Banks levy a plethora of charges on their savings bank account customers. Common charges include those for taking demand drafts, for not maintaining minimum balance in the account, and for online fund transfers.The Reserve Bank of India mandates them to disclose what they charge customers for and how much. Banks have to put this information on their Web sites. This article talks bank charges, revision of bank charges such as Debit card, Cheques return, ATM withdrawal and discusses how to calculate Average Monthly Balance and Average Quarterly Balance.

Table of Contents

Bank Charges are being revised

On 6 Mar 2017, Major Indian banks such as SBI, ICICI, HDFC and Axis have decided to charge users for cash transactions above certain limits and for a few facilities which were free till now. More banks are expected to follow suit. The new charges are aimed at discouraging cash transactions though banks might end up profiting from them hugely.

You can find Service charges of all the banks at RBI webpage at RBI webpage

State Bank of India

- From April 1, SBI will permit savings bank account holders to deposit cash three times a month free of charge. Beyond that, it will charge Rs 50 plus service tax for every transaction.

- In case of current account, the levy could go as high as Rs 20,000.

- SBI account holders will also have to keep a minimum balance in their accounts, failing which they will be fined. The fine will be lower for rural areas. In metropolitan areas, there will be a charge of Rs 100 plus service tax if the balance falls below 75 per cent of the minimum available balance of Rs 5,000. If the shortfall is 50 per cent or less, the bank will charge Rs 50 plus service tax. SBI used to have such charges in 2012. After a gap of five years, the SBI has decided to reintroduce penalty on non-maintenance of minimum balance in accounts from April 1. It also revised charges on other services, including at ATM.

- Withdrawal of cash from ATMs will attract a charge of up to Rs 20 if the number of transactions from ATMs of other banks exceeds three and Rs 10 for more than five withdrawals from SBI ATMs.

- However, SBI will not levy any charge on withdrawals from its own ATMs if the balance exceeds Rs 25,000. In case of withdrawals from ATMs of other banks, there will be no charge if the balance exceeds Rs 1 lakh.

- SBI will charge Rs 15 for SMS alerts per quarter from debit card holders who maintain average quarterly balance of up to Rs 25,000 during the three months. There will be no charge for UPI/USSD transactions of up to Rs 1,000.

Axis Bank

- Axis Bank customers will be allowed five free transactions every month, including deposits and withdrawals. Above that, customers will be charged a minimum fee of Rs 95 per transaction.

- Up to five non-home branch transactions will be free for customers, subject to a maximum per-day deposit of Rs 50,000. For larger deposits or the sixth transaction, the bank would charge Rs 2.50 per Rs 1,000, or Rs 95 per transaction, whichever is higher.

HDFC Bank

- HDFC Bank will levy Rs 150 per transaction, beyond four free ones (deposits and withdrawals) each month.

- The new charges would apply to savings as well as salary accounts.

- For home-branch transactions, the bank will allow deposits or withdrawals of up to Rs 2 lakh free of cost at one go per day. Beyond this, it will charge Rs 5 per Rs 1,000, or Rs 150.

- At non-home branches, transactions beyond Rs 25,000 a day will attract a charge of Rs 5 per Rs 1,000, or Rs 150.

ICICI Bank

- 1. There will be no charge for first four transactions a month at branches in home city while Rs 5 per Rs 1,000 will be charged thereafter subject to a minimum of Rs 150 in one month.

- The third-party limit would be Rs 50,000 per day.

- For non-home branches, ICICI Bank would not charge for first cash withdrawal of a calendar month and Rs 5 per Rs 1,000 thereafter subject to a minimum of Rs 150.

- For anywhere cash deposit, ICICI Bank would charge Rs 5 per Rs 1,000 (subject to a minimum of 150) at branches, while deposit at cash acceptance machines would be free of charge for first cash deposit of a calendar month and Rs 5 per Rs 1,000 thereafter.

