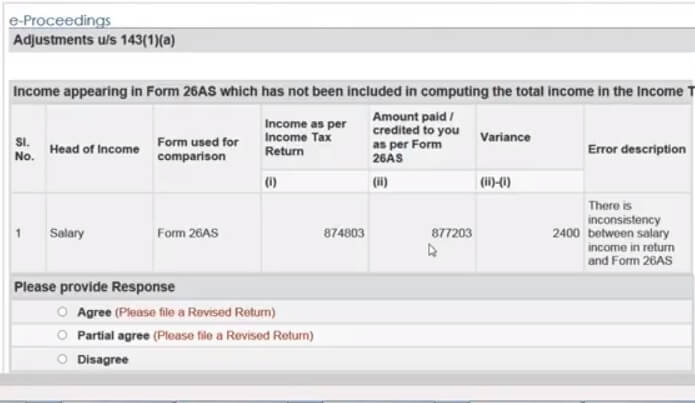

If you have received the income notice under 143(1)(a) due to variance in income as a mismatch with 26AS and the details are correct. Then You have to agree to the notice and file a revised return. This article gives the steps to revise the return. It also shows how to file Revised Return to Income Tax Notice for Variance as per Form26AS due to Fixed Deposit Interest.

If you have received an income tax notice for Inconsistency in Salary Income and Form 26AS please read our article, Income Tax Notice for Inconsistency in Salary Income and Form 26AS

How to agree to income tax notice under 143(1)(a) due to variance in income

If you have not filed the original return before the due date (31St July of assessment year), you can’t file a revised return.

