The parental universe is typically powered by twin passions: kids and money. When it comes to money Your kids should be aware of now about:Earnings, Savings, Buying , Giving and Investing. This article also talks about teaching Kids about Money. Quiz on How to find your Childs’s money personality and a quiz for parents whether they are laying a good foundation for kids.

Table of Contents

Teaching Kids About Money

When it comes to money Your kids should be aware of now about:Earnings, Savings, Buying , Giving and Investing. The parental universe is typically powered by twin passions: kids and money. Caught between furnishing money and fostering the kids , the parents forget that there is also the need to strengthen the bond between the two. Instead of buying assets and hoarding money to secure your child’s financial future, just inculcate good money habits and skills. It will ensure that he is able to manage his own finances as an adult and not rely on your legacy to sustain him.

We have written a book and workbooks on teaching kids about money.

- Kindle edition of book is available here. Hard copy for Rs 150 + shipping charge

- Workbook is Rs 80+ shipping charges. Soft copy for Rs 50. Sample worksheets can be seen here.

Teaching Kids Value of Money

Understanding the value of money is the foundation on which the child’s future attitude towards money is based. Value can be interpreted in two ways:

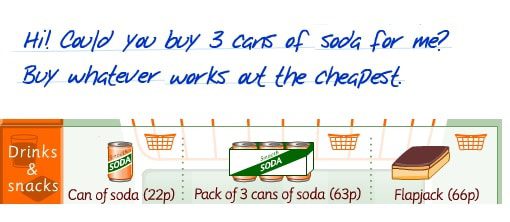

- purchasing power of money. How many things can be bought with a given sum. When you go to buy grocery items give money to your child. The child will understand how many things could be bought with a specific amount and also learnt to calculate the balance he has to get back . Not only must your child be able to calculate the exact amount to be paid and balance to be taken, but should also get the most value for money spent. During the grocery shopping trip you can list out three brands and tell them pick one by weighing the quality of the product with its cost.

- appreciating the hard work that goes into earning it.

Teaching the child how to manage money at a young age will not only help him organise his finances as an adult, but also instil the discipline to live within one’s means. So give him pocket money and let him decide what to do with it. The purpose is to make the child keep tabs on the inflow and outflow of money, while learning the importance of saving and spending right.

Don’t frame rules on its usage, but insert a casual remark about careful spending or how saving a little amount or how saving a little amount can help buy a coveted toy later. Trust the child, let him take his own decisions so that he understands how best he can utilise and make the money last. When your child son is younger, he might finish an entire pack of of 8-9 sweet snacks in a day. You can tell him how he could spread it over an entire week by having one a day or alternate it with other cheaper snacks.

Kids Math Games are interactive fun money games for kids about counting and using money. For example in Fun Shopping Game for Kids which has interactive activities where one has to use the money to go shopping but meeting some conditions such as spending least amount of money in buying 3 sodas

