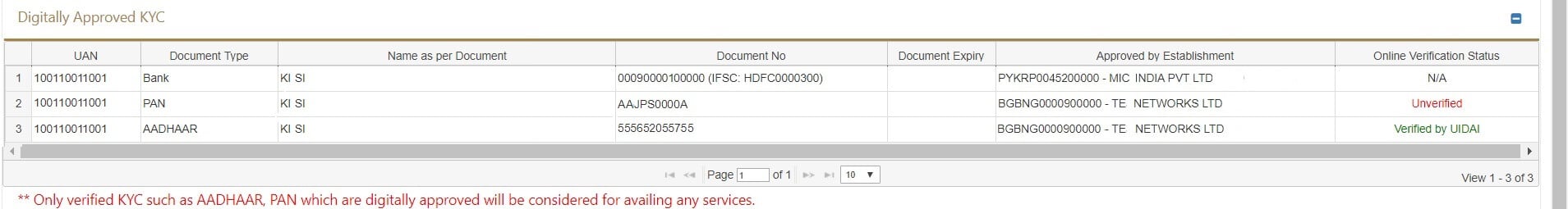

Only Verified KYC such as Aadhaar, PAN which are digitally approved will be considered for availing any services, says UAN EPF website. If you log in to UAN website with your UAN and password and you see PAN Unverified with a Verify button, as shown in the image below. This article talks about why does EPFO need PAN details, how to verify PAN at UAN website and see that the PAN verification status is updated. It also gives an overview of KYC for EPF. It also discusses about how for Mr Sumit Singh PAN Verification failed due to gender in PAN details and UAN mismatch.

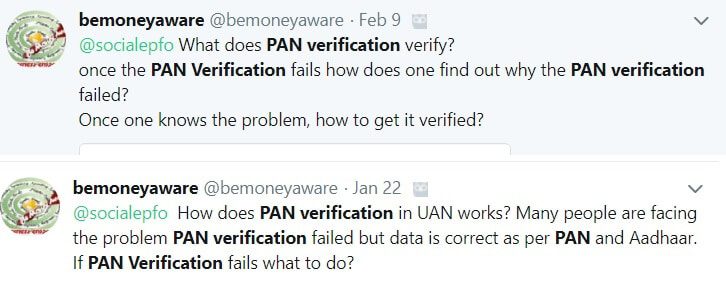

There have been many cases where the PAN Verification has failed. After raising questions multiple times with EPFO through their Twitter channel, finally, we started a Change.org petition. If you could take a moment to sign the petition here we will appreciate it.

