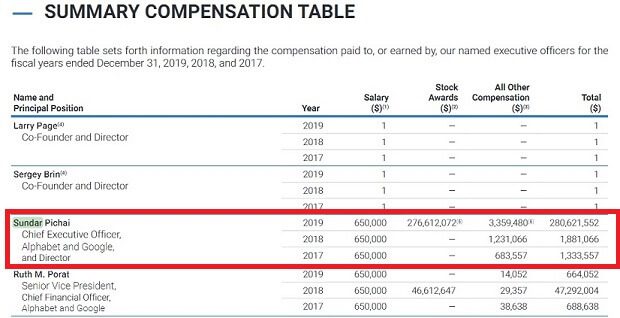

Sundar Pichai in 2020 will receive an annual salary of $2 million. Also, he will receive stocks worth of $240 million. Sundar Pichai is now CEO of Alphabet, the parent company of Google. Is Sundar Pichai salary really ₹18,29,40,12,000? Let’s look at Sundar Pichai salary in Google, Why he receives such huge amount, How does his salary compare to other Tech Giants in the US? What is the difference between Google and Alphabet and Class A and Class C of Google shares.

Table of Contents

What does an Employee earn? Breakup of Salary

Income of an employee consists of the following components, which in India is commonly called as CTC or Cost to Company. Please understand Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

Salary = Basic Pay + Allowances + Retirement Benefits(EPF/NPS) + Perquisites + RSUS/ESOP/ESPP + Variable Pay

- Basic Pay: This is the core of salary, and many other components may be calculated based on this amount. It usually depends on one’s grade within the company’s salary structure. It is a fixed part of one’s compensation structure.

- Allowances: It is the amount received by an individual paid by his/her employer in addition to salary to meet some service requirements such as Dearness Allowance(DA), House Rent Allowance (HRA), Leave Travel Assistance(LTA), Lunch Allowance, Dearness Allowance etc. Dearness allowance (given mostly to government employees) is a percentage of basic pay and is paid to lower the impact of inflation.

- Long Term Benefits: Contributions towards long-term and retirement benefits such as Provident fund, Superannuation fund and Gratuity

- Benefits and Perquisites: such as leaves, medical, car, insurance

- Stock Options: ESOP, RSU, ESPP: Company issues shares to the employee at discounted prices

- RSU(Restricted Stock Units) The company offers its stocks to employees without any strings attached but with a vesting period. The vesting period means an employee has to wait before he becomes eligible to own it. A 500 RSU with 3 year vesting period means that the employee can claim the 500 shares after he has successfully continued in his job for a minimum of 3 years

- ESOP(Employee Stock Option Plan): The employee has the option to purchase the stock of the company at a future date at a pre-determined price.

- ESPP(Employee Stock Purchase Plan): The employee can purchase stocks of the organization at a discounted price. The employee has to contribute a part of his salary for a fixed period of time say 6 months. At the end of the period, the amount accumulated is used to purchase the company’s stock at a discounted price.

- Variable salary: includes Performance-based incentive called as Variable Pay, Sale based incentive and Profit based bonus.

- Variable Pay is expressed as a percentage is based on two main factors, employee’s own performance and his company’s performance. Companies pay based on that combination.

- For salespeople, variable pay plus sales incentives can range from 30% to 40%. Sales incentives aren’t defined as variable pay as they are commissions.

- Our article Variable Pay explains it in detail.

Breakup of Sundar Pichai salary. How has Sundar Pichai Salary grown?

- When he took over as Google’s chief in 2015, Pichai drew an annual salary of $652,500.

- In April 2013 Sundar was granted 353,939 restricted shares of Alphabet stock that had a 5-year vesting period. At the time he was awarded the grant, the shares were worth $184 million. When those shares fully vested in April 2018, they had a paper value of $380 million. They had been worth as much as $450 million when the stock was trading at nearly $1300 per share.

- In 2014, shortly before Pichai was promoted to take over many of Google co-founder Larry Page’s responsibilities, he received restricted stock worth about $250 million.

- Prior to being named CEO at Google, Pichai was rumoured to be at the front of the line as CEO at Microsoft (MSFT). The position eventually went to current CEO Satya Nadella.

- In 2015, when he became Google CEO, he got $100 million of stocks.

- In 2016, Pichai received another grant of stocks worth almost $200 million to be vested over 3 years.

