The Reserve Bank of India (RBI) has made it mandatory for all credit information agencies in the country to give a free full credit report (FFCR) without any charge, on request, once a calendar year to individuals whose credit history is available. This rule has come into force from 1 January 2017. This article gives an overview of the credit report, compares the credit card companies and talks about how can one get free credit report in India from CIBIL, Experian, Equifax and CRIF High Mark.

Table of Contents

Get Free Credit Report in India

Credit Reports are crucial for granting of loans to borrowers. A credit report is the summary of the credit history of an individual. It simply includes the detailed records of your bill payments. Credit bureaus collect an individual’s credit information and prepare credit reports depending on the obtained information. Credit reports play an important role in helping an individual analyse the details of their credit related information.

A credit score is a three-digit number that explains the creditworthiness of an individual. It usually ranges from 300-900. 300 is the least credit score of an individual and 900 is the highest credit score of an individual. The higher the score, the higher is the creditworthiness of an individual. The credit report of an individual helps in determining whether the loan application will be approved or rejected and also decides the loan’s price

During a seminar in July 2016, RBI Governor Shri Raghuram Rajan declared that Experian, CIBIL will provide a free credit report and credit score once every year beginning from 2017. RBI came out with notification in Sep 2016. From Jan 2017 it has become mandatory that every Credit Information Company(CIC) in India should provide one free credit report every year. This report is going to be in a digital format and absolutely free.

At present, there are four such companies in India:

- CRIF High Mark Credit Information Services Pvt. Ltd,

- Equifax Credit Information Services Pvt. Ltd,

- Experian Credit Information Co. of India Pvt. Ltd and

- Transunion CIBIL Ltd.

To obtain their free credit report, individuals should go to the website of any of the credit bureaus in India, and request for the credit report that also includes the credit score. Thus, you can actually have four credit reports for free each year, as you can get one from each company.

Comparison of the Credit Information Companies in India

CIBIL, Equifax, Experian and Highmark, all work on similar principles and are alike in a number of ways. Comparison of the companies are given in the table below:

| Parameter | CIBIL | Equifax | Experian | Highmark |

| Established | 2000 | License granted in 2010 | 2006, license granted in 2010 | 2007, received license in 2010 |

| Advantages | Oldest among all 4 CICs, more popular | New technologies, and additional services | Cost effective | Latest entrant offering greater variety in products and service |

| Report cost | Credit Report + Score for Rs 500 | Credit report plus score for Rs 400 | Rs 138 (Credit report only) | NA |

| Credit Score | Individuals are provided a CIBIL score between 300 and 900, with 900 being the best and 300 the lowest | Equifax scores individuals on a scale of 1 to 999, with 1 being the lowest and 999 the highest | Experian scores individuals on a scale of 1 to 999, with scores over 961 considered excellent, while scores below 560 viewed as poor | Highmark scores range from 300 to 850, with a score of 720 and above considered excellent while a score below 640 is considered poor |

| How does it score | Lenders who are registered members of CIBIL submit monthly reports to CIBIL regarding its borrowers and CIBIL TransUnion prepares its reports based on such information. | it uses its proprietary statistical algorithm to calculate your credit score hence the score provided by Experian would be different from that provided by CIBIL TransUnion and Equifax | ||

| About the credit company | CIBIL has teamed up with TransUnion, a globally recognised credit rating and analytics company | Equifax is an Alanta, US-based international organisation engaged in providing information solutions for the workforce, commercial and consumer segments. | Experian India is a completely owned subsidiary of Dublin, Ireland-based Experian LLC | CRIF, included in FinTech 100, is among the leading providers of banking credit information in continental Europe |

| Key Collarbartors | Bank of India, Indian Overseas Bank, Bank of India, ICICI Bank, India Alternatives Private Equity Fund, Aditya Birla Trustee Company Private Ltd., Union Bank of India, Bank of Baroda and Trans Union International Inc. |

Union Bank of India, Sundaram Finance Limited, Religare Finvest Limited, Kotak Mahindra Prime Limited, Bank of India, Bank of Baroda and State Bank of India |

Union Bank of India, Sundaram Finance, Punjab National Bank, Magna Finance, Federal Bank, Axis Bank and Indian Bank. | State Bank of India, Punjab National Bank, SIDBI, Edelweiss and Shriram City Union. |

Free Credit Report from CIBIL

CIBIL stands for Credit Information Bureau (India) Ltd. and it was set up as India’s first credit bureau. It is the oldest and most popular credit companies in India.

