You can invest directly only in HDFC Mutual Fund schemes online on HDFC Mutual Fund website called as HDFC MFOnline. You need to first create an account i.e register, even if you have invested before in HDFC Mutual Fund and have a folio number. If you have never invested in a Mutual Fund, you need to do KYC. This article explains about how to do direct invest in HDFC Mutual Fund schemes online using HDFC Mutual Fund Website.

Table of Contents

Direct Investing in Mutual Funds

Regular and Direct Mutual Fund plans are options to buy the same mutual fund scheme, run by the same fund managers who invest in the same stocks and bonds. The major difference between direct plan and a regular plan is that in the case of a regular plan your mutual fund(also known as AMC) pays a commission to your broker whereas, in case of a direct plan, no such commission is paid. On average, you will earn 0.50%-1% more per annum by investing in a mutual fund scheme through its direct plan rather than its regular plan as explained in our article What is the difference between Direct and Regular Mutual Funds?

HDFC Mutual Fund is the top Mutual Fund in India handling maximum money technically called as Assets under Manangement or AUM.

To invest directly only in HDFC Mutual Fund schemes, you can do online on HDFC Mutual Find website called as HDFC MFOnline. If you want to invest in other mutual fund scheme directly then you need to either open account with other mutual fund or use other platforms like MFUtiltity, ETMoney App, PayTM Money App etc. Our article, Compare Direct Mutual Funds Investing Platforms, compares some of these platforms in detail.

Direct Investing in HDFC Mutual Fund

You can invest directly only in HDFC Mutual Fund schemes online on HDFC Mutual Fund website called as HDFC MFOnline. You can use mobile or tablet or website to access HDFC MFOnline Investors.

You need to first create an account i.e register, even if you have invested before in HDFC Mutual Fund and have a folio number. So you will have a user id and password before you can log in for transacting on HDFC Mutual Fund website.

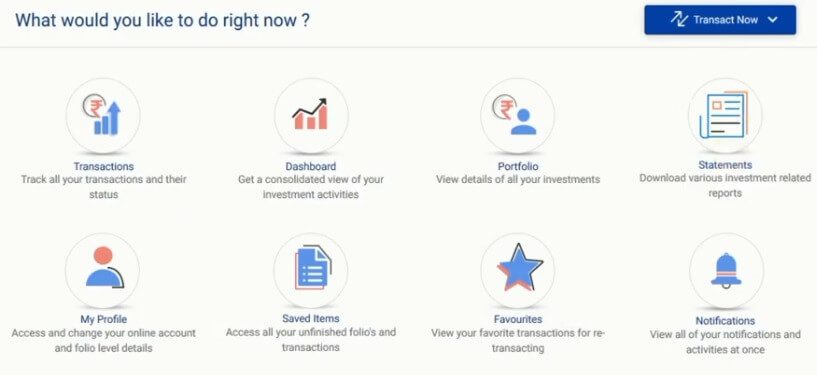

- Do Instant Registration(Required to be done One time only)

- Transact online in any of HDFC Mutual Fund schemes. You can do SIP, Lump sum Purchase, Switch, Redemption or sell, Systematic Transfer Plan(STP), SWAP, Flex Index and DTP

- Account statement available real time along with other reports/statements such as: Capital Gain Statement, Dividend Statement, Exit Load Statement and Balance Confirmation Report.

- All your folios or investment in HDFC Mutual Fund, done through anywhere will get automatically linked to the account using your PAN. So you can track your Investments on the go for all investment performances done previously.

Creating account on HDFC Mutual Fund website

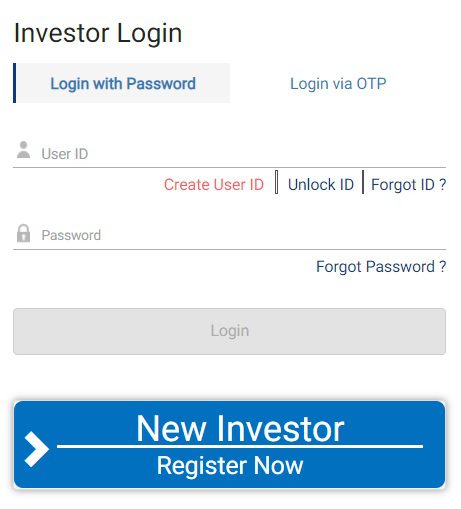

Login of HDFC Mutual Fund site for direct investing is shown in the image below.

