A remittance or money transfer is usually related to foreign workers sending money to family in their home countries. Many Indians all over the world send money to India for reasons like supporting their parents in old age or helping a travelling friend get the resources they need. Roughly 68 billion dollars are sent to India as remittances each year, with the majority of them going to states like Kerala, Punjab, Andhra Pradesh, and Tamil Nadu. Keep reading to find out everything you need to know about remittances to India.

Table of Contents

Remittances Terms to Know

If you are new to remittances, there might be some financial language involved that you have never heard before. Being educated on these terms will make it easier to get the services you need. Remittance or a payment remittance is simply the term for money that is sent through some sort of money transfer service.

- It is called an outward remittance when you are sending it and

- an inward remittance when the other person is accepting it.

- A remittance address, also called a remit-to address or remit, is the technical term for the address of the person or the money transfer center you are sending the money to.

- A float is the amount of time it takes from you giving the money to the other person taking possession of it.

Methods of Sending Remittances

There are all sorts of remittance methods, and knowing about them will help you pick the one that works for your needs. Of course the most basic is using post to send money as a personal check or bank note, but this is not always secure.

Wire transfers send money directly from one bank account to another. These work well as long as both parties involved have a bank account and are willing to spend the time and money needed to securely and conveniently exchange money.

Money transfer services charge you a fee to handle transfers for you. They let you use a bank account, cash, or card to pay at one location, and then the money is sent to the center’s physical location in India where they can pick up the cash or money order.

With the increasing popularity of the internet, you can now find apps and websites that will let you send money to another nation. The quality of these sites and apps can vary greatly, so it is important to review them and ensure they are reliable before sending money.

Fees Associated With Remittances

Of course the main reason that it can take some time to find a remittance service you enjoy is the fees. Every potential method of sending money comes with its own unique fees.

The first fee you will need to consider is simply the cost of the remittance itself. Some places, like banks, may charge a flat rate for all amounts of money, while others may have variable fees that increase when you are trying to send more.

The form of currency you want to send, such as a money order or cash, can also affect how much of a fee you are charged.

In addition to base fees, some remittance services will let you pay a fee to expedite the process and get it to a person in India faster.

Even services that advertise they are completely free will still have some charges due to currency conversion.

The majority of India remittances are from the United States and Saudi Arabia, and switching to rupees comes with a conversion charge that can vary as exchange rates fluctuate.

On average, people sending money to India can expect to pay fees of roughly 6.9 percent for each 200 USD they send.

Cash Versus Credit or Bank Transfer Remittances

Of course, there are all sorts of types of cash in the modern world, so you have many options when sending money to India.

Depending on the service you pick, you may be able to pay for the remittance with cash, a bank account transfer, or a credit card.

Likewise, you can choose for the person in India to get the remittance as a bank transfer, prepaid card, or cash.

Wanting to send or pick up cash can limit your remittance options. You will need to find a service that is willing to deal in cash and has a location near you and the person in India. This can be necessary for some people because cash is more useful in small villages where cards are not common.

How to send Money Example

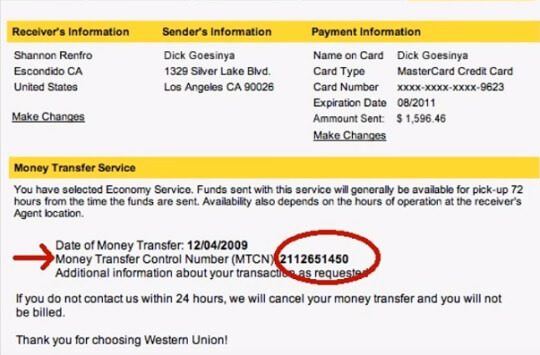

This video shows how to send money to India through Western Union Transfer, the receiver can get the money in his State Bank on India account.

India and Remittance

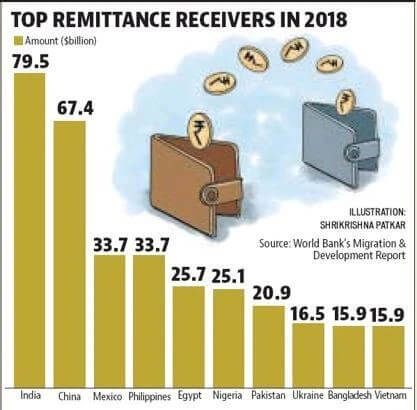

According to World Bank’s Migration and Development Brief of Dec 2018, Indians sent USD 79 billion back home in 2018. Over the last three years, India has registered a significant flow of remittances from USD 62.7 billion in 2016 to USD 65.3 billion 2017.

India was followed by China (USD 67 billion), Mexico (USD 36 billion), the Philippines (USD 34 billion), and Egypt (USD 29 billion). According to the report, remittances to low-and middle-income countries reached a record high of USD 529 billion in 2018, an increase of 9.6 per cent over the previous record high of USD 483 billion in 2017.

The Bank said, remittances to South Asia grew 12 per cent to USD 131 billion in 2018, outpacing the six per cent growth in 2017. “The upsurge was driven by stronger economic conditions in the United States and a pick-up in oil prices, which had a positive impact on outward remittances from some GCC countries,” The Gulf Cooperation Council (GCC) is a regional inter-governmental political and economic bloc of Bahrain, Kuwait, Oman, Qatar, Saudi Arabia and the UAE.

Now that you know more about remittances, you can confidently send money to India from wherever you are located. What’s your favourite way of sending money to India?

Hi sir moji of check Karna hi.