LIC has announced its bonus for the year 2016-17 as it usually does in Sep along with LIC’s One Time Diamond Jubilee Bonus. Bonus is a part of the guaranteed returns that LIC offers. This article will give Overview of LIC Bonus, LIC’s One Time Diamond Jubilee Bonus, the meaning of bonus, its types, how it is calculated and comparison of LIC bonuses with private companies.

Table of Contents

Overview of LIC Bonus

Every year in Sep LIC,Actuarial department does the valuation, and declares the bonus rates ,Simple Reversionary Bonus, Final additional bonus (FAB) and Loyalty addition (LA). As per the LIC Act, it shares 95% of its profit with the policyholders and the rest with the government as its owner. In 2014-15, LIC paid Rs 34,283 crore as regular annual bonus to the policyholders. In 2015-16 LIC had paid surplus of Rs 2,502 crore to the government up from Rs 1,803 crore.

Life Insurance Corporation of India has also declared the One time Diamond Jubilee Bonus on its 60th anniversary

These bonus rates are applicable for new policies between 01/04/2015 to 31/03/2016 and in force as on 31/03/2016. It will be applicable to policies resulting from claims by death or maturity (including those discounted within one year of maturity) or surrendered on or after 01/01/2016. Please note that the bonus are paid as per the policy conditions and depend on the Sum assured and policy term. The bonus is reversed back to the policy, and the amount will be paid at maturity.

LIC’s One Time Diamond Jubilee Bonus

As LIC is celebrating its 60th anniversary, it has also declared a one-time diamond jubilee bonus in addition to the simple reversionary bonus, final addition bonus and loyalty bonus. As per the plan, the corporation will pay anywhere between Rs 5 to Rs 60 per Rs 1,000 sum assured, depending on the tenor of the policy. The old policy holder gets more jubilee bonus than the new policy holder.

- The bonus will be eligible for policies in force as of March 31, 2016, and existing on or after September 1, 2016.

- This onetime bonus will be paid over and above the annual payout of its profit sharing. Holders of money back, whole life and endowment with profit plans policies benefit. With this bonus, old policies may be revived.

- Even policies which have lapsed as of March 31, 2016 will be eligible provided they are subsequently revived

- The move will benefit over 29 crore individual policyholders of the national insurer as well as over 12 lakh group policyholders.

- LIC Diamond Jubliee Bonus converts into Rs. 500 for a policyholder with an assured sum of Rs. 1,00,000, or Rs. 6,000, depending on the duration of the policy, meaning older the policy or closer to the maturity date, maximum the bonus. The bonus amount will increase by Rs. 500 each for every older policy with a five-year gap. For example, a policy that started in April 2010 will get Rs. 1,000 for every Rs. 1 lakh of assured sum between April 1, 2010 and March 31, 2016.

- A policyholder will be eligible for jubilee bonus if it policy is “with profit” and fulfills other conditions like that for a regular reversionary bonus.

- Policies that are entitled for guaranteed additional bonus will not be eligible for diamond jubilee bonus.

| Policy subscription date | Bonus rate

(per 1000 sum assured) |

| 1st April 2011 – 31st March 2016 | 5 |

| 1st April 2006 – 31st March 2011 | 10 |

| 1st April 2001 – 31st March 2006 | 15 |

| 1st April 1996 – 31st March 2001 | 25 |

| 1st April 1991- 31st March 2006 | 35 |

| 1st April 1986- 31st March 1991 | 45 |

| Upto 31st march 1986 | 60 |

LIC Special Bonus

On the occasion a Special Golden Jubilee,on the 1st September, 2005, Reversionary Bonus ranging from Rs. 5 to Rs. 50 per thousand sum assured was declared by LIC. Ref

The Life Insurance Corporation of India (LIC) had declared higher bonus rates for the 2011-12 year under seven of its ‘With Profit Plans’ and Loyalty Additions under seven other plans, on the occasion of its 55th anniversary celebrations. The bonus was declared in seven plans, namely, Jeevan Anand, Jeevan Tarang, Jeevan Madhur, Child Future Plan, Jeevan Shree I, Jeevan Bharati I and Jeevan Pramukh, all in the range of Rs. 1 – Rs. 6 per thousand sum assured.

