UPI or Unified Payment Interface allows the transfer of money from one bank account to another instantly, anytime( 24×7) on mobile using mobile number only with Apps like Google Pay, Paytm, BHIM, PhonePe, Amazon Pay on mobile only. UPI can be used for almost any purpose such as pay at local stores, food deliveries, for online shopping, send and receive money from friends, to make bill payments and even to invest in an IPO. The upper limit per UPI transaction is Rs 1 lakh per account per day. It is safe as you need to provide 2 passwords(or Pins) to use it, one to open App and other to do transactions called UPI. As shown in the image below. Let’s look at UPI in detail.

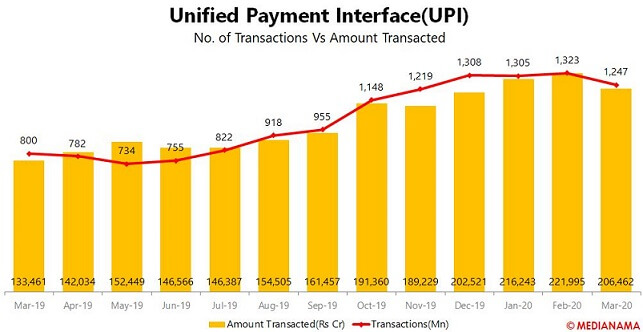

UPI transactions have been growing. Around 40 million happen per day using UPI

The total amount transacted using UPI in Mar 2020 was Rs 2,06,462 crore.

Google Pay Send Money using Bank Transfer

Table of Contents

What do you need to use UPI

To use UPI,

you must have bank account registered with you mobile number, which allows UPI. Most of the banks allow UPI, ex State Bank of India, HDFC Bank and ICICI Bank. You can check the list of member banks here.

Download the UPI supporting app on your smartphone. Some of the commonly used apps are BHIM, players as well such as Paytm, PhonePe, Google Pay, Amazon Pay(some private )etc. You can check the list of UPI apps by clicking here.

Remember, your mobile number must be registered with your bank account for the purpose of verification.

The upper limit per UPI transaction is Rs 1 lakh per account per day. Within this upper limit, different banks may have their own sub-limits hence one should check with the bank

How to set up UPI?

Once you have downloaded your chosen UPI app, then you will be required to choose the bank from the given options. To verify that it is your bank account, your bank will send you a one-time password (OTP). Once the OTP is verified, your virtual payment address (VPA) will be created.

Here is how you can set up a UPI account using the BHIM app:

Step 1: Download and install BHIM app from Google Play store or Apple App Store.

Step 2: Select your preferred language.

Step 3: Select the SIM which has your mobile number registered with your bank account.

Step 4: Set-up a four-digit login password. You need to enter this four-digit password to access the app.

Step 5: Select and link your bank account. Set your UPI PIN by providing last six digits and expiry date of your debit card. Your account is now registered and you can send or request for money to be transferred to your account.

Remember, you cannot link your mobile wallet to UPI, only a bank account can be linked to UPI.

You can link more than one bank account to UPI.

What is UPI PIN?

UPI PIN (UPI Personal Identification Number) is a 4-6 digit code you create/set during first time registration with a UPI enabled App. This is like your password. This PIN is required for you to allow your account to be debited for transactions while sending money to others. A UPI PIN should never be shared or disclosed with anyone and should always be entered only on your own phone and on the UPI PIN page of a UPI enabled app.

If you forget UPI Pin?

If you forget the UPI PIN, you can generate a new UPI PIN using your debit card details (the last six digits of their debit card and expiry date).

If your phone gets lost you can reset your UPI Pin.

If you change your mobile phone then you need to first link new mobile number with bank account and then again register on UPI App.

What is UPI Id?

UPI Id is like your email id ex abc@gmail.com, shyam12@yahoo.com. Just like you give email Id to send or receive emails, you give UPI ID to send/receive money.

UPI ID is your identity for people to easily send you money or ask you for money. UPI ID is usually a combination of your name, number with an ‘’@’’ symbol ending with a bank name or UPI. Eg- name@upi, 9000XXXX@upi, name@bankname etc

Different Apps provide different UPI ids just like different email providers. Those using Gmail have an email address like shivam@gmail.com and those with yahoo have parvati@yahoo.com. Most common ones are

| BHIM | @upi | |

| Google Pay | Axis Bank | @okaxis |

| HDFC Bank | @okhdfcbank | |

| ICICI | @okicici | |

| State Bank of India | @oksbi | |

| PhonePe | YesBank | @ybl |

How to transfer money using UPI

There are ways to transfer money via UPI

- by scanning QR code

- by mobile number

- by entering UPI Id

- account number and IFSC

Can I change my UPI App?

Yes, you can change your UPI App anytime. You can use any UPI app. If you change your UPI app, you need to register again. But app may create a new UPI ID as UPI ID depends on the App.

How to find UPI ID?

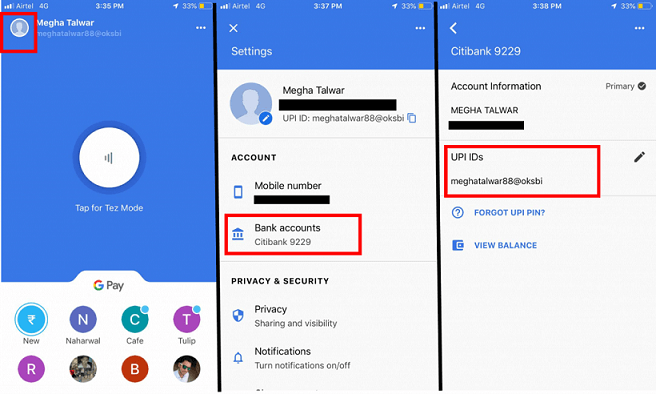

How to find UPI Id on Google Pay

- Open the Google Pay app.

