Mutual fund investments must be linked to Aadhaar by 31 Dec 2017 as per a recent amendment in the Prevention of Money Laundering Act (PMLA) Rules, 2017. This article talks about Why should one Link Aadhaar to Mutual Funds Investments? Who are R&T Agents ? how to Link Aadhaar to Mutual Funds Investments online using eKYC?

Why Link Aadhaar to Mutual Funds Investments

As per the Prevention of Money Laundering Act (PMLA) Rules, 2017, the financial institutions have been asked to do following, ” Where the client is an individual, who is eligible to be enrolled for an Aadhaar number, he shall submit to the reporting entity- (a) Aadhaar number and (b) PAN or Form No. 60. “

Over the last few months, Aadhaar has become one of the most important documents to have and though it is being argued that the mandatory provisions were for welfare schemes, it has been extended to more services. Supreme Court will hear pleas on Aadhaar matter in November 2017.

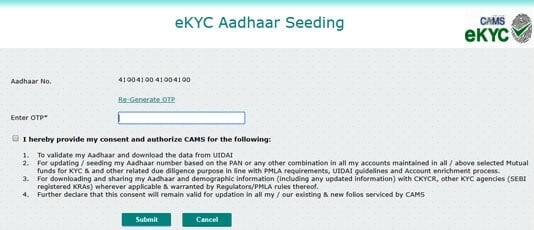

By linking MF investments with Aadhaar, one is authorising the agent for seeding one’s Aadhaar number based on PAN or any other combination in all the accounts maintained with asset management companies for KYC (know-your-customer) and other related due diligence purposes in line with PMLA requirements and UIDAI guidelines.

Further, one also authorises the agent for downloading and sharing the Aadhaar and demographic information (including any updated information) with CKYCR (Central KYC Registry), other KYC agencies (SEBI-registered KRAs or KYC registration agents) wherever applicable and warranted by regulators or the PMLA.

This consent is valid for updating existing and new folios serviced.

Who are R&T Agents

You have to link Aadhaar with all your mutual fund investments. Registrar and transfer (R&T) agent maintain records of every mutual fund transaction on behalf of the fund house.

Our article Mutual Funds: Registrar and Transfer Agent CAMS, Karvy talks about the R&T agents and work done by them. The major Registrar and Transfer Agents in the Indian Mutual Fund space are as follows.

- Computer Age Management Services (CAMS) Ltd Registrar for HDFC, ICICI, SBI, Birla,

DSP BlackRock and several other Mutual Funds - Karvy Computershare Ltd is Registrar and Transfer Agent for fund houses such as Reliance, UTI, Principal, LIC, TATA and several other Mutual Funds

- Franklin Templeton International Services (India) Pvt. Ltd is the in-house R&T for Franklin Templeton Mutual Funds

- Sundaram BNP Paribas Fund Services: Registrar for Sundaram and BNP Paribas Mutual Funds

(R&T) agent, CAMS (Computer Age Management Services), has launched an online facility to link mutual fund investments to Aadhaar. Other R&T agents such as Karvy and Sundaram BNP Paribas Fund Services are yet to begin this service.

How to Link Aadhaar to Mutual Fund Investments on CAMS

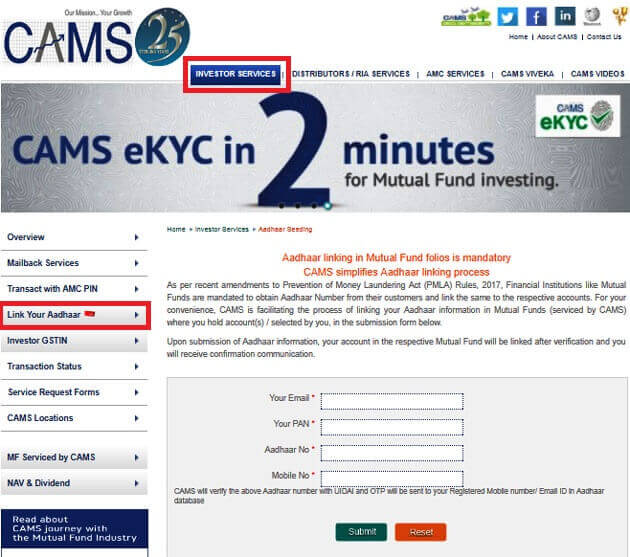

On the CAMS website, click on Investor Services on the top menu and then click on Link your Aadhaar on the left side.

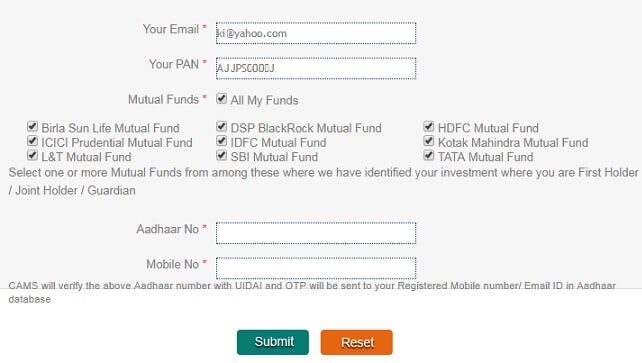

Fill in your registered email id and PAN, the page auto-populates with the names of fund houses (as below) where you would be holding the mutual fund units.

Click on all the fund houses, fill in your Aadhaar and registered mobile number and click on Submit.

You would get an OTP (one-time password). Enter OTP and click Submit.

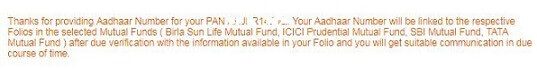

You will get an acknowledgment like the one shown below.

- Mutual Funds: Registrar and Transfer Agent : CAMS, Karvy

- Get started with Mutual Fund investing: KYC, Platform

- What is Aadhaar, How to enrol,Check Aadhaar status,Download e Aadhaar

- Aadhaar eKYC,eSign: Paperless for PAN, eNPS, Mutual Funds,Insurance

- How to Update or Correct Details in Aadhaar

- Income Tax: How to Link Aadhaar with PAN for filing ITR

Are you going to link Aadhaar with your Mutual Funds? Do you think Aadhaar should be made compulsory?

One response to “How to link Aadhaar to Mutual Funds Investments”

[…] How to link Aadhaar to Mutual Funds Investments (bemoneyaware) […]