Understanding Bonus

What is Bonus?

Life insurance companies distribute their annual profits to the policy holders. This profit is known as bonus. Various types of bonuses are distributed during a year. Our article Bonus of Life Insurance Policies explains bonus in detail.

Who is eligible for a bonus?

Not every policy holder is entitled a bonus declared by LIC. Only the insurance policies which are participating in nature are eligible for a bonus. Participating insurance policies like the traditional policies like endowment policy, whole life insurance policy and money back plan qualify for a bonus. The premium for participating policy is higher than non-participating policy. The percentage of bonus that will be paid is not fixed.

What are the types of bonuses given out by an Insurance company?

- Reversionary bonus: They are declared as a percentage rate, which applies to the sum assured of the policy, in respect of the basic policy benefit.Once declared, they form a part of the guaranteed benefits of the policy. These are and paid at the end of maturity period only or on death, whichever is earlier. Reversionary bonuses are of following kinds:

- Simple reversionary bonus :Simple reversionary bonuses are declared as a percentage rate, calculated on the sum assured.

- Compound reversionary bonus :Compound reversionary bonuses also declared as a percentage rate like simple reversionary bonus but they are applied to sum assured and to the reversionary bonuses already attached to the policy

- Special reversionary bonus: Special reversionary bonus is a one-time bonus during the term of the policy . This bonus is declared if there are some profits arising due to a one-off reason, and the same profits are not expected to repeat again. This bonus is declared immediately but paid at the time of claim or maturity. For example, to coincide with its fiftieth anniversary, LIC announced a special bonus for its policyholders in 2005. Apart from the special bonus, the corporation announced a final additional bonus for its policyholders.

- Other kinds of bonuses are :

- Terminal bonus or Final additional bonus : Terminal bonus is paid at maturity or at the time of claim. After declaring reversionary bonuses if there are still residual profits available in the policy, they are declared as terminal bonus.

- Loyalty addition (LA) :This is one time payment which will be given only after completion of certain period

- Guaranteed Addition (GA) : In few plans bonus is guaranteed where life insurance company is obliged to pay fixed amount of bonus till the agreed period, called as Guaranteed Addition. Ex LIC’s Komal Jeevan and Jeevan Shree-1.

What is Simple reversionary bonus?

Simple reversionary bonus is a with profits life assurance bonus, normally declared annually, which is based on the profits of the life company’s investment and is payable at the maturity of the policy or prior death. Simple reversionary bonuses are declared as a percentage rate, calculated on the sum assured. For example if you hold a policy of Rs 10,00,000 Sum assured and the simple reversionary bonus for the year declared is Rs 60 per thousand sum assured, then your bonus amount is Rs 60 * 10,00,000/1,000 which is Rs 60,000 for this year, but you will only get it at maturity or on death.

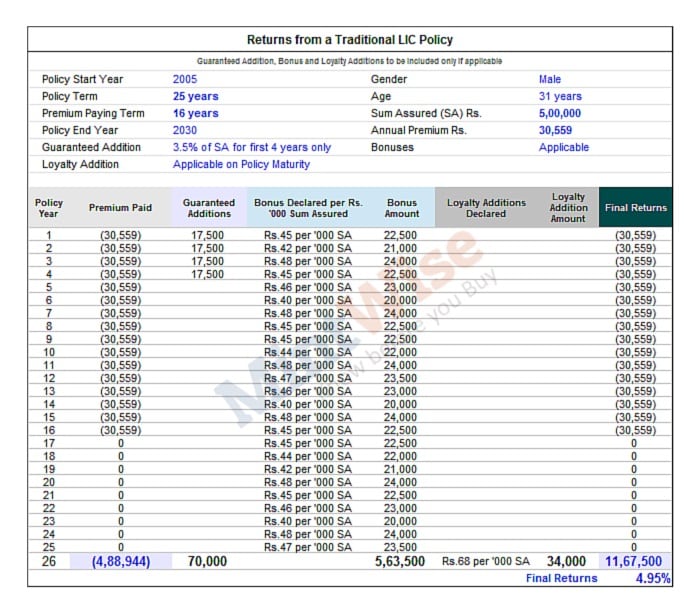

A detailed article on when all queries related to bonus like what happens when you surrender the policy, when it is paid etc can be found at Bonus of Life Insurance Policies .Returns from a traditional LIC Policy looks as follows:

LIC Bonus

How to calculate LIC bonus?