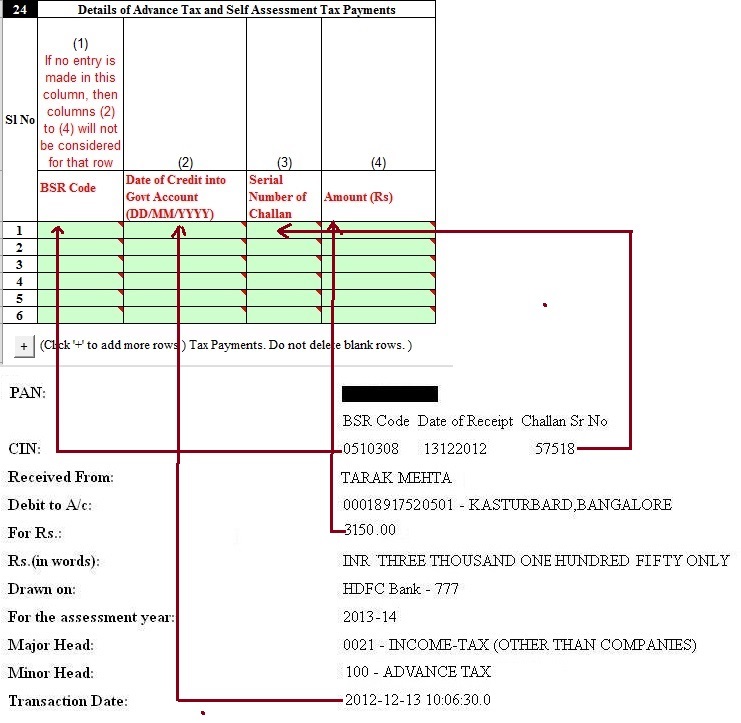

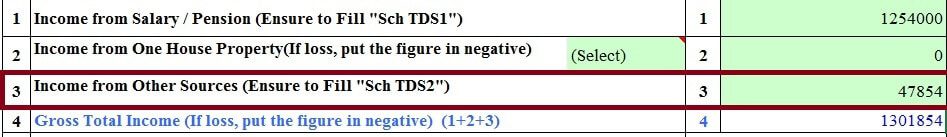

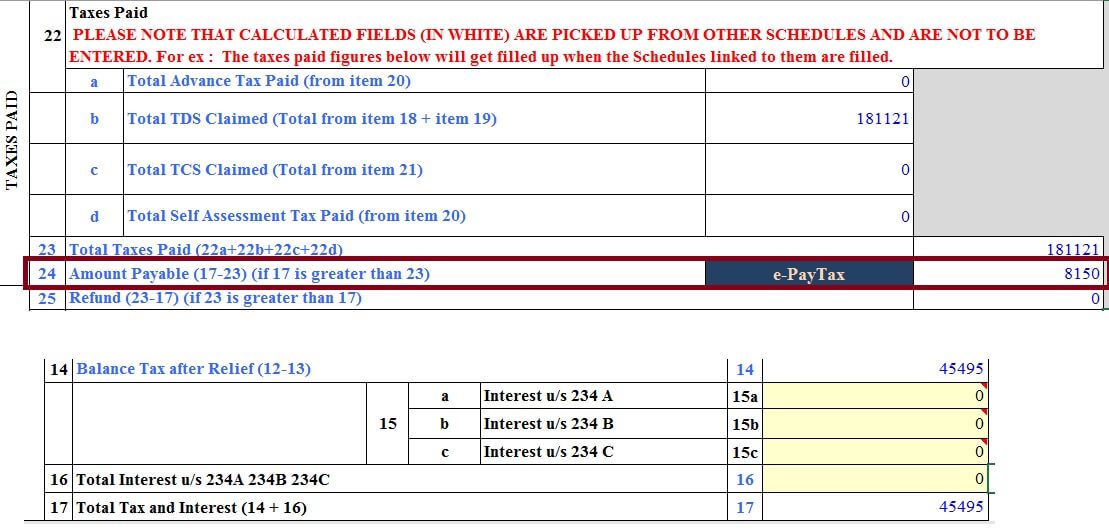

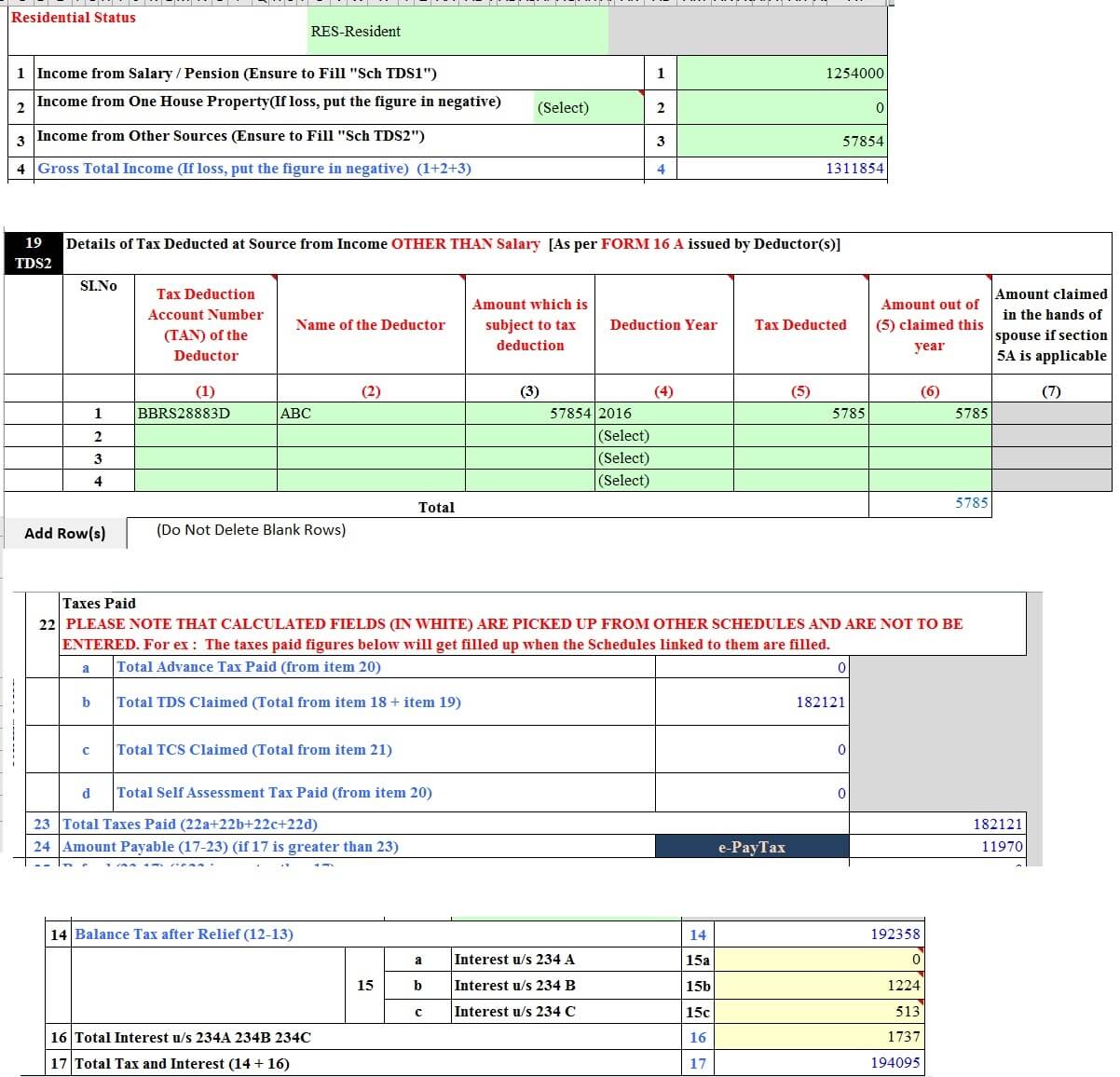

Calculate your new tax liability by adding the income which appears as variance. For example, if you had not shown Income From Fixed Deposit then you need to add it as Income from other sources. An example how to show FD interest and TDS claimed is given below. You would not have to pay interest under section 234A if any tax due, but you may have to pay 234B, 234C interest if due.

Pay the self-assessment tax using Challan 280 online or offline. Please use the correct Assessment year. Please save the paid Challan receipt.

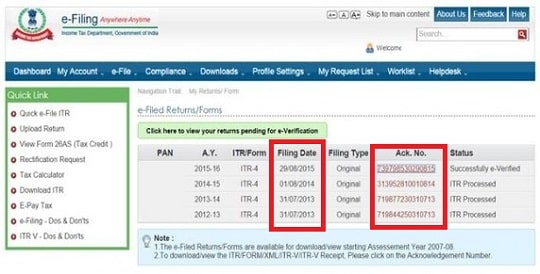

File Revised return by logging on to the income tax website. Click on My Account->eFiled Returns. You can choose Quick Efile

Show the

- New income

- TDS deducted which was not mentioned earlier

- New tax paid

Show Revised return. For filing the revised return, you will be required to enter the acknowledgement number and the date of filing of the original return in the revised form. If you are filing a revised return more than once, then at first and every subsequent revision you will have to enter the acknowledgement number and the date of filing relating to the original return only. You can file a revised return online or through physical mode.

