From 1 Apr 2020, following are withdrawn

- Dividend distribution tax (DDT) on companies and mutual funds. In India, a company which has declared, distributed or paid any amount as a dividend, was required to pay a dividend distribution tax at 15% plus applicable surcharge and cess taking the effective rate to 20.6%

- The tax of 10% on the dividend of more than Rs 10 lakh (Section 115BBDA) for resident individuals, HUF and firms.

For more details refer to our article Dividend and Tax: DDT, Dividend from Stocks, Mutual Funds from FY 2020-21

Starting 1 April 2018, tax on distributed income by equity-oriented mutual funds at the rate of 10 percent. The fund house will deduct a 10 percent dividend distribution tax(DDT) and pay the investor. So, if you were getting a dividend of Rs 1,000 per month from your mutual fund scheme, you may now get less than Rs 900 only(including surcharge and cess). Any Long Term Capital Gains (LTCG) over Rs 100,000 per year on Equity Mutual funds will now be taxed at 10 percent. This article explains What are Dividends in Mutual Funds? What is Dividend distribution tax or DDT? How do these changes, DDT and LTCG on equity mutual fund affect the investment in the dividend option of Equity Mutual Funds? If you decide to switch what should you consider?

Table of Contents

Dividend and Mutual Funds

Typically dividend is associated with stocks. A dividend is a portion of a company’s earnings that is returned to shareholders. Dividends provide an added incentive to own stock in stable companies. For a lot of stock investors, dividend income means a lot.With stocks, regular dividends (in combination with other key factors like revenue and profit growth, cash flows) speak for the company’s solid fundamentals.

But with Mutual Funds dividends are different. Under dividend option, the mutual fund will pay you from the profits made by the scheme when fund houses sell some stocks or bonds and pay out the proceeds to unitholders. Technically called as Realised profit. The dividend gets deducted from the NAV of the fund. If your fund has a NAV of 50 and declares a 20% dividend ( 2 on a face value of 10), the NAV will fall to 48 after paying the dividend. So Dividend in a mutual fund is your own money coming back to you. These dividends are not guaranteed and the mutual fund is not under any obligation to announce a dividend, dividend amount is also not fixed.

There are two sub-options: Dividend Payout & Dividend Reinvestment

- Dividend Payout Option: Dividend is paid out to the investor into his bank account.

- Dividend Reinvestment Option:

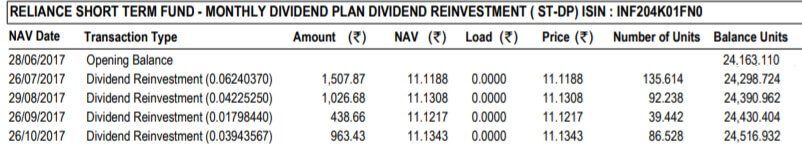

- Under this option, the dividend is not paid to the investor but is used to buy more units of the scheme on his behalf.In dividend reinvestment option too, profits are stripped. But instead of giving them as cash, they are allotted to you as units at the prevailing NAV. Hence, indirectly, by adding more units, you simply stay invested in the fund. Conceptually, the dividend reinvestment option is the same as the growth option for all equity funds.

- Dividends received from all mutual funds are tax-free in the hands of the investors. Though Dividends are not taxable in hands of investors they need to be shown in the Income Tax Return Form as Exempt Income.

- Our article Exempt Income and Income Tax Return explain it in detail.

- For Debt funds, the fund house pays a dividend distribution tax of 25%(or 29.12% with surcharge and cess. Before 1 Apr 2018 DDT was 28.84%)

- In an equity mutual fund, there is a dividend distribution tax of 10%(11.648% with cess). Before 1 Apr 2018 there was no tax.

Our article Growth and Dividend Option in Mutual Funds covers Dividend option in Mutual Funds

What is Dividend distribution tax or DDT?

Dividend distribution tax is the tax imposed by the Indian Government on stocks when companies pay a dividend to its stockholders. The dividend distribution tax on stocks is 15%, was announced in the Budget 2007.