- In the top left corner, tap on your profile picture

- Click on “Bank accounts”

- Tap the bank account whose UPI ID you want to view.

- You will find all UPI IDs associated with that bank account under “UPI IDs”

Find UPI Id on Google Pay

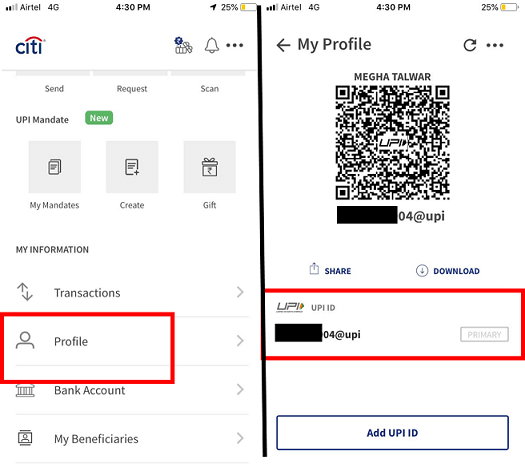

How to find UPI id on BHIM App

- Open the BHIM app.

- Click on “Profile” on the homepage

- You will find the UPI. It will be your registeredmobilenumber@upi.

Find UPI Id on BHIM Pe

How to find UPI Id on Phone Pe

- Open the PhonePe app.

- In the top left corner, tap on your profile picture

- Click on “MY BHIM UPI ID” and you will find your unique ID. It will be your phonenumber@ybl.

Is UPI popular? How many transactions happen through UPI?

The total amount transacted reduced in Mar 2020 was Rs 2,06,462 crore. The amount of transactions done through UPI is shown in the image below.

UPI transactions in 2020

Which UPI App should one use?

People who are new to the UPI payment system are attracted by cashback and other offers.

Collectively, Google Pay, PhonePe, Amazon Pay and Paytm have a market share of 90%. Even social media sites, such as Whatsapp, have integrated the UPI platform for sending and receiving quick money on a real-time basis.

Google Pay and PhonePe, have been clocking over 33% of total transactions via UPI

Our article Google Pay & UPI: How to use, How to set talks about how to use Google Pay in detail with images and videos.

Who has developed UPI? What is NPCI?

National Payments Corporation of India or NPCI owns and operates important payments systems such as UPI and IMPS. NPCI is a private body owned by the public sector and private banks in India, it

List of UPI Ids on different Apps

UPI Id depends on the UPI app. Given below is the table which shows the Merchant/App you used to create your UPI and the Handle Name.

| Sr. No. | TPAP / Merchant Name | PSP / Acquiring Bank | Handle Name |

|---|---|---|---|

| 1 | Airtel | Airtel Payments bank | @airtel |

| 2 | Amazon Pay | Axis Bank | @apl |

| 3 | Angel Bee | Yes Bank | @yesbank |

| 4 | Angel Broking | Yes Bank | @yesbank |

| 5 | Bajaj Finserv Direct Ltd | Axis Bank | @abfspay |

| 6 | Cleartrip | Yes Bank | @ybl |

| 7 | CoinTab | Federal Bank | @fbl |

| 8 | Cred | Axis Bank | @axisb |

| 9 | FAStag | IndusInd Bank | @indusind |

| 10 | Flipkart | Yes Bank | @ybl |

| 11 | Google Pay | Axis Bank | @okaxis |

| HDFC Bank | @okhdfcbank | ||

| ICICI | @okicici | ||

| State Bank of India | @oksbi | ||

| 12 | Hungerbox | Yes Bank | @ybl |

| 13 | JustDial | HDFC Bank | @hdfcbankjd |

| 14 | Khalijeb | Kotak Mahindra Bank | @kmbl |

| 15 | Make My Trip | ICICI | @icici |

| 16 | MI Pay | ICICI Bank | @myicici |

| 17 | Mobikwik | HDFC Bank | @ikwik |

| 18 | MudraPay | Yes Bank | @yesbank |

| 19 | Myntra | Yes Bank | @ybl |

| 20 | Omegaon | Yes Bank | @yesbank |

| 21 | PayBee | IDFC Bank | @idfcbank |

| 22 | Phonepe | Yes Bank | @ybl |

| 23 | PVR | Yes Bank | @ybl |

| 24 | Redbus | Yes Bank | @ybl |

| 25 | Samsung Pay | Axis Bank | @pingpay |

| 26 | SHAREit | Yes Bank | @yesbank |

| 27 | Strucred (Kreon) | Yes Bank | @yesbank |

| 28 | Swiggy | Yes Bank | @ybl |

| 29 | TrueCaller | ICICI | @icici |

| Bank of Baroda | @barodapay | ||

| 30 | Uber India | Axis Bank | @axisbank |

| 31 | Udaan | Yes Bank | @yesbank |

| 32 | Ultracash | IDFC Bank | @idfcbank |

| 33 | ICICI Bank | @icici |

Related Articles:

- How India pays: Cash, Cheque,NEFT,Cards etc

- Google Pay & UPI: How to use, How to set

- How to use IMPS to send money instantly

- What is Bank?

- Difference between NEFT, RTGS, IMPS, UPI

- WhatsApp Payment: How to use Whats App to Send Money

Do you use UPI? Which UPI app do you use?