Mutual fund investors, bank account holders and those who have invested in insurance schemes between 1 July 2014 and 31 August 2015, cannot operate their accounts, from 1 May 2017 if they are not compliant with FATCA. This article explains what is FATCA? How to do FATCA declaration for Bank Accounts, NPS and Mutual Funds.

FATCA is not necessary for NPS. On 3 May 2017 NPS sent a mail saying

As per the latest instruction received from PFRDA/NPS Trust, PRAN would not be blocked on account of non-submission of FATCA Self-Certification. PFRDA / NPS Trust will issue revised guidelines on FATCA shortly.

Table of Contents

What is FATCA?

FATCA stands for Foreign account tax compliance act. The basic purpose of FATCA is to prevent US persons from using banks and other financial institutions outside the USA to park their wealth outside US to avoid US taxation on income generated from such wealth.

FATCA enables automatic exchange of financial information between India and the US. Indian financial institutions have to provide necessary information to Indian tax authorities, which will then be transmitted to the US. The inter-governmental agreement (IGA) with the US for implementing FATCA came into effect on August 31, 2015. Financial institutions were told to obtain self-certification and carry out due diligence procedure to determine the reasonableness of the self-certification in respect of all individual and entity accounts opened from July 1, 2014 to August 31, 2015.

What does FATCA Compliance mean for Indians?

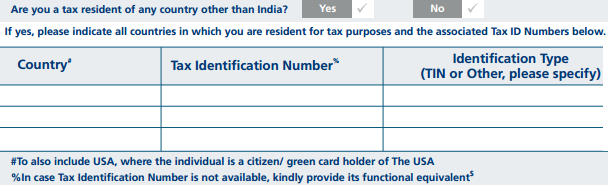

FATCA compliance simply requires a declaration giving information such as your PAN details, country of birth, country of residence, Nationality, Occupation, Gross Annual Income, and details of whether you’re a politically exposed person. It is a mandatory exercise for both Individual and Non-Individual Investors. If you have been paying taxes in any country apart from India, you need to provide the tax identification number.

Please do FATCA Compliance for your Bank Accounts, NPS Account, Mutual Funds. Except for NPS account, FATCA Compliance can be done online.

If you are resident of India with no tax liability outside then you don’t need to submit any document.

If you don’t get FATCA done now, your account will be frozen till you submit the FATCA declaration.

FATCA and bank account holders

If you are a bank account holder and if you haven’t given a self-certification till 30 April 2017, your account could be frozen, which would mean that the financial institution would prohibit the account holder from effecting any transaction with respect to such accounts.

Investors and account holders have to provide a self-certification about ‘tax residency’ to their respective financial institutions for compliance with FATCA failing which the account will be blocked.

- Individuals: Customers can Login to Net Banking & submit online FATCA declaration or submit a duly filled form at the branch

- Non Individuals: submit online FATCA declaration or submit a duly filled form at the branch

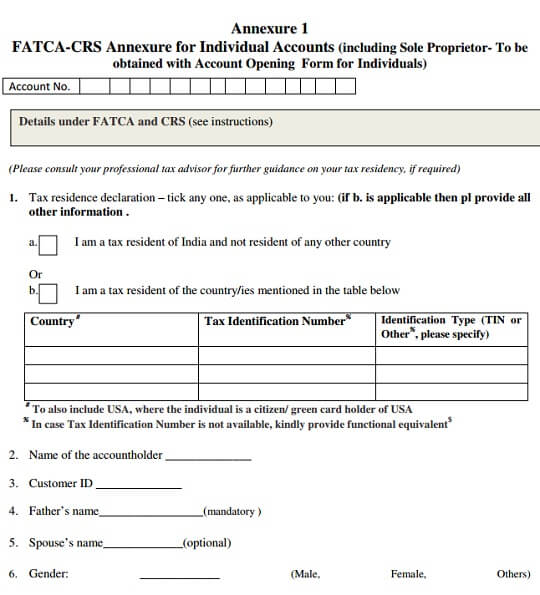

Excerpt for FATCA form for Bank is shown in the image below. Full form can be downloaded from here.