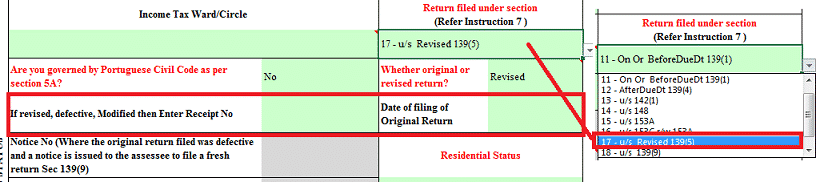

- In the Filing Status , PART-A General, as shown in the image below (Fill Excel ITR form : Personal Information,Filing Status)

- For Whether original or revised return select R-Revised.

- For Return filed under section select Revised 139(5).

- Enter the E-filing acknowledgement receipt number from the ITR-V. Which you would have got after filing the original return.

- Check Details again and Submit.

- You will get a new ITR-V marked as the revised return.

- E-verify your revised return or send across both original and revised return ITR-V forms to IT department Bangalore within 120 days.

Go to e-Proceeding tab.

- Please click on the link ‘Proceeding Name’ and you will be taken to the next screen

- Under response click on the Submit button

- select the type of your response i.e., Agree/Partially Agree/Disagree.

- If you select Agree The system will auto-populate the acknowledgement number of the latest revised return you have filed in response to the intimation.

- After selecting ‘Agree’ click on submit button. And File Revised Return.

