Stock market are volatile. Stock prices change every day. For the person new to the stock market, the constantly changing market dynamics can be overwhelming. Behind the movement of the stock market prices are the demand supply dynamics. If more people want to buy a stock (demand) than sell it (supply), then the price moves up and if more people want to sell a stock(supply) than buy (demand) then prices move down. News shape a stock’s demand-supply dynamics.

News could be company specific, related to economy, national or global. Good and bad news both affect the stock market and sometimes bad news has a positive effect. Corporate layoffs immediately increase company earnings, Market scandals such as the Enron scandal have a negative effect on the market. Positive news from world leaders has a positive effect on the market, but news of war and decreased supply of goods and services has a negative market effect. Besides market also react to news that is yet to come. Markets react rapidly in anticipation of what is going to happen and have a tendency to discount things faster than general investor. While long-term movements in stock market are affected by fundamental market forces, short-term movements are driven by news, events and futures trading and are difficult to predict. In this article we shall cover the various factors/news that makes the stock market react.

Economic Data

A string of economic data, both national and international is released every week or every month. This includes figures for

- Inflation

- Index of industrial production (IIP)

- Gross domestic product (GDP) estimates , among others

Markets react within minutes of these numbers being released. For instance on 14 August 2012 Sensex surged 95 points after data revealed that inflation for July declined to 6.87% from 7.25 % in June. On 9th Aug IIP closed 1.8% down from the corresponding period last year. Both BSE and NSE closed in negative.

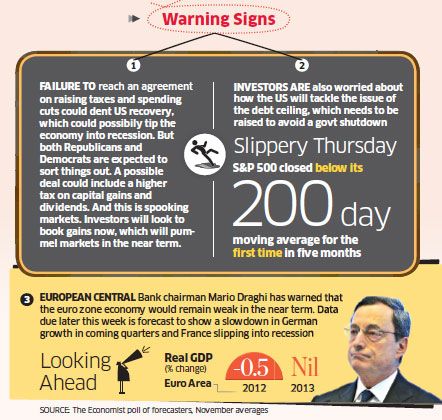

In addition even the news from the US(such as employment claims), Europe(Euro Crisis, PIGS ) impacts markets globally.

Foreign Institutional investors (FIIs)

Institutional Investor is any investor or investment fund that is from or registered in a country outside of the one in which it is currently investing. Institutional investors include hedge funds, insurance companies, pension funds and mutual funds. The growing Indian market had attracted the foreign investors, which are called Foreign Institutional Investors (FII) to Indian equity market. When Foreign Institutional investors (FIIs) deploy money in the market they boost market sentiment and when they take the money then market crashes! Paper IMPACT OF FOREIGN INSTITUTIONAL INVESTOR ON THE STOCK MARKET (pdf) discusses it in detail. Our article Ups and Downs of Sensex shows the movement of Sensex over the years.

FII flows take Nifty past 6,000 to 2-year high

Interest Rates

Interest rates directly affect several economic factors such as demand, consumption and industrial growth among others. Ex: Cut in statutory liquidity ratio immediately affected Bank Nifty positively by 0.3% But a major change in interest rate affects rate sensitive factors such as banks(which lend), auto(which depends on auto loans offtake) and real estate (which depends on real estate offtake). The Reserve Bank of India (RBI) can raise or lower interest rates to stabilize or stimulate the Indian economy. This is known as monetary policy. If a company borrows money to expand and improve its business, higher interest rates will affect the cost of its debt. This can reduce company profits and the dividends it pays shareholders. As a result, its share price may drop. Interest rates and inflation tend to work in tandem. When they rise, investors often become more conservative in their approach. Instead of purchasing high-risk, high-reward stocks, they shift their focus to safer vehicles such as government-backed securities. And, in times of higher interest rates, investments that pay interest(example fixed deposits) tend to be more attractive to investors than stocks.

RBI cuts interest rates by 50 basis points, surprises markets!