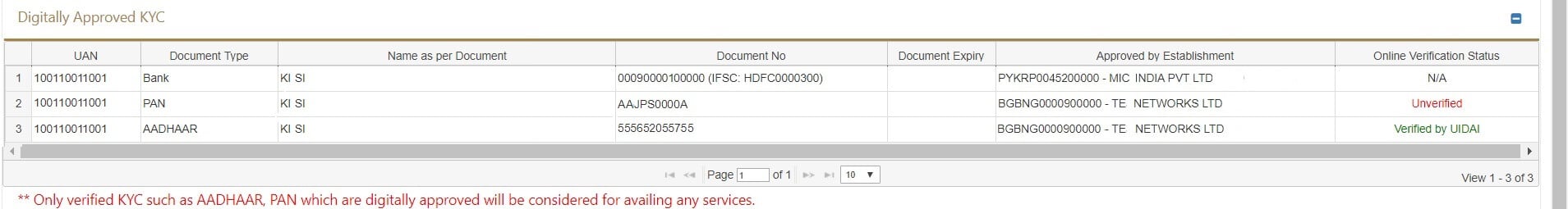

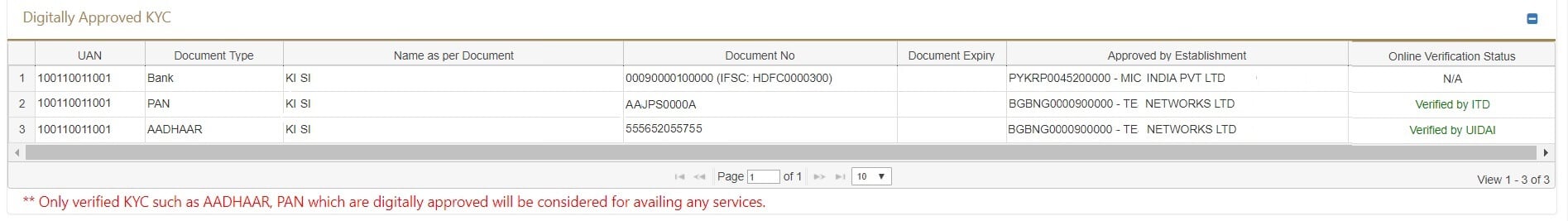

If you check your KYC, by clicking Manage->KYC, and check your Digitally Approved KYC, then in the Online Verification Status column the PAN would appear as Unverified, as shown in the image below.

Table of Contents

Why does EPFO require PAN?

PAN is basically needed by EPFO for deducting tax if you have contributed less than 5 years in EPFO.

- If the employee withdraws the EPF balance before completing 5 yrs of service, then EPF balance is taxable. For calculating the period of 5 yrs of service, it is not necessary that service should be continued with the same employer but it looks for total year of contribution to EPF.

- TDS on EPF will be deducted if withdrawal is more than Rs 50,000. In Jun 2016 the limit was raised Rs 30,000 from Rs 50,000.

- The rate of TDS: TDS will be deducted at 10 % provided PAN is submitted. Otherwise, TDS is deducted at the rate of 34.608 % if PAN is not submitted.

However, there are certain EXCEPTIONS to the deduction of TDS on EPF by EPF organisation.

- TDS is deducted in case of transfer of PF from one account to another PF account

In case where Form 15G or Form 15H are submitted by the employee, then TDS is not deducted. These Forms are to declare that their income would not be taxable after receiving the payment of accumulated PF balance. Form 15H is submitted by senior citizens (above 60yrs of age) and Form 15G is submitted by those who are below the age of 60 yrs.

For calculating the period of 5 yrs of service, it is not necessary that service should be continued with the same employer. He may have worked in different organisations. But whenever a person changes the job, he must get the PF balance in previous company transferred to new company PF Account.

Example: Let’s say If Shyam worked for a period of 4 yrs in XYZ and 2 yrs in ABC And at the time of changing the job, he has transferred the PF balance of XYZ ltd to ABC. Then the total period of service would be 6 yrs. So if he withdraws the accumulated PF balance, then it will not be taxable.

Our article EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR explains it in detail.

How to Verify PAN at UAN website for employee

Note: Please try this on your desktop or Mobile in Desktop Mode preferably in Chrome.

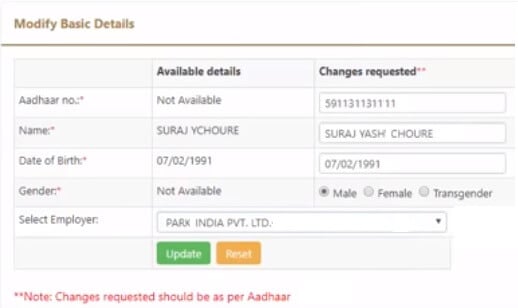

Note: If your Aadhaar is not uploaded and the name is different in UAN and Aadhaar, please use Modify Basic Details to first make the modifications before you try to upload PAN as shown in the image below and explained in the article eKYC Portal of EPF Link UAN with Aadhaar without Employer

PAN already uploaded use Verify

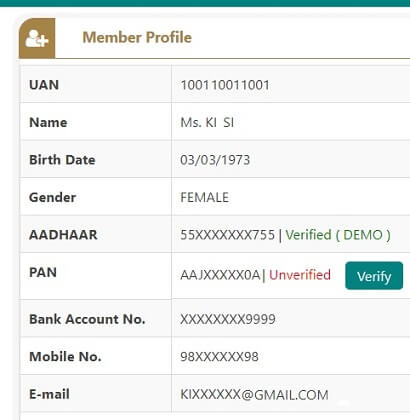

If your employer has added the PAN then on Member Profile you will see the Verify button.

