LIC is offering a New Year gift to the public in the form of a limited-premium, non-linked and with-profit endowment assurance plan Jeevan Labh from 4 Jan 2016. The highlight of the plan is that premium is payable for a limited period while risk is covered for the longer policy term. Jeevan Labh is a word in Hindi, Jeevan means Life and Labh means profit. But who will profit from the policy? Will it be profitable to you?

Table of Contents

Overview of LIC Jeevan Labh plan

LIC Jeevan Labh also called Table 836 is a non-linked participating Endowment Insurance Plan. It offers a combination of protection and saving features.

- The plan is available from ages 8 to 59 years. The maximum age at maturity is 75 years.

- Minimum basic sum assured is ₹2 lakh with maximum basic sum assured having no limit.

- In LIC Jeevan Labh there are only 3 policy terms with corresponding premium paying term. The customer can select any one of these according to their requirement.The policy terms are 16, 21, and 25 years with premium-paying terms of 10,15 and 16 years respectively. Policy term means till when one would be covered with insurance. Premium Paying Term, PPT, means till when one has to pay premium.

- For example if Rahul , who is 30 years of age, plans to take LIC Jeevan Labh for the term of 21 years which has premium payment term (PPT) of 15 years . He will be covered i.e have insurance till he is 50 years old but he will have to pay premium only till 15 years i.e till he is 45 years. For next 6 years even though he is not paying premium he is still insured.

- LIC Jeevan Labh provides Optional Benefit, Accidental Death and Disability Benefit Rider by payment of additional premium. If buyer opted for this rider, an amount equal to sum assured will be payable if death occurs due to accident. In case of permanent disability due to accident, future premium will be waived and the amount equal to Sum Assured is payable in 10 years equal monthly installments.

- New term assurance rider is also available at the inception of the policy on payment of additional premium. If policy holder opts for this rider, an amount equal to term assurance rider sum assured will be payable on the death of the life assured during the policy term.

- One can take Loan against LIC Jeevan Labh Plan 836 after payment of premiums for at least 3 years subject to conditions: Maximum loan for inforce policy-90% of surrender value and for paid up policies 80% of surrender value.

- One can Surrender after 3 years of full premium payment.

- Paid-up Value = Basic Sum assured x (No. of premiums paid/ Total no. of premiums payable)

- Premium Payment Mode rebate

- 2% on yearly,

- 1% on Half Yearly,

- Nil on Quarterly & Monthly

- Rebate on High Sum Assured (Per 1000 of Sum Assured)

- 0% up to 4,90,000

- 1.25% for 5,00,000 to 9,90,000

- 1.50% for 10,00,000 to 14,90,000

- 1.75% for 15,00,000 and above

Offical information at LIC website LIC Jeevan Labh

Understanding Insurance Jargon : Sum Assured,Policy Term,Participating …

Lets try to understand the Insurance jargon used in the overview of the plan. Our article Life Insurance explains these terms in detail.

- Insurance is basically a contract,a policy, between us and the insurance company. The insurance company promises you to pay a certain agreed amount,Sum assured, on happening of an uncertain event.When we buy insurance we transfer a portion of risk to the insurance company. This protection comes at a price,premium, but (hopefully) it’s at fraction of cost what we might find otherwise ourselves burdened with.

- Policy tenure or Term : The period for which an insurance policy provides cover or the number of years you choose to insure yourself. Policy terms vary from a single year many years. Premium paying term is the number of years you pay premium on your policy. Usually the premium paying term is the same as the policy term. However, some policies offer you the option of selecting a premium paying term that is lower than the policy term.

- Endowment Plan: An endowment plans if policy holder dies during the policy term, nominee gets the sum assured plus some returns; if he survives the policy term, he gets back the sum assured and returns. Unlike Term Insurance where if the insured dies during the policy term his family gets the money, but if he survives the policy term he or his family does not get anything.

- Non Linked : It means that it is NOT Unit linked Insurance Plan or ULIP which are combined life insurance and investment plans. In ULIP part of the premium paid by the customer goes towards providing the insurance cover and the balance is invested in venues of investment desired by the policy holder. These insurance plans double as mutual funds.In Unit Linked Insurance Plans(ULIP), the investments are subject to risks associated with the capital markets i.e linked to the stock market. But this plan is not linked to stock market.

- Participating : Over and above the returns mentioned ,you also get an additional benefit in the form of reversionary bonuses. Typically, these bonuses are a percentage of the sum assured and are declared at the end of every year. Once declared they become guaranteed. These bonuses come from the surplus generated by the participating fund. The insurer is free to exercise its discretion, while declaring the surplus.Such plans are called as Participating plans. Bonus is only paid to customers who have bought a Participating Insurance Policy .Our article Bonus of Life Insurance Policies explains about Bonus in detail.

- Terminal bonus or Final additional bonus : Terminal bonus is paid at maturity or at the time of claim.