FATCA and NPS account holders

If you have opened a National Pension System (NPS) account on or after 1 July 2014 and it is being maintained with NSDL as Central Recordkeeping Agency for NPS, it will also get blocked unless you have submitted a self-certification of FATCA.

You can now log in to your NPS account, and submit FATCA Self-Certification for your NPS account. Steps for online Self-Certification are

- Log in to your NPS account (please visit www.cra-nsdl.com)

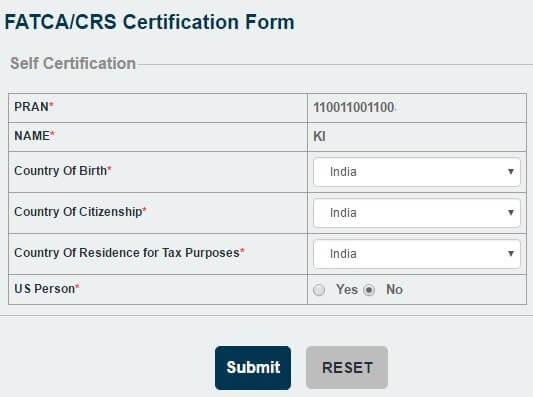

- Click on sub menu FATCA Self-Certification under the main menu Transaction as shown in the image below

- Submit the required details under FATCA/CRS Declaration Form

- Click on Submit

- You are requested to read and tick Declaration & Authorization by all customers

- Click on Confirm

- Enter OTP received on your registered mobile number from NPSCRA

- After Authentication through OTP, Acknowledgment for the completion of FATCA Self-certification will be displayed.

Details for FATCA/CRS Declaration Form

On 28 Apr 201 , NPS account holder were informed that they must submit FATCA form in physical form by 30.04.2017, otherwise their accounts will be frozenut later CRA has withdrawn the instructions. You can see the mail here

Submitting FATCA declaration for NPS Offline

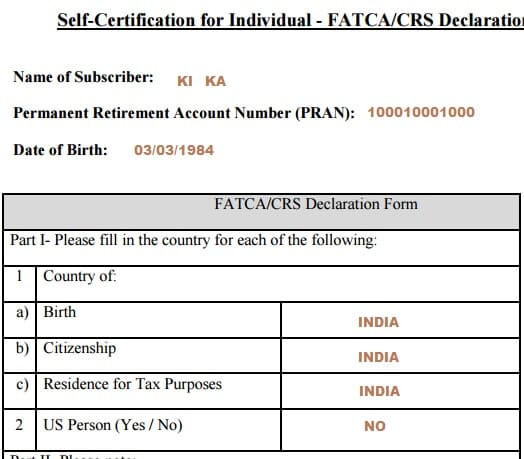

You can download the NPS FATCA Self Declaration Format by clicking here or from the email you received.

Fill up the form and send it with envelope saying Self-Certification – FATCA/CRS Declaration Form to Central Recordkeeping Agency (CRA) for NPS at the following address:

- NSDL e-Governance Infrastructure Limited,

- 1st Floor,Times Tower, Kamala Mills Compound, Senapati Bapat Marg,

- Lower Parel, Mumbai – 400 013

If the self-declaration NPS FATCA form is not received before April 30, 2017 the NPS account would be blocked. The account can be activated only after subscriber submits the above form.

For Indians whose country of birth, residence, and tax is India and do not have US tax status have to fill only part I and part III.

