Mutual funds are considered as one of the best available investments. Investors purchase funds because they do not have the time or the expertise to manage their own portfolio. Mutual Funds are managed by well qualified professionals. By pooling money together in a mutual fund, investors can purchase stocks or bonds with much lower costs than if they tried to do it on their own. While mutual funds are popular and attractive investments because they provide exposure to a number of stocks in a single investment vehicle, too much of a good thing can be a bad idea. Having a portfolio with more mutual funds does not mean better returns, as many mutual funds often invest in the same stocks or sectors. In this article we shall look at what one should take care of when investing in multiple mutual funds.

Diversification

Diversification is spreading out your money across available or different types of investments. By choosing to diversify respective investment holdings reduces risk tremendously up to certain extent. The simplest example of diversification is provided by the proverb “Don’t put all your eggs in one basket“. Dropping the basket will break all the eggs. Placing each egg in a different basket is more diversified. There is more risk of losing one egg, but less risk of losing all of them.

In finance, an example of an undiversified portfolio is to hold only one stock. This is risky; it is not unusual for a single stock to go down 50% in one year. It is much less common for a portfolio of 20 stocks to go down that much, even if they are selected at random. If the stocks are selected from a variety of industries, company sizes and types (such as some growth stocks and some value stocks) it is still less likely. A Nifty based index fund, for example Goldman Sachs Nifty BeES owns stock in 50 companies. That’s a lot of diversification for one investment!

Diversification is of two types :

- Between asset categories :allocate your investments among different kinds of investments such stocks, bonds, fixed income, cash, real estate etc. This is popularly called as Asset Allocation. These asset categories don’t move up or down in the same directions.

- Within asset categories: such as buying different kind of stocks or Mutual Funds

The goal of diversification is to reduce the risk and volatility in a portfolio. Volatility is limited by the fact that not all asset classes or industries or individual companies move up and down in value at the same time or at the same rate. Diversification reduces both the upside and downside potential and allows for more consistent performance under a wide range of economic conditions.

Diversification is not something new. It is mentioned in the Bible, in the book of Ecclesiastes which was written in approximately 935 B.C. Quoting from Chapter 11 Uncertainties of Life:

But divide your investments among many places,

for you do not know what risks might lie ahead.

Diversification is also mentioned in the Talmud, rabbinic discussions pertaining to Jewish law, ethics, philosophy, customs and history. The formula given there is to :

split one’s assets into thirds: one third in business (buying and selling things), one third kept liquid (e.g. gold coins), and one third in land (real estate).

The most basic level of diversification in equity is to buy multiple stocks rather than just one stock. Mutual funds are set up to buy many stocks. Beyond that, you can diversify even more by purchasing different kinds of equity based mutual funds, then adding bonds, then international, and so on. As mutual funds automatically diversify in a predetermined category of investments (ex growth companies, emerging or mid size companies, corporate bonds, etc). So if you purchase a few mutual funds you are done.

Diworsification

As mentioned earlier one of the easiest ways to diversify is through ownership of mutual funds rather than stocks. Continued investment in multiple schemes with similar objectives, investment style and market-cap segments may lead to having the same underlying stocks, sectors or assets in a portfolio and lead to risk addition. The more funds you own, the more likely you are to own at least a couple that do practically the same thing. When an investor over-diversifies his investment portfolio by investing in too many funds it can cause Diworsification. Peter Lynch, legendary stock-picker, former manager of US based Fidelity Magellan Fund, coined diworsification to describe a company that expanded into businesses beyond its core competencies. He also coined the phrase ten bagger in a financial context. This refers to an investment which is worth ten times its original purchase price and comes from baseball where “bags” or “bases” that a runner reaches are the measure of the success of a play. Let’s see how is the overlap between the similar funds?

Overlap among Mutual Funds

The more funds you own, the more likely you are to own at least a couple that do practically the same thing. Question asked on ValueresearchOnline highlights the point:

Will UTI Equity or UTI Opportunities be a good supplementary fund to my 49 per cent exposure to HDFC Equity and HDFC Top 200 from my portfolio?

UTI Equity and UTI Opportunities happen to be managed by the same fund manager. UTI Equity seems to be a better bet if you’re looking for a more consistent and diverse offering. UTI Opportunities has the mandate to take more focused bets. Both funds have done reasonably well in the past 3-4 years, but UTI Equity will be the better fund to supplement your current holdings.You should also be aware that there is a great degree of commonality between HDFC Top 200 and HDFC Equity, which might not be meaningful to your overall portfolio. You would do well by investing in only one of the two.