Bank Charges

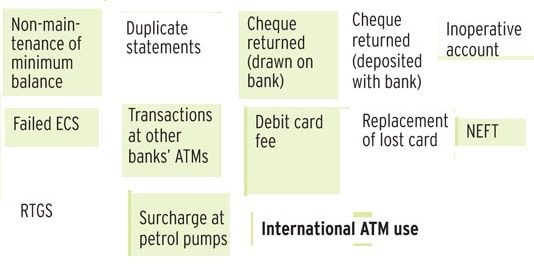

Charges varies from bank to bank, and even the same bank could have differing balance requirement depending on the account holder’s location (Urban, Semi-urban and Rural) or category of account (Normal, Privilege, Platinum, etc). Some of the charges by the bank are shown below and given below.

Requests beyond the usual monthly or quarterly account statements entail costs. For example, Royal Bank of Scotland (RBS) charges Rs 100 for duplicate and ad-hoc statements. Checking your bank account online may save you this cost. Similarly, many banks charge customers for duplicate pass-books and old records. Also, email/SMS alert services could cost you.

The first five transactions each month at other ATMs are usually free but are charged thereafter. ICICI Bank, for instance, charges from the sixth transaction onwards at the rate of Rs 20 for cash withdrawals and Rs 8.5 for non-financial transactions. Please note that Say you check your balance and then withdraw cash. Even if you’ve done this in one visit, it will be counted as two transactions.

Cheques returned without being paid – whether deposited or issued by you – will entail a cost. HDFC bank, for example, charges Rs 350 for the first cheque in a quarter and Rs 750 from second cheque in the quarter if a cheque you issue returns unpaid due to insufficient funds.

If you need your bank to attest your photo or signature, or confirm your address too, be ready to pay. HDFC Bank charges Rs 100 per instance for the former, and Rs 50 for the latter.

Requesting chequebooks beyond the allowed quota also carries charges. HDFC Bank, for instance, issues 25 cheque leaves free every quarter. Every additional cheque book will cost you Rs 50.

Many banks also charge for ATM card replacement in case of loss and pin regeneration in case you forget it. For example ICICI bank charges Rs 200 per card for Replacement Card fees (Lost / Damaged card)

Standing instructions to debit your account carry charges too. You have to pay both for setting up a standing instruction and for each transaction. For instance, SBI charges Rs 51 for setting one up and Rs 25 for processing it. Rejection of a standing instruction can also dent your bank balance.

Demand Draft : Charges are for making a Demand Draft. For example for ICICIBank charges are Rs.50 per D.D. up to Rs.10,000, Rs.3 per thousand rupees or part thereof for DD of more than Rs.10,000, subject to a minimum of Rs.75 and maximum of Rs. 15,000. HDFC Bank charges different amount, less amount for internet/phone banking than visiting the branch, for example upto Rs. 10,000 Rs. 50 or Rs. 40 (senior citizens/individuals in rural areas) But Rs. 30 through Phonebanking

Banks has started charging for the online transfer of money to third party accounts. For example for ICICI Bank charges

| NEFT Charges – Inward | Nil |

| NEFT Charges – Outward | Upto Rs.10,000 – Rs. 2.50 per transaction. Rs.10.001 to Rs.1 lakh – Rs. 5 per transaction. Above Rs. 1 lakh to Rs. 2 lakhs – Rs. 15 per transaction. Above Rs. 2 lakhs – Rs. 25 per transaction. |

| RTGS-Outward |

Rs. 2 lakhs to Rs.5 lakhs – Rs. 25 per transaction.

Above Rs. 5 lakhs – Rs. 50 per transaction |

| RTGS-Inward | Nil |

| IMPS-Outward |

Rs. 5 per transaction ( Max limit per transaction per day: Rs. 50,000)

|

| IMPS-Inward | Nil |

Savings and current account holders are typically required to maintain a minimum balance in their bank account. But this is not the minimum balance that is to be maintained everyday but is the average balance in the account over the quarter or month as the case maybe . Hence it is called as the average quarterly balance (QAB) or Average Monthly Balance (MAB) . For example ICICI Bank’s minimum monthly balance requirement is Rs 10,000 at metro and urban locations; Rs 5,000 at semi-urban branches; and Rs 2,000 in rural areas. How it is calculated is discussed in detail later in the post.