Go to your Main page by clicking Home in the Menu, and you would see the Verify button

click on Verify button in your Member Profile, you would see a message box saying Verifying.

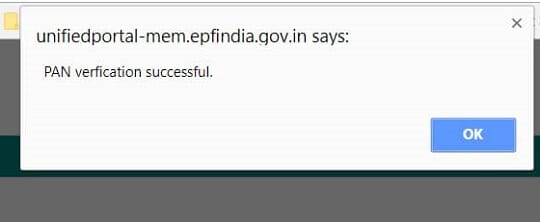

Then a window will pop up saying PAN Verification is successful, as shown in the image below.

If you now check your KYC, by clicking Manage->KYC, then you will notice that Online Verification Status for PAN now shows Verified by ITD(or income tax department), as shown in the image below.

PAN not uploaded, upload PAN document in Manage KYC

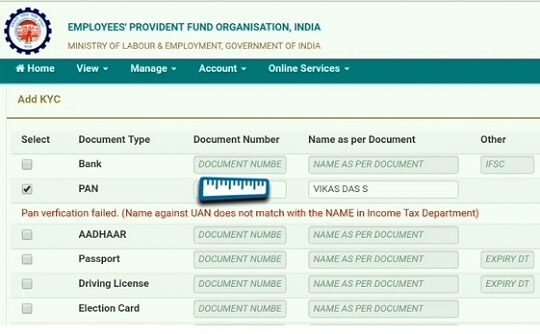

If your employer has not uploaded PAN then when you upload PAN, Verification is done. Then your PAN Verification may Pass or Fail as shown in the image below.

Workarounds after PAN Verification Failure

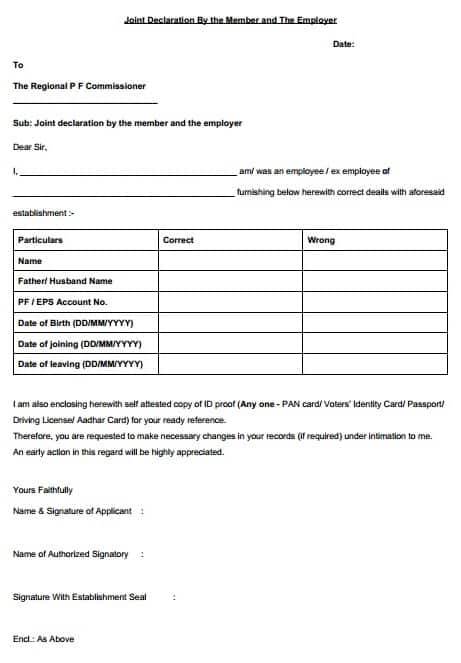

The workarounds after PAN Verification Failure is to match your name, gender details in UAN site with that of Income Tax Department.

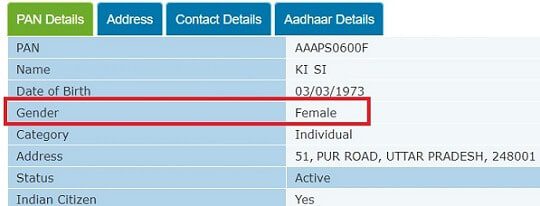

MisMatch of Gender Details in UAN website and PAN

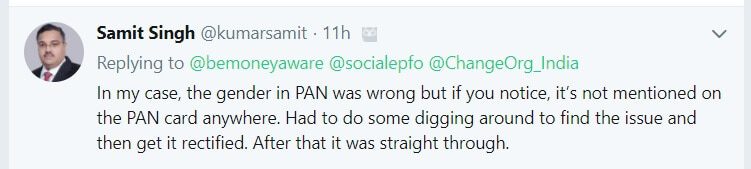

Mr Sumit Singh shared following on Twitter about the reason for the failure of PAN Verification. His Gender details in PAN did not match those in UAN database.

