State Bank of India is the leading and most trusted public sector bank in India. SBI provides a range of financial product and services including all kinds of loans, SME banking, and savings accounts through its wide network of branches in India and overseas. It is always good to have a nationalized bank account (useful while filing Government related application forms). This article talks about how to open Saving Bank account with SBI The State Bank of India. It gives an overview of process to open Saving Bank account with SBI, links to Videos to see the process of filling online application form, How to download online Application Form after submitting, What is TCRN and TARN that are generated while filling the online application form to open saving bank account with SBI State Bank of India.

Table of Contents

Overview of How to Open Saving Bank account with SBI The State Bank of India

To utilize any service with SBI you would first require an account with them. You can go to SBI branch with required documents and fill the form. Most of SBI branches now insist that you fill online application form, take print out of the form and then visit the branch.

- Go to: https://oaa.onlinesbi.com/oao/onlineaccapp.htm

- Fill the application form.

- Joint Accounts can be also opened online for maximum three persons.

- Download the Filled in Application Form.

- A TCRN (Temporary Customer Reference Number) will be generated, please note down. TCRN will also be sent to the registered mobile number of the applicant(s).

- Print the Application Form.

- Attach the required documents, such as photographs and proof of identity and address, as mentioned in the Account Opening Form.

- You must approach a branch within 30 days of submitting the information online. If the account is not opened within 30 days, the customer information is deleted.

- Visit the branch with documents- 2 recent photographs, Original and copies Address and identity proof like AADHAR Card, Passport, Driving License etc.

- The Account will be opened instantly unlike manual opening as the data is already available in the system.

- You can watch detailed videos from SBI on How to fill Online Application Form for opening SBI New Saving Bank account

Advantage of Saving Account with SBI, State Bank of India

SBI offers a range of savings bank accounts ranging from premium accounts to basic ones, accounts for children and also for youth etc. Saving Bank account with SBI can be opened by any individual above 18 years old. Despite being a Public Sector bank, SBI’s customer service is one of its USPs. The wide network of branches across the country makes it quite easy to transact with SBI. Some other important benefits of having an SBI savings bank account are given below. We personally feel that one should have an account with nationalized bank such as SBI for often while applying for Govt related educational institutions or jobs they required Demand Draft from Nationalised Banks only. Opening of PPF account, Sukanya Samriddhi account or NPS is also easy.

- Internet, Mobile and Branch Banking

- Multicity cheques

- Facility to link savings account to a multi-option deposit account (MOD account)

- Inter-bank account transfer without having to change the account number

- No minimum balance required unless specified. Minimum Balance required for Savings Plus Account is Rs 5000 and Premium Savings Account is Rs 25000.

- SBI savings account interest rate is 4% p.a. Interest is calculated on a daily balance.

Types of Saving account with SBI, State Bank of India

SBI offers a range of savings bank accounts ranging from premium accounts to basic ones, accounts for children and also for youth etc. The various kinds of accounts offered by SBI are given below. You can find information about different type of Saving Bank Accounts at https://www.sbi.co.in/portal/web/personal-banking/deposit-schemes. We recommend that you open a Regular Saving Account in SBI.

- Yuva Savings Account With SBI

- This type of savings account is specially designed for youths between the age of 18 and 30 years. The account will continue even after the account holder has attained the age of 30 years.

- The account debit card has concessionary and complimentary facilities which are given free of cost, such as, One draft/banker’s cheque per calendar month will be issued free of cost favouring educational institutions or job applications.

- Basic Savings Account With SBI

- This account is to enable the common man to access basic banking facilities.

- A basic savings account cannot be opened if the person already has a savings account. If the person holds a savings account, it needs to be closed within 30 days of opening this basic account.

- A basic ATM/Debit card is issued free of cost subject to a maximum of 4 withdrawals per month, after which the regular service charge is applicable.

- Small Account With SBI:

- A small account is provided to people who cannot meet the KYC (Know your customer) requirements.

- The account will be operational only for 12 months. If the account holder can provide proof of application for any official valid document, then the account can be extended by another 12 months.

- All credits in the financial year should not exceed Rs. 1 Lakh Withdrawals and transfers in a month should not exceed Rs 10,000.

- Savings Account for Minors With SBI:

- Minors below the age of 10 years can avail of the PehlaKadam scheme which requires the parents/guardian to jointly open and operate the account.

- This type of account aims at exposing minors to banking and the current features like mobile and Internet banking so that they are acquainted with modern-day banking and also understand the importance of savings and personal finance

- Savings Plus Account With SBI

- This type of account is linked to Multi Option Deposit (MOD) where surplus funds crossing the upper limit of the savings bank account is automatically transferred to Term Deposits.

- This scheme will retain a minimum of Rs. 25,000 in the savings account.

- The term deposits will be opened in multiples of Rs. 1000 with a minimum of Rs. 10,000 at one instance.

- The account holder can choose the tenure of the deposit of 1 to 5 years.