Monsoon

As most of the India’s agricultural production depends on the monsoons, any rain related prediction affects the market. For instance on 4 Aug when India Meteorological Department predicted below normal rainfall this year, the Sensex fell by 1% . However on 22 Aug market rose on the back of heavy rainfall reported in parts of the country. India has had five severe droughts in the past. The worst were in 1972 and 2009 when the nationwide rainfall deficits were 24% and 23%, respectively. Rainfall was 19% below normal during the droughts of 1979, 1987 and 2002. Less rainfall affects food production, slumps the rural consumption, tends to push food inflation higher. With the poor monsoon, purchasing power goes down especially in the rural areas, which brings down sales. It impacts companies in two ways, a demand squeeze and high input cost inflation. Monsoons have a bearing on not only the agricultural sector but also on chemicals and pesticides, tyre and tractor companies. For details at Monsoon deficit and it’s impact

Rupee movement

The rupee’s appreciation or depreciation immediately moves the market. The impact is even more pronounced for sectors that export or import goods or deal with foreign clients. For ex: on 25 July 2012 as markets were anticipating a cut in petrol prices the rupee depreciated by 21 paise, leading to a fall of over 100 points in the Sensex. Oil companies led the losses and where down by over 1 %. In fact share prices of companies in most sectors fell. Rupee appreciation is considered bad for companies where major part of their revenue comes from export. Appreciation of rupee makes products more expensive for export. For example, software industry and textile companies will be affected by Rupee appreciation. Rupee appreciation is good for companies that depend on import from other countries. For example, oil companies, Parma, Engineering, and medical device companies will be fine with rupee appreciation. Vice-versa for rupee depriciation

Indian Rupee’s Free Fall Hurts Stock Investors – WSJ.com

Indian rupee falls for 4th session; hopes for reforms fade away

Usual discussions on the fall in the rupee bring up macro-economic matters such as slowing economic growth, corporate earnings and market volatility. However, the woes aren’t restricted to corporate corridors or the Dalal Street. From essentials such as food and education to foreign vacation and the swanky gadget you plan to buy, the falling rupee will hurt you in more ways than one. Business Today Tighten Your Purse Strings (Feb 2012) cover it in detail.

Events of Importance

From the Union Budget and elections to policy reforms almost every political and economic event of significance affects the stock market’s direction. For ex although most economists and TV channels dubbed the Union Budget 2012 a non-event, the Sensex rose by about 3% towards the end of Feb 2011. However in Mar 2011, following nuclear disasters in Japan, the Sensex fell 1.5%.

Major events throughout the world can have an impact on stock prices and market fluctuations. Events such as wars, changes in gas and oil prices and political unrest influence investor confidence, which will have an impact on what they do with their money. Changes in the value of foreign currency will also affect foreign markets, which in turn will affect stock markets. Aside from this interest rate changes and policy decisions by foreign central banks impact our stock market

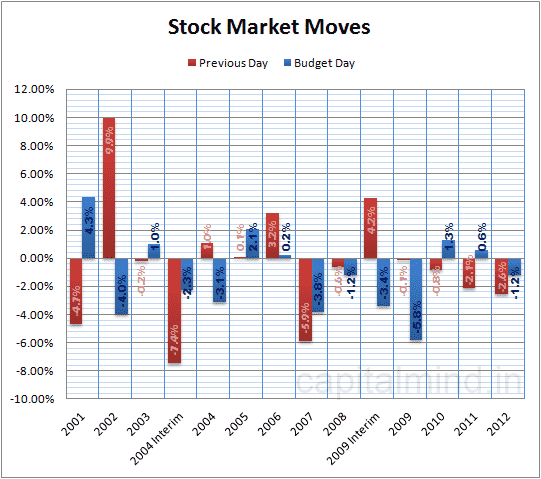

Let’s see How the Budget and Stock Markets are related. The Budget is a keenly watched event for the stock markets

- Investor and investment friendly budgets usually get a thumb up

- Any increase in taxes or added burden on finances does not get a positive reaction

Capitalmind’s Past Budget Day move for the stocks shows the stock market moves on the day prior to budget and budget day.

