This article explains the process of Dematerialization, shows the physical certificate and how to fill the Dematerialization Request Form. Historically, investors used to take physical possession of shares and securities. However, there were numerous risks associated with physical certificates, such as theft, forgery, bad delivery, and fake certificates, besides others. In order to mitigate these risks, the concept of dematerialization was introduced.

Dematerialization is the process of converting physical share certificates into an electronic form. The shares may, then, be registered and transferred through the Internet. In order to trade stocks in an electronic form, it is necessary to open a demat account online.

Process of Dematerialization

Contrary to the popular belief, transferring shares to an electronic form is quite an easy task. Investors may follow the step-by-step guide given below and dematerialize shares without any hassles.

- Shortlisting of a Depository Participant

A Depository Participant (DP) is an intermediary between a depository and the investors. The list of DPs is made available on the websites of Central Depository Services (India) Limited (CDSL) and National Securities Depository Limited (NSDL).

The first step in dematerializing shares is to open an account with a DP offering demat account services. Upon opening of such an account, investors need not open separate accounts for trading in debt, bonds, or any other financial instrument.

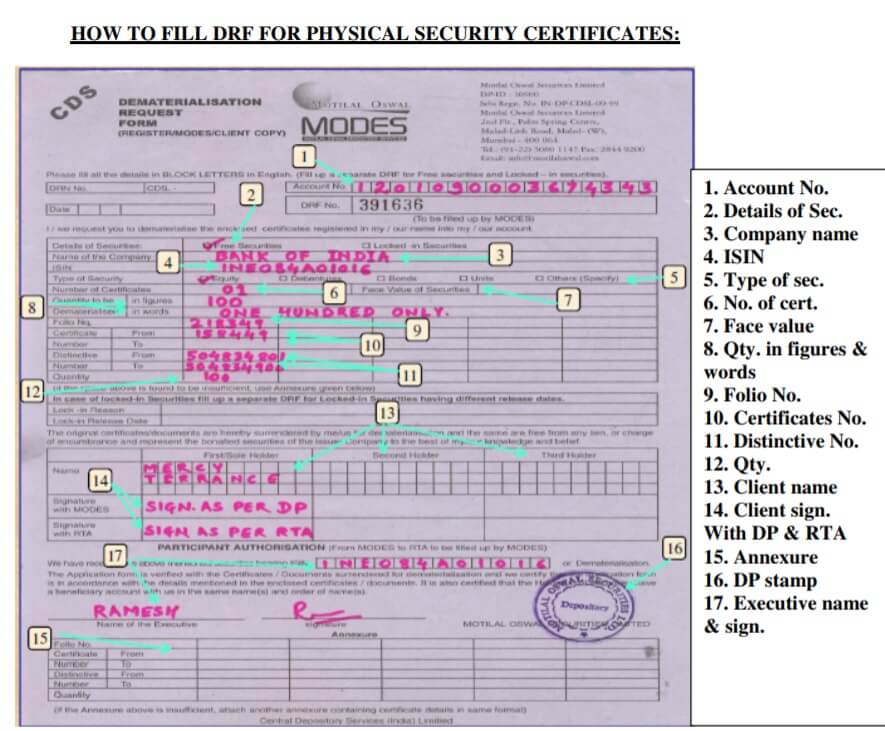

- Filling the Dematerialization Request Form

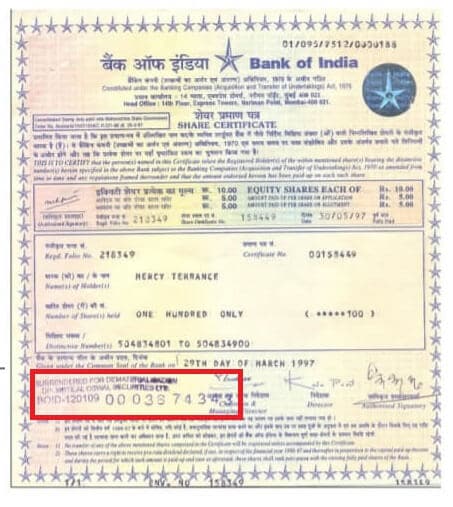

A Dematerialization Request Form (DRF), available with the DP, has to be filled and submitted by the investor as shown in the image below. Along with the duly filled DRF form, investors have to surrender their physical share certificates. It is important to make sure that on every share certificate, ‘Surrendered for Dematerialization’is mentioned as shown in the image below.

- Processing of the request

Upon submission of the DRF and physical certificates, the application is processed by the DP. The physical share certificates are submitted to registrar of the issuer company. The registrar confirms the dematerialization request.

- Receiving an approval of the request

Once the request has been approved, the registrar informs the DP of the completion of the process. All the share certificates held in the physical form arethen destroyed. The investor’s account will then show a credit of the shares. After submission of the dematerialization request, it generally takes around 15 to 30 days for the shares to get transferred electronically.

Dematerialization has numerous benefits. Besides providing security of the shares, it minimizes the paperwork associated with the ownership, transfer, and trading of securities. Additionally, it facilitates quicker transactions and offers the benefit of convenience. Investors do not have to pay stamp duty on their electronic shares. Just a nominal holding fee is charged. Investors may take advantage of the aforementioned benefits and dematerialize their shares. This will also bring about a phenomenal growth in the Indian capital market.

Related articles:

All About Stocks, Equities,Stock Market, Investing in Stock Market

- How to start investing in Stock Market?

- Stock Market Index: The Basics

- Returns of Stock Market, Gold, Real Estate,Fixed Deposit

- Investing in Equities: Stocks vs Mutual Funds

- Transaction costs while buying or selling shares or stocks

- Investing in Stock Market: Open Demat account and Trading account

One response to “ All about the Process of Dematerialization: DRF Form”

Very useful. What to do if the physical shares are missing?

And, is there a way to know/track shares of one’s late parent – any shares not found.

Thanks.