.

If it is the maturity date and you haven’t got claim form then check with LIC office.

I enjoyed going to your webiste. I rarely leave comments, but

you definately up deserve a thumbs!

sir,

how to submit online NEFT Form/mandate of individual for getting bonus

Can I send the NEFT mandate form alongwith cancelled cheque through post or courier. Please reply.

NEFT MANDATE FORM REQUIRED FOR CLAIMING MATURITY CLAIM OF POLICY 761210797 STANDING IN THE NAME OF MY SON MR SURESH V

POLICY COMMENCEMENT DATE 28-01-1994 TERM 14-25 AMOUNT OF POLICY 5000 MATURITY DATE 28-01-2019 ANNUAL PREMIUM OF THE POLICY IS PAID BY MR VASUDEVAN KRISHNARAO RETIRED SBI MANAGER THROUGH ECS MODE TO DEBIT BANK ACCOUNT 10566814604 HOW TO SUBMIT NEFT MANDATE FORM ONLINE

PLEASESEND REPLY BY EMAIL ID VIZ krishvasu1937@gmail.com or SEND SMS TO MOBILE NUMBER 7667475208