Nifty and Sensex are at an ALL TIME high but my Mutual Fund Lump Sum and SIP investments are not doing too well. Why is this so ? What are the reasons that Why Markets have Gone up but Mutual Funds haven’t? What are the challenges of the market today? What should you do of your SIPs?

Table of Contents

Why Markets have Gone up, Challenges

Reasons Why Markets have Gone up but Mutual Funds haven’t

-

- The current rally is being fueled by only a select few stocks. Mutual funds composition is different from Nifty and Sensex. Many of them have also invested in small and mid cap stocks which have seen some correction in the recent past

- New SEBI rules

- Additional Surveillance Measures

- Massive sell off in Midcap stocks

- Mutual funds had to sell Rs 10,000 crore in mid cap and small cap to meet new requirements

Challenges before the Market in 2018-19

- Rising crude oil prices

- Weakening INR against USD

- Rate hikes by RBI

- Widening CAD

- State elections

- General Elections in 2019

- Trade Wars, Turkey

What should you do with your SIPs?

Is the Party for Mutual Funds Over?

Investments in Equity Mutual Funds through either SIP or Lump Sum should be done with a long-term view. The longer your SIP investment period, the probability of negative returns from the equity investments becomes smaller. In our opinion, run your SIPs for at least 5 years. Do not stop or pause your SIPs if the markets undergo a correction. Do not panic, one would only be buying more units at a lower price when the markets are down.

Video on Why Markets have gone up but Mutual Funds have not performed

Our video which talks in detail about the Reasons and Challenges

Understanding Why the market has gone up?

Are Highest Marks in Class Representative of Class Performance? No right.

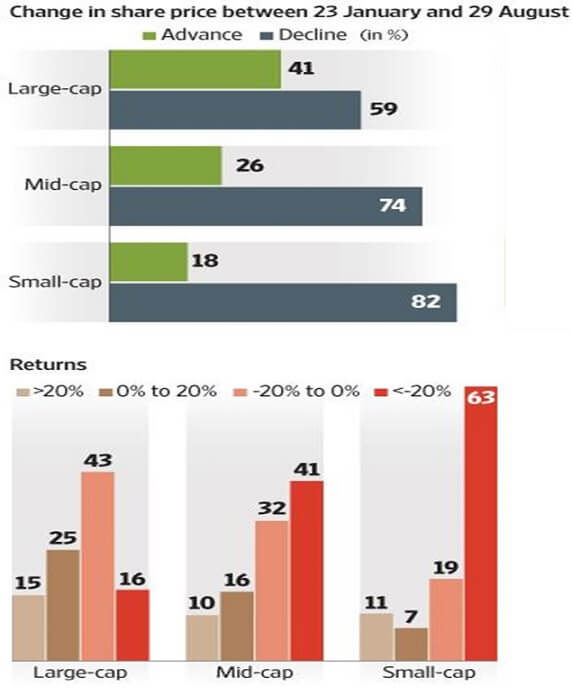

Same has been the case of Nifty and Sensex doing well. Nifty and Sensex indices are made up of just 50 and 30 largest stocks respectively. Mutual funds invest in a wide range of stocks for optimum diversification and potential long-term wealth creation. The composition of these funds is different from Nifty and Sensex. Many of them have also invested in small and mid-cap stocks which have seen some correction in the recent past

Sensex or Nifty going up means that the shares of largest companies in India have gone up. There are more than 3000 public listed companies in India. The current rally is being fueled by only a select few stocks. The market right now is in love with a few stocks, like Reliance, TCS, HDFC Bank, Bajaj Finance, where growth quality is high. In the last few months, only these stocks have done well, not the entire market. Because these stocks have a heavyweight in the index, the market is going up. Only the Top 10 stocks in the Nifty index have contributed 94% of all the gains. This means that the rest of the 40 stocks have either not performed very well or some have actually gone down in the last one year.

While Nifty and Sensex have made all-time highs, the Mid Cap and the Small Cap indices are currently 13% and 18% below their highs which were hit in the January 2018.

How will the market perform going forward? Should one invest in Equity Mutual Funds now?

One response to “In 2018 Markets have gone up but Mutual Funds have not performed”

very informative. Thanks for sharing