- Go to https://www.cibil.com/freecibilscore and click on ‘click here to try your Free Annual CIBIL Score & Report‘ link or go directly to https://www.cibil.com/freecreditscore/

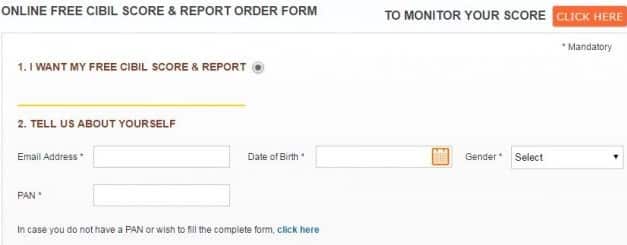

- Click ‘I want my Free CIBIL Score & Report’.

- You have to provide your email address, Date of Birth, Gender, PAN details & Captcha code and then click on Submit button.

- In the next page, you have to provide your communication address, mobile number etc and click on Submit button.

- You will get a pop-up window comparing fee-based CIBIL report Vs free CIBIL report. You can click on No, Thanks option to continue.

- In the next page, you can provide an alternate email-id by clicking Submit or skip the step.

- Instantly you will get an SMS to your mobile, with details about your Credit Score. Also, you will receive an email with login credentials to access your Free Credit Report @ myCIBIL.

- You have to now visit myCIBIL page and log-in with the credentials provided in the email.

- You can see your Credit score and Credit Report.

Getting Free Credit Report from CRIF High Mark

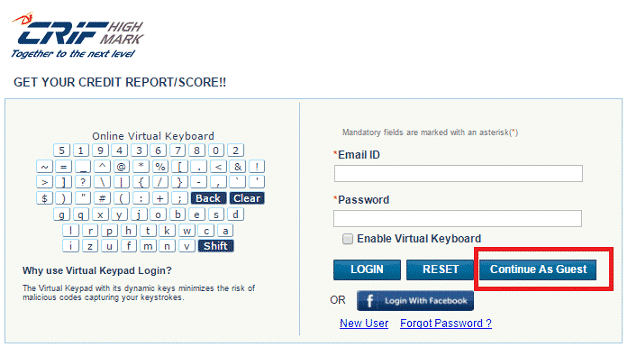

When you access the site, you will find a link to the process for a free credit report on the home page (www.crifhighmark.com). After you click the link, you can sign up as the new user or Continue as Guest as shown in the image.