- He turned down an additional stock grant in 2018

- Pichai earned nearly $1.9 million in 2018, which mostly included the costs for his security and personal use of aircraft. His base salary that year was $650,000.

- On December 19, 2019, Sundar Pichai was granted stocks consisting of both performance-based(PSU) and time-based equity(GSU), vesting from 2020 through 2022.

- There are two ticker symbols for Alphabet Inc. on the NASDAQ stock exchange: GOOG and GOOGL. The two tickers represent two different share classes: A (GOOGL) and C (GOOG).

- Google provides what are called GSU’s instead of RSU’s.

- Sundar Pichai was granted an award of $120,000,000 in the form of GSUs.

- These GSUs will vest as follows: 1/12th will vest on March 25, 2020 and an additional 1/12th will vest quarterly thereafter until fully vested, in each case subject to continued employment.

- Upon vesting, each GSU will entitle Mr. Pichai to receive one share of Alphabet’s Class C capital stock.

- Mr. Pichai also will be granted a transitional award of $30,000,000 in the form of GSUs with the exact number of GSUs calculated as set forth above.

- Upon termination of employment by reason of death, all unvested GSUs will immediately vest in full and be settled in shares of Alphabet’s Class C capital stock.

- About PSU

- Sundar Pichai was granted an award consisting of two tranches of PSUs with a target value of $45,000,000 each.

- The target number of PSUs for each tranche was calculated by dividing the target value of $45,000,000 by the average closing price of Alphabet’s Class C capital stock during the month of November 2019 (the “Average Closing Price”).

- The PSUs will vest, if at all, based on the TSR performance of Alphabet relative to the companies comprising the S&P 100 over a 2020-2021 performance period for the first tranche and over a 2020-2022 performance period for the second tranche, subject to continued employment.

- Depending upon performance, the number of PSUs that vest will range from 0%-200% of target.

- Upon vesting, each PSU will entitle Mr. Pichai to receive one share of Alphabet’s Class C capital stock.

Sundar Pichai NetWorth

Sundar Pichai’s wealth estimate is difficult to pin down, but as of June 2019, his net worth was said to be $933 million. As Pichai reportedly owned 4,800 units of Alphabet stock valued at $108.5 million. He’s also reportedly sold $822.47 million worth of company stock in the preceding four years.

Sundar Pichai’s net worth pales in comparison to Larry Page and Sergey Brin, founders of Google, both of whom own roughly 6 per cent of Alphabet and have respective net worths of $65 billion and $63 billion and have a salary of just $1.

How does the world know of Sundar Pichai salary?

In the USA, a publicly-traded company has to disclose the compensation of the CEO, CFO and the three other most highly compensated executive officers for the current and past two fiscal years in their proxy statement (Form DEF 14A), filed with the Securities and Exchange Commission.

In India also, companies have to disclose salaries of 10 top-paid employees in the director’s report or to the registrar of companies (RoC) and those earning in excess of Rs 1.02 crore per annum. This information is available at NSE/BSE Websites. Hence we know that Mukesh Ambani salary was 15 crore from 2008-09 to 2019-20. In 2020 Mukesh Ambani will not be taking any salary due to Corona Virus pandemic. But Mukesh Ambani gets hefty dividend payment for his shareholding in the Reliance Industries as explained in our article Mukesh Ambani: Richest Man of India

About Sundar Pichai

Sundar Pichai (real name is Pichai Sundararajan), was born in Chennai, India on 10 June 1972. His parents, Lakshmi and Regunatha,both worked full time, his mother making a living as a stenographer and his dad working as an electrical engineer at U.K.-based GEC.

He is married to Anjali Pichai, whom he met at the Indian Institute of Technology Kharagpur. The couple has two children. Pichai’s interests include football and cricket.

After attending school in his hometown of Ashok Nagar, Chennai, Pichai attended the Indian Institute of Technology Madras and eventually earned a degree from the Indian Institute of Technology Kharagpur, with a degree in metallurgical engineering.

Sundar Pichai joined Google in 2004. Before Google Sundar worked in engineering and product management at Applied Materials, Inc., a semiconductor company and in management consulting at McKinsey & Company, a management consulting firm.

In Google, he took on responsibility for some of its most popular products, including Gmail, the Chrome browser and the Android operating system. Sundar served as Google’s Senior Vice President of Android, Chrome and Apps from March 2013 to October 2014 and as Google’s Senior Vice President of Products from October 2014 to October 2015. Pichai is considered soft-spoken and an adapt problem solver without ruffling any feathers. More than his knowledge of products and technology, it is his ability to lead and work with people that made him the most important man within Google.

