Saving accounts are one of the most popular deposit accounts for individuals in India. Savings accounts offer easy access to your cash you can make withdrawal easily and quickly i.e your money is liquid . Savings account helps people to put through day-to-day banking transactions besides interest .In such accounts, the depositor is normally issued cheque books and the customer is allowed the flexibility of deposits of any amount and withdrawal of funds from the account at any time. In this article we shall talk about Best Interest rates on Saving Accounts, how interest rates have changed over the years, tax on interest on saving account and how one should look beyond the interest rate offered.

Best Interest Rates on Savings Accounts

Reserve Bank of India deregulated interest rates on savings accounts in India in October 2011 and banks are now free to decide the same within certain conditions imposed by RBI. Before the deregulation, all banks offered the same interest rate of 4.00% on savings accounts. Rates are subject to change from time to time at the sole discretion of Banks. So please check the website of the respective banks! Following bank shows the interest rate offered by various banks. (Updated on Oct 23 2016)

| Savings Account | Interest Rate Offered |

| RBL Bank | 7.1% p.a = Daily balance above Rs.10 lakhs

6.1% p.a = Daily balance above Rs.1 lakh 5.1% p.a = Daily balance upto Rs.1 lakh |

| Yes Bank | 6% p.a. (On Savings Account balances below Rs.1 crore.) |

| Kotak Mahindra Bank | 6% p.a |

| Lakshmi Vilas Bank | 5% p.a = Daily Balance Upto Rs.5 lakh

6% p.a = Above Rs.5 lakh |

| IndusInd Bank | 4% p.a = Daily balance upto Rs.1 lakh

5% p.a = Daily balance above Rs.1 lakh but less than Rs.10 lakhs 6% p.a = Daily balance above Rs.10 lakhs 4% p.a = Non-resident NRO and NRE accounts |

| Bandhan Bank | 4.25% p.a = Daily balance upto Rs.1 lakh. Interest paid half yearly.

5% p.a = Daily balance above Rs.1 lakh. Interest paid half yearly. |

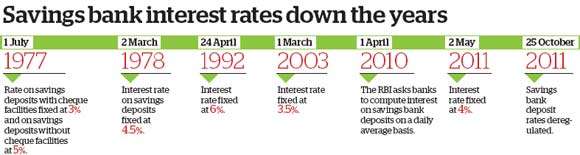

Interest on saving bank account over the years is shown in the picture below . It is now calculated on daily average basis. Our article Saving Bank Account:Do you know how interest is calculated and more discusses it in detail.

Saving rates over the years

Tax on interest on Bank Saving accounts

From FY 2012-13 (AY 2013-14) under the proposed new section 80 TTA of the Income-tax Act, deduction up to an extent of Rs 10,00 in interest from all the bank accounts shall be allowed to an individual or Hindu undivided family, Interest over Rs 10,000 will be taxed at marginal tax rate of an individual. To earn an interest income of Rs 10,000, one will have to invest

- Rs 1.66 lakh at 6%

- Rs 1.42 lakh at 7%

- Rs 2.5 lakh at 4%

This will be applicable from the assessment year 2013-14 and subsequent assessment years.

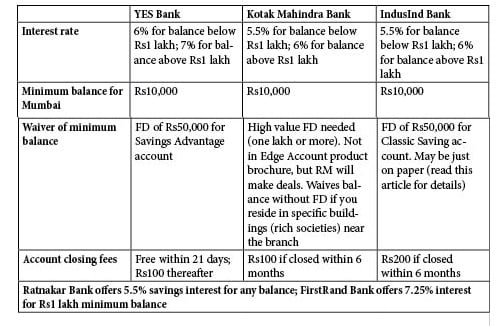

Beyond the Interest Rates on Saving accounts : Charges of the bank

Don’t just get lured by the high interest on saving bank account. MoneyLife’s How to earn 7% in a savings account with no minimum balance shows how bank often offer attractive interest rates for limited period or have requirement of minimum balance or account closing charges. For example Quarterly Average Balance is average of the all the closing day balance in a given quarter. So given a quarter, add up all the closing day balance and then divide it by the number of days in the quarter. In some banks one can wave of minium balance by opening a Fixed Deposit. The comparison is show below

Remember that Higher interest on saving account will transalte to minute gains unless you have a huge sum idling in the bank.

How much do you gain by changing bank

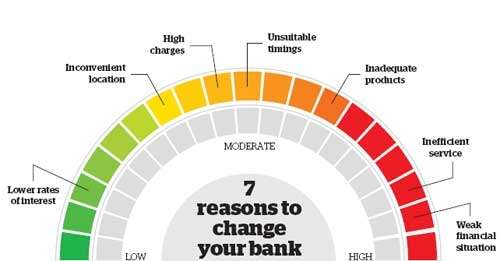

Reason for changing banks should be as follows. For details read out article Saving Bank Account:Do you know how interest is calculated and more

Reasons for changing the bank account

Related articles :

- Saving Bank Account:Do you know how interest is calculated and more

- Finding Info on NFOs of FMP,MFs,FD and Saving Interest Rates

- Understanding Public Provident Fund, PPF

- Filling ITR 1-Form

Which saving bank account do you use and why? Have you changed your saving bank account due to higher interest rate? How much money do keep in your saving bank account?

I’m one person who tries to find the best ways to maximize money. In this day and age of low-interest rates, the interest rates on savings accounts form the traditional brick and mortar banks are minuscule. I admit that the only reason why I started banking with SBI Newyork bank was that of the interest rate. Traditional banks still pay only 0.01% while Discover currently pays 0.06%.

I really love the service State bank of India – New York offers,If you want to Checking Account it is easy to reach them via phone or email and they take good care of the account queries and service. Way to go SBI

Hi there to every body, it’s my first pay a quick visit of this blog; this website consists of awesome and genuinely excellent information in favor of visitors.