Now you can do basic banking with WhatsApp. From knowing the account balance to the available credit limit on your credit card to find the IFSC code of a bank branch. On WhatsApp, you can ask and get details relating to your account via WhatsApp, but you can’t carry out any money transactions. WhatsApp banking services are now offered by HDFC Bank, ICICI Bank, Kotak Mahindra Bank, Saraswat Bank, AU Small Finance Bank, etc. Let’s look at WhatsApp services of banks in detail, What services are offered by banks through WhatsApp with a live demo. Look at WhatsApp Banking services of banks like ICICI Bank, HDFC Bank, Kotak Bank. And what to do if your mobile gets lost?

Table of Contents

WhatsApp Banking

WhatsApp could now be transitioning beyond an app into a “platform”, with commerce and transactions (payments) becoming integral to its strategy, besides communication. Facebook committed to $5.7 billion investment in Reliance Industries owned Jio Platforms in Apr 2020.

To avail WhatsApp banking services, you first need to give a missed call from the registered mobile number to the relevant number provided by the bank on its website. This number would be different from the phone banking number of the bank. It is mandatory to give a missed call from the registered mobile number with the bank to avail banking services. By giving a missed call, you basically provide your consent to the bank for using this service.

You will receive a welcome text message from the bank’s WhatsApp number. You should save this WhatsApp number of the bank in your contact list.

Customers can check their savings account balance, last three transactions, credit card limit, get details of pre-approved instant loan offers and block/unblock credit and debit card with WhatsApp banking services.

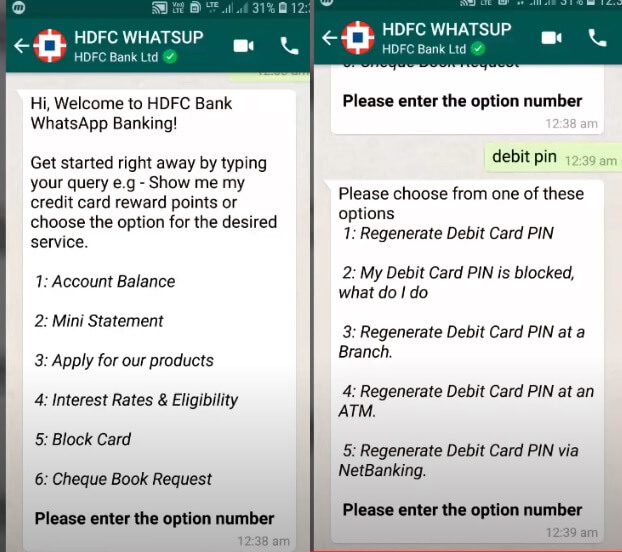

To initiate a chat through WhatsApp for any banking service, you need to send a message typing ‘Hi’. Further, as per the on-screen instruction, you may type ‘1’ or ‘2’ and so on as per your requirement

One can always opt-out of the service.

Banks do not charge anything for availing WhatsApp banking services

Safety: WhatsApp banking is safe because all messages are secured with end-to-end encryption. Also, your account information is not shared with any person. You do not need to enter any confidential information such as PIN or password while messaging on WhatsApp because it does not offer any transaction facilities.

The benefit of WhatsApp Banking is that the basic banking services will be available round-the-clock and even on bank holidays. There are no charges levied by the bank. However, data charges may apply when the app is used.

Video on WhatsApp Banking Services

This 4-minute video shows how to How to use Whatsapp Banking for HDFC Bank

WhatsApp Banking Services of HDFC Bank

HDFC bank WhatsApp Banking allows one to check the balance in the savings account or view the mini statement. One can ask for the latest account statement and even place a request for a new cheque book. For those who are holding the HDFC Bank credit card, they can check the outstanding balance on the credit card or even ask for the card statement. Further, one may view the rewards points accumulated on the card or know the available limit on the card.