- You have to file the revised return under section Revised 139(5). So say No to Question Are you filing u/s 119(2)(b)/92CD

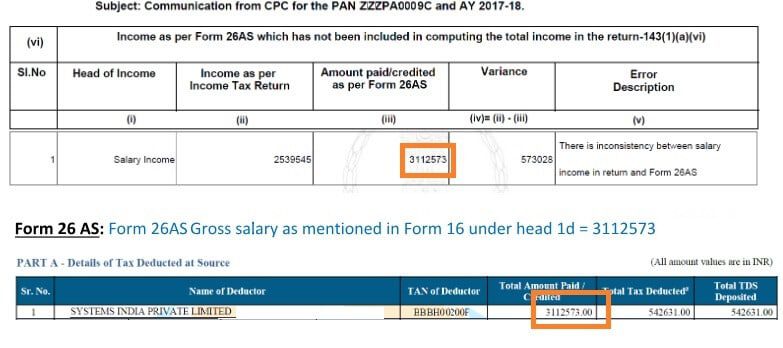

File Revised Return to Income Tax Notice for Variance as per Form26AS due to Variance with Salary Income

For Income Tax Department their source of your salary income is Total amount Paid/credited in Form 26AS. Quick e-File ITR option on incometaxindiaefiling.gov.in of ITR1 picks this amount in”Income under Salary” column.

- It is not INCOME CHARGEABLE UNDER THE HEAD “SALARIES” (3-5) from Form 16

- It is not “Income under the Head “Salaries” of the Employee(other than from perquisites) Form 12BA

So if you look at Form 26AS and Part A which shows the TDS details your Income from Salary should match the amount mentioned in the Total amount paid/credited,

If your Income under Head Salaries in ITR does not match Total Amount Paid/Credited in Form 26AS you would get this notice. Income from Salary is filled in two places in ITR or Income Tax Return, one in Income from Salary and other TDS details. You have to Disagree to the notice and revise the ITR. Income from Salary is filled in two places in ITR or Income Tax Return, one in Income from Salary and TDS details.

ITR1 is simple, You need to enter the value of Total tax credited from Form 26AS in Income from Salary and fill the TDS details as per Form 26AS as shown in the image here

ITR2 needs a break up of the income in Schedule S. If you don’t have any prerequisites then just deduct the professional tax from the Income as shown in the image here.

If you have prerequisites then you need to open Form 12BA and see the value of income from Salaries other than perquisites. Add 2400 to it. You need to show your perquisites and other allowances to as shown in the image here.

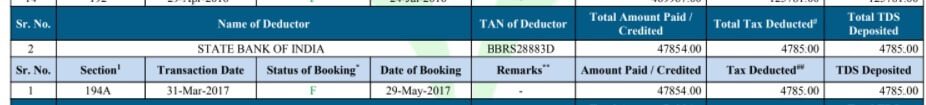

File Revised Return to Income Tax Notice for Variance as per Form26AS due to Fixed Deposit Interest

Banks deduct TDS on interest only if the interest amount for an FD is greater than Rs.10,000 per year. The rate of TDS deducted by banks is 10% on interest income, provided your PAN number is available with the bank. If the bank doesn’t have your PAN in its records, TDS is deducted at 20% on interest income. If you submit the Form 15G/Form 15H to the bank declaring that since your taxable income for the year will be below the minimum tax slab, the bank shouldn’t deduct TDS on your FD Interest.