Yahoo’s How the Budget and Stock Markets are related shows how budegt impact has reduced since 1990’s

Mood of the Heavy weight

When there is significant movement in a stock with a major weightage in an index, it also affects index direction. For instance on 16 Aug 2012 BSE Sensex fell by 70 points as ITC dropped almost 3.75% on that day. The situation was completely opposite on 21 Aug with Sensex rising by more than 1% thanks to rise of over 3.5% in Infosys.

Index dragged down by heavyweights

Markets slip nearly 2% as heavyweights weigh

Company news and Performance

Some company-specific factors that can affect the share price are as follows:

- News releases on earnings and profits, and future estimated earnings

- Announcement of dividends

- Introduction of a new product or a product recall

- Securing a new large contract

- Employee layoffs

- Anticipated takeover or merger

- A change of management

- Accounting errors or scandals

Corporate layoffs immediately increase company earnings and have a positive effect on a corporation, but when too many companies experience layoffs at the same time it creates a drop in the market as a whole. Market scandals such as the Harshad Mehta, Ketan Parekh scandal have a negative effect on the market.

Mismatch between actual earnings and expected earnings of the corporates may cause the stock markets to fluctuate. That’s because, when the corporates report week results than expected, the investors react by selling of their holdings in that stock resulting in a huge drop in stock prices. The opposite is also true. If corporates come up with better than expected earnings results, more an more investors would invest in those stocks resulting in a surge in stock price.

Often, the stock price of the companies in the same industry will move in tandem with each other. This is because market conditions generally affect the companies in the same industry the same way. But sometimes, the stock price of a company will benefit from a piece of bad news for its competitor if the companies are competing for the same market.

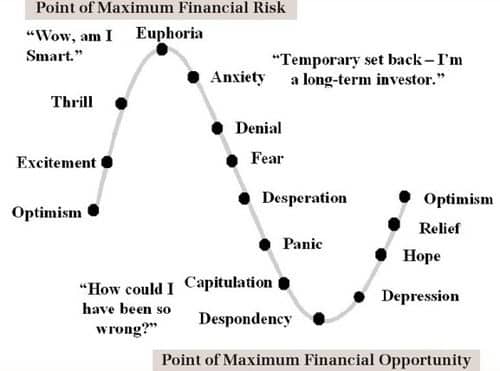

Investor Sentiments

Sentiments has more to do with investor’s psychology. Sentiments represent a collective view of all the participants at a give point of time, also called as herd mentality. The moment there’s a change in stock prices, common investors would assume that it’s going to continue for a long time and would react accordingly. For example – if the stock market responds with a 50 point slide due to increase in interest rates, investor’s negative sentiments may kick off a series of downfalls since, they would keep selling their positions expecting further damage. Extreme optimism can coincide with market tops. People think the sky’s the limit and send stock prices flying. Savvier investors sell into this frenzy and run to cash. The market tanks soon afterward! If it looks like the economy is going to expand, stock prices may rise. Investors may buy more stocks thinking they will see future profits and higher stock prices. If the economic outlook is uncertain, investors may reduce their buying or start selling. Extreme pessimism can be bullish. Toward the end of a big decline, the last bulls throw in the towel and sell with a vengeance. Cooler heads smell a fire sale. They dive into the market and buy equities with both hands to launch the next rally!

As Isaac Newton (yes the one who discovered gravity when apple fell on his head) said “I can calculate the motions of heavenly bodies… But not the madness of people!” after losing a fortune in the South Sea Trading Company’s fiasco of 1720.This trading company had all the characteristics of a contemporary “hot stock,” with investors creating a mania over the company’s prospects for success. Investors dreams that the company would gain trade monopolies in the South Seas sent the company’s price into the stratosphere finally majority of the investors were wiped out!

