In 2016, Mr. Suresh Prabhu-led Indian Railways unveiled a travel insurance scheme allowing passengers to get an insurance coverage up to Rs 10 lakhs in case of mishaps. The following benefits are available under the scheme:

| Scenarios | Compensation |

| Death or disability of a passenger | Rs 10 lakhs |

| Partial disability | Rs 7.5 lakhs |

| Hospitalisation expenses | Up to Rs 2 lakhs |

| Transportation of mortal remains | Rs 10,000 |

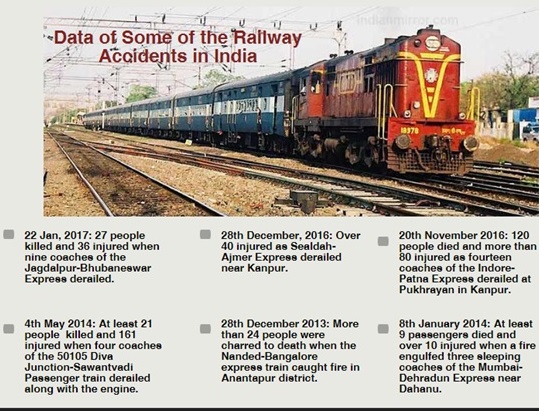

Offered as an option during Diwali last year, the government is planning to make this insurance coverage mandatory for all railway passengers. However, given the rising incidences of accidents is it wise to rely upon this insurance amount only? Let me rephrase this question, do you think this amount is sufficient to secure you and your loved ones in case you meet with an accident?

The insurance scheme is available only on confirmed and RAC tickets, but what if you are travelling on a general ticket and meet with an accident? You and your family will not be entitled to get any benefit. So, can you rely only on the insurance coverage offered by Indian Railways?

The answer is No. In addition to the emotional loss, an accident can also result in a financial loss. The situation deteriorates further if the breadwinner is involved in an accident. Besides medical expenses, there could be other expenses also, including household expenses, loan EMIs, etc., which also need to be taken care of. For that, it is imperative to make a proper funds arrangement.

What is the solution?

As the Railway Ministry is preparing drafts of the Railway Budget, 2017, the government should make an extra provision to declare it mandatory for people to buy personal accident insurance. It will ensure the complete coverage if the policyholder dies of serious injuries following an accident. As the coverage is decided as per the age and income of the policyholder, it will be sufficient enough to secure the family financially.

How can a personal accident policy help you?

We feel secure when we travel in a car which is loaded with all safety features, when we adhere to traffic rules on roads and when we are aware of all fire safety instructions learned during fire drills. However, none of the measures can make us full-proof and guarantee our security from an accident—which can happen even while climbing stairs, playing football with friends or while walking on the roads. While one might encounter an accident while doing daily household chores, road accidents are an acute concern.

A personal accident insurance policy would come in handy here. Besides paying out in the case of accidental death, the insurer would also make a payment in the case of partial or total disability. Here are some of the coverages offered by the policy:

- Accidental death benefit

- Permanent total disability

- Reimbursement of accidental hospitalisation expenses

- Accidental hospital daily allowance

- Additional features: Some insurers offer the following extra benefits if a policyholder agrees to pay additional premiums:

- Legal and education benefits

- Child education benefits

- Injuries due to terrorism

A mediclaim policy would cover hospitalisation expenses only as it would not secure your family from the loss of income that may happen if the breadwinner is involved in an accident. Similarly, a term insurance plan makes a payout only when a policyholder dies. But if the accident leaves a person incapacitated, no benefits will be paid.

How much coverage is sufficient?

Any disability or accident can have a major financial and physical impact on the wellbeing of a person and his/her family. Therefore, you should buy that much of personal accident insurance cover which is sufficient to:

- Ensure the complete wellbeing of your family

- Meet life’s goals

- Cover medical expenses

How much it costs to have a personal accident insurance policy?

Unlike health and life insurance policies, the premium of a personal accident insurance policy doesn’t depend on the age of the policyholder but on the job profile of the person. It means a 25-year old may pay high premiums as compared to a 50-year old if the latter has a riskier job. Further, a medical checkup is not a pre-requisite to purchase a personal accident cover.

Key points to remember

- Carefully look out for policy exclusions. Some policies may not cover partial disability, leaving you with no financial net to fall back

- Your employer might have already provided the coverage under personal accident cover. However, you should go for an individual policy which will not only offer you high coverage but will also be available even if you leave the job

- Accidents or injuries due to self-inflicted injuries, under the influence of drugs/alcohol and suicide attempts are not covered under the policy

Conclusion

Soon this financial year will come to an end on a heavy note with the ban on high-value currency notes leading to chaos and cash deficit throughout the nation. While people are still fathoming out the effect of demonetisation, it is the budget 2017 that is most awaited. It is the first time when both the Railway Budget and Union Budget will be placed together.

While we are eagerly waiting for the government to come up with numerous sops, we wish the government makes personal accident insurance mandatory in this year’s budget. But even if it is not made mandatory, it is the time to take some necessary steps to secure our life.

Accidents come unannounced and ‘derail’ your otherwise smooth journey. So, buy a comprehensive personal accident cover now to keep yours, and loved one’s life on track always.