We should live and enjoy today but also work and save for tomorrow. Saving is to put money aside. Usually, people save money in the bank. A BANK is a place that looks after people’s money for them and keeps it safe. It also lends money to people to help them buy things like houses. This section is about banks. Here we’ll explore as to What is a Bank? Why should we save? Why do we need a Bank to save money? Why is a piggy bank called a piggy bank? What is a bank account? How to use services of the bank? Kinds of Bank in India

Table of Contents

What is a Bank?

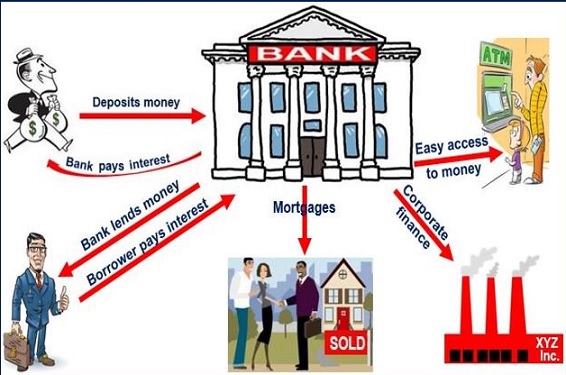

A bank is a business establishment in which money is kept for saving. To save money in a bank, one needs to open an account with the bank. Then one needs to put money in the bank. Putting money in the bank is called a deposit. Bank would provide a chequebook and an ATM card.

When one needs money, one goes to the bank and takes it out. Taking money from the bank is called a withdrawal. Banks keep your money safe. AND, more importantly, banks will pay you for keeping your money in the bank! The money the bank pays you is called interest.

The bank uses your money to help other people or companies who need money for big purchases, like a house or a car or for college. The money that bank give to the others is called a loan. The banks lend them the money to buy these things, but the banks expect people to pay the money back AND pay the bank a little extra money, besides. The money the bank charges you is also called interest.

Let’s say you borrowed 1000 Rs from a bank. You get the 1000 Rs right away. But when you pay back the 1000 Rs, the bank will charge you 80 or 100 Rs extra for giving you the money when you needed it. So you pay the bank Rs 1080 or Rs 1100. That’s how banks earn money.

Without money from people like you, banks wouldn’t have any money to lend. That’s why banks will pay you interest. Though bank gives the money, whenever you need it, it is in your account. Your money is safe in the bank. So if the bank gets in trouble or the money is stolen from bank government will replace it (till 1 lakh of a rupee per account).

What is Bank

Why should one save money?

The story of The Ant and the Grasshopper reminds us why we should save? One summer day, a grasshopper was singing and chirping and hopping about. He was having a wonderful time. He saw an ant that was busy gathering and storing grain for the winter.

“Stop and talk to me,” said the grasshopper.

“We can sing some songs and dance a while.”

“Oh no,” said the ant, “Winter is coming. I am storing up food for the winter. I think you should do the same.”

“Oh, I can’t be bothered,” said the grasshopper. “Winter is a long time off. There is plenty of food.” So, the grasshopper continued to dance and sing and chirp and the ant continued to work.

When winter came, the grasshopper had no food and was starving. He went to the ant’s house and asked, “Can I have some wheat or maybe a few kernels of corn?. Without food, I will starve,” whined the grasshopper.

“You danced last summer,” said the ant “And see what happened.” It gave him food and grasshopper sang:

Idleness brings want

To work today is to eat tomorrow

It is best to prepare for the days of necessity

The Ant and the Grasshopper story teaches us the virtues of hard work and saving. We should live and enjoy today but also work and save for tomorrow. It also teaches us that we should not spend all the money that we have, but keep some money for future use. Saving is to put money aside.

Why do we need a Bank to save money?

The question is where can we put the saved money?

- In a piggy bank

- In an envelope tucked in a drawer

- Under the mattress

- In a locked box in the house

As long as the money is in the house, it will never be 100% safe. You are making it easy for anyone entering your house to access your cash. your friend or maid or even you can just lift the mattress and take the money or burglars or robbers or even rats. Yes for rats your money is an invitation to eat.

When I use cash only, I have no idea how much I spent, or where the money went, which makes it hard to track my expenses. Using a debit or a credit card instead is so much easier. You just swipe it, and your bank sends you a neat statement, telling you how much you spent.

Why is it safe to save money in bank

Why is a piggy bank called a piggy bank?

Kids like to save money in a piggy bank. Do you know why the piggy bank is shaped like a pig? Long back ‘pygg’ in English referred to a certain kind of clay. It was used for making all kinds of household objects such as kitchen pots and jars. People used to save money in kitchen pots and jars called as ‘pygg jars’

By 18th-century pygg jar had become pig banks. Potters started casting the jars to store money in the shape of its common name-pig. By the way, clay bottles filled with hot water are still used as bed-warmers in parts of Britain, and are called “pigs” or “china pigs”

What is a bank account?

A bank account is a record maintained by the bank in which it records an ongoing series of cash inflows and outflows on behalf of a customer. The bank account also shows the current balance of cash in the record as of any point in time. If there is more than one individual who has access to the account, it is known as a joint account.