- Simple reversionary bonuses : Simple reversionary bonus is a with profits life assurance bonus, normally declared annually, which is based on the profits of the life company’s investment and is payable at the maturity of the policy or prior death. Simple reversionary bonuses are declared as a percentage rate, calculated on the sum assured. For example if you hold a policy of Rs 10,00,000 Sum assured and the simple reversionary bonus for the year declared is Rs 60 per thousand sum assured, then your bonus amount is Rs 60 * 10,00,000/1,000 which is Rs 60,000 for this year, but you will only get it at maturity or on death.

- The sum assured is the amount of money an insurance policy guarantees that the policyholder will receive. This is also known as the cover or the coverage amount and is the total amount for which an individual is insured.Maturity value is the amount the insurance company has to pay an individual when the policy matures. So Maturity value includes the sum assured and the bonuses.Premium to arrive at Basic Sum Assured will not include the taxes you paid, any extra premium and is before applying rebate.

- Riders: Additional covers that can be added to a life policy, for a cost For example – If Akshay, has taken a policy which offers a sum assured of Rs. 10 lakhs and has taken an accidental death benefit rider of an additional Rs. 10 lakhs. In the event of death of the policy holder due to an accident during the tenure of the policy, the nominee would get Rs. 20 lakhs as the death benefit.

- Tax benefits on Insurance policies is available.

- Premiums paid towards a life insurance policy qualify for tax deductions under Section 80C with a limit of 1.5 lakh (before 10 Jul 2014 it was 1 lakh) in a financial year.

- Section 10 (10D) exempts maturity proceeds from tax.

All regular-premium life insurance policies issued after April 1 2012, except pension plans, will have to offer a protection cover of at least 10 times the annual premium. Otherwise, they will not be eligible for tax benefits under section 80C and 10 (10D). Before 1st April 2012, the mandated cover was five times the annual premium.

Lets see what a policy holder of LIC Jeevan Labh will get.

- On Death of Policy holder – If policy holder dies during the policy term, his nominee will receive the Sum Assured + Accrued Bonuses + Final additional bonus or FAB (if any). After this, the policy will cease to exist. The death benefit would not be less than 105 per cent of the total premiums paid as on date of death.

- On Surviving till maturity – If policy holder survives till the end of policy term, he will get the Sum Assured + Accrued Bonuses+FAB (if any). Final additional bonus or FABThe policy will terminate thereafter.

LIC Bonus Rates

When Life Insurance companies make profits and share the profits with their policyholders they do so by calling it a Bonus. Bonus is not shared with every customer or every policyholder. It is only paid to customers who have bought a Participating Insurance Policy such as traditional insurance policies like the endowment policy. The percentage of bonus that is paid to the policyholder is not fixed. We have touched two kinds of bonus, Simple reversionary bonus (SRB) and Terminal or Final additional bonus (FAB)

Every year LIC declares bonus rates on all its Products. LIC’s Bonus rates for 2014-2015, were declared in Aug,2015. Bonus of LIC Plan is available at http://www.licindia.in/bonus_info.htm

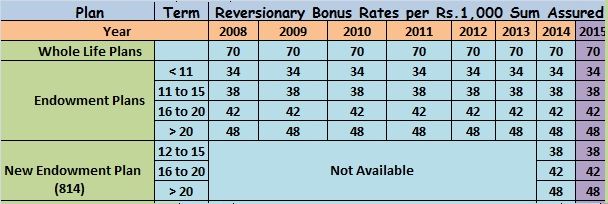

- SRB Bonus rates vary according to the type of policy, policy and term of the policy. E.g. Endowment plan have different Bonus rates than WholeBack Plan. Jeevan Anand policy with a term of 5 year will have a different bonus rate than Jeevan Anand of 11 years.

- As per the last reported bonus rates LIC of India reported different rates for policies with term <11 years, between 11-15 years, between 16-20 years and >20 years

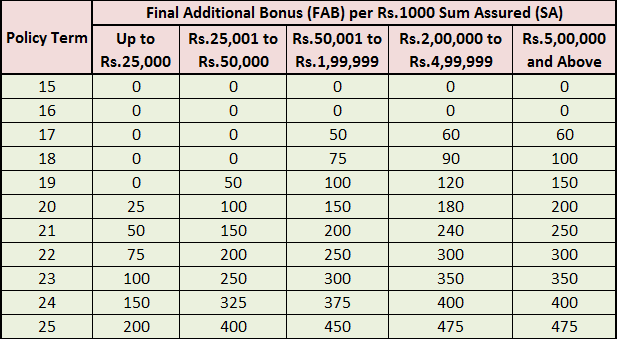

- Final Additional Bonus is dependent on the term of the policy and the sum assured. E.g. LIC of India’s Jeevan Anand policy of Sum Assured of 3 lakhs for 5 years will have a different FAB than same policy of 10 lakhs for same 5 years.