If you also failed to Verify PAN and found the reason and then successfully verified it please do share. It will help other readers?

If you look at PAN Card you will not be able to see the Gender. But if you log in to the income tax website and go to Profile->Pan Details you will the Gender as shown in the image below.

MisMatch of Name Details in UAN website and PAN

- Get the Name, Gender updated in PAN

- The online method for Correcting PAN

- Visit NSDL Online by going to https://www.onlineservices.nsdl.com/paam/endUserRegisterContact.html

- Select ‘PAN correction’ option from the ‘application type’ drop-down, and fill out your personal details.

- Offline method

- To make corrections in the PAN offline, re-issuance or surrender, an individual needs to submit the PAN correction form with the nearest NSDL collection centre and also file a letter with the jurisdictional Assessing Officer.

- Click here to download the form. The fields in this form are similar to the online form.

- The online method for Correcting PAN

- Get the Name, Gender Updated in UAN website.

- If names and gender match and you cannot understand the reason then Submit the request through EPF grievance website. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

KYC and UAN

KYC means to know your customer.If you have your KYC details in your UAN and they are approved by your employer then dependency on the employer goes away. Then To withdraw or take a loan from EPF you can directly approach EPFO. Our article Online EPF Withdrawal: How to do Full or Partial EPF Withdrawal Online explains it in detail.

After logging on to UAN Website(https://unifiedportal-mem.epfindia.gov.in/memberinterface/) you can click Manage->KYC to see or add your details. You can add details like PAN, Aadhar, and Passport for KYC. To add KYC you can upload the document and related information.

Minimum you should have following documents approved for KYC.

- Bank Details

- Aadhaar

- PAN. Mandatory if you do withdrawal before 5 years of EPF contribution as TDS is deducted.

Add the details of the document, Document number, Name as per the document and details like Expiry date for passport, IFSC code for Bank. Click on Save

If document details don’t match then you will get errors.

If there is no error, then these documents appear in Pending KYC section. You have to wait for the employer to approve the KYC details.

After approval by your employer, these documents appear in Digitally Approved KYC as shown in the images above.

Petition at Change.org for Failure of PAN Verification amd others

For Many people who have KYC approved for PAN and Aadhaar are facing the problem of PAN verification failure. After asking EPFO on Twitter multiple times we started a Change.org petition asking following. If you could take a moment to sign the petition here we will appreciate it.

- Is PAN Verification necessary if one has worked for more than 5 years.

- How does PAN verification in UAN works?

- Once the PAN Verification fails how does one find out why the PAN verification failed?

- Once one knows the problem, how to get it verified?

Related Articles:

All About UAN or Universal Account Number of EPF

- How to view EPF UAN Passbook?

- EPF Withdrawal before 5 years,TDS,Form 15G,Tax and ITR

- New UAN Unified Portal for Employees

- FAQ on UAN number and Change of Job

- eKYC Portal of EPF Link UAN with Aadhaar without Employer

Why did EPF introduce an extra step of Verification, we don’t know, we have raised this question on twitter channel of epfo(twitter.com/socialepfo). Did PAN Verification fail or you were successful in verifying it? Please let us know by leaving a comment.

81 responses to “How can an employee Verify PAN in UAN website”

[…] 4. How can an employee Verify PAN in UAN website […]

DocBOYZ Data Masking API covers the Aadhaar Numbers to make Aadhaar cards usable as Officially Valid Documents (OVDs). DocBoyz presents India’s first Phygital Platform for payment collection. Know More: – Masked Aadhar Card

KYC is a business process to verify your customer … money into your Zeta Wallet only with successful KYC verification. Stop fraud and theft in its tracks and reduce the risk to your company and your customers with KYC.