Bonus declared is per thousand sum assured. To find Bonus for a particular year is given below.

- You need to find your LIC policy by Name/Table number.

- Find the row corresponding to the term plan or time period of your policy

- Find the Bonus Rate per 1000 corresponding to term plan

- Find the Sum Assured of your Policy

- Bonus calculations Formula: (Sum Assured/1000)*Bonus rates

Say Mr. Shah has taken Jeevan Surabhi Plan for 15 years and the sum assured is Rs. 10 lakhs. From the :LIC Bonus Rates his Bonus Rate is 34 per thousand.

| Name of Plan | Term Plan | Reversionary bonus rate per 1000 sum assured | |

| 6 | Jeevan Surabhi Plan 106, 107 & 108 | 15 | 34 |

| 20 | 41 | ||

| 25 | 50 |

- So sum assured = Rs. 10,00,000

- Number of thousands in 10 lakh: 10,00,000/ 1000 = 1000

- Bonus rate of Jeevan Surabhi = 34/ 1000

- Eligible bonus in that year: 34 x 1000 = Rs. 34000

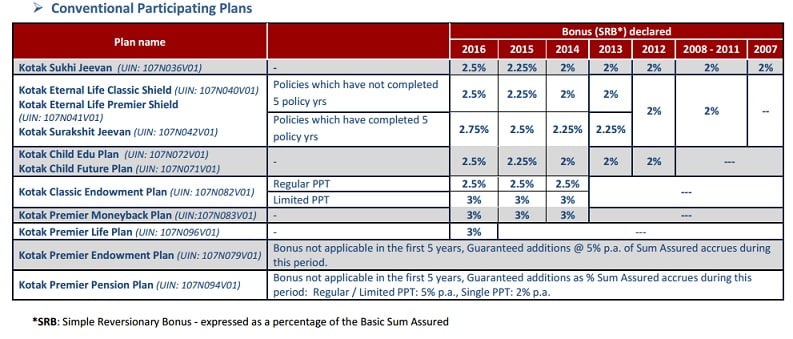

LIC bonus v/s Private insurance companies’ bonus

It’s not that only LIC declares Bonus. Other private companies also declare bonus for With-Profits plans For the Bonus Rates from are given below.

For ICICI Insurance Policies the Bonus Rates are

How can one find the LIC bonus by sending sms ?

To know the amount of bonus vested for your policy send an SMS to 56767855 with the following message:

ASKLIC <POLICY NO> BONUS

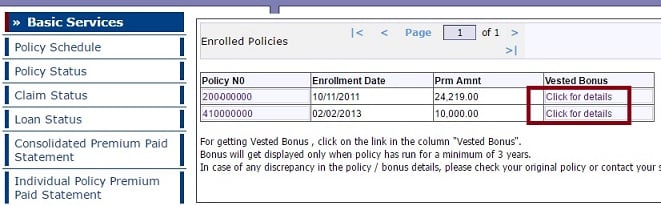

How can one find the bonus from LIC e Website?

- Log into LIC website.

- Select the Policy Status.

- For Enrolled Policies click on Vested Bonus as shown in image below

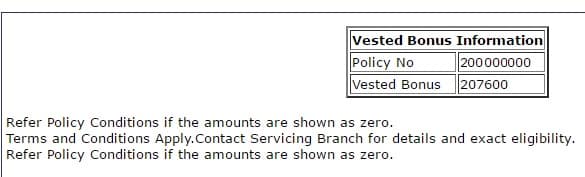

You can see the Vested Bonus for the policy. If its 0 it means that your policy is not eligible for bonus.