- New investors to HDFC Mutual fund can register on HDFC MFOnline Investors by clicking ‘Not an Investor – Register Now’ option. PAN has to be KYC compliant and either your email ID or mobile number should be registered in KYC records.

- Existing investors of HDFC Mutual Fund can click on ‘Don’t have a User ID’ to register and start using HDFC MFOnline Investors. Email ID has to be present in folio.

If you are a new investor you need to click on New Investor, Register Now as shown in the image below. If you have already invested in HDFC mutual funds you need to create User Id. This step needs to be done only once.

- For investors with tax status – ‘Individual’ (including Resident individuals, HUF, NRIs, Non-resident Minor, Nonresident HUF), all the folios where the unit holder’s (first holder) PAN is same are automatically mapped to user ID.

- Non-individual investors need to create a separate user ID for each folio and only that folio will be mapped to an online account.

- For tax status ‘On Behalf of Minor’, the folio will be mapped to guardian’s online account.

Video on How to invest directly in HDFC Mutual Funds through HDFC MF Website

This 5 minute video of HDFC Mutual Fund website shows how to directly invest in HDFC Mutual Fund schemes.

About HDFC Mutual Fund

There are 44 Mutual Fund houses. And HDFC Mutual Fund is at the top handling maximum money.

HDFC Mutual Fund has been around from Jun-30-2000. Is sponsored by HDFC(Housing Development Finance Corporation Ltd) and Standard Life Investments Ltd.

HDFC Mutual Fund CEO / MD is Mr. Milind Barve and Chief Information Officer(CIO) is Mr. Prashant Jain who is a reputed Fund Manager.

Top Mutual Fund Houses or AMCs in India

ICICI Prudential Mutual Fund

348,068

|

Mutual Funds |

September 2019 |

|---|---|

|

HDFC Mutual Fund |

376,598 |

|

SBI Mutual Fund |

320,663 |

|

Aditya Birla Sun Life Mutual Fund |

253,829 |

|

Nippon India Mutual Fund |

202,649 |

|

Kotak Mahindra Mutual Fund |

168,399 |

|

UTI Mutual Fund |

154,229 |

|

Franklin Templeton Mutual Fund |

124,025 |

|

Axis Mutual Fund |

105,526 |

Top Mutual Funds of HDFC

|

Fund

|

Rating

|

Category

|

Launch

|

Expense

Ratio (%) |

1-Year

Return (%) |

Net Assets (Cr)

|

|---|---|---|---|---|---|---|

| HDFC Liquid Fund | 3 |

Debt-Liquid

|

Oct-2000 | 0.30 | 6.83 | 90,795 |

| HDFC Liquid Fund – Direct Plan | 2 |

Debt-Liquid

|

Jan-2013 | 0.20 | 6.94 | 90,795 |

| HDFC Balanced Advantage Fund (Erstwhile HDFC Growth) | Unrated |

Hybrid-DAA

|

Feb-1994 | 1.67 | 6.17 | 44,110 |

| HDFC Balanced Advantage Fund – Direct Plan (Erstwhile HDFC Growth) | Unrated |

HY-DAA

|

Jan-2013 | 1.07 | 6.91 | 44,110 |

| HDFC Equity Fund | 3 |

EQ-MLC

|

Jan-1995 | 1.71 | 6.45 | 23,441 |

| HDFC Equity Fund – Direct Plan | 3 |

EQ-MLC

|

Jan-2013 | 1.21 | 7.10 | 23,441 |

| HDFC Mid-Cap Opportunities Fund | 3 |

EQ-MC

|

Jun-2007 | 1.99 | 2.10 | 22,637 |

| HDFC Mid-Cap Opportunities Fund – Direct Plan | 3 |

EQ-MC

|

Jan-2013 | 1.14 | 2.87 | 22,637 |

| HDFC Hybrid Equity Fund (Erstwhile HDFC Premier Multi-Cap) | 4 |

HY-AH

|

Sep-2000 | 1.77 | 7.64 | 21,087 |

| HDFC Hybrid Equity Fund – Direct Plan (Erstwhile HDFC Premier Multi-Cap) | 4 |

HY-AH

|

Jan-2013 | 1.17 | 8.37 | 21,087 |

| HDFC Top 100 Fund (Erstwhile HDFC Top 200) | 3 |

EQ-LC

|

Oct-1996 | 1.78 | 7.31 | 18,507 |

| HDFC Top 100 Fund – Direct Plan (Erstwhile HDFC Top 200) | 3 |

EQ-LC

|

Jan-2013 | 1.28 | 7.92 | 18,507 |

| HDFC Low Duration Fund (Erstwhile HDFC Cash Mgmt Treasury Advantage Retail) | 3 |