Dear Sir,

My PAN approved by the employer successful but when i am trying to claim my pf online it was showing that “PAN NOT VERIFIED” , there is no Verify button to verify the pan on my UAN member profile, kindly advise me to withdraw my epf amount,

Even I’m facing the same issue

Facing same issue , please let me know if you find any solution

Facing same issue , please let me know if you find any solution

Reply

Same thing happening with me ..

please someone help needful

Hi I am MUKESH

I also have faced same

Problem if you get a

Solution please send

Me full process of it

Mo : 9904064409

Hi on the epfo website in the month of december 2019 I was trying to withdraw my pf and the pan and aadhar was showing verified. However while claiming I got an error that aadhar number not linked to aadhar card. So I recently updated my aadhar number and now on the epfo website only aadhar shows as verified and pan shows an N/a. So I submitted the request to my employer again and it has been 5 days the pan is not approved by the employer. Please advise.

did you find any solution to this? I am facing the same issue.

Try raising the complaint at EPF grievance site explained in the article How to register EPF complaint at EPF Grievance website online

Hi sir

I am facing problem with pan no is not verified by the uan name details and pan name are not matched itseems, but my service is less than 3 years and my pf balance of final settlement is less than 50k ,is it necessary pan to claim the money by without charges…

HI please help me i don’t know how to fix this issue

My name in every document is “Anand Yadav B N” but in PAN database they expanded my initial.

In PAN card i cannot correct name without expanding my name it shows BN is not allowed in the last name.

How to fix it please help me am desperate here.

Were you able to fix this? i have the same problem, please help.

hellow

i am patel asfak.

pl tell me what to do for this type error is coming when i upload my pan card.

my all card name is same to same in all id pouf.

Pan verfication failed. (Name against UAN does not match with the NAME in Income Tax Department)

hi sir,

My all details are matched with all document, but i was unable to upload my PAN in PF account, it shows failed and when I am going to update once again it was shows “Pan verification failed. (Name against UAN does not match with the NAME in Income Tax Department)”

Okah ! fine

Please go through the efilling website first register yourself on that portal and check your PAN details ..

definitely you can find your error

I very much appreciate your effort to respond to comments and clarify issues which, in some cases, are unique and repetitive!

Thank you!

–

My aadhaar-PAN, aadhaar-UAN is linked and bank details updated.

(PAN verification in UAN website has failed due to name issue but approved by employer.)

I am willing to withdraw PF amount which is more than Rs. 50000/- and my work experience is 7-8 years (currently not employed).

1. Can I withdraw PF without any issue due to unverified PAN?

(Note: aadhaar is verified, KYC is “Yes”.)

2. Is tax deducted for withdrawal amount > 50000 and experience > 7-8 years?

3. If TDS is levied (online or offline), can I ask for refund while filing ITR?

Thanks,

Vi

By mistake i provided the pan card name wrong. so it is showing verification failed.How can i update again.

Please file and EPF complaint as explained in the article How to register EPF complaint at EPF Grievance website

Bemoney aware .. I had worked in a company from 2011 to 2017 and changed the company in 2017. After joining the new company, i transferred the previously accumulated balance to the new company in 2018. i left the new company and its been more than 60 days since i left job. Now when i try online withdrawal, i get a message that my service is less than 5 years and PAN not verified. Both my previous and current employer have updated the service history. My question is, if service is more than 5 years and amount is more than 50000, will still Tax be cut unless PAN is verified ? If so, what is the process for PAN verification.

my adhar and pan is verified but when am trying to withdraw on line pf , its shows that my mobile is not associated with adhar but in reality it is connected according to adhar center, please adise

Previous I was ABC company, then joined EFG company, again joined XYZ company. Here all PF no are linked with one UAN no. Currently I can’t verify my PAN no.

As I checked my UAN detail, my previous i.e. first ABC employer not verified my PAN no. In this can I ask ABC to verify my PAN number.

Hi,

My pan card verification has failed in uan portal. After i tried to modify the details, it said that the details does not match the uan details. Actually my there is slight changes in my name in aadhar and pan. And i have given the name to uan as per aadhar card. What is the solution?

Please update your pan card as par aadhar card… Or you can change aadhar name as paer pan card.. Both pan and aadhar.. Details should be same..