LIC Bonus Rates

LIC bonuses from 2011- 2015 are given in table below. Ref The rates of LIC Bonus have been static is last few years.

Comparison of reversionary bonus rates declared by LIC in 2003-04 and the rates declared for 2014-15 reveals that rates have fallen across plans. A noteworthy point is that bonus rates have remained static since 2007-08 in most plans, but have increased under Jeevan Anand, New Jeevan Anand and Jeevan Shree policies.

- The reversionary bonus rate per Rs 1,000 sum assured on a whole life plan was Rs 80 in 2003-04. It fell to Rs 71 in 2004-05, but remained static at Rs 70 since 2006-07 till 2014-15.

- On endowment policies, it ranged from Rs 51-Rs 57 in 2003-04, while it was Rs 34-Rs 48 as on March 31, 2015.

- In the case of Jeevan Mitra, Jeevan Sathi Limited Endowment plans, the reversionary bonus ranged from Rs 52-Rs 58 for 2003-04, but diminished to Rs 40-Rs 50 for Jeevan Mitra and Rs 40-48 for Jeevan Saathi for 2014-15.

- For Jeevan Anand, the bonus rate for 2003-04 ranged from Rs 49 to Rs 53, fell to Rs 34-45 in 2007-08 but has increased to Rs 38-Rs 49 for 2014-15.

- For Jeevan Surabhi, it was Rs 48 (20-year term) and Rs 57 (25-year term)) for 2003-04, but has been earning Rs 41 (20-year term) and Rs 50 on a policy of 25-year term for 2014-15.

Money back plans generally have a lower rate of bonus than endowment policies. This is because money is paid back to the investor of money back policy on a regular basis while the sum assured remains till the end or maturity of the policy.

| Reversionary bonus rates per 1000 sum assured | ||||||||

| Group | Plan | Term | 2016 – 17 | 2015 – 16 | 2014-15 | 2013 -14 | 2012-13 | 2011-12 |

| 1 | Whole life type (Plans 2,5,6,8,10,28,35,36,37,38,09,77,78,85,86) | NA | 70 | 70 | 70 | 70 | 70 | 70 |

| 2 | Endowment type / Plans 14, 17, 27/

After conversion, 28 after conversion, 34, 39, 40, 41, 42, 50, 79, 80, 81, 84, 87,90,91, 92,95, 101, 102,103, 109, 110 & 121 |

<11 | 34 | 34 | 34 | 34 | 34 | 34 |

| 11 to 15 | 38 | 38 | 38 | 38 | 38 | 38 | ||

| 16 to 20 | 42 | 42 | 42 | 42 | 42 | 42 | ||

| 20> | 48 | 48 | 48 | 48 | 48 | 48 | ||

| 3 | New Endowment Plan 814 | 12 to 15 | 38 | 38 | 38 | NA | NA | NA |

| 16 to 20 | 42 | 42 | 42 | NA | NA | NA | ||

| 20> | 48 | 48 | 48 | NA | NA | NA | ||

| 4 | Single Premium Endowment Plan No 817 | 10 to 15 | 41 | 41 | 40 | NA | NA | NA |

| 16 to 20 | 46 | 46 | 45 | NA | NA | NA | ||

| 20> | 56 | 51 | 50 | NA | NA | NA | ||

| 5 | Money Back Assurance Plan 75 & 93 | 20 | 39 | 39 | 39 | 39 | 39 | 39 |

| 25 | 44 | 44 | 44 | 44 | 44 | 44 | ||

| 6 | Jeevan Surabhi Plan 106, 107 & 108 | 15 | 34 | 34 | 34 | 34 | 34 | 34 |

| 20 | 41 | 41 | 41 | 41 | 41 | 41 | ||

| 25 | 50 | 50 | 50 | 50 | 50 | 50 | ||

| 7 | Jeevan Mitra (Double cover) & Jeevan Saathi 88 & 89 | 15 | 40 | 40 | 40 | 40 | 40 | 40 |