Dormant and Closing account: Banks often levy charges on those which are dormant. For instance, Karnataka Bank charges Rs 50 per year on a dormant account. Banks also charge when closing account within a specified time period for example, Dena Bank charges Rs 200 for saving accounts closed within one year from the date of account opening.

Sample of Charges of HDFC Bank, ICICI Bank and links for service charges of other banks at RBI webpage

Quarterly Average Balance and Monthly Average Balance

Savings and current account holders are typically required to maintain a minimum balance in their bank account. But this is not the minimum balance that is to be maintained everyday but is the average balance in the account over the quarter or month as the case maybe . Hence it is called as the average quarterly balance (QAB) or Average Monthly Balance (MAB). Let’s see how bank calculates balance maintained by an account holder.

Quarterly Average Balance (QAB)

If QAB is Rs 10,000 it means that on an average the account holder needs to maintain Rs 10,000 daily.Note he does not maintain Rs 10,000 balance every single day, but on an average. Under QAB the bank computes the average balance on a quarterly basis, i.e. once every 3 month. To calculate QAB for a quarter say from Jan to Mar quarter, balance at the end of the day for each day in the quarter would be summed up and divided by the number of days in the quarter. Let’s understand with a sample bank statement below:

Opening balance on quarter beginning, i.e. 1st Jan is Rs 20,000 on 15th Jan 15,000 Rs is withdrawn. On 7th Feb 8,000 is added. So between 1st Jan to 15 Jan 20,000 Rs was for 14 days hence total amount in account for the 14 days was 2,80,000. Similarily for 23 days from 15 Jan to 7 Feb(assuming 28 days) the amount was Rs 15,000 hence total amount was (5000 * 23) 1,15,000 and 6,89,000 (13,000 * 53) for 53 days. Adding all the amounts 10,84,000(2,80,000 + 1,15,000+689,000) and dividing by 90 days we get QAB to be 12,044.44. Note that even though balance maintained was below 10,000 for 23 days, QAB requirement of Rs 10,000 is still met. (Calculations are shown in table below)

|

Date |

Description |

Withdrawal |

Deposit |

Balance (B) |

Days (D) |

Product (B*D) |

|

1 Jan |

Opening Balance |

20,000 |

14 |

2,80,000 |

||

|

15-Jan |

Withdrawal |

15,000 |

5,000 |

23 |

1,15,000 |

|

|

7-Feb |

Cash Deposit |

8,000 |

13,000 |

53 |

689,000 |

|

|

SUM |

90 (C) |

10,84,000 (D) |

||||

|

QAB = D/C |

12,044.44 |

Monthly Average Balance (MAB)

Monthly Average Balance (MAB) is similar to QAB. For Monthly average balance the bank will add balances at the end of the day for each day of the month and divide by number of days in the month. So the difference is that while for QAB balance computation is for quarter i.e for 3 months at a time, for Monthly average balance (MAB) computation is done every month.

So for the same example lets see the MAB computation

|

Date |

Description |

Withdrawal |

Deposit |

Balance (B) |

Days (D) |

Product (B*D) |

|

1 Jan |

Opening Balance |

20,000 |

14 |

2,80,000 |

||

|

15-Jan |

Withdrawal |

15,000 |

5,000 |

17 |

85,000 |

|

|

31 Jan |

MAB for Jan |

5,000 |

31 |

3,65,000/31=11774.19 |

||

|

1-Feb |

Opening Balance |

5,000 |

6 |

30,000 |

||

|

7-Feb |

Cash Deposit |

8,000 |

13,000 |

22 |

2,86,000 |

|

| 28-Feb | MAB for Feb |

28 |

3,16,000/28=11285.71

|

|||

| 1-Mar | Opening Balance | 13,000 | 13,000 |

31 |

||

| 31-Mar | MAB for Mar |

31 |

4,03,000/31 = 13,000 |

|||

QAB vs MAB – Which is better?