My PAN is not verified on UAN Portal. I asked my previous employer to verify it. They said that some of the information is not matched with PAN Database. However, My PAN, Aadhaar and UAN portal details are in sync and has same information like, Name, PAN#, DOB, Gender except adress on PAN card and all other details are same. I believe address on PAN is not that important as It was communication address and I also have my permanent address updated on Income tax website.

I am also filling ITR since 2008 using same PAN. but Still my employer is getting same message as Mismatch information. I am not sure what information is not matching with my PAN database.

Did you check the gender on the UAN portal and on PAN?

Check Check Gender in PAN here

Hey, thank you for reading this, the problem I am facing is that, when I used to work for the company, I did not update the pan over there, however I have my pan card details now, so to update it on the epfo website, it says pending approval, and rightly so, will it be approved, as over there it says pending to be approved by the employer, however in my scenario, during my time with the employer the pan was not declared please suggest, thank you.

You can raise the complaint with EPFO attaching the self-attested scan of PAN Card.

Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

Wait for a week for a reply.

If that doesn’t work then

You can visit the Regional EPFO office with the xerox of PAN card and original and talk to them.

HELLO SIR

I REPEATEDLY TRY to update pan card details im seeing the update stating Pan verfication failed. (Name against UAN does not match with the NAME in Income Tax Department)

but as per all documents my name is same in uan,passport,pf but i still dont know why is it saying unverified or failed when i update

could you help me please

Sir meri company closed ho chuki h mera kyc bhi updated nahi h koi rasta h pf nikalne ka

Regarding: PAN and Adhaar verification failed issue in pf portal. Contact for solution 9916304766

There was name mismatch between my Pan card and UAN account. Hence Pan Verification got failed. But I have requested for name change in PAN account, which is change right now. But pan card status is failed and also verify button not there to verify pan card. I tried to add in KYC but i got message that This functionality will be available, once your UAN is linked to

any establishment. same issue since a month.

It seems you created the UAN yourself using your Aadhaar.

You can raise the grievance and ask to get the button of PAN verification functional.

The KYC needs to be approved by the employer.

And as no contribution is being made into your account from employer hence no one can approve your KYC.

Wait till you join an organization, then give this UAN number to your employer.

Then add KYC details and request your employer to approve it.

Dear Sir,

Recently I have changed my name in PAN, it is now in sync with Aadhar and UAN portal. I am updated my aadhar successfuly in KYC section of EPF portal and it is approved by my ex employer but still facing issues with PAN.

“Pan verfication failed. (Name against UAN does not match with the NAME in Income Tax Department)”

I want to withdraw my PF amount for personal use.

Please advise if I need to do any other steps. to sort this out.

Regards,

Yogananda

Please visit Regional EPFO.

My Uan number KYC update activet

Question is not clear.

If you want KYC updated then you need to contact your employer.

Hi,

I have a problem to Link my PAN details to UAN account. It showing error message as “Pan verfication failed. (Name against UAN does not match with the NAME in Income Tax Department)”.

But Aadhaar verified successfully.

Name in Aahdaar & UAN : Chandrasekaran A

In IT Website PAN Name as : APPICHIGOUNDER CHANDRASEKARAN

If i try to change PAN Details in website “www.onlineservices.nsdl.com”, the SurName showing validation as “Applicant should not have single character initial”. But my all other doc having single char as surname.

How to solve this problem to update PAN details and verify with UAN Account. Please help.

Well, yours is a most common case why PAN verification is failing.

Please stick to name in Aadhaar.

You can try raising EPF complaint. Our article How to register EPF complaint at EPF Grievance website online explains the process in detail.

I have worked 8 years in the company.Iam also facing the same issue.Pan verification failed due to initial expansion in pan card.Adhar and Uan card has name with initial.pan card mismatching.I have to claim online pf amount , but not able to withdraw due to pan unverified.Can anyone suggest how to process for this.thsnk you.

