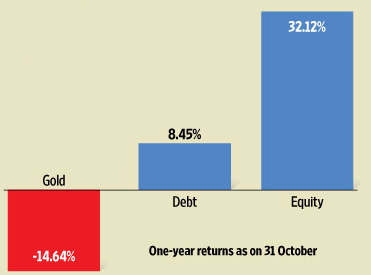

Mu? One year returns of different asset classes is as follows

Equity

In Oct Sensex gained 1235 points. The movement in stock market in Oct 2014 is shown in image below (from google finance) . Oct started off on a bad note for domestic equity markets. The benchmark indices Sensex and Nifty corrected roughly 2% in a span of 15 days.By the end of the month, equity investors had shed all the uncertainty seen at the start of October and market climbed higher and higher due to following events.

- The Bharatiya Janata Party (BJP) winning the majority in both Haryana and Maharashtra assembly elections was a sentiment booster as analysts felt this would mean a greater chance for policy initiatives to move forward.

- Jitters set in as the global economy seemed to falter on growth. and back home there was profit booking in the run-up to the second quarter results. results were a mixed bag.

- A rally in world stocks triggered by a surprise announcement from the Bank of Japan (BoJ) that it will increase its asset purchases sent key equity benchmark indices in India surging.

- Global crude oil prices fell which aided the rally on the domestic bourses. The government on 18 October 2014 announced deregulation of diesel prices.

- Click on image to enlarge. At google finance you can also see the major events that led to the fluctuations in the market.

Results of Quarter 2 2014 a mixed bag

Second quarter results were a mixed bag. As reported by the business standard, nearly 1,847 companies have declared their Q2FY15 quarter results. While sales have grown by merely 5.69% on an average, net profits have surged nearly 21%. This suggests that, the demand is yet to pick. Rise in net profit could be largely on account of falling energy and raw material prices.

- Even for sturdy sectors such as technology, results were mixed with Infosys Ltd standing its ground and Tata Consultancy Services Ltd faltering on earnings

- Banking stocks held fort but non-performing assets continue to mount.

- Another sector that was under pressure was realty. The BSE Realty index corrected nearly 2% during the month. but the main culprit was DLF .td, which received bad news after he market regulator banned the company and some of its senior executives from using the capital markets for three years.

- Other than banking and capital goods. the segment that stood out was auto, which moved up on positive sentiment thanks to increased sales during festive time.

Table of Contents

Big Picture

India’s fiscal deficit was Rs 4.39 lakh crore ($71.5 billion) during April-September, or 82.6% of the full-year target, government data showed today, 31 October 2014. The government’s decision to decontrol diesel prices and a sharp decline in global crude oil prices recently will help India in containing its fiscal deficit. The fall in global crude oil prices will also help India in containing its current account deficit and fuel price inflation. India imports 80% of its crude oil requirement. A slump in Brent crude since the end of June contributed to consumer-price index slowing to 6.46% last month, the least since 2012.

The October release showed that the inflation as per Consumer Price Index for September had fallen to 6.46%. But some concerns came up about execution of policy to push start capital expenditure in the country.

Standard & Poor’s has upgraded India’s sovereign rating from Negative to Stable. This is a big positive for India as more foreign investors will now buy its bonds. India’s companies, too, will be able to get easier access to the global debt market.

Debt in Oct 2014

After the inflation reading came in lower than expected, bond yields began their journey south. The benchmark 10-year government securities yield which started the month at a yield of around 8.5%, finished slightly lower than 8.3%. Although the central bank resisted lowering rates, the market expectation around the rate tut timeline has shortened. Money market rates have also fallen slightly. the three-month bank certificate of deposit is trading at around 85% per annum. At the same time, one year bonds are quoting around 9.2% per annum.

Experts suggest that the next move in fixed income rates is likely to come only when the interest rate cycle moves decisively lower, Another factor that has led to a heightened expectation of rate cuts happening sooner than later is the sharp fall in crude prices globally. This is expected to get translated into lower fuel prices in India which will have a positive impact on inflationary expectations.

It remains to be seen whether RBI announces a rate cut following a deep decline in inflation or it prefers to maintain status quo.

Gold in Oct 2014

Even as October saw some risk-off, gold wasn’t the asset of choice. In the market, while the festive season would have supported the demand for gold. prices continued to be influenced by global trends and finally ended lower for the month- In the past one year, gold prices in India have already corrected 22%.

MUTUAL FUNDS in Oct 2014

As per Securities and Exchange Board of India (Sebi), investors put in a net of Rs 1.55 lakh crore in mutual fund schemes (MF) last month after pouring in a staggering Rs 30,517 crore in September. At gross level, MFs mobilised Rs 63.21 lakh crore in October, while there were redemptions worth Rs 61.67 lakh crore as well, resulting in a net inflow of Rs 1,54,958 crore. Investors had poured in Rs 1 lakh crore and Rs 1.13 lakh crore, respectively, in MF schemes in August and July. Prior to that, there was an outflow of Rs 59,726 crore in June.