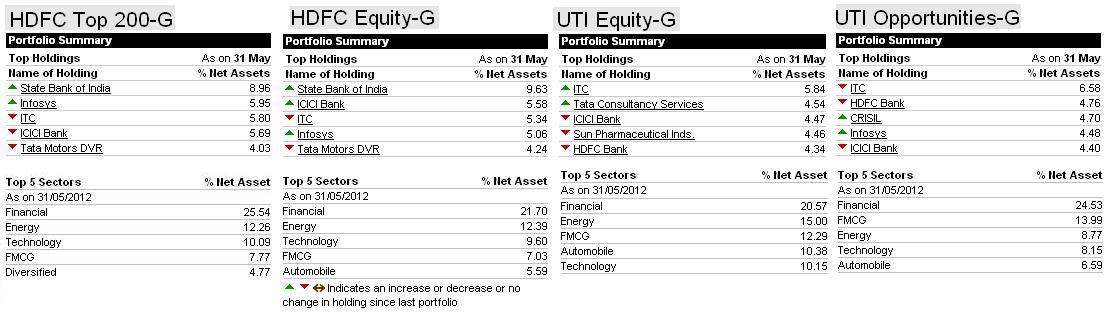

Portfolio of schemes based of top 5 stocks and sectors as on 31st May 2012 is given below. Data is collected from ValueResearchOnline.com details on the schemes UTI Equity , UTI Opportunities ,HDFC Top 200 and HDFC Equity (as on 31 May 2012)

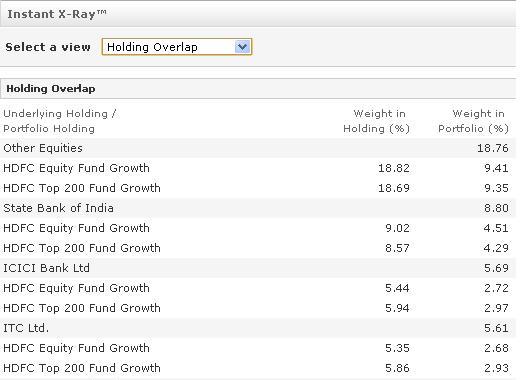

MorningStar:Instant X-Ray helps you to see the overlap between the mutual funds. The Holding overlap between HDFC Equity Growth and HDFC Top 200 is shown in image below( data as on 30 Apr 2012 hence different from the earlier figure.) Weight in Holding means % of Mutual fund held in the specific holding , while Weight in Portfolio means % of Mutual fund held in your portfolio. As the sample portfolio had only two funds hence Weight in Portfolio is half of Weight of holding.

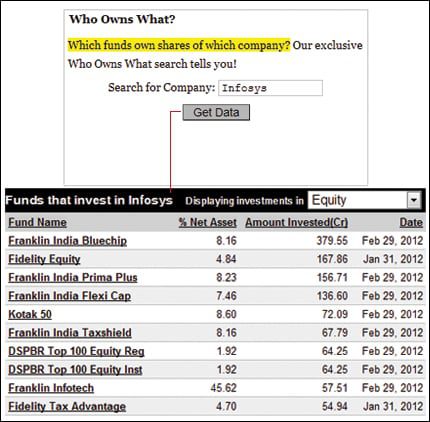

Available on the homepage of ValueResearchOnline.com, Who Owns What (WOW) tells you exactly how much of a stock is owned by which funds.

[poll id=”14″]

[poll id=”15″]

Buying many mutual fund schemes of the same kind leads to duplication. It also wastes times as they have to track and manage those funds. But how many mutual funds would be ideal or would balance risk and volatility without over-diversifying? We shall talk about it in our next article How many mutual funds to own.

3 responses to “Many Mutual Funds: Diversification or Diworsification”

Thank for sharing this post.

[…] “Wide diversification is only required when investors do not understand what they are doing. Our Many Mutual Funds: Diversification or Diworsification and Number of Mutual Funds talks about in detail. John C. Bogle in his book, Common Sense on […]

[…] our earlier post, Many Mutual Funds: Diversification or Diworsification ,we had talked about one of the easiest ways to diversify is through ownership of mutual funds […]