| 16 to 20 | 44 | 44 | 44 | 44 | 44 | 44 | ||

| 20> | 48 | 48 | 48 | 48 | 48 | 48 | ||

| 8 | Jeevan mitra plan 133 Triple Cover | 16 to 20 | 40 | 40 | 40 | 40 | 40 | 40 |

| >20 | 45 | 45 | 45 | 45 | 45 | 45 | ||

| <16 | 50 | 50 | 50 | 50 | 50 | 50 | ||

| 9 | Limited Payment Endowment Plan 48 | 16 to 20 | 40 | 45 | NA | NA | NA | NA |

| >20 | 50 | 50 | NA | NA | NA | NA | ||

| <11 | 40 | 40 | NA | NA | NA | NA | ||

| 10 | Jeevan Anand Plan no 149 | 11 to 15 | 41 | 41 | 40 | 40 | 39 | 39 |

| 16 to 20 | 45 | 45 | 44 | 44 | 43 | 43 | ||

| >20 | 49 | 49 | 48 | 48 | 47 | 47 | ||

| 11 | New Jeevan Anand Plan 815 | 15 | 41 | 41 | 40 | NA | NA | NA |

| 16 to 20 | 45 | 45 | 44 | NA | NA | NA | ||

| >20 | 49 | 49 | 48 | NA | NA | NA | ||

| 12 | Jeevan Rekha Plan 152 | <11 | 49 | 49 | 49 | 49 | 49 | |

| 11 to 15 | 44 | 44 | 44 | 44 | 44 | |||

| 16 to 20 | 40 | 40 | 40 | 40 | 40 | |||

| >20 | 34 | 34 | 34 | 34 | 34 | |||

| 13 | Jeevan Anurag Plan 168 | <11 | 38 | 38 | 38 | 38 | 38 | 38 |

| 11 to 15 | 40 | 40 | 40 | 40 | 40 | 40 | ||

| 16 to 20 | 42 | 42 | 42 | 42 | 42 | 42 | ||

| >20 | 44 | 44 | 44 | 44 | 44 | 44 | ||

| 14 | New Jeevan Dhara – I Plan 148 | <6 | 20 | 20 | 20 | 20 | 20 | 20 |

| 6 to 10 | 25 | 25 | 25 | 25 | 25 | 25 | ||

| 11 to 15 | 28 | 28 | 28 | 28 | 28 | 28 | ||

| >15 | 32 | 32 | 32 | 32 | 32 | |||

| 15 | Jeevan Tarang Plan 178 | 10 | 44 | 47 | 47 | 47 | 46 | |

| 15 | 48 | 48 | 48 | 48 | 46 | |||

| 20 | 49 | 49 | 49 | 49 | 48 | |||

| 16 | Jeevan Madhur Plan 182 | <11 | 21 | 21 | 21 | 21 | NA | |

| 11 to 15 | 26 | 26 | 26 | 26 | NA | |||

| 17 | Child Career Plan 184 | 11 to 15 | 34 | 34 | 34 | 34 | NA | |

| 16 to 20 | 38 | 38 | 38 | 38 | NA | |||

| >20 | 40 | 40 | 40 | 40 | NA | |||

| 18 | Child future Plan 185 | 11 to 15 | 38 | 38 | 38 | 38 | NA | |

| 16 to 20 | 42 | 42 | 42 | 42 | NA | |||

| >20 | 44 | 44 | 44 | 44 | NA | |||

| 19 | Jeevan Bharati Plan 160 | 15 | 38 | 38 | 38 | 38 | 38 | |

| 20 | 40 | 40 | 40 | 40 | 40 | |||

| 20 | Jeevan Nidhi Plan 169 | <11 | 40 | 38 | 36 | 34 | 32 | |

| 11 to 15 | 42 | 40 | 38 | 36 | 34 | |||

| 16 to 20 | 44 | 42 | 40 | 38 | 36 | |||

| >20 | 46 | 44 | 42 | 40 | 38 | |||

| 21 | Jeevan Shree – I Plan 162 | 10 | 45 | 44 | 43 | 43 | 42 | 42 |

| 15 | 46 | 45 | 44 | 44 | 42 | 42 | ||

| 20 | 49 | 48 | 47 | 47 | 46 | 46 | ||