Good News Bad News

A curious fact is that good news doesn’t always translate to a jump in stock price, in fact, often the good news will produce a slight drop in a stock price. Why? Because unofficial news, also known as “rumors”, can have as much impact on stock prices as official news announcements. The stock market often anticipates these news stories and “prices in” its expectations accordingly. When those expectations are confirmed with actual investment news, the price may temporarily drop.

Of course, the reverse applies, too. If rumors swirling around a stock aren’t proven true, investors may respond in surprising ways. If the surprise is a good one, stock prices can be driven upward as a result.

Investor Type

Investing and trading are two very different methods of attempting to profit in the financial markets. The goal of investing is to gradually build wealth over an extended period of time through the buying and holding of a portfolio of stocks. Trading, on the other hand, involves the more frequent buying and selling of stock. Trading profits are generated through buying at a lower price and selling at a higher price within a relatively short period of time. The reverse is also true: trading profits are made by selling at a higher price and buying to cover at a lower price (known as “selling short”) to profit in falling markets. Traders buy/sell stocks because they sense a price movement (through technical analysis, market/sector news,etc ) , they have no real interest in the company behind the stock other than it is in the right place at the right time. Traders are more affected with short term news than Investors. An investor is aware of broad market direction but doesn’t worry about everyday swings. He buys a stock with the intent of holding on to the stock for a long time. So he ignores news that doesn’t affect the fundamentals of a sector or a stock. As Warren Buffet says “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years” Ref : Investopedia What is the difference between investing and trading?

Related Articles :

- Ups and Downs of Sensex

- Review of Year 2012 and Road ahead in 2013

- Stock Market Index: The Basics

- Comparison of Fixed Deposits and Sensex Returns

- Outlookmoney Oct 2012

Summary

Here are some other things that one should make note of:

- Market factors good news into a stock price before the event happens. In fact they might even fall when the news is confirmed.

- lt takes time for unanticipated positive news to affect the market but unanticipated negative news influences the market very quickly.

- Sentiment prevaling at a particular time also has a lot of bearing on the impact of any news.

- lt takes time for unanticipated positive news to affect the market but unanticipated negative news influences the market very quickly.

- Investors Be aware of broad market direction but don’t worry about everyday swings. Ignore news that doesn’t affect the fundamentals of a sector or a stock. As Warren Buffet says “Only buy something that you’d be perfectly happy to hold if the market shut down for 10 years”

- Investors focus on individual companies and on their long-term earnings potential. Good companies with strong managements are able to manoeuvre their way through tough situations creating value over long term.

How do you react to the news that affects the stock market? Should one worry about the news or some specific news?

The touchy fabric of stock market is such that any business related news, local or global, has an impact on the stock market. Whether impact will be positive or negative depends on the nature of the news. Smart investors should always keep a tab on all the happenings in the world and should make swift decisions to either minimise the losses or to chance upon the profit making opportunities.

Thanks for sharing great article.

Thank you so much for sharing detailed information

Its superb as your other articles : D, value it for putting up. “To be at peace with ourselves we need to know ourselves.” by Caitlin Matthews.

A marathon post, I must say… covered a lot of things…

Thanks Prasad there are so many factors that can affect the market and the stock that one needs to decide what to focus on!

Good Read.

By the way,I suspect you have installed new cache plugin which is not working correctly.

Thanks Paresh for informing. I have not fiddled with my cache plugin. if you could elaborate on what exactly happens it would help me in fixing the problem!

I think it…. because rather than updated homepage ..old home page of your blog is being served.Initially I thought its local problem so I completely delete caches from my machine till its serving old cached home page…I don’t know its happening on my computer only or elsewhere also.

Thanks Paresh, I’ll check it. I appreciate your efforts in informing us. Thanks

Its ok now..I think it was non-www version of home page which was serving old page.

Thanks I am relieved.