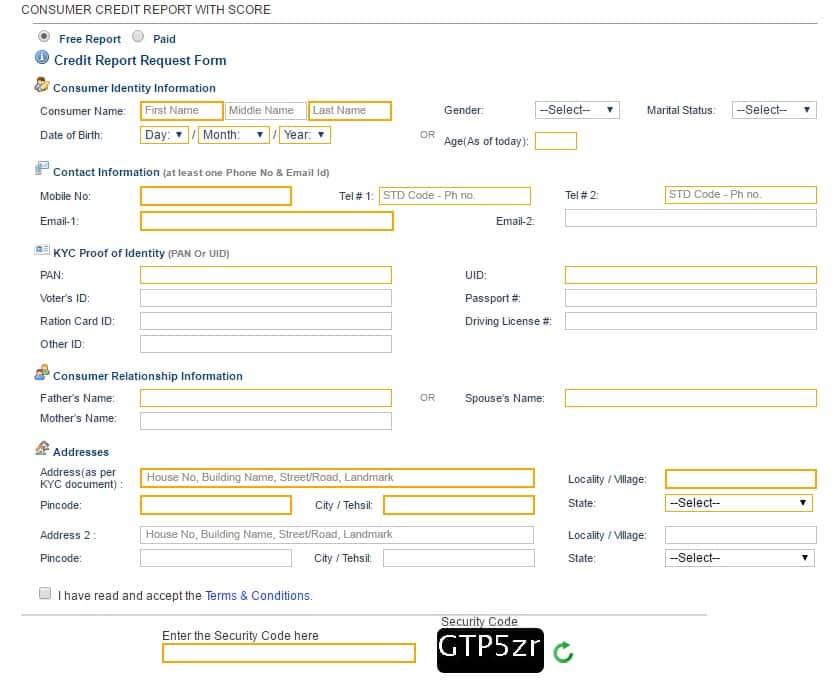

If you click Continue as Guest you will have to fill details as shown in the image below.

On Clicking submit you will the same form(the form you filled with details) but with the message on the top saying “Inquiry submitted successfully. We would be informing you of how to proceed within 24 hrs”

You will get the email “We are glad to inform that your details have been verified. We are in process of preparing your Credit Information Report and you would be able to proceed further in 3 days”

After the proper verification of the details mentioned by you, you will be sent your Credit Report ID and you will be asked to answer some questions related to the credit report.

You will have to answer these questions correctly. After answering these questions correctly, you will receive your free credit report on your email id.

Getting Free Credit Report from Equifax

On the home page (www.equifax.co.in), you can find a prominent link with a process note to get the free report. The first step, according to the note, is that you have to download an app.

The App is available on Google( Kit Kat, Lollipop, Marshmallow, Nougat) & iOS ( version 9.x, version 10.x). Following is the process for obtaining your FFCR using the Equifax App:

- STEP 1 – Login to the Equifax App

- Provide your email address to receive your temporary pin

- Login using your email and temporary pin to create a 6-digit login

- STEP 2 – Authenticate yourself/KYC

- Provide your personal information and Aadhar card to authenticate your identity

- After your information is confirmed, a one-time password will be sent to your Aadhaar registered mobile number

- Enter your OTP in the Equifax App

- STEP 3 – Obtaining your FFCR

- Provide personal details (DOB, Address, Any one ID like PAN, Passport, Voter ID)

- Login to Equifax App after 24-hours (24-hours after the successful completion of STEP 1) to authenticate your identity based on your credit history by answering the account based questionnaire

- Answer three questions based on your credit history (Note: You have four attempts to authenticate yourself)

- Once authenticated successfully, your password protected FFCR will be sent to your registered email address within 24-hours after the successful completion of STEP 2

Password: First 4 characters of your name (with 1st character capitalised), followed by yyyy (year of birth), followed by “@” (symbol) and last 4 digits of your Aadhaar number as entered in the input field. E.g. – Abcd1990@1234

Free Credit Report from Experian

- You can avail your Free Credit Report by logging onto www.experian.in then click on the link “Your Free Credit Report”, fill in the details as requested in the form. All fields are mandatory.

- After completing all the fields please click on Request Free Voucher.

- You will receive the voucher to avail your Free CIR within 48 hours.

- You will receive the voucher with the instructions to avail your Free Credit Report.

Related Articles

- FAQ on CIBIL CIR Report and Score

- Understanding CIBIL CIR report

- CIBIL CIR : Account and Negative Factors.

- Understanding Loans

- Life of Debt – Responsibly

5 responses to “How to Get Free Credit Report in India”

Thank you for sharing the useful information

I have been wanting to start an online business for a while and have done a lot of research about the various types of opportunities. You are absolutely right about the number of scams out there! I’ve finally come to an honest website just when I was about to give up. I realize that nothing worth having comes easy and I am prepared to work hard to develop a business I can be proud of:)

i have 7 cxc 0’level passes including math and english, i don’t have a certificate for I.T, but i have had jobs which consisted of data entry and was also a data operator for customs and excise, my question is what qualifies for the IT personnel job?

Nice information, Learn more at http://www.loankuber.com/content/cibil-score/resolution-of-cibil-disputes/

Very Useful Information, learn more at Loankuber http://www.loankuber.com/content/cibil-score/tips-to-manage-credit-utilisation-rate-to-improve-the-cibil-score/