| 25 | 53 | 52 | 51 | 51 | 50 | 50 | ||

| 22 | Jeevan Pramukh Plan 167 | 10 | 49 | 47 | 45 | 45 | 44 | |

| 15 | 50 | 48 | 46 | 46 | 44 | |||

| 20 | 53 | 51 | 49 | 49 | 48 | |||

| 25 | 57 | 53 | 53 | 53 | 52 | |||

| 23 | Jeevan Amrit Plan 186 | 10 to 15 | 32 | 30 | 30 | 30 | NA | |

| 16 to 20 | 32 | 30 | 30 | 30 | NA | |||

| >20 | 32 | 30 | 30 | 30 | NA | |||

| 24 | Jeevan Bharati Plan 192 | 15 | 29 | 29 | 29 | 29 | 29 | |

| 20 | 31 | 31 | 31 | 31 | 31 | |||

| 25 | New Money Back Plans 820 & 821 | 20 | 39 | 39 | 39 | NA | NA | |

| 25 | 44 | 44 | 44 | NA | NA | |||

| 26 | Limited Payment Endowment Plan 830 | 12 | 40 | 40 | NA | NA | NA | |

| 16 | 45 | 45 | NA | NA | NA | |||

| 21 | 50 | 50 | NA | NA | NA | |||

| 27 | Limited Payment Endowment Plan – New Children Money Back Plan 832 | 13 to 15 | 38 | 38 | NA | NA | NA | |

| 16 to 20 | 42 | 42 | NA | NA | NA | |||

| >20 | 48 | 48 | NA | NA | NA | |||

| 28 | Jeevan Lakshya Plan 833 | 13 to 15 | 41 | 41 | NA | NA | NA | |

| 16 to 20 | 45 | 45 | NA | NA | NA | |||

| >20 | 49 | 49 | NA | NA | NA | |||

| 29 | Jeevan Tarun Plan 834 | 13 to 15 | 38 | NA | NA | NA | NA | |

| 16 to 20 | 42 | NA | NA | NA | NA | |||

| >20 | 48 | NA | NA | NA | NA | |||

| 30 | Jeevan Labh Plan 836 | 16 | 43 | NA | NA | NA | NA | |

| 21 | 47 | NA | NA | NA | NA | |||

| 25 | 50 | NA | NA | NA | NA | |||

| 31 | Jeevan Pragati Plan 838 | 12 to 15 | 37 | NA | NA | NA | NA | |

| 16 to 20 | 40 | NA | NA | NA | NA | |||

| 32 | New Jeevan Suraksha – I Plan 147 | <6 | 21 | 21 | 21 | 21 | 21 | |

| 6 to 10 | 27 | 27 | 27 | 27 | 27 | |||

| 11 to 15 | 31 | 31 | 31 | 31 | 31 | |||

| >15 | 35 | 35 | 35 | 35 | 35 | |||

Related Articles:

- Mixing Insurance with Investment

- Discontinue Life Insurance Policy: Surrender,Paid Up,Loan

- LIC Jeevan Shikhar Insurance Policy

- Revive Lapsed Insurance Policy, LIC Revival Camp

LIC NOT STILL JUBLIDIMAND BONUS DECLAR AS PER NEWS ADVERTIESMENT 2. 28/12/2001 date COP PLAM 112, 15/10 ; BONUS DECLAR SEPTRMBER AFTER MATURITY MONTH DECEMBER WHY NOT PAYMENT DECLER BONUS ?

my police NO 870946512

jeevan shree plan 112 special jubli year bonues eligble ? 2) d o c 28/12/2001 plan112. term 15/10 calculation amount. with bonues police no 870946512

I purchased pic policy jeevan shree1 in 2006 table no.162 sir please calibrate maturity amount in 2020