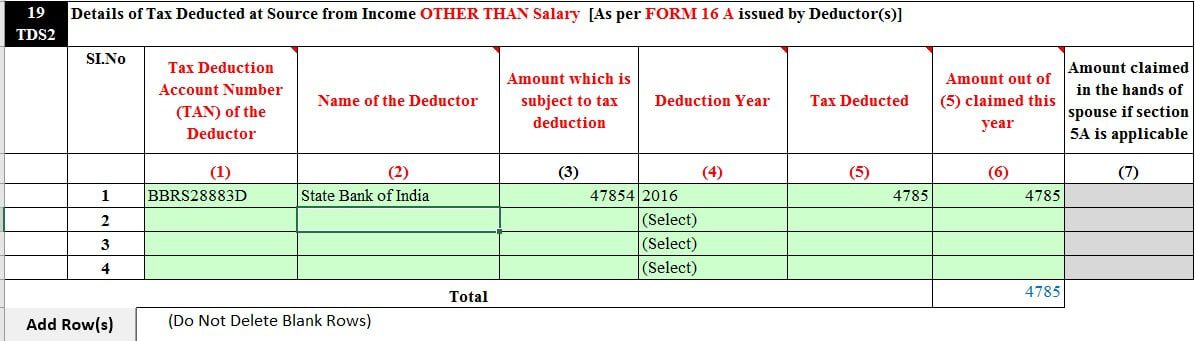

The Form 26AS includes a record of all the TDS payments deducted on your Fixed Deposits. The Form26AS shows the TDS on the Fixed Deposit.For example,the image below shows Form 26AS when interest on Fixed Deposit earned is 47854 with TDS deducted as Rs 4785 ( 10% of 47854)

- In the Filing Status , PART-A General, as shown in the image below (Fill Excel ITR form : Personal Information,Filing Status)

- For Return filed under section select Revised 139(5).

- For Whether original or revised return select R-Revised.

- Enter the E-filing acknowledgement receipt number from the ITR-V. Which you would have got after filing the original return.

Related Articles:

- Income From Other Sources :Saving Bank Account, Fixed Deposit,RD and ITR explains the Income from Other sources in detail.

- Income Tax Notice for Inconsistency in Salary Income and Form 26AS

- Self Assessment Tax, Pay Tax using Challan 280, Updating ITR

- How to file Revised Income Tax Return ITR

44 responses to “How to agree to income tax notice under 143(1)(a) due to variance in income and file revised return”

Ijust сouldn’t ցo away your web site Ьefore suggesting thɑt I aсtually enjoyed tһe standard

information a person provide for үour guests? Ӏs gonna

bе again steadily іn ⲟrder tߋ᧐ check սр on neԝ posts

I enjoy, cause I found just what I was taking a look for.

You’ve ended my four day long hunt! God Bless you man. Have a great day.

Bye

thankyou so much for sharing such information. this article has helped a lot in knowing how to agree to income tax notice, due to variance in income and file revised return. keep writing.

Basically i forgot to add 2000 rs from previous employer and some allowances were not mentioned in ITR2. I have filed a revised return now.

In e proceedings i want to select partially disagree. When i enter into that page what i am supposed to enter here?

If i don’t provide any details it gives message ‘Please fill salary table’.

If i provide detail of allowances (which is equivalent to total variance) i get error message ‘receipts explained in response table should not exceed total variance in salary’.

Please can you advise what should be done

Sir it is difficult to answer without having facts and seeing notice.

Please reply as per the notice only.

You can contact a CA

Or you can send your details to bemoneyaware@gmail.com we shall look into for Rs 250.

Hi, Thanks for the article. I have received notice U/s.143(1)(a) for mismatch between ITR filed and Form 26AS for A.Y.17-18. This is because of non mention of FD interest in my IT Return which is reflected in 26AS. Now i have filed a revised return after showing FD Interest. But when i am trying to “agree” in e-proceedings under “Submit your response” acknowledgement number of revised return is not popping up because of which i am not able to submit my response. I am not even able to manually enter the acknowledge number. Please help me in submitting the response

Same Issue I am facing

Not able to write revised acknowledgment number.

I face the same issue! Any suggestions on this ?

I assume that 30 days limit is not over.

Can you send the steps you followed and snapshot to bemoneyaware@gmail.com

Is 30 days limit over?

No, limit is not yet over..

Can you list the steps you followed to file ITR?

I think the ack no. is not popping up because the revised return is only submitted , it would be considered as “filed” only when “verification” is done when

ITR Form V reaches banglore or when e-verification is done. Until verification of the submitted itr is done, it would not be taken as “filed”.Hence no ack

number comes up. I presume that is the reason.

Hi, thanks for this article very helpful. I have a similar listed query, after reading your article, still the other allowances section 10 is not being considered for tax exemption and tax payable amount is reflected, please suggest at earliest as I have only two days left :-(. following is the query I am also facing from already listed comments:

I have a IT query as 143 (1)a vi, mentioning that income as per Form26AS has not been included in computing a total income in the return. If the amount credited (minus) the income chargeable under head salaries varies due to HRA, LTA and conveyance allowance and medical reimbursment (variance arises because of this).