In Mutual Funds debt mutual funds are subject to a dividend distribution tax (DDT). Till 31 Mar 2018, dividend in equity oriented mutual fund schemes was tax-free in the hands of the investor. Now for any equity mutual funds such as balanced fund, ELSS fund, a sector fund, equity savings fund, DDT of 10% will be charged which with Surcharge and Cess comes out to be 11.648% as shown below. Mutual fund schemes that invest less than 65% of the corpus in equity are categorised as non-equity funds and they are taxed as applicable on debt mutual funds.

- The DDT tax is 10%.

- Adding the 12% surcharge (10 *.12 + 10)=11.2

- 4% cess =4% of 11.2 = 0.448

- this becomes 11.648% = 11.2+0.448

For an investor, the only thing he sees is fall in NAV and a dividend. NAVs of funds is shown post accounting the expense ratio and paying dividend distribution tax (DDT) etc.

For example, the Mutual fund company or AMC decides to give a dividend of 10% and NAV of the fund is Rs 15. The NAV will get reduced by 11.648% to 13.835. So now instead of Rs 14 being invested one only has 13.835 invested.

Why was DDT introduced for Equity Mutual Funds?

“I also propose to introduce a tax on distributed income by the equity oriented mutual fund at the rate of 10%. This will provide level playing field across 30 growth-oriented funds and dividend distributing funds,” FM Arun Jaitley said in his Budget speech.

The DDT in debt mutual funds was introduced to reduce the arbitrage between bank fixed deposit and debt funds. So the introduction of 10 percent tax on dividends has ensured there is no arbitrage between dividend and growth schemes. Introduction of a 10% Dividend Distribution tax (DDT) on dividend options of equity funds is to bring them on par with the growth schemes. This may impact flows into funds where investors were primarily entering with the expectation of regular dividends.

The AMCs had sold some balanced funds to retirees promising them regular dividends. Dividend distribution tax on equity oriented mutual funds will help stop mis-selling of balanced funds. With or without DDT, balanced funds are not suitable for dividend payouts. If you want regular income from mutual funds, one should opt for pure debt funds or go for an SWP

To invest in Growth or Dividend option of Mutual Funds?

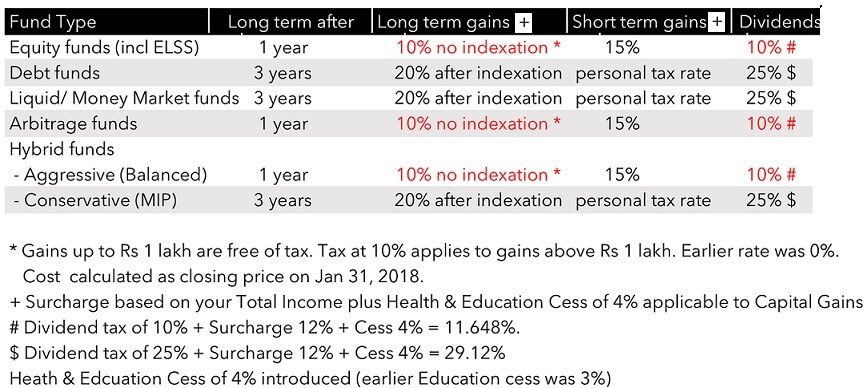

Picking between Growth and Dividend depends on how long you plan to stay invested and your current tax rate. The compounding effect of having the dividends reinvested kicks in as time goes on. Over longer investment periods the decision to select the growth option and could mean tens of lakhs of rupees in additional investment returns. The tables below recaps the capital gain tax(long term, short term) on Equity and Debt Mutual Funds and also explains how to select Growth or Dividend option in Mutual Funds due to following changes

- Any Long Term Capital Gains (LTCG) over Rs 100,000 per year on Equity Mutual funds will now be taxed at 10 percent. All gains until January 31, 2018 have been “grandfathered”. So you can assume the new cost of holding your Equity Mutual Funds is the closing price on January 31, 2018. The start date of your holding remains the original purchase date.

- Dividends on Equity Mutual funds now taxed at 10 percent.