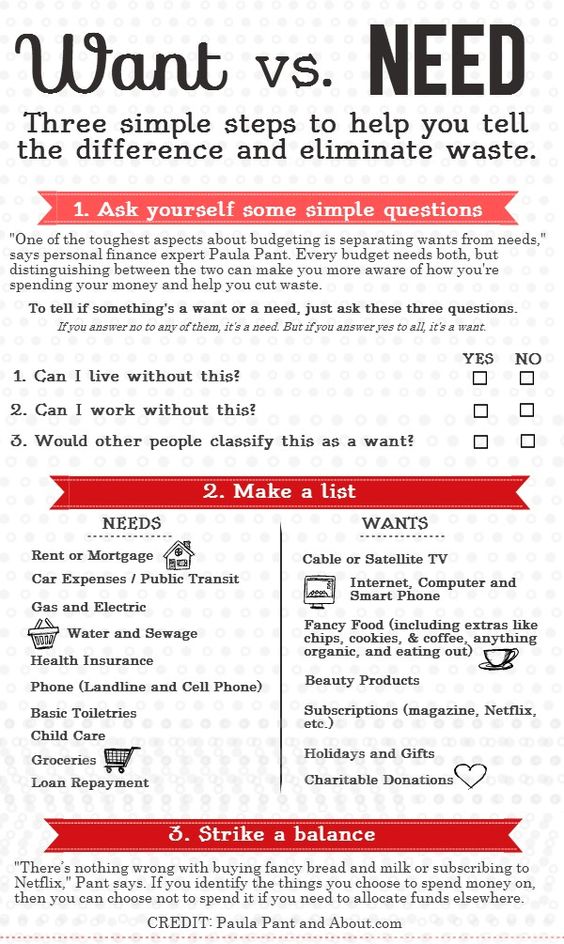

Explaining the Difference between Need and Want

Teaching Kids about Making & reaching goals

It’s a skill that is critical to achieving major financial milestones later in life. So if a child is keen to buy something, make him do it by setting it up as a goal. Let him figure out how much money he can save each month and then calculate the time it will take to amass the required sum. For example if your 10 year old daughter, is keen to buy a Kindle. Parents can tell her that it is an expensive gadget and if she wants to, she will have to buy it it from her own kitty and save for it . Parents should try to contribute to the shortfall, but the child must understand the sacrifice involved in the process of achieving goals. Make sure that it is a time-bound exercise and has tangible rewards at the end of it

Teaching Children Making money grow

This is a skill that is typically given a miss by most parents till the child is an adult. It is, however, a good idea to explain to the child how money can grow at a different pace depending on the avenue in which you invest it. As a simple exercise, have the child put the money in a piggy bank and show how it remains the same after, say, six months. Then put it in a bank account and reveal how it has grown during the same period. As the child grows, list out various investing avenues, spelling out not only the likely returns, but also the pros and cons of each. This will, of course, require you to brush up your own investing knowledge.

Impact of Parents Financial Behavior on Children

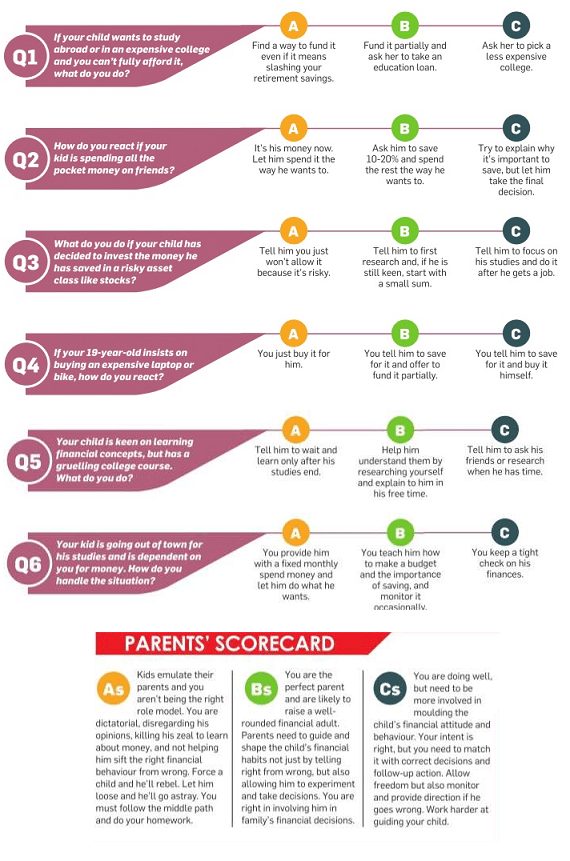

As per a 2015 study by the German Institute for Economic Research, the way parents educate their kids about finances and childhood experiences about money have a direct bearing on financial literacy. It goes without saying then that parents’ financial behaviour is one of the biggest influences on the kid. Find out if you are passing on the right signals and financial habits to your child.

How spouses communicate with each other and their interaction with kids holds the key to most money problems. If you don’t talk, the message it sends to the kids is that either money is not an important subject to discuss or is too mysterious and difficult and, hence, something to stay away from. It also prevents the family to work like a team to tide over bad times, or help the kids appreciate the effort that goes into running a household. Talking it out also helps kids be more amenable to parents’ advice. If your son wants to buy a laptop worth Rs 50,000, but when you explain how it was more suited to office use, he can agree to buy one worth Rs 30,000.

How to Teach Finance to Kids (5-12 years)

Quiz for Parents on laying sound financial foundation for Kids

Related Articles

- All about ATM, how to Bank using ATM

- Go Cashless:Digital Wallets, NEFT,IMPS,UPI, Debit Cards,Credit Cards

- Learn Importance of Struggle: Gujarati billionaire Savji Dholakia to his son

- What are you teaching your kids about money?

- Kids and Money Talk

3 responses to “Teaching Kids about Money and Quiz on Child Money Personality”

[…] Teaching Kids About Money and Quiz on Child Money Personality […]

Thank you for sharing the fatwallet link. It helped for me. This book “when times are tough” is so good for elders to teach to kids about time is tough. As it is costly in india, try to get a glimpse in youtube. Nice work. Your articled helped. Thanks.

Thanks. Nice to know you liked it.

Yes sadly the book when times are tough is expensive in India.