Bonus rates of LIC for Whole Life Plans and Endowment Plans over the years are shown in images below

LIC Terminal Bonus or Final additional bonus for policy term per 1000 Rs of Sum Assured is shown below

Should you invest in LIC Jeevan Labh Scheme?

People buy endowment or money back insurance plans because they get the money back. But how much do they get back? Let’s see.

Following are some of the sample annual tabular premium rates (in Rs.) (exclusive of service tax) per Rs. 1000 Basic Sum Assured. So if someage aged 20 years go for Sum assured or insurance amount of 2,00,000 for 16 years then Premium would be 85.20 times 200(Its per 1000 sum assured) which is 17,040 while if someone aged 30 years goes for 25 years for 5 lakh sum assured then from table value is 46.60 i.e premium without service tax is 46.60*300 terms which is 23,300. You can see the premium for different ages here

| Age

(in years) |

Policy Term/Premium Paying Term (in Years) | ||

| 16 (10) | 21 (15) | 25 (16) | |

| 20 | 85.20 | 54.50 | 45.95 |

| 30 | 85.50 | 54.95 | 46.60 |

| 40 | 86.80 | 56.80 | 48. |

One will get returns in the range of 6% to 7% under different options of LIC’s Jeevan Labh plan. For example If oneaged 35 years opts for LIC Jeevan Labh policy for Sum assured of 2 lakh Policy term of 16 years and PPT as 10 years, premium is Rs 17,892 with service. He would then have to pay the premium for 10 years. In the beginning of 17th year he may receive the maturity benefit of Rs 3.38 Lakh (inclusive of Sum Assured, accrued bonuses and final additional bonus). The expected return on his investment is around 5.6%.

| Sum Assured (SA) | 2,00,000 | 2,00,000 | 2,00,000 |

| Policy Term(Years) | 16 | 21 | 25 |

| Premium Paying Term(Years) | 10 | 15 | 16 |

| Yearly Premium for aged 35 years | 17,892 | 11,676 | 10,031 |

| Total | 1,78,920 | 1,75,140 | 1,60,496 |

| Bonus Rates(based on past declaration)

SRB: per 1000 of Sum Assured(SA) |

SRB : Rs 42

FAB 2% of SA |

SRB : Rs 48

FAB 10% of SA |

SRB : Rs 50

FAB 40% of SA |

| Total Maturity Value on surviving | 3,38,400 | 4,21,600 | 5,30,000 |

| Return | 5.59% | 6.22% | 6.79% |

Life insurance is meant to offer financial protection to dependents in the unfortunate event of one’s death. Its purpose is to enable one’s dependents to maintain their current life style and pursue their life goals.Our article Checklist for buying Life Insurance Policy talks about the questions one should ask before buying a Life insurance policy. Before buying insurance or any product, think what you are getting and an what cost? Try not complicate your life by combining investment and insurance in one. Article Mixing Insurance with Investment talks about why mixing investment with insurance is not a good idea.

How to buy LIC Jeevan Labh

The policy is not available online. For application/proposal form visit the nearest branch of LIC or contact any LIC Agent.Following are the required documents to buy the policy of LIC Jeevan Labh Plan.

- Application form/Proposal form: The Revised Proposal Form Numbers are 300, 340 and 360.

- Address proof

- Age proof

- Medical reports(if required).

How to Claim LIC Jeevan Labh

Below are the necessary Document to claim for LIC Jeevan Labh Table no. 836.

- Original Policy Document

- NEFT Mandate Form.

- Proof of Title.

- Death Certificate.

- Accident/ Disability Proof (as mentioned in the rider circular).

- School/ College/ employer’s certificate.

A lot of new tax saving plans are launched during Jan-Mar as most of salaried individuals have to submit tax saving investment proof to their employers. So people are in rush to buy the tax saving plan. The premiums paid on LIC Jeevan Labh policy may give you income tax benefit under section 80c, but you would be locking yourself paying premium for the premium paying term. Surrender is only possible after 3 years. Do think beyond taxes when investing in Financial Products.

- If you are looking for an investment avenue to save some taxes, you may consider buying ELSS Funds/PPF for long-term.

- If your requirement is to save taxes plus would like to have life cover, you can consider buying a pure Term Insurance Plan.

Hi! the article is really great for ppl like me who do not have any kindly information regarding the policies. i am planning to take LIC policy but a bit confused which i shall go for either the Jeevan labh or Anand or may be any other.. Kindly help guide me

How much will i get if i surrender after three years of premium payment?

Which one is best jeevan labh 836 and jeevan anand..???

Plz guide i am so confuse..

Jeevan Labh with 25 years will give good return than Jeevan Anand

Are you asking or telling?

Can you expand more?

Nice article

Thanks for commenting.

It encourages us a lot

wheather Jeevan Labh table no. 836 is providing pension after maturity and if so what is the rate or calculation . my age is 32 sum assured 15 lakh for 25 years.

After paying first premium.if we withdraw.will we get any money?

No you will not any money

Excellent article. Thank you.

Excellent article. Thank you.