The various alternatives are as follows:

You can raise it on social media platforms of epfo : Facebook (https://www.facebook.com/socialepfo) and Twitter(https://twitter.com/socialepfo)

You can file the grievance. Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

You can visit the EPFO. Our article How to find your employer’s EPFO office and EPFO office Phone Numbers gives details.

The last alternative is to use RTI.

There was name mismatch between my Pan card and UAN account. Hence Pan Verification got failed. But I have requested for name change in PAN account, which is change right now. But pan card status is failed and also verify button not there to verify pan card. I tried to add in KYC but i got message that This functionality will be available, once your UAN is linked to

any establishment.

Did you generate UAN yourself?

If yes then you cannot update your KYC as there is no employer who can verify your details.

Once you join an organization then your employer will ask you for your PAN and bank account number and update it.

Thanks for your blog. It is very useful in many ways.

My member profile is empty. In that case, how can I submit for PAN verification. I do not have any details under the member profile in the unified portal home page.

Member profile is empty when you have generated UAN yourself using Aadhaar.

Member Id or Provident Fund Account number is given by employer when he starts deducting EPF.

So are you working somewhere? Do you have a PF account?

Hi

I filled a complain against employer but it worngly submitted to other RO of how to cancel this complain plz help

Hello,

I left my last company and now joined new company, in my previous company PF was deducted and its showing one passbook but when I joined new company there is two passbook showing now my aadhar, pan and bank was verified but still I am not enable to use transfer request in “online services” now just want to transfer my whole previous employer fund to my current one please let me know the process.

Hello Sir,

My PAN and AADHAR are verified but my epf is not verified. Could you please tell me how to go with it.

Sorry, Anand what does EPF not verified mean?

Only your PAN and Aadhaar should be verified?

March 26, 2018 at 12:11 PM

I am trying to enter my PAN details in unified portal. Receive the following error message “Error while PAN authentication. Could not send Message. ” Kindly advise as I need to withdraw partial PF to tend to an emergency.

Did you try partial withdrawal and it asked for PAN authentication?

You can start offline process, submit Form

Our article EPF New Composite Claim Forms for Full and Partial Withdrawal Aadhar and Non Aadhar based discusses it in detail.

I am trying to enter my PAN details in unified portal. Receive the following error message “Error while PAN authentication. Could not send Message. ” Kindly advise as I need to withdraw partial PF to tend to an emergency. PF for 3.9 years.

Is your name in UAN different from that in PAN.

That is the reason for the failure message.

For online withdrawal sadly PAN, Aadhaar have to be verified.

HI

I want to withdraw PF as currently not working . I have worked for 2 organization(4+4) total 8 years. i have transferred 1st company PF to 2nd company. now i want to withdraw PF.

my question is : 1) will tax applicable on withdrawal PF amount ?

2) Will I get both employee and employer PF contribution ?

3) PAN is UNVERIFIED in UAN. can i proceed for withdrawal or do i need to verify pan mandatory (since 8 years service)?

Sir,iam facing the pan verification failed problem,my name gender din are same in the aadhar,yan and pan, but my father name is krishna kuruva in the pan,krushna k in the yan data base,kuruva krishna in the aadhar,but aadhar is verified,now which document to be corrected,pls suggest

Hi,

I worked in previous company for two years, where my UAN was generated. Now I joined a new company 9 months back using the same UAN no. but in KYC, PAN shows unverified from previous organization, and there is no option showing for clicking in verify button. Requested for KYC approval with present employment, but every time, I try to get it approved from present employer, it is not verified as it shows unverified from previous organisation. Had a talk with previous organisation, they said they cannot help as they have closed my records. Moreover, while checking on Transfer request page, by giving the UAN no. no details is showing under transfer details. It is full blank. How can I get my PAN verified to transfer my old pf balance to new?

Has your UAN been linked to new employer?

Can you send pictures of your UAN profile, KYC etc to bemoneyaware@gmail.com .

Raise an EPF grievance to get the details of your case.

Then you may have to visit the Regional EPFO office with appropriate documents to get it approved.