How to Open Saving account with SBI, the State Bank of India in Detail

Go to the official online Account opening page https://oaa.onlinesbi.com/oao/onlineaccapp.htm. You will see screen given below. Read the information such as Benefits, Information that you need to provide, Click on Apply Now. For opening an account, you need to provide the following information:

- KYC (Know Your Customer) information

- Information about the Savings Bank account you wish to open and the facilities you would want in the account.

- Form 60, if you do not have Permanent Account Number (PAN) of Income Tax.

- Form DA-1 (optional), if you wish to make a nomination (recommended).

Please Read the Savings Bank Rules carefully before signing the account opening form. By applying to the Bank for opening the account, you would be confirming that you have read the rules and that you agree to abide by these. A print of the same can also be taken by you after generation of TARN.

Note: Fields marked asterisk (*) are mandatory.

Step 1: Fill the Customer Information Section

- This section will have to be filled for each person wishing to open the account.

- You must fill Part A first. Subsequent parts can be filled only after you have successfully filled Part A.

- Once you fill Part A and save the form, a Temporary Customer Reference Number (TCRN) will be generated. You will need it later to edit the form, if you desire, and to link the customer in the Account Opening Form. Please note it. It will also be sent to your mobile number provided in the form.

Step 2: Fill the Account Information Section

- Part A: Type of Account and Services Required.

- Part B: Nomination Form (optional but recommended).

- You must fill Part A first. Subsequent parts in this step can be filled only after you have successfully filled Part A

- Once you fill Part A and save the form, a Temporary Account Reference Number (TARN) will be generated which may please be noted. You will need it later to edit or print the form.

- After successful filling up of data in the account opening form, an SMS notification will be sent to 1st applicant’s mobile number along with the TARN.

What is KYC

KYC is an acronym for Know your Customer or Know your client. It refers to due diligence activities that financial institutions and other regulated companies (LPG,telephone) must perform to ascertain relevant information from their clients for the purpose of doing business with them. For example, a bank must verify a customer’s identity and, if necessary, monitor transactions for suspicious activity. There are two aspects of Customer Identification. One is establishing identity and the other is establishing the present residential address. KYC needs two kinds of documentation, given below. Our article Know Your Customer or KYC discusses KYC in detail.

- Identity Proof to tell them you are you and not anyone else. It requires any authentic document carrying photo of the customer such as PAN card, passport, driving license, ration card (as per institution expectation)

- Address proof, so that emails and bills etc can be sent to the right home, such as PAN card, passport, driving license, bills of utilities like telephone, LPG, electricity etc., bank statement, ration card. if you are a student then Letter issued by the institution.Though Proof of Identity documents carry the residential address of the customer, it may not be the present address. Therefore, in order to establish the present address of the customer, in addition to Proof of Identity, the institution asks for address proof.

How to find branch number of SBI for opening Saving Bank Account

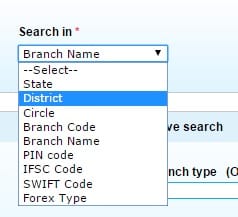

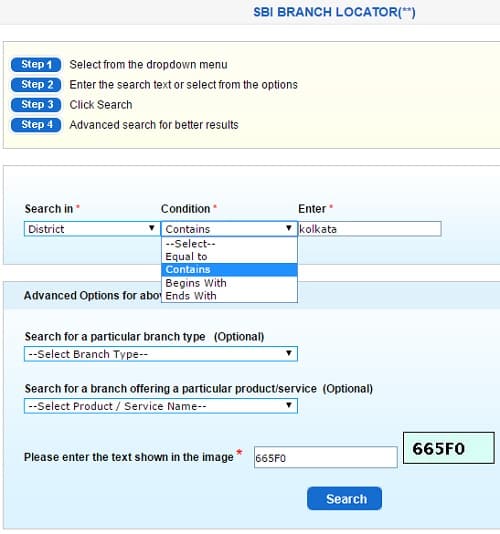

You need to give branch number while filling the online Application Form for open Saving Bank Account. Though the website provides a button to Find branch number, we found it handy to have the branch number before filling the form. Go to

- Go to https://www.sbi.co.in/corporate/branchlocator.htm, search on district or pin code

- Select the Search In which is either district, Pin Code etc as shown in the image below.

- Select Condition which can be Contains, is Equal to, Begins With, and Ends with

- Enter the text given in image, also called as captcha

- Click on Search

- How to find SBI Branch using SBI Branch Locator

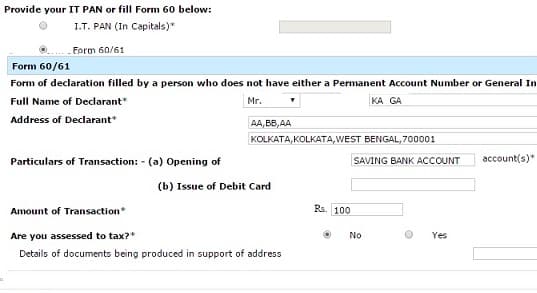

Filling Form 60 if you do not have PAN

PAN has become an essential proof of identity. Form 60 is submitted by an individual when she or he enters into a particular transaction that requires PAN. The Income Tax Act mentions specifically the transactions where PAN is mandatory. We recommend you get PAN card for it is an important document. Our article What is PAN Card ? explains Importance of PAN card and how to apply. When you fill up the Form 60 for a financial transaction, please fill in following details.