Mutual fund managers raised their exposure in bank stocks to an all-time high of nearly Rs 63,000 crore in October this year amid a rally in the stock market.

Registrations for systematic investment plans (SIPs) with mutual funds have more than doubled since January this year. According to data from mutual fund registrar CAMS, the number of additions to SIP schemes in September was about 3.48 lakh compared with 1.51 lakh in January.New folio additions in September were 5.85 lakh against 2.85 lakh in January. The average size of the fresh SIP has also increased 20-30%, growing to about 2,600 every month from 2,000-2,200 earlier.

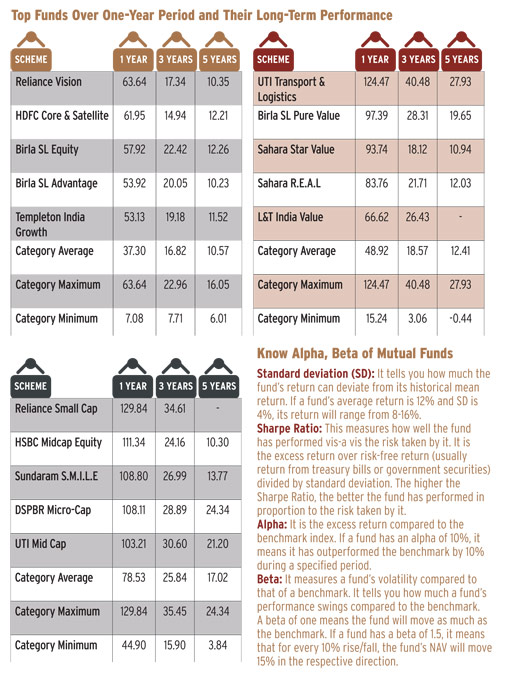

At this stage, all equity funds are doing well, but some are giving exceptionally good returns. But everything that shines is not gold.n the mid- and small-cap category, HSBC Mid Cap Equity and Sundaram S.M.I.L.E. are second and third, respectively. However, on the basis of five-year returns, the two are among the bottom 10 in their category. From Business Today Collective wisdom Top Funds from Sep 2013 to Oct 2014 and their long term performance are given below

Global Markets

For global investors, October started with an air of uncertainty as expectations were riding high on the US quantitative easing programme coming to an end. At the same time, growth concerns are back in Europe, where the economic recovery is convening at a pace slower than anticipated. Another key economy, Japan, is struggling with deflationary issues. Even as Chinese growth is yet to reach its previous glory, 7.3% gross domestic product (GDP) growth has been accepted well. The silver lining through these uncertainties was the sharp drop in crude prices. At present, Brent crude is trading 25% lower than the levels seen in January

Personal Finance

ATM Charges : HDFC Bank and Axis Bank have decided to charge their customers if they exceed five transactions at their ATMs from 1 December.

- HDFC Bank will charge Rs 20 for every financial transaction and rs 8.50 for non-financial transaction (balance enquiry, mini statement).

- Axis Bank will charge Rs 20 for financial transactions and Rs 9.50 for non-financial ones. At other bank ATMs, the customers of these banks will be charged beyond three transactions. Axis Bank has made the 10 transactions free for its Prime Plus Savings Account and Prime Salary account holders. But these accounts require a minimum balance of rs 1 lakh, the report said.

There is a mood of exuberance and jubilation on Dalal street. No one can say if India’s stock markets have peaked. But one thing is clear. They have risen sharply since September last year. A lot of people keep waiting to see if the rally is for real and invest when it is about to end. This can be risky. For instance, the bulk of retail money entered stock markets between May and September, while the Sensex started rising from September 2013. The absolute return between 1 September 2013 and 14 October 2014 is 40%. Since May, the returns are a more tepid 18%. The same thing happened in 2007-08. In three months before the peak in January 2008, investors poured Rs 22,574 crore into equities. After January, panic set in, and equity funds faced huge redemptions (investors pulled out over Rs 32,000 crore from equity mutual funds in 2009-14).

Reference : Livemint’s monthly market commentary

Related Articles :

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- Understanding Inflation

- News that affect the Stock Market

- Comparison of Fixed Deposits and Sensex Returns

- Service Charges on Saving Accounts by Bank,QAB,MAB

Do not forget the famous saying-be fearful when others are greedy! Have you made any changes to your investment strategy? Are you investing in current market level? Is the euphoria due to recovery in conditions of India or Modi led Government?

2 responses to “How did Stock market,Gold,Debt,Inflation fare in Oct”

“It seems that the information you provide about the market is accurate.

BazarClicks provides you with stock tips of NSE with accuracy more than 90% and effective call. We provide an option of free trial tips, this will help you to know about our effective and accurate services.

For more information visit our website Bazarclicks.com.”

“It seems that the information you provide about the market is accurate.

BazarClicks provides you with stock tips of NSE with accuracy more than 90% and effective call. We provide an option of free trial tips, this will help you to know about our effective and accurate services.

For more information visit our website Bazarclicks.com.”