Sundar Pichai became Chief Executive Officer of Google in October 2015.

Served as a member of Board of Directors of Google since July 2017.

And became CEO of Alphabet, the parent company of Google, in Dec 2019.

Sundar education qualifications are

- BE in metallurgical engineering from the IIT(Indian Institute of Technology Kharagpur), passing out in 1993.

- Master of Science in materials science & engineering from Stanford University

- MBA(Master of Business Administration) from The Wharton School of the University of Pennsylvania

Here is what Google founders wrote about Pichai,

“Sundar brings humility and a deep passion for technology to our users, partners and our employees every day. He’s worked closely with us for 15 years, through the formation of Alphabet, as CEO of Google, and a member of the Alphabet Board of Directors. He shares our confidence in the value of the Alphabet structure, and the ability it provides us to tackle big challenges through technology. There is no one that we have relied on more since Alphabet was founded, and no better person to lead Google and Alphabet into the future.”

And how Indians/Chennai’s claim their VERY OWN Sundar Pichai.

Comparing Sundar Pichai Salary

Sundar Pichai’s net worth pales in comparison to Larry Page and Sergey Brin, founders of Google, both of whom own roughly 6 per cent of Alphabet and have respective net worths of $65 billion and $63 billion and have a salary of just $1.

Microsoft CEO Satya Nadella made a base salary of $2.3 million, slightly higher than Pichai’s, but that was only a small part of his total 2019 compensation of $42.9 million. He was paid another $10.8 million in cash, plus $29.6 million in stock awards based on Microsoft’s performance under his leadership. Satya Nadella joined Microsoft in 1998 and became CEO in February 2014, and he’s managed to turn the company right around in the time since. He’s successfully managed to shift Microsoft away from being an OS company to an online services provider.

Even with this salary increase, Sundar Pichai won’t make the list of highest-paid tech CEOs in the US in 2019.

- Elon Musk – Tesla/SpaceX – $513.3 million: Despite Tesla reporting a $1 billion loss. Though he’s paid minimum wage as mandated by law, his actual gains come from massive stock options tied to performance goals.

- Tim Cook – Apple – $141.6 million. In 2018 Apple gave him 280,000 time-based and 280,000 performance-based vested restricted stock worth $126 million all-told. And that was on top of a base salary of $3 million, cash bonus of $12 million, and perks worth $682,000.

- Nikesh Arora – Palo Alto Networks – $130.7 million. Nikesh Arora has been CEO of cybersecurity firm Palo Alto Networks since June 2018. He received a $19 million in restricted stock as a sign-on award, as well as stock awards and options worth $39.3 million and $72 million respectively.

- Oracle CEO Mark Hurd: $108.3 million. Oracle CEO Mark Hurd had a respectable base salary of $950,000. However, he was also getting stock options of $103.7 million, as well as perks of $32,470 and a bonus of $3.7 million

- Satya Nadella – Microsoft – $42.9 million. He was paid another $10.8 million in cash, plus $29.6 million in stock awards based on Microsoft’s performance under his leadership

- PayPal CEO Daniel Schulman: $38.8 million.

- DXC Technology CEO Mike Lawrie: $32.2 million.

- Adobe CEO Shantanu Narayen: $28.4 million.

- Salesforce co-CEO Marc Benioff: $28.4 million

- Chuck Robbins – Cisco – $21.3 million

- Ajay Banga – Mastercard – $20.4 million

Why does Sundar Pichai get so much salary?

With great salary comes great responsibility

Challenges before Sundar Pichai

In 2014 the Google CEO job began to morph from a technical leadership role into a political minefield. And then there is issue of employee relationship with management. Pichai, given the top job in 2015 for his engineering prowess, has had to address these concerns, while juggling a host of other politically charged issues.

When Page and Brin created the Alphabet holding company in 2015, they chose Pichai to run the core money-making businesses as Google CEO. Over the years, Pichai has taken on more duties and it was he who answered questions at a 3 hour congressional hearing (video below) about the political slants of his staff, the firm’s algorithms and Chinese censorship and surveillance, even a conspiracy theory about Hillary Clinton that spread on Google’s YouTube video service. Co-founders Page and Sergey Brin, have stepped away from day-to-day management, and former CEO Eric Schmidt, who used to handle politics, left the board. On 3 Dec 2019, Pichai replaced Page as CEO of Alphabet.