- Full address and name of the declarant.

- Particulars related to the transaction for which you are the filling the Form 60. In case you are opening a savings account with any bank, then specifically mention that it is for opening a savings account and state the name of the bank.

- Transaction amount must be stated too. If it is not applicable then you must write N.A.

- In case you are assessed to IT (Income Tax) mention the details of the Range, Circle or Ward where you had filed the last IT.

- You must state your reason for not having a PAN card. If you have applied for it and are yet to receive it, then mention it on the form.

What is TCRN, TARN while filling online Application Form for opening Saving Bank account with SBI

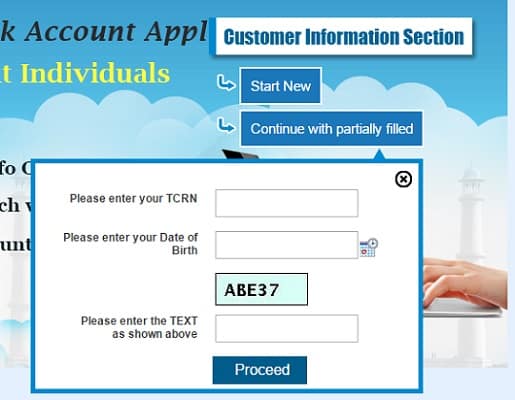

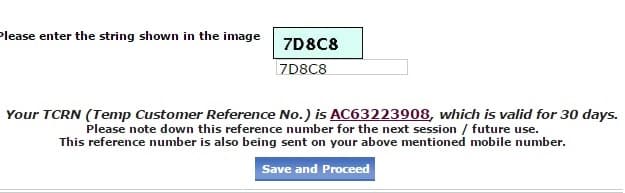

TCRN stands for Temporary Customer Reference Number. It is generated when you fill Personal Details in Customer Information section as shown in the image below. It is also sent as SMS to the mobile number you entered while filling application

TARN stands for Temporary Account Reference Number. Once you fill Part A of account Information and save the form, a Temporary Account Reference Number (TARN) will be generated which you note. It is also sent as SMS to the mobile number you entered while filling the application. You will need TARN later to edit or print the form.

If you do not enter the information in Form for some time your session expires. Then to continue filling the Customer Information in Application form click on Continue with partially filled under Customer Information Section. To continue filling Account Information Section in Application form click on Continue with partially filled under Account Information Section

On clicking Continue with partially filled under Customer Information Section you will see the screen shown in the image below.

Continue with partially filled using TCRN for filling online application for opening account with SBI

How to Download Application Form of Saving Bank account with State Bank of India

To Download the Application Form after filling and submitting online of Saving Bank Account with State Bank of India go to Go to the official online Account opening page https://oaa.onlinesbi.com/oao/onlineaccapp.htm. Click on Download Completed Application Form. Another dialog box comes on the screen which asks for First Applicant TARN and Sole/First Applicant Date of Birth as shown in the image below. You would have got TARN after submitting the application online. It would also be sent as SMS to your mobile number. After entering details Click on Download, pdf file gets downloaded. Take the printout of the application before going to the branch.

Video on How to Fill Customer Information in State Bank of India Online Application Form

Video of How to Fill Account Information in State Bank of India Online Application Form

Related Articles:

- Payment Banks,Types of Banks in India, History of Banking in India

- What is PAN Card ?

- Different ways of Banking:Internet,Mobile

- Interest on Saving Bank Account : Tax, 80TTA

- What do we want from Bank : Is Social Banking the way to go?

- What is Auto Sweep Bank Account?

- JAM Trinity: Jan Dhan Yojana, Aadhaar and Mobile number

hlo sir I am a sainik of para commandoo in Indian army sir mai SBI Bank account open karna chata hou sir mujhey bataye cheque book kay kay kitnay rupee’s per month kat latay hoo

25 cheque leaves per 6 months:No charge

Additional chequebook of 25 leaves will be charged @ Rs 75 per chequebook

Bank account this profit

Bank account saving gareti

New account khola hai

Congrats.

Ab aap kya karna chahte hain?

https://youtu.be/-MDL0tTIspo SBI application form 2017

Yes i have SBI saving account

NAME RAJIB GOON

BANK NAME STATE BANK OF INDIA. A/C NO 35254153141

CIF NO 88715408606

IFSC CODE SBIN0006701

BRANCH KALYANI INDUSTRIAL GROWTH CEN

BRANCH CODE 6701

PHONE NUMBER 8697317998. THANK