There are several different types of bank accounts. Most common is Saving Bank Account. Details of different kinds of bank accounts are covered in Different Types of Bank Accounts in India

A Saving Bank account (SB account) is meant to promote the habit of saving among the people. It also facilitates safekeeping of money. In this account, fund is allowed to be withdrawn whenever required, without any condition. Now, most of the banks offer facilities such as cheque books, ATM card, debit card, credit card, internet banking.

One can withdraw his/her money or pay bills or money to others by submitting a cheque to the bank and details of the account.

Through debit/ATM card one can take money from any of the ATM centers of the particular bank which will be open 24 hours a day

Through internet banking facility one can do the transactions like withdrawals, deposits, statement of account etc through the internet.

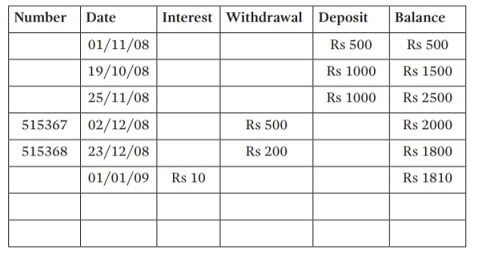

All savings accounts offer itemized lists of all financial transactions, traditionally through a passbook/ bank statement. Money deposited, withdrawn along with the dates and the balance, is recorded in a passbook or a bank statement. A sample of transactions in a passbook or monthly statement is given below.

Example of bank statement

The interest rate of savings bank account in India varies between 3.5% and 6%. The rate of interest may change from time to time according to the rules of Reserve Bank of India. Most savings accounts charge a fee if your balance (money in account) falls below a specified minimum.

A Savings the account can be opened either individually or jointly with another individual. In a joint account only the sign of one account holder is needed to write a cheque. An account can be opened for a child by parent/Guardian and it is operated by Parent/Guardian. Some of the banks that offer saving accounts for kids are given in table below.

How to use services of the bank?

Banks offer many different channels to access their banking and other services

A branch is a location where a bank offers a wide array of face-to-face service to its customers. For example, State Bank of India is India’s largest bank with a branch network of over 11000 branches and 6 associate banks located even in the remotest parts of India.

ATM is a computerised telecommunications device that provides bank’s customers with a method of financial transactions in a public space without the need for a human clerk or bank teller. Most banks now have more ATMs than branches, and ATMs are providing a wider range of services to a wider range of users.

Phone banking: Telephone banking is a service provided by banks which allows its customers to perform transactions over the telephone. See the services provided by phone banking by clicking

Internet or Online banking is a term used for performing transactions, payments etc. over the Internet through a bank’s secure website. For example:OnlineSBI.com is the Internet banking portal for State Bank of India. The website provides anywhere, anytime, online access to accounts for State Bank’s customers.

Mobile Banking: Mobile banking is a method of using one’s mobile phone to conduct simple banking transactions by remotely linking into a banking network.

Kinds of Bank in India

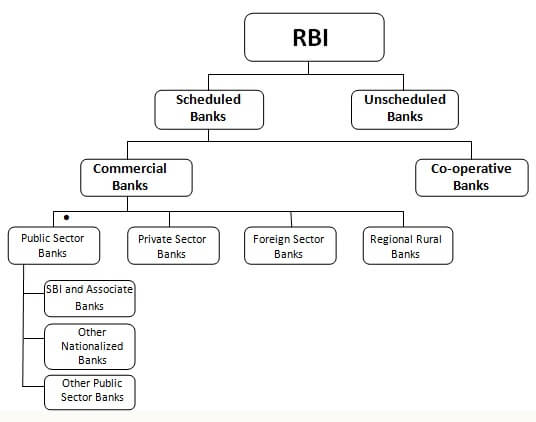

There are different kinds of banks in India. One way to classify it as Public sector banks, Private Sector Banks, Foreign banks etc. The various types of banks in India are as follows.

- Public sector banks, for example, State Bank of India, Bank of India, Punjab National Bank etc. Public sector banks are those which are operated by government bodies.

- Private sector banks, for example, ICICI Bank, HDFC Bank, ING Vysya Bank. Private sector banks are the banks which are controlled by the private lenders with the approval from the RBI.

- Foreign banks, for example, HSBC, Deutsche Bank. These banks offer banking services but are actually branches of banks of other countries, for example, HSBC is Hong Kong and Shanghai Banking Corporation. It is headquartered in England and is Europe’s biggest bank

Just as in school there is a principal to supervise the teachers & children. The bank which supervises all the banks in a country is called Central Bank. Central Bank of India is Reserve Bank of India (RBI). RBI issues the bank notes & also checks that all banks are working properly. (Note: Reserve Bank of India (RBI) is the central bank of the country and is different from Central Bank of India.) Reserve Bank of India

Some of the bank logos you would have seen are as shown below

Logos of some of bank in India

And the orgnization structure of the bank

Kinds of Bank in India

Related Articles:

- Kinds of Cheques

- Saving Bank Account: Do you know how interest is calculated and more

- Interest on Saving Bank Account : Tax, 80TTA

- Best Interest Rates on Saving Account

- Dormant Bank Account

Thank you for some other informative website. The place else may just I get that kind of information written in such a perfect method? I have a venture that I am simply now running on, and I’ve been at the glance out for such info.