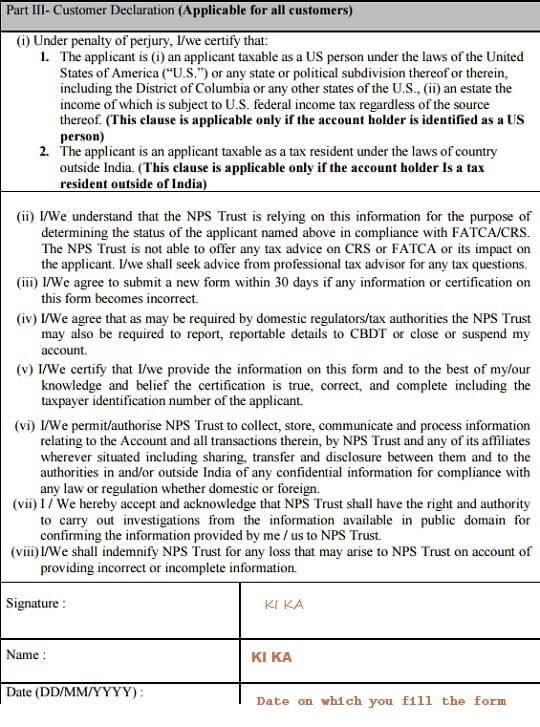

Part III of FATCA for NPS declaration is

FATCA and mutual funds

As per a Finance ministry release issued on April 11, 2017, all accounts/Folios with mutual funds, opened between July 1, 2014 and August 31, 2015 , must be FATCA compliant by April 30th, 2017.

In case of non-compliance by this date these accounts will be blocked i.e. no financial transactions will be allowed in such non-compliant accounts after April 30, 2017. Financial transactions, such as purchase, redemption, will be allowed only after these accounts become FATCA compliant.

One can copy and paste the following links of the registrars of the mutual funds to update one’s details. Our article How to fill FATCA and additional KYC for Mutual Funds Online or Offline through CAMS or Karvy or directly explains it in detail.

Online you can do at:

- CAMS

- Karvy Mutual Fund Services

- Franklin Templeton Investments

- Sundaram BNP Paribas Fund Services

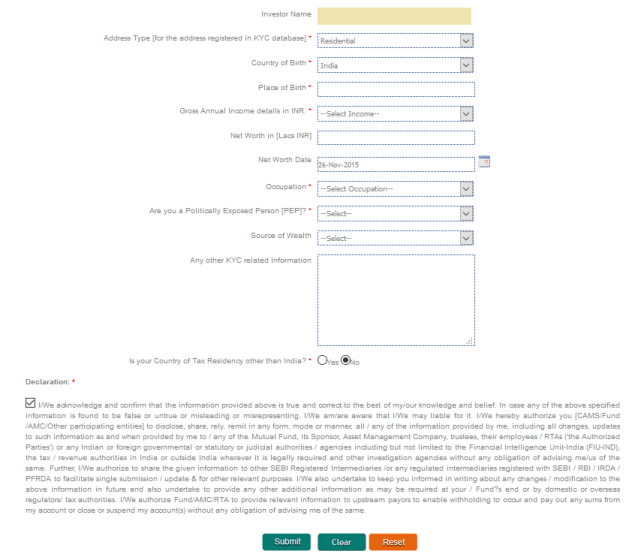

The image below shows FATCA declaration at CAMS for Mutual Funds.

This video explains how to fill FATCA for Mutual Funds Online

You can also submit FATCA declaration offline

Related Articles:

- How to fill FATCA and additional KYC for Mutual Funds Online or Offline through CAMS or Karvy or directly explains it in detail.

- Commission on Post office schemes,Insurance, Stocks and Mutual Funds

- Mutual Funds: Registrar and Transfer Agent : CAMS, Karvy

- Get started with Mutual Fund investing: KYC, Platform

- Accessing NPS account and CRA: How to Set IPin,Tpin

- How to do online Contribution to NPS using eNPS

3 responses to “FATCA Compliance for Bank Accounts, NPS, Mutual Funds”

Sir your total reading is correct. But eny fund transfer companydo not payment me

PayPal,western union. Skril.pioneer. HSBC Bank.bank of America.citi bank. ETC other huge payment due total payment collect and my country India tax system following and tax paid please you if possible my total payment collection help me thank

My query is with regard to savings bank accounts. Please advise if FATCA declaration has to be submitted even by those individuals who have opened bank accounts before 1/7/2014 and after 31/8/2015. You have mentioned that it is applicable only for those bank accounts which were opened between 1 July 2014 and 31 August 2015.

If you get a mail/SMS from bank then you would have to submit.

If you haven’t got any SMS or mail from Bank then you are not required to submit FATCA declaration.

You can still call your bank and verify