Flipkart season sale, Big Billion Days offers discounts and bundled offers on smartphones, laptops, TVs, headphones, and more. Do you know that there are various ways in which you can pay on FlipKart such as Debit Card EMI, No Cost EMI and Pay Later. Also the advantages that one can get on becoming a Flipkart plus member , earn SuperCoins and redeem them.

Table of Contents

Payment Options of FlipKart

Credit Card EMI: You can pay for your order in easy monthly instalments using Credit Card. Interest is charged by the bank

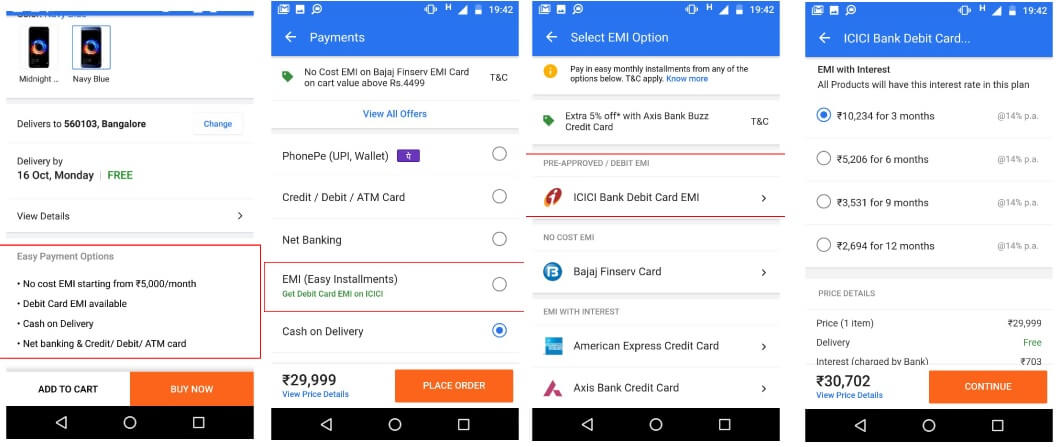

Debit card EMI: It lets you pay for your orders in easy monthly instalments using your Debit Card/ATM card. This option os available for a selected group of customers who are pre-approved by the bank partners. Just SMS DCEMI to 57575 and find out if you’re eligible for Flipkart Debit Card EMI? If you’re eligible, a ‘Debit Cart EMI available’ text will be visible on the app or website under easy payment options.

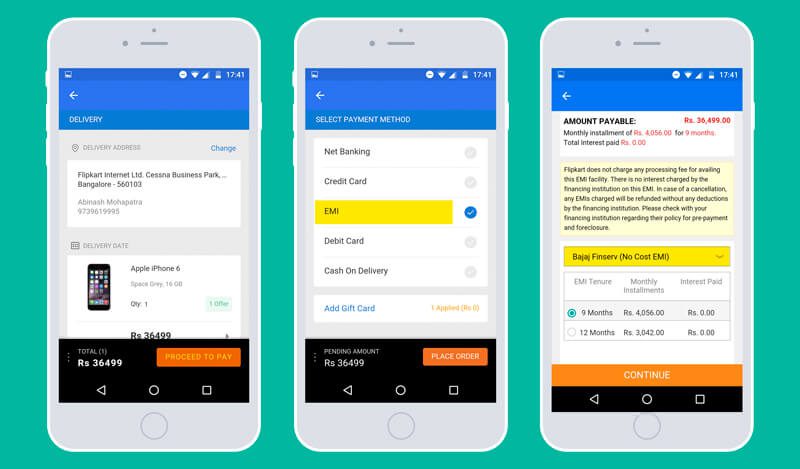

No Cost EMI: Flipkart offers zero processing fees, zero down-payments and zero monthly interest! Flipkart in partnership with Bajaj FinServe offers EMI Card. It also has tie up with other credit cards with no interest being charged. The Flipkart No Cost EMI comes with loan tenures ranging from 3 to 12 months. Based on the cost of the product and term of payment an agreed amount is deducted every month until the loan term is completed.

