Systematic Investment Plan (SIP) is an investment option offered by mutual funds, allowing investors to invest small amounts periodically instead of lump sums. This article will cover what is SIP, What are Benefits of SIP, Why SIP does not guarantee positive returns? Comparing Recurring Deposits with Equity SIP? What is KYC for investing in Mutual Funds? How can one do e-KYC? How to do SIP?

Table of Contents

How does SIP work?

What is SIP?

Systematic Investment Plan (SIP) is an investment option offered by mutual funds, allowing investors to invest small amounts periodically instead of lump sums. SIP allows you to invest a certain pre-determined amount at a regular interval. The frequency of investment is usually weekly, monthly or quarterly. It is conceptually similar to a recurring deposit whereby a fixed investment is made on a regular basis.

SIP works like other mutual funds do, the handling of your money is done by market experts and you don’t have to worry about it. Every month, your money is auto-debited from your bank, generally on 1st /7th/10th or 25th of every month as you notify your bank. Every month, on the day the money is debited, you are allotted a certain number of units of the schemes on the ongoing market rates called NAV or Net Asset Value of the day. The schemes can be Equity Funds or Debt funds. Minimum investment for SIP can be as low as Rs. 500- Rs. 1000 per month.

Benefits of SIP

Benefits of Systematic Investment Plans are

- Save Regularly: SIP will compel you to save regularly as you will be obliged to pay the next installment. Low and manageable SIPs will keep you motivated and focused towards your financial goals thus cutting down on unwanted expenses.

- Flexibility: Investment through SIP gives the investor an option to exit whenever he wants. He can withdraw all the money without any exit load or penalty. He also has an option to increase/decrease the amount of SIP at any time. This is beneficial because say you lose your job or get a promotion, in both extreme scenarios, SIP can work in your favor.

- Convenience:

With others taking the headache of managing your funds, you can escape the stress of entering and exiting the market. You have to just direct your bank for an auto-debit option, rest the money invested in SIP will take care of itself and earn returns for you! - Manage Volatility:

As SIP enables you to fetch more units when the price is low and less units when the price is high, you can achieve a lower average cost per unit thus hedging you against market volatility.

The two major benefits of SIP for the investors are Power of compounding and Rupee cost averaging which are explained in detail below.

Rupee cost averaging while investing in SIP

Investors are always worried about the right time to enter the market. “What if prices fall lower if I wait some more?”, is a general worry. Investing via SIPs eliminates the guessing game and a regular investor does not worry about the time of entering. At times, NAV might be higher sometimes lower than average but during this volatile period, an investor can usually achieve a lower average cost per unit.

For example, Mr. Mehta invests Rs. 2000 each month via the SIP route for 6 months. The table below shows how many units he got at what price every month. When the NAV is low, Mr. Mehta got more units. On the other hand, when the prices are high, he automatically got lesser units. If Mr. Mehta would have invested the same amount,12000, as a one-time investment he would have got 800 units at Rs 15 per unit. As you can see at the end of 6 months, despite the market volatility Mr. Mehta has 54 units(854 vs 800) more by investing the same amount.

| Month | NAV (Rs) | Monthly

Investment made in SIP (Rs) |

No. of

Units |

Average

Cost Per Unit |

| 1st | 15 | 2000 | 133 | 14.05

Rs/Unit |

| 2nd | 12 | 2000 | 167 | |

| 3rd | 17 | 2000 | 118 | |

| 4th | 11 | 2000 | 182 | |

| 5th | 18 | 2000 | 111 | |

| 6th | 14 | 2000 | 143 | |

| Total | 12000 | 854 |

Power of compounding while investing in SIP

The rule for compounding is simple – the sooner you start investing, the more time your money has to grow. If you start your SIP investment early, it will have more time to grow. So ideally early SIP investment that is compounded will help you achieve your goal faster as compared to delayed investment.

For Example:

At age 40, if you start investing Rs. 1000 a month for your retirement in 20 years you will have Rs. 2.4 lakhs. If that investment grew by an average of 7% a year, it would be worth Rs. 5.24 lakhs when you reach 60.

However, if you started investing 10 years earlier, your Rs. 1000 each month would add up to Rs. 3.6 lakh over 30 years. Assuming the same average annual growth of 7%, you would have Rs. 12.2 lakhs when 60.

SIP always not does give positive returns

It is a misconception that SIPs will always generate positive returns. The returns depend on the market and the performance of the scheme. SIPs only help to average out the costs but there is no assurance of capital protection. SIPs only ensure that the investor buys at all market levels. Let check the performance of three-year SIPs under different market conditions. Our articles Mutual Fund SIP returns over time discusses the performance of SIP and why one should not stop SIP when the market is down. The image from the article shows SIP returns in equity funds over different periods of time.