Though QAB and MAB requirement for the same amount might look the same they are not. Chances of charges for non-maintenance on minimum balance is higher under MAB. Which is better Quarterly Average Balance (QAB) or Monthly Average Balance (MAB) depends on who is answering the question bank or customers. Let see with help of an example:

You had Rs 5,000 in account for in First month, Rs 5000 in the second month and in the third month on the 26th Dec you deposited Rs 1,00,00. So QAB would be [(86*5,000)+(6*100,000)]/92 = 925,000/92 = 10,054.35

|

Date |

Description |

Withdrawal |

Deposit |

Balance (B) |

Days (D) |

Product (B*D) |

|

1 Oct |

Opening Balance |

5,000 |

31 |

1,55,000 |

||

|

31 Oct |

MAB for Oct |

5,000 |

31 |

1,55,000/31=5000 |

||

|

1-Nov |

Opening Balance |

5,000 |

30 |

30,000 |

||

| 30-Nov | MAB for Nov |

30 |

1,50,000/30=5000

|

|||

| 1-Dec | Opening Balance | 5,000 | 5,000 |

25 |

1,25,000 | |

| 26-Dec | Cash Deposit | 1,00,000 | 1,00,000 |

6 |

6,00,000 |

|

| 31-Dec | MAB for Dec |

31 |

7,25,000/31 = 23,387.10 |

|||

| 31-Dec | QAB for Oct-Dec |

92 |

(1,55,000 + 1,50,000+7,25,000)/92=1030000/92=11195.65 |

For MAB balance maintained would be Rs 5000 for 1st and 2nd months and 23,387.10 for the 3rd month. Thus the bank will charge for non-maintenance on minimum balance for the 1st and 2nd month. Assuming charges of Rs 250 per month, total charges works out to Rs 500 under MAB, while NIL in QAB.

Banks and QAB and MAB

The RBI has not stipulated any minimum balance to be maintained in savings accounts or the charges for non maintaining the balance to any bank . The RBI guidelines only state that accountholders should get from their banks a month’s notice on any change in the minimum balance norm. Interested Readers can read Reserve Bank of India’s view on service charges of bank in detail.

QAB or MAB

- Some of the private sector banks,like ICICI Bank and HDFC Bank have switched from QAB to MAB. What this means is that customers will have to keep higher balances. It impacts the small savings account holders the most. It increase the Fees income for the bank in the form of MAB charges

- PSU banks like Bank of India , Allahabad bank generally have a lower Quarterly Average Balance to be maintained in saving bank account.

- State Bank of India, which had imposed charges for non-maintenance of minimum balance a few months ago, rolled back the move and does not charge anything.

Minimum balance and penalty for not maintaining QAB/MAB

- ICICI Bank’s minimum monthly balance(MAB) requirement is Rs 10,000 at metro, Rs 5,000 at semi-urban branches and Rs 2,000 in rural areas.

- For Axis Bank and HDFC Bank. , the minimum monthly balance requirement at metro and urban areas is Rs 10,000,5000 for semi-urban areas,for rural Rs 5,000 in the case of HDFC Bank and Rs 2,500 in the case of Axis Bank.

- Charges for HDFC Bank and ICICI Bank range between Rs 250 and Rs 350; while, those of Axis Bank are Rs 750 (metro and semi-urban) and Rs 500 (rural).

- For Union Bank for Savings Bank Account (pdf) with Cheque facility

- Minimum balance(Average Quarterly Balance)

- Rural Rs. 250

- Semi Urban Rs.500

- Urban Rs. 1000 Rs. 1000

- Metro Rs. 1000

- Pension accounts Rs.250

- Charges for non maintenance thereof Rs. 110.00 per quarter

- Minimum balance(Average Quarterly Balance)

Related Articles :

- Saving Bank Account:Do you know how interest is calculated and more

- Interest on Saving Bank Account : Tax, 80TTA

- Best Interest Rates on Saving Account

- Dormant Bank Account

- Explaining about Banks to Kids