Our article How to register EPF complaint at EPF Grievance website online explains how to raise EPF grievance in detail

Hi Soumik,

Were you able to resolve your PF issues. I have similar problem and not sure how to proceed.

Let me know if you were able to get your PF.

Thanks

Dear Sir,

Is PAN verification in EPFO is Mandatory, if i withdraw online after 9 years of EPF contribution ?? because PAN verification is Failed due to mismatch in my NAME.

My Aadhaar is verified successfully.

Thanks

Prem

The UAN website says that Aadhaar and PAN should be digitally verified to use online services as shown in the image below.

if you have worked for more than 5 years your PAN should not be required.

Did you try to withdraw, two months after leaving the job, what did the UAN site say?

Can you email it to bemoneyaware@gmail.com

PAN is approved by Employer and verified by ITD also. But PAN is not available in Member profile. Please suggest.

That is strange.

Check your KYC.

There was name mismatch between my Pan card and UAN account. Hence Pan Verification got failed. But I have requested for name change in UAN account, which is change right now. But also pan card status is failed and also verify button not there to verify pan card.

PAN verification failed it shows, but all my data are correct as per pan and aadhar

PAN verification failed it shows, but all my data are correct as per pan and aadhar

Does name in PAN matches name in UAN account?

Can you send the screenshot of the name in UAN and PAN to our email id bemoneyaware@gmail.com

You can raise EPF grievance by uploading appropriate documents.

Our article How to register EPF complaint at EPF Grievance website online explains it in detail.

Does name in PAN matches name in UAN account?

Can you send the screenshot of the name in UAN and PAN to our email id bemoneyaware@gmail.com

You can raise EPF grievance by uploading appropriate documents.

Our article How to register EPF complaint at EPF Grievance website online explains the proces in detail

Hello I have UAN account and I had been working in IT company for past 4 year. Recently I have changed my company and when I checked my UAN status there my PAN and ADAAR has been not verified and I tried verifying in online by the verify options but it shown error like not verified and I am unable to identify the issue..!either it’s a document issue or anything else. Dose someone knows any help line number online help.

Check your KYC is approved by clicking Manage->KYC and checking digital approved KYC.

You should see something similar to what is shown in the image below.

Please send the picture to our email id bemoneyaware@gmail.com

When I am uploading my pan it shows temprory error failed to upload

Please try again and see if the problem occurs again.

Please let us know if you were able to upload your PAN.

I have update my pan card details in UAN NO. IT NOT UPDATED.& REMARKS ARE SHOW.

Pan verfication failed. (Name against UAN does not match with the NAME in Income Tax Department).

MY PAN NO WAS RIGHT . APPPV2014M Name-vikas

Dear Sir,Ma’am,

There was name mismatch between my Pan card and UAN account. Hence Pan Verification got failed.

Now I have requested for name change in UAN account, which is pending right now.

My Question is:- Once my name got updated in UAN account, can i revefiry my Pan card?

Thanks,

Seema

There was name mismatch between my Pan card and UAN account. Hence Pan Verification got failed.

Now I have requested for name change in UAN account, which is pending right now.

My Question is:- Once my name got updated in UAN account, can i revefiry my Pan card?

Thanks,

Seema

Yes you can then reverify your PAN card then

I have the same situation, now i corrected my name in PAN and wants to re-verify how i can do it

My PAN verification shows ambiguous status . On home page I see that PAN verification says failed and on KYC page it shows unverified.

Kindly suggest what should be the way out of this deadlock.

Does your name on PAN and UAN match?

Have you filed your ITR returns using that PAN?

Can you send snapshot/picture of it to our email id bemoneyaware@gmail.com?

You can raise the EPF grievance as explained in our article How to register EPF complaint at EPF Grievance website online

HI SIR I AM TRYING TO UPDATE MY PAN CARD NO IN KYC PORTAL BUT IT SHOWS ERROR AND MY AADHAR CARD IS UPDATED SUCCESSFULLY.ANY SUGGESTION PLS.