DT-LD

|

Nov-1999 | 1.03 | 8.46 | 14,904 |

| HDFC Low Duration Fund – Direct Plan (Erstwhile HDFC Cash Mgmt Treasury Advantage Retail) | 3 |

DT-LD

|

Jan-2013 | 0.43 | 9.11 | 14,904 |

| HDFC Credit Risk Debt Fund – Direct Plan (Erstwhile HDFC Corporate Debt Opportunities Fund) | 3 |

DT-CR

|

Mar-2014 | 1.06 | 9.86 | 14,625 |

| HDFC Credit Risk Debt Fund – Regular Plan (Erstwhile HDFC Corporate Debt Opportunities Fund) | 3 |

DT-CR

|

Mar-2014 | 1.46 | 9.37 | 14,625 |

| HDFC Corporate Bond Fund (Erstwhile HDFC Medium Term Opportunities) | 3 |

DT-CB

|

Jun-2010 | 0.45 | 11.30 | 11,938 |

| HDFC Corporate Bond Fund – Direct Plan (Erstwhile HDFC Medium Term Opportunities) | 3 |

DT-CB

|

Jan-2013 | 0.30 | 11.41 | 11,938 |

| HDFC Overnight Fund (Erstwhile HDFC Cash Mgmt Call) | Unrated |

DT-OVERNHT

|

Feb-2002 | 0.20 | 5.75 | 10,416 |

| HDFC Overnight Fund – Direct Plan (Erstwhile HDFC Cash Mgmt Call) | Unrated |

DT-OVERNHT

|

Jan-2013 | 0.10 | 5.86 | 10,416 |

| HDFC Floating Rate Debt Fund (Erstwhile HDFC Floating Rate Income ST Ret) | Unrated |

DT-Floater

|

Oct-2007 | 0.38 | 8.94 | 9,533 |

| HDFC Floating Rate Debt Fund – Direct Plan (Erstwhile HDFC Floating Rate Income ST Ret (Changed)) | Unrated |

DT-Floater

|

Jan-2013 | 0.23 | 9.11 | 9,533 |

| HDFC Small Cap Fund – Direct Plan | 4 |

EQ-SC

|

Jan-2013 | 0.89 | -7.61 | 9,137 |

| HDFC Small Cap Fund – Regular Plan | 4 |

EQ-SC

|

Apr-2008 | 1.79 | -8.69 | 9,137 |

Should you create an account on HDFC Mutual Fund website?

If you are Do-it-yourself Mutual Fund investor and understand Mutual Funds then you can invest directly in Mutual Funds.

There are 44 Mutual Fund houses. If you want to limit number of mutual fund houses or schemes then you can open account in top fund houses such as HDFC Mutual Fund, ICICI Prudential Mutual Funds.

But if you want to have one platform to invest in different mutual funds then you should look for platform like What is MF Utility or platforms like ETMoney and PayTm Money App. Compare Direct Mutual Funds Investing Platforms, compares some of these platforms in detail.

Related Articles:

All About Mutual Funds : Basics, Choosing, Paperwork, Direct Investing

- Direct Investing in Mutual Funds

- Compare Direct Mutual Funds Investing Platforms,

- PayTM Money

- Switching of Mutual Funds

- Redeeming Mutual Funds : Check Exit Load,Taxes

- Investing in Equities: Stocks vs Mutual Funds

Have you opened an account in a Mutual Fund Website to invest? How do you invest directly in Mutual Funds? Do you invest in HDFC Mutual Fund? Which Scheme of HDFC Mutual Fund do you invest in?

Thanks for sharing such a informative content which is so useful for investor. As you have highlighted different financial services so you blog sites is a one stop solution for investor. Being a blogger I really appreciate your content. I am looking forward for more in depth content in future on “How to invest in Mutual Fund”

I am using MFUOnline.com for last few years and I would say its really good.

Its interface is good to buy and sell.

But doesn’t provide a good reporting interface.

Very well covered all the details related to the Mutual Funds of HDFC.

Daily Capital Market Dose