Credit card in an individual’s life is just as oxygen is to a human body, impossible to live without! With minimal eligibility and easy availability credit cards have been booming in the Indian financial market. EMI facility, innumerable incentives and offers that the credit card brings has made it more likeable and popular. Other than offering effortless access to credit, credit cards also allow ATM withdrawals just like debit cards. This article will cover how the credit period of credit cards work, if you should withdraw money using credit card from ATM, fees charged for credit card ATM withdrawals and what are the alternatives available instead of using credit card for ATM withdrawals.

Table of Contents

Overview on how to withdraw money using credit card from ATM

Withdrawing cash from a credit card is as simple as using your debit card at an ATM. The difference is the price you pay.

- Money can be withdrawn from ATM using a credit card just like a Debit Card by PIN as authorization. It is technically called Cash Advance.

- The maximum amount that can be withdrawn from an ATM using a credit card is generally preset by the bank and is usually capped at up to 30%-40% of the card limit.

- On withdrawing cash from ATM you have to pay a transaction fee ranging between Rs. 250 to Rs. 350 + service tax.

- An interest of 2.5-3.5% per month which is compounded monthly i.e. approximately 41.75% p.a on the amount withdrawn is levied other than the transaction fee . This is calculated as follows (outstanding amount X Interest% per month X 12 months X no of days)/365.

- And no, unlike purchases where you are given an interest period ranging between 45 days to one month depending on when you make the purchase, the interest rate meter starts ticking the moment you make the withdrawal.

- According to the data submitted by Reserve Bank of India 43 lakh credit cards were used at ATMS in the year 2014-15 for transactions worth Rs. 2347 crore. Even though debit cards are far more outreached than the latter, Rs.5500 on an average is used by each credit card to withdraw money. Ref Report-using-credit-card-at-atm-think-again,

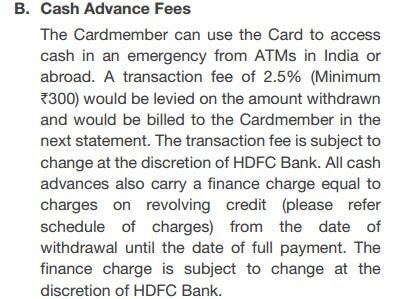

The image from HDFC Bank Credit card gives an overview of the conditions.

How do credit cards work?

A typical credit card transaction is where a person buys any asset/goods and instead of paying cash for the transaction, swipes his respective bank’s credit card. Every credit card is a billing date where a statement is generated that is comprehensive of all the transactions done for the previous month. The bill so generated needs to be honored in the stipulated time period and non-compliance to which attracts interest on the outstanding amount.

Let us assume that Mr. Shah has taken a credit card from ICICI bank and the billing date of his credit card is 1st of every month. Generally the due date for honoring the bill is 22 days after the billing date and so in this case, it is 23rd of every month.

Now for example, Mr. Shah has bought a washing machine from Croma for Rs. 20000 on 30th of May 2017, the billing date of his credit card is 1st of June. Therefore he has to pay Rs. 20000 to the bank before the 23rd of June, 2017 failing for which will attract interest.

If a person misses the mark to pay the outstanding amount to the bank, an interest at the rate of 2.95% per month is levied. So if Mr. Shah fails to pay Rs. 20000 to the bank on 23rd of June, 2017, he will have to pay Rs. 590 extra per month until the day he clears his dues. So Rs. 20590 needs to be paid if he repays the bank in July, Rs. 21080 if he repays the bank in August and so on.

Our article Paying Credit Card Bill, Understanding statement,Paying Just Minimum discusses how you can pay the credit card bill, what happens if you don’t pay the bill and de-codes the general glossary revolving around credit card payment.

How to withdraw money using credit card from ATM

Can money be withdrawn using a credit card? Yes, it can be. The process of withdrawing money from an ATM using a credit card is simple and is to be executed just like how you withdraw money from a debit card:

- Go to the ATM and insert your credit card in the machine.

- Enter your credit card PIN to authorize the transaction.

- Collect money.

As compared to the normal billing cycle of 28/55 days, the terms and conditions applicable on withdrawal of money from ATM using credit card is tad different. In case of transactions done using credit cards, if you are late in clearing your dues interest is applicable from the month of missed deadline but in case of ATM withdrawals the burden begins as soon as your withdraw the money. Should you withdraw money using credit card? Let’s figure out.

Interest and fees when you withdraw money using credit card from ATM

An interest of 2.5-3.5% per month which is compounded monthly i.e. approximately 41.75% p.a on the amount withdrawn is levied along with a transaction fee of Rs. 250-350.

For example, Mr. Shah withdrew Rs. 10000 from an ATM on 29th June 2017 and the bill generation date of this credit card is 1st of every month. Mr. Shah will have to immediately pay a transaction fee of Rs. 250-350 depending upon the bank and ATM where he has used the card plus service charge @ 15%.

Possibility 1:

Let us assume that MR. Shah will be charged interest at 2.95% per month on withdrawal of Rs.10000. Mr. Shah pays this amount back before July 23rd 2017 thus attracting a total interest of Rs. 295 and making an inclusive payment of 10000+250+295+ 38= 10583 to the bank for one ATM withdrawal, where in:

| Description | Amount |

| ATM Withdrawal of 10000 June 2017 | 10000 |

| Transaction fees | 250 |

| Interest Payment at 2.95% | 295 |

| Service tax @ 15% | 38 |

| Total payment | 10583 |

Possibility 2:

Let us assume MR. Shah pays the money back to the bank on the same day of withdrawal i.e. 29th June, 2017, only cash handling fees ranging from Rs.250-700 will be applied. No interest will be charged.

Possibility 3:

Let us assume MR. Shah fails to make the payment before the end of the first billing cycle i.e. 23rd of July, 2017 then 2.95% basic interest+ the compound interest penalty will be applied in the subsequent bills until the payment is made.

How much money can be withdrawn using credit card from ATM

The maximum amount that can be withdrawn from an ATM using a credit card is generally preset by the bank and is usually capped at up to 30%-40% of the card limit.

Alternatives to withdrawing money using credit card from ATM

- Debit card: Why not keep a debit card handy where emergency liquidity needs can be easily met with hardly Rs.400 annual fees and no per transaction cost?

- Personal loan: If you are in a financial crunch and need urgent money to meet your needs, it is always better to opt for a personal loan. Though the process might be slightly lengthier and might require some documentation, it would help you to save a lot of money on interest. Personal loan interest rate ranges between 12-30% depending upon your credit score, profile and repayment ability as compared to 35-50% of credit cards. Our article Comparison-personal-loans-credit-cards will help you make a better decision while choosing between credit cards and personal loans.

Related Articles:

List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- Life of Debt – Responsibly

- Credit Card Fees and Charges

- Credit Card Debt

- Go Cashless:Digital Wallets, NEFT,IMPS,UPI, Debit Cards,Credit Cards

- Comparison of Personal Loans and Credit cards

- How to get Free CIBIL Credit Report and CIBIL Credit Score

Still making the mistake of withdrawing money using your credit cards? Give a second thought and refrain this habit until the need is inevitable and see how your credit card statement manages to get under the hood!

2 responses to “Withdraw money using credit card from ATM: How to, Charges”

cash advance very useful to me!Per month one transaction , earn 10-15% and pay 5% to them.Life is sweet use cash wisely!

I am very much scar to use a credit card, but after reading this article, I am planning to use a credit card as you given how to use a credit card wisely.