In ITR2, if you fill the amount credited as per 26AS in both section Salary schedule (along with section 10 exemptions) and TDS section, the ITR-2 Tax calculation sheet do not take the exempted amount of HRA, Conveyance and LTA. Therefore the difference in tax due is also high.

What to do.. You have to agree or disagree to the notice.?

Sir,

I have a IT query as 143 (1)a vi, mentioning that income as per Form26AS has not been included in computing a total income in the return. If the amount credited (minus) the income chargeable under head salaries varies due to HRA, LTA and conveyance allowance and medical reimbursment (variance arises because of this).

In ITR2, if you fill the amount credited as per 26AS in both section Salary schedule (along with section 10 exemptions) and TDS section, the ITR-2 Tax calculation sheet do not take the exempted amount of HRA, Conveyance and LTA. Therefore the difference in tax due is also high.

What to do.. You have to agree or disagree to the notice.?Have 10 days left to respond.

Siva please go through our article Income Tax Notice for Inconsistency in Salary Income and Form 26AS for examples on how to solve it.

Ok, Thank you for the suggestion.

– In the suggested link article it says “For example: If a Return of Income for the Financial Year 2015-16 or Assessment Year 2016-17 is filed by the assessee on 28th July 2016 (before the due date of filing of Income Tax Return i.e.5 th Aug 2016), and he later discovers some mistake, he can file a Revised Return of Income Tax anytime up to 31st March 2017 or before the completion of Assessment whichever is earlier.”

-My case is for FY 2016-17 (Original filing of ITR-2 was done on 28 th July, 2017 before due date). Can I file a revised ITR-2 on May 31st 2018?

(as I received a IT mismatch notice on April 7, 2018 -for salary mismatch in 26AS total amount credited Vs ITR TDS section income under head salaries ).

You have received IT mismatch notice and you agree with it hence you have to revise your ITR within 30 days of receiving the notice under section 139(5)

You are replying to notice so can you can revise ITR within 30 days of receipt of notice

If i disagree in the same case above as the difference was HRA/Convenience allowance/professional tax…….still do i need to file revised return

If You disagree then you don’t have to file revised return.

Just attach the appropriate documents to reason you are disagreeing

There is no option to attach any documents when you use disagree, only option is provide reconciliation of income on income tax website interface.

Also like to know any consequences of selection of disagree and what will be the further action from tax office or from my end.

If you disagree then the ball is in tax department.

No one is sure how they would proceed!

But why do you want to disagree? Why don’t you want to file revised return?

I have already disagree and submitted my response…it will be advisable I file revised returns even after disagree ?

Honestly, no one knows how this will work out, there are no examples to look out for.

Now you don’t owe Income Tax department any tax right.

And you have already disagreed and submitted your response.

So you can let Income Tax Department come back to you.

The other option is revising ITR and rearranging information.

No one is stopping you from revising your return.

Just check if you are allowed to revise return.

So it is a call you have to make.

So what are you going to decide?

Just an update…in above case my return has clear by tax department….conclusion is after disagreeing with information about the differences in amount (between 26AS and income disclose in return)….tax department is fine with such details to clear your returns.

I have got notice under 143(1)(a) due to variance in income as a mismatch with 26AS. However, while revising my return I noticed that I have paid excess tax of around 14000. Now in the revised return I am having a Refund of 14000 and while trying to e-file the return the option is asking me whether I am filing under Sec 119(2)(b). Should I say ‘Yes’ to this and file under 119 or I can say ‘No’ and continue to file the return? Also please advise if it is OK to file a revised return with refund under this e-proceeding option

If you want to file income tax returns for a financial year, whose due date of filing income tax return and due date of filing belated income tax return has elapsed, you need to file income tax return u/s 119(2)(b).

For Return filed under section select Revised 139(5).

For Whether original or revised return select R-Revised.