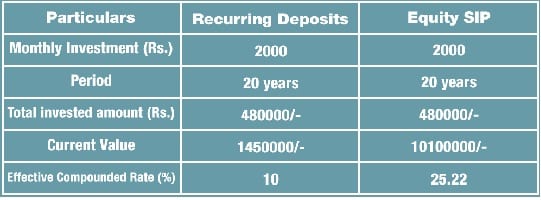

Comparing Recurring Deposits with Equity SIP

For people willing to invest a fixed amount every month rather than a single time investment of huge amount, opening a Recurring Deposit or starting a SIP are the most preferred options. In a Recurring Deposit scheme, a person deposits a fixed amount every month for a predefined period of time. At the end of the tenure, he gets back the interest and investment amount. n a SIP, the investor has to set aside small amounts of money either monthly or quarterly rather than having to invest a lump amount. The choice between SIP in mutual funds and recurring deposits should be made based on one’s investment horizon, risk appetite and structure of the portfolio.

Investments in recurring deposits help one achieve short-term financial goals, especially when the money is needed within five years. If one is looking to build a retirement corpus or a large fund for children’s education or marriage, then it would be better to opt for SIPs in some good equity mutual funds.

| Factors | Recurring Deposit (RD) | Systematic Investment Plan (SIP) |

| Investment Scheme | In RD scheme, you will have to invest in a deposit plan that will give you fixed rate of returns. It is debt part of your portfolio. | In a SIP for mutual funds, you can choose between debt or equity type of funds depending on your risk capability. |

| Risk Factor | Recurring Deposits are not prone to risks and is one of the safest form of investment. | Returns that you can expect from the SIP are variable. There can be a risk of capital and returns depending on the stock market. But, recent data shows us the SIP gives good returns if held for a long period of time. |

| Investment Type | In a Recurring deposit scheme, the investor has to deposit a fixed amount every month. | Systematic Investment Plan is a way to put your money on mutual funds. Investment can be done on a periodic basis – daily, weekly, monthly or quarterly. |

| Returns | As the rate of interest is fixed in a recurring deposit scheme, the return is also fixed and known at the time of investment. | The returns from a SIP for mutual funds is dependent on debt and equity markets and is also based on the fund scheme chosen by the investor. |

| Liquidity | Recurring Deposit is liquid but premature withdrawal or closure will attract penalty charges. | In terms of liquidity, a SIP is better when compared to RD. SIP can be closed and the money can be withdrawn without any penal charges. |

Every month, especially salaried employees and housewives save a little amount to deposit in banks. Recurring deposit is opted by them where a pre-decided amount is invested in the account. SIP or systematic investment works in a similar manner, where a fixed amount is invested in the market on a month/quarterly basis. SIP is a planned investment that helps you save as well as create future wealth. SIP is considered to be a much better option as compared to Recurring deposit, here is how:

Returns from SIP vs Recurring Deposits

Have a plan before investing in SIP

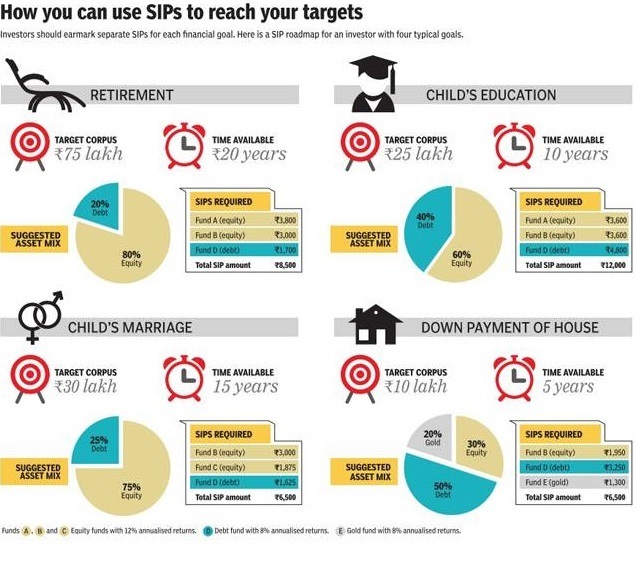

SIP has many benefits and when aptly invested it can help you create a decent amount of wealth for the future. Before you start investing in Mutual Funds through SIP, you must focus on the following points as SIP should be part of your investment strategy:

- Financial goal: Firstly, you should determine your purpose of investment. Financial goals can be anything, your children’s marriage, their higher education, your retirement etc.

- Set timeline: Decide within what period what you want to achieve this goal. This duration will be your investment tenure.

- Split the investment in different Mutual Funds with the focus on different asset class i.e. equity, debt etc., as per your risk appetite and return expectation. Diversification would ensure good returns despite fluctuation in the market. You can consult a financial advisor who will assist you with asset allocation in striking the right balance between debt and equity funds to keep both risks and returns handy. Or you can do it yourself.