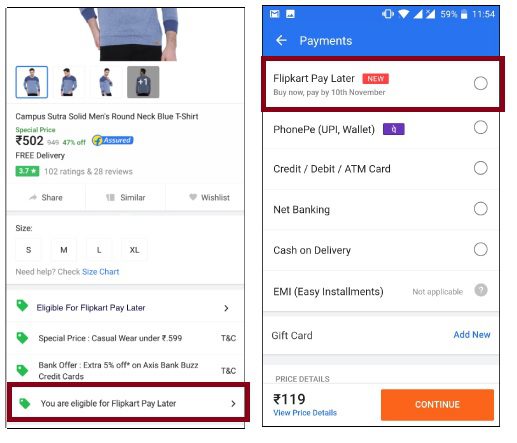

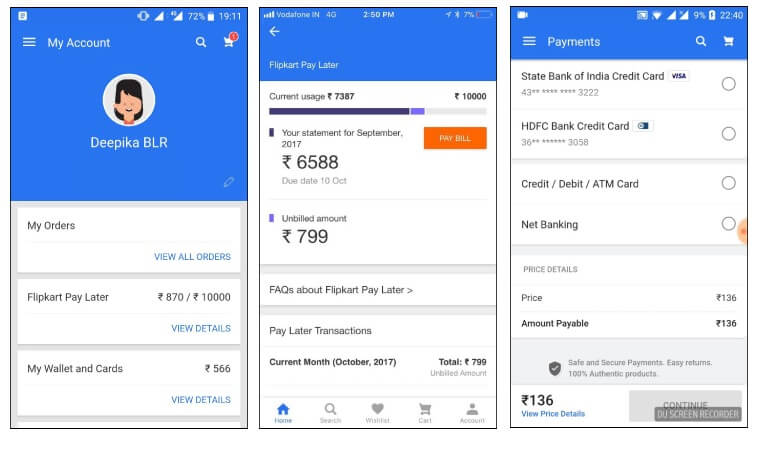

Flipkart Pay Later or Cardless Credit: You can avail easy credit up to ₹1 Lakh i.e buy the products in multiple transactions and then pay later in One Go. To avail this option you need to check that you are eligible to claim this option.

Debit Card EMI of Flipkart

As per RBI, there are 79.38 crore debit cardholders while credit cardholders account for only 3.14 crore customers. Flipkart has designed Debit Card EMI specifically to enable such customers to shop confidently without worrying about denting their monthly cash flow.

- Flipkart Debit Card EMI, lets you pay for your orders in easy monthly instalments using your Debit Card/ATM card.

- Flipkart has partnered with Axis Bank, State Bank of India (SBI), HDFC Bank and ICICI Bank to offer Debit Card EMI facility to customers. Amount available depends on Bank, For example, you need to have a minimum cart value of Rs 8,000 (for Axis Bank, SBI and ICICI Bank customers) / Rs 5,000 (for HDFC Bank customers)

- There are no processing fee or additional charges levied by Flipkart for availing this payment option. The bank may levy GST or other taxes on the interest of the EMI.

- The Debit Card EMI option from Flipkart is available for a selected group of customers who are pre-approved by the bank partners. Eligibility is determined not by Flipkart, but by the bank partner based on the customer’s past transaction history and relationship with the bank.

- Just SMS DCEMI to 57575 and find out if you’re eligible for Flipkart Debit Card EMI. If you’re eligible, a ‘Debit Cart EMI available’ text will be visible on the app or website under easy payment options.

- Bank will convert the payment into EMI within 4-7 business days. Your monthly debit card statement will reflect the EMI amount with the interest

- To foreclose your EMIs with ‘Debit Card EMI’ payment mode you need to contact the Bank.

No Cost EMI

No Cost EMI option of Flipkart has zero processing fees, zero down-payments and zero monthly interest! Flipkart has partnered with Bajaj Finserv for this offer.

The Flipkart No Cost EMI comes with loan tenures ranging from 3 to 12 months, making sure it doesn’t dent your savings. Based on the term of payment and cost of the product, an agreed amount is deducted every month until the loan term is completed.

The scheme is currently available for a select set of Brands and Products and can be availed from the convenience of your smartphone

To avail this scheme, all you need is a Bajaj Finserv EMI Card. Once you select a pre-approved loan amount, you have the freedom to buy the products of your choice. At the time of purchase, you can choose the duration of your interest-free loan. The installment amount will be deducted directly from your account. Once you have paid the first installment, you also have the freedom to pre-close your EMIs before the term ends, at no extra charge.