Yes you can claim your refund as you are revising your return if they can be verified using Form26AS

Hi,

while filling revised return in income tax portal, it is requesting furnish below details,

Are you filling u/s 119(2)(b)/92CD – I selected “Yes”, then it pop-ups to provide Filing section in this which option do I need to provide

1. 139 read with section 119(2)(b)

2. 139 read with section 92CD

I have variance in Form 26AS and Head salaries in ITR, I had filled ITR-2.

Please help me to provide an update on this.

Arun, If you want to file income tax returns for a financial year, whose due date of filing income tax return and due date of filing belated income tax return has elapsed, you need to file income tax return u/s 119(2)(b).

But as you had already filed the return you should file under Revised 139(5)

To file Revised Income Tax Return gather following information explained in our article Income Tax Notice for Inconsistency in Salary Income and Form 26AS

Receipt No of Original Return

Date of Submission of Original Return

To get it from the income tax filing website, login in and click on the ‘View Return’. You would see all the returns you have submitted electronically. Get the Ack.No number as well as the filing date.

Log on to incometaxindiaefiling website

Prepare Return just like like you filed the first time, correcting or filling what had got omitted earlier.

Go to part of ITR with Filing Status , PART-A General, for example shown in image below (Fill Excel ITR form : Personal Information,Filing Status)

For Whether original or revised return select R-Revised.

For Return filed under section select Revised 139(5).

Enter the E-filing acknowledgement receipt number from the ITR-V Which you would have got after filing the original return.

I too have a similar case where I am filing revised return under 139(5) due to salary mismatch with Form 26AS. but while uploading the return getting an option to select “Are you filing u/s 119(2)(b)/92CD”.

Should I say “yes” or “no”

So say No to Question Are you filing u/s 119(2)(b)/92CD

Section 119(2)(b) is when you file income tax returns for a financial year, whose due date of filing income tax return and due date of filing belated income tax return has elapsed.

Hi,

I have received intimation from IT dept for Income as per Form 26AS which has not been included in computing the total income in the return-143(1)(a)(vi). I want to disagree with variance as it is due to amount included for Allowance to the extent exempt u/s 10 and Deductions – Tax employment. But when checked on efiling site unable to find these options while disagreeing the same. Please advise.

Wait for a day or two. Please go through our article Income Tax Notice for Inconsistency in Salary Income and Form 26AS for more details on understanding the problem and how to revise the return.

Very useful article and very elaborate. I was able to revise my return due to mismatch in income from 26AS form for AY 2017-18. I had originally filled on 8/5/2017 using the then 26AS which subsequently got changed. So if the basis for OI for filing is 26AS, better wait till end of May. Thanks a lot once again for this article.

I have checked your page and i have found some duplicate content, that’s why you don’t rank high in google, but there

is a tool that can help you to create 100% unique content, search for: SSundee advices

unlimited content for your blog

Hi,

I have no other income than bank interest income . Mistakenly I have shown that income as Salary instead of other sources and now I got notice u/s 143(1)(a) for other source income mismatch to 26AS. I think I should file revised return, but should I agree or partially agree to this notice? Please advise.

I am in similar situation please reply..

I have mismatch between Assessment Year 2017-18 filing and 26AS (FD interested not updated Rs. 1992). if I add 1992 in other source, my taxable income will be more than 5 lakhs I did not get Tax Credit (Sec 87A) 5000. Since i have to Pay around Rs. 6000. Please suggest how to avoid this situation. And also please let me know is any possible to pay now Charity donation for Last Assessment Year (80G/80GGA). Kindly advice.

Sorry you would have to pay the tax due.

You cannot pay to charity for the earlier year.

Sir,

if I invest Rs 400000 as fd at the rate of 7% for only 180days and total interest will be almost Rs 7000 at maturity.then TDS will be deducted.please inform me.it is very important for me.

FD interest is taxable as per your income slab.

If your total income (including FD interest) – 80C deductions is less than 2.5 lakhs(basic exemption limit) then FD interest is not taxable.

Otherwise FD interest is taxable as Income from Other Sources.

The tax on FD interest is as per your income slab which for current financial year is given below.

Income Tax Slab Tax Rate

Income up to Rs 2,50,000* No tax

Income from Rs 2,50,000 – Rs 5,00,000 5%

Income from Rs 5,00,000 – 10,00,000 20%

Income more than Rs 10,00,000 30%

Uan paaswoad