- The amount of investment: Calculate your SIP amount and your portfolio.

- Selecting the fund: Analyze the fund’s record. Do your own research when selecting a fund for investment and don’t hesitate to take the advice of an investment expert if you find any difficulty.

- Investing Directly or not: You can invest directly through MFUtility or go online to each of these mutual fund websites & invest online in DIRECT PLANS with low cost/expense ratio to save on broker commissions

- Review Assess your investment regularly and compare the performance with other better performing funds and plan the redemption as and when required.

The image below shows how to invest in SIP for common financial goals.

How to invest in SIP

Know your customer or KYC

The first thing you need to do before starting investing in Mutual Funds is fulfilling the Know Your Customer (KYC) requirement. Know Your Customer (KYC) is a government regulation for verifying the identity of the investor and the source of the investment. The Prevention of Money Laundering Act 2002 led SEBI (The Security and Exchange Board of India) to come up with a procedure for financial organisations to know their customers. KYC detects money laundering and other suspicious activities. KYC means submitting an identity proof, address proof, and a photograph. You also have confirm your physical existence through an In-Person Verification or (IPV). You don’t have to fulfill it separately with each and every fund house you wish to invest. This is a one-time exercise after which you can invest in a mutual fund in India online/offline.

Physical/Offline method: You can fill the form online and visit a KYC registration agency such as CAMS for in-person verification. CAMS is not the registrar and transfer agent for every mutual fund, some mutual funds are taken care by Karvy. So you must check who services the fund of your choice.

Online: SEBI passed a circular allowing customers to complete their KYC through a Video Verification or using their Aadhaar number.

- The Adhaar eKYC has a limit of Rs 50,000 per financial year per Asset Management Company (Mutual Fund Company). However, should you wish to invest more than Rs 50,000 over time, you can convert your eKYC into a full KYC by doing an in-person verification KYC.

- E-KYC is an Aadhaar based KYC verification service launched by UIDAI.

- Investor details and photograph maintained under UIDAI as a result of e-KYC process shall be treated as sufficient proof of identity and address of the investor. The investor is required to authorise the mutual fund to access his data through the UIDAI system.

- The investor must scan and upload address, id proof, photograph and application form for carrying out e-KYC.

- In-person verification is done using real-time video based chat.

- To complete the IPV (In-Person Verification) requirement the fund house will ask you to select a suitable time slot at which you can confirm your physical existence through a webcam.

- Keep your original PAN card and address proof handy as you will be asked to show them during the video call

- Video KYC has no limits.

- Most fund houses like Birla Sun Life, Quantum, etc have started providing this facility through their website. You simply have to click on the ekyc link and follow the steps.

How to invest in SIP?

Choose Directly or Through Financial Advisor/Third party: You can opt to invest directly if you have the knowledge and experience in the field of investing.Direct plans usually carry less charges. Or through financial advisors.

Choose the method of investing Online/Offline: You have two alternatives as to Invest Offline or Online.Offline means submitting the forms and documents manually to Mutual Fund Company/Banks.There are various Online Mutual fund Platforms where you can easily fill the application forms, upload your documents and requisite proofs. If you are going for Direct invest we would recommend opening account in MF Utility.

Choose Mode of Payment – Manual Transfer/Auto Debit Facility :You can manually transfer the SIP amount or give post dated cheques also in order to make regular SIP payments. Or You can opt for Auto Debit facility i.e. money shall be automatically debited from your account each month as per your standing instructions.You just have to fill an Auto debit form in this regard authorising the bank/fund house to deduct the payment.

Choose the Amount and Date of SIP Each Mutual Fund Company/Bank has its own dates for investing.You can choose a date for monthly investment as per your convenience.Generally,the dates are 1,5,10,15,20,25 but these can vary based on different companies.You can select multiple dates for investing through SIP in different funds.

Submit Application Form : You have to provide your particulars in the Common Application Form.Fill the details as asked and paste or upload your scanned passport size photograph.After giving the KYC details, selecting the fund type, the date and amount of SIP and submitting the Application form you are almost done with the compliance and SIP procedure.

I wasn’t very sure about what rupee cost averaging with SIP investment plan actually meant. You have thrown light on those points with this blog. Thanks for sharing this piece of information. Now I will surely start my savings with SIP investment plan.

There are various Mutual Funds that allow you to invest through a SIP. But the main problem is selecting the best Mutual Funds for SIP. Though the best Mutual Funds might vary from person to person, choosing the best SIP plan, matters the most!

Furthermore, investing in the top or best SIP Mutual Funds will reduce your effort to manage the SIP investment.

https://goo.gl/WzUXfc