Those HDFC bank account holders who also have a fixed deposit in the bank can view the FD summary. Also, if you are looking for a car loan, home loan etc, you may ask the bank about the list of documents you need to keep handy for applying. And, in case you need to know the IFSC code of a bank branch, WhatsApp Banking can do that for you in a jiffy.

If there are important updates, payment alerts or regulatory messages that the bank wants to send you, WhatsApp Banking is a tool to keep you informed.

Step 1. Register for HDFC Bank WhatsApp services

To register, one needs to give a missed call or send SMS SUB to 7065970659 from the same mobile number registered with the bank. The HDFC WhatsApp banking number is 7065970659.

Step 2. Add HDFC WhatsApp number in your contacts

hereafter, add the number 70659 70659 to your contacts and say ‘Hi in the message window.

One will get registered to avail the various services of the bank available through WhatsApp. Even those who do not have HDFC bank account may use the service and get information about the bank’s products and services.

One can always opt-out of the service by sending SMS UNSUB from your mobile number (same as registered with the bank) to 70659 70659.

ICICI banking services on WhatsApp

The customer simply needs to save ICICI Bank’s verified WhatsApp profile number, 9324953001, to his/her ‘contacts’ on the mobile phone and send <Hi> to this number from his/her mobile number which is registered with the bank. The bank will respond with a list of services available

From the list of services, type the keyword of the service required. Example : <Balance>, <Block> etc. The service is carried out and displayed instantly.

Here is the list of banking and other services available on WhatsApp:

Check account balance: Type any keyword like <balance>, <bal>, <ac bal> among others

View last three transactions: Type <transaction>, <stmt>, <history> among others

Get outstanding balance and view available credit limit of credit card: Type <limit>, <cc limit>, <cc balance> among others.

Block/Unblock credit and debit card instantly: Type <block>, <lost my card>, <unblock> among others

View details of available pre-approved instant loans: Type <loan>, <home loan>, <personal loan>, <instant loans> among others

View nearest ICICI Bank ATM and branch: Type <ATM> , <branch> among others

Check available nearby offers on travel, dining, shopping: Type <offer>, <discounts> among others

Video on How to use WhatsApp for ICICI Bank

WhatsApp Banking Services of Kotak Bank

1. If you are on mobile, click here to get started OR Give a missed call on 9718566655 from your registered mobile number

2. Add ‘022 6600 6022’ to your mobile contacts

3. Go to WhatsApp, search for the contact and send “help” as a message to know the list of services available

4. Simply type the number against the service like “1” or “Bank Account”

5. Enter the 6 digits OTP on WhatsApp sent to your registered mobile number and then follow the steps mentioned on screen

Changed your mind? No problem! You can opt-out at any stage by saying ‘Stop’

What happens if you lose your phone?

In case of loss of the mobile device, you should immediately deactivate your WhatsApp account by sending an email with a phrase “Lost/Stolen: Please deactivate my account” in the body and subject of the email to support@whatsapp.com .You need to include your phone number in the body. The phone number should be in international format. For instance, if your registered mobile number in India is 9876543210, you need to enter your mobile number as +919876543210 in the email. This way, your WhatsApp account will be deactivated immediately and a thief can’t misuse the WhatsApp banking service.

Unfortunately, you can’t deactivate your WhatsApp banking service using net banking/branch visit/ phone banking facility of the bank. First, you need to apply for another SIM card from your mobile operator. Then, you would have to register for WhatsApp from another mobile handset. So, automatically, the previous WhatsApp account from the lost mobile handset will get deactivated.

However, it is important that the safety of your mobile phone will need to be addressed for which one may resort to keeping app locks and other app safety features in place

Related Articles:

- WhatsApp Payment: How to use Whats App to Send Money

- When you lose your mobile: What to do?

- When you lose your wallet,Credit Card, PAN Card, Driving License

WhatsApp has changed the way we communicate. Would you prefer to do Banking Services through WhatsApp? Would you like to send and recieve money through WhatsApp? Which is your preferred way of banking? Internet, Mobile?