To get a Bajaj Finserv EMI Card, please check out the eligibility and process of application on their website. You can click this link to access the card.

Flipkart Pay Later: CardLess Credit

Flipkart Pay Later as a payment option allows you to avail easy credit up to ₹1 Lakh i.e buy the products in multiple transactions and then pay later in One Go. But only if you are eligible for this option.

To be eligible for Flipkart Pay Later, you need to get approved. Go to My Account,

- Enter your PAN and other details.

- If approved Check your Credit Limit (My Accounts > Cardless Credit on the Flipkart app)

- Complete your simple and quick digital KYC process

- Shop on Flipkart using the Cardless Credit payment option

- Repay by the 15th of next month on the Flipkart app

Remember that you cannot make partial repayment to clear your balance. Neither can you pay an excess amount, this facility is not a wallet where you can park excess money. If you have an outstanding amount, you will be notified that you must pay the full amount to clear your dues and continue enjoying the benefit of Flipkart Pay Later.

FlipKart Plus and FlipKart Plus Coins

Flipkart has Flipkart Plus just like Amazon prime. Flipkart Plus is an exclusive benefits program that unlocks more for you everytime you shop on Flipkart along with free and fast delivery like Amazon prime.

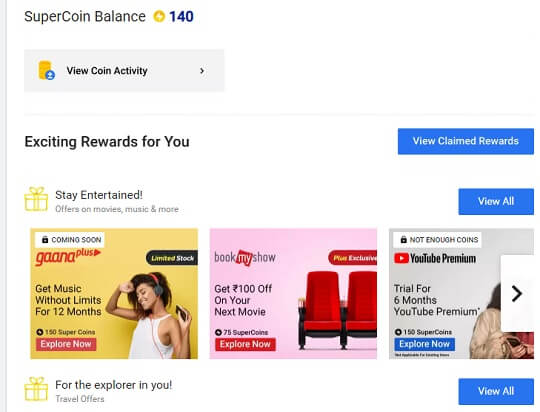

The Flipkart Plus Members earn Flipkart SuperCoins.

How to Earn SuperCoins?

In order to earn SuperCoins, You are required to place an order on the Platform, or make travel bookings (flights, buses and hotels) on the Flipkart travel page located at Travel Zone or transactions on Super Partners minimum of Rs.100 and above (the net order value will be taken into consideration which is total order value minus cancelled/returned item value ) (“Eligible Order”).

For every Eligible Order, You are eligible to earn 2 SuperCoins, Flipkart Plus customers will earn 2X SuperCoins. For example, for an order value of Rs 100 you earn 2 SuperCoins and Flipkart Plus customer will earn 4 SuperCoins. Please note that the SuperCoins earned will be on the actual order value excluding any instant discounts or cashbacks credited to the PhonePe wallet.This will not be applicable for Super Partners and earning of SuperCoins will be as per Super Partners guidelines.

Plus coins will be credited to your account after completation of the return period of the item you have ordered. If you cancel your order then you will not receive any Flipkart Plus Coins.

SuperCoins will expire after 1 year at the end of the month in which they were credited to a user’s account.

How to use SuperCoins?

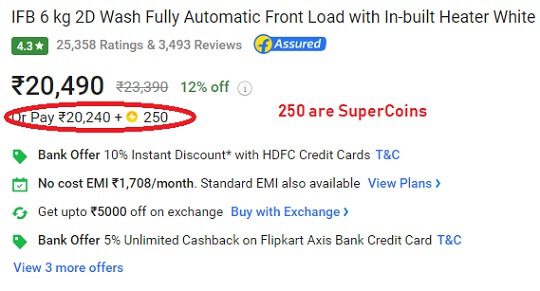

Use it to claim the offers in My Account->Super Coin Zone or pay partial amount using SuperCoins

The image below shows how one can pay using Super coins.

2 responses to “Flipkart Big Billion Day Sale Buying Options: Debit Card EMI, Pay Later, SuperCoins”

Nice post thank you so much

Hi,

Nice post Thank you so much