Employees marched in protest of President Donald Trump’s immigration plan in early 2016.

In 2017, a memo from James Damore, a Google engineer claiming the company was biased against conservatives, exploded into a national scandal.

In 2018, Google workers revolted over a military contract and a proposed censored search engine in China.

In July 2018, Google employees organized the 20,000-person Google Walkout protest after discovering the company had given big bonuses to executives accused of sexual harassment. Android co-founder Andy Rubin’s was discreetly given $90 million exit package. Google employees organized the 20,000-person Google Walkout protest.

At a staff meeting in 2019, one Google worker asked why Pichai was paid hundreds of millions of dollars, while some employees struggle to afford to live in Silicon Valley?

Google vs Congress Video

Lawmakers questioned Google’s CEO Sundar Pichai for over three hours, looking for answers on alleged anti-conservative bias, plans for a censored search engine for China, and data collection. This video shows Google’s congressional hearing highlights in 11 minutes

Google and Alphabet

Google was founded by Larry Page and Sergey Brin in a garage in September 1998. They became billionaires when the company had its initial public offering in 2004.

Alphabet Inc is the parent of Google, the world’s largest search engine, which dominates Internet search activity globally. Alphabet is involved in a broad array of businesses, suhc as cloud computing, software and hardware, advertising services, and mobile and desktop applications.

Born in Russia, Sergey Brin and his family emigrated to the United States in 1979 when he was six. While completing his doctorate in computer science at Stanford, he met Larry Page. As part of a research project, the pair developed an early version of Google.

In 2015, Google created a corporate structure under a new holding company called Alphabet.

Type of Google shares

There are two ticker symbols for Alphabet Inc. on the NASDAQ stock exchange: GOOG and GOOGL. The two tickers represent two different share classes: A (GOOGL) and C (GOOG).

Google split its stock in April 2014, which created the A and C shares. Like any other one-for-one split, the number of shares doubled, and the price dropped in half. Google also has B type of shares which are owned by insiders and don’t trade on the public markets. B shares are still in the possession of Brin, Page, Schmidt and a few other directors. Difference between types of shares

- A shares receive one vote,

- C shares receive no votes,

- B shares receive 10 votes.

Anyone who held A shares at the time of the split received an equal number of C shares, but their voting power did not increase. This class of shares is an attempt by the co-founders of Google, Sergey Brin, and Larry Page, along with company chairman Eric Schmidt, to retain as much control of the company as possible

- GOOG stock represents Class C shares, while GOOGL stock represents Class A shares.

- Class C shares (GOOG) have no voting rights, while Class A shares (GOOGL) have one vote each.

- Anyone who owned Google stock before the split got one share of the voting GOOGL stock and one share of the non-voting GOOG stock.

- Of course, there are also Class B shares of Google stock, which do not trade in the public market, are owned by Google insiders and each get ten votes.

- The fine print: Every time the company sells a share of Class C stock, it also must convert one Class B share into a Class A share.

- Also, Google (as the result of a class-action settlement around the stock split) will compensate non-voting GOOG stock investors in a year if there is a substantial difference in price between the two classes.

- Google Class A and C shares were both represented on Nasdaq OMX indices such as the Nasdaq-100 through June 20. Thus, the Nasdaq-100 actually had 101 constituents during that time.

- Google Class A shares stopped being listed on Nasdaq OMX indices after the quarterly rebalance on June 23, 2014, and Google instead will be represented on such indices by the Class C shares. Class A shares will continue to trade on the exchange, however.

Related Articles:

Explore BemoneyAware: EPF, UAN, Investing, Women, Debt, Big Boss & More

What should you know as an employee? CTC, Salary, Allowances, EPF, UAN, When you change jobs

- Salary, Net Salary, Gross Salary, Cost to Company: What is the difference

- Variable Pay

- Employee Stock Purchase Plan or ESPP

- It’s not what you earn that makes your financial position!

- Understanding Form 16: Part I

- What are Employee Stock Options (ESOP)

- RSU of MNC, perquisite, tax , Capital gains, ITR, eTrade

- Sachin Tendulkar vs Virat Kohli : Cricket, NetWorth, Family, Awards

So what do you think of Sundar Pichai Salary? Is it more for the challenges he has to face? How much variable pay will he earn in coming years? Will the monopoly of Google go away?

One response to “How much is Salary of Sundar Pichai of Google?”

[…] Visit Direct Link […]