Savings and investing are both important, but they’re not the same thing. It is wise to save your money, but it isn’t always the most financially astute decision. If you need the money in a fairly short time, saving is probably more important, but for longer-term goals like retirement, savings shouldn’t be the only financial strategy. This is when you really need to concentrate on investing, especially investing in the stock market, preferably through mutual funds.

In India, Total household assets were $8.5 trillion (around Rs 595 trillion), about three times India’s FY18 GDP. Of this, only $391 billion (Rs 27 trillion) were parked in equities. Percentage wise it is only 4.6%. Note that it is the highest since FY08. It had dropped to 2.2 per cent in 2014 and has been gradually improving since then. It is similar in other countries, even the developed countries like the US where a recent Gallup poll found that fewer young Americans today are putting their money in stocks.

Table of Contents

Why should one Invest?

A Liveable Income

Savings pays little interest, with no way to live off the income stream, but investments can provide a liveable income, some in the 4 to 6 per cent range, enough to live off when you have a large enough portfolio balance. Property investments, may grow and pay out income from the net yield after operating expenses.

Keeping Up with Inflation

Unless your income is incredibly high, your savings will have to grow substantially for you to save more than what you’ll need to retire. Interest from savings loses money to inflation. That’s why it’s important to save by investing so that you’ll be able to afford to retire when the time comes. Investing is the best defence against losing your purchasing power. The inflation rate is around 5-7 percent – if you have a return below that you will lose purchasing power over time.

Start Early for Compounding Returns

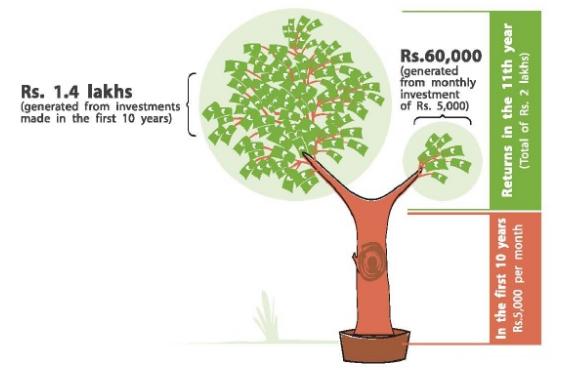

If you begin investing now rather than saving while time is on your side, you’ll end up with much more than those who begin investing later in life. You’ll be putting yourself ahead in the world of personal finance, with your investments growing over time so that you’ll be able to afford things others your same age simply cannot. At various times in your life, personal finances are likely to get tight with inevitable bumps in the road that arise, but investing at a younger age can help make it easier to get through those lean times.

Compounding returns are incredibly powerful over the long haul, and the earlier you get started the better your chances for taking advantage of this. In more simple terms, this is the power of the time value of money. Regular investments in an investment portfolio or a retirement account may lead to significant compounding benefits.

Early investing is very much like growing a tree…if you can take good care of it at the start, it will take care of itself later. Growing your wealth is similar to growing the new tree. Given lots of tender care, your small baby steps will become your Mighty Money Tree. Your investments in first 5 yrs out of a 30 yrs period makes the 50% final corpus and rest another 25 yrs makes another 50% corpus. That means the initial 16% tenure makes 50% corpus and later 84% tenure builds rest 50% corpus.

Diversify to Reduce Risk

If you own property, you’ll have to make other investments to achieve a balance. When you become too overloaded in cash or property, it can cause problems if everything declines in value at the same time or earns little to nothing. Diversifying will help to smooth variable returns as investments in one particular class may perform well, balancing out a decline in another asset class.

Difference between Savings and Investments

The following table shows the Difference between Savings and Investments

| BASIS FOR COMPARISON | SAVINGS | INVESTMENT |

|---|---|---|

| Meaning | Savings represents that part of the person’s income which has not been spent.

Savings = Income – Expenses |

Investment refers to the process of making money grow. It typically comes of savings. |

| Purpose | Savings should be for short term or urgent requirements. | Investment is for creating wealth |

| Risk | Low or negligible | One can take returns higher than savings for growth |

| Returns | Less or No return | High as one wants money to grow. Returns depend on where one invests. |

| Liquidity | Highly liquid | Less liquid |

Video on the Difference between Savings and Investment

Here is a video that will help you understand how different are Savings and Investment and why should one Invest.

Infographic on Difference between Savings and Investment

This infographic, from tomorrowMakers, tell difference between Savings and Investment

Money Tips : How much to Save or Invest

How much should one save? There isn’t one magic number for everyone. Everyone’s situation is different. Everyone’s comfort level is different. Figure out what that number is for you. If you have a partner, sit down with them and discuss numbers. Try to save as much as you can while still living your life and enjoying the moment. Try to first save and then spend.

My personal view is that you should save a minimum of 10%, but you should be targeting 25%+ as your income increases.

Few important money tips that might be helpful are :

- Check your income.

- Decide your priorities.

- Set a monthly budget and set aside a fixed amount each month

- Self Control -Avoid impulsive buying.

- Invest wisely and keep a track of your returns on investment.

How much do you save? Where do you invest?

One response to “Investing Vs Saving : Why You Should Invest Rather than Save”

Investment is Better than Saving because.

Take risk and high profit…