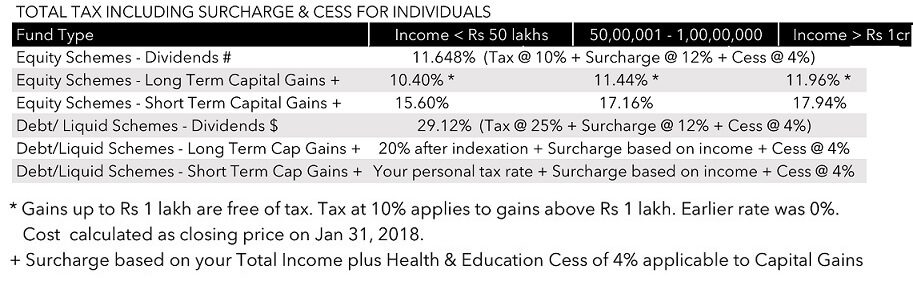

Total tax including Surcharge and Cess for Individuals are shown in the table below.

To invest in Growth or Dividend option of Mutual Funds. If you are investing in Equity funds for less than a year you should use Dividend Payout as Any gains on holdings < 1 year are taxed at 15%. Dividends are taxed at 10%. Else it is better to go with Growth option

If you invest in Debt Funds for less than 3 years and If your current income tax rate is 30 percent, you would be better off picking the Dividend Payout option as your dividends are taxed at a lower rate of 29.12 percent as against your income tax rate of 30 percent (plus surcharge and cess)

| Fund Type | Duration of investment | Option

for Income Slabs 10-20% |

Option

for Income Slabs 30% |

Why |

| Equity funds

Balanced funds Arbitrage funds |

< 1 year | Dividend Payout | Dividend Payout | Any gains on holdings < 1 year are taxed at 15%.

Dividends are taxed at 10% Dividend tax of 10% + Surcharge 12% + Cess 4% = 11.648% |

| Equity funds

Balanced funds Arbitrage funds |

> 1 year | Growth | Growth | Gains above Rs 1 lakh held for > 1 year are taxed at 10%

Surcharge based on your Total Income & Health and Education Cess of 4% is applicable to Capital Gains |

| Equity Tax Saving (ELSS) funds | > 3 years | Growth | Growth | You have to stay invested for > 3 years.

Any dividends reinvested are locked in for 3 years. Surcharge based on your Total Income & Health and Education Cess of 4% is applicable to Capital Gains |

| Debt funds Income funds Liquid funds | < 3 years | Growth | Dividend Payout | For income slabs of 10/20% Your gains are taxed at 10% or 20% which is lower than the dividend tax rate of 25%.

For income slabs of 30% Your dividend are taxed 25% lower than 30% Dividend tax of 25% + Surcharge 12% + Cess 4% 29.72% |

| Debt funds Income funds Liquid funds | > 3 years | Growth | Growth | Your gains are taxed a 20% after indexation.

Surcharge based on your Total Income & Health and Education Cess of 4% is applicable to Capital Gains

|

Switching of Mutual Funds

For investors using dividends for cash flows, it will make sense to switch to growth option and use systematic withdrawal plan (SWP), as that will lower his tax liability considerably

Those who have completed more than a year to switch from dividend options to growth options. Do this switch a year after the investment to avoid paying exit load and also avoid any short-term capital gains tax. Once an investor moves to the growth option and withdraws using SWP, the tax will be paid on only the profits earned and the tax liability would be far lower. This is because long-term capital gains up to Rs 1 lakh per year is tax-free.

Those investors in the dividend reinvestment option too to switch to the growth option. In the reinvestment option, your money keeps getting reduced. Even though the percentage of tax on capital gains is the same as the dividend, your eventual returns will be impacted because the dividend tax constantly reduces the amount available for further growth,

While switching from dividend option to the growth option of the same scheme, investors need to keep a couple of things in mind.

- You need to see the exit load a fund house charges which varies from one fund house to another. While some fund houses charge an exit load if you switch, many do not charge for a switch in the same scheme.

- Also a switch is considered a sale transaction and if it is less than a year, you will have to pay short-term capital gains tax for the same which is equal to 15 percent.

2 responses to “DDT on Dividends of equity mutual funds, LTCG,Growth or Dividend option”

Very good things which you post at here, these thinks are really tricky maybe can work for me.

I actually added your blog to my favorites and will look forward for more updates. Great Job, Keep it up. First of all let me tell you, you have got a great blog .I am interested in looking for more of such topics and would like to have further information. Hope to see the next blog soon.