Cards with waves/wifi symbol, also known as ContactLess card, speed up purchases as one does not have to Enter PIN. So its no dipping, swiping or waiting for Contactless Card debit and credit cards at the Contactless machines. Card Never Leaves your Hand. In India, payment through contactless mode is allowed for a maximum of Rs 5000(from 1 Jan 2021, earlier was 2000) for a single transaction where you are not asked to input your PIN. You can still use your card for purchases using Chip and PIN at machines without the contactless technology. There is no difference in using the Contactless card for amounts more than Rs 5000(from 1 Jan 2021, earlier was 2000) or using the card at ATM or on the Internet. This article talks about Contact Less Cards, How to use ContactLess Card? Frequently asked Questions about Contact Cards. Technology behind ContactLess Cards and are ContactLess cards safe?

Table of Contents

What is a Contactless Card?

Contact Less is a chip credit/debit card with the wifi/wave symbol

Contactless payments offer the same level of protection as Chip & PIN payments.

Note: There is no difference in using the Contactless card for amounts more than Rs 5000(from 1 Jan 2021, earlier was 2000), or using the card at ATM or on the Internet.

- For the amount to pay on using Contactless card for more than Rs 5000(from 1 Jan 2021, earlier was 2000) one has to use PIN even for machines with contactless technology.

- For ATM transactions you need to enter the PIN

- For Internet transaction, you need to enter your OTP or password.

Various payment systems call this technology differently: MasterCard Worldwide calls it PayPass while VISA calls it payWave.

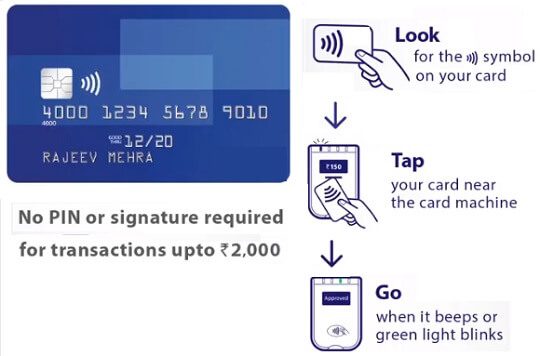

How to use ContactLess Card?

Using contactless payment is like how employees use their ID card to enter the office by showing their ID card over a terminal by the door. Contactless payment method works on the same principle. Steps to use the Contactless Card are as follows

- Step 1: Look for the contactless logo (wifi logo ) at the merchant machine called as the point of sale(POS).

- Step 2: The cashier enters your purchase amount into the terminal. This amount will be displayed on the contactless reader.

- Step 3: Hold your card over the reader or at the POS at close range (less than 4 cm from where the contactless logo appears).

- Step 4: Four green indicator lights or a beep sound will indicate when the transaction is complete. A message will also be displayed on the screen indicating the transaction is complete. No PIN is required for amounts less than Rs 5000(from 1 Jan 2021, earlier was 2000)

Video on How to use ContactLess cards?

Where are ContactLess Cards popular?

Contactless smart cards that function as stored-value cards are becoming popular for use as transit system farecards, such as the Oyster card in London or RioCard, used in the transport system of Rio de Janeiro state, Brazil. In fact, in the U.K., contactless cards which were introduced in 2007 have toppled cash and coins as the No. 1 payment method, according to July 2017 figures from the British Retail Consortium.

Countries like Australia, New Zealand, Taiwan and Singapore do over 50 per cent transactions with contactless cards

Globally, over 1.5 billion contactless payment cards are expected to be issued by the end of 2018 and will account for 50 per cent of all payment cards shipped.

Contactless Cards in India

Visa Contactless card was launched in India in 2015. Visa revealed that the acceptance infrastructure for such cards has crossed one million terminals and over 20 million consumers across India across in 2018. With more banks currently issuing contactless cards, Indian consumers are now experiencing a faster way to pay at supermarkets, dining, entertainment venues and retailers such as Big Bazaar, Reliance Retail, PVR, Vishal Mega Mart etc.

The government’s push towards digital payments was further strengthened with a directive in July 2018 to consider adding NFC (contactless) capabilities, in addition to the EMV chip feature, and for all cards being upgraded as part of the RBI mandate to replace all existing magstripe cards by December 2018.

FAQ on ContactLess Cards

Can I use my contactless card if the purchase amount is more than Rs 5000(from 1 Jan 2021, earlier was 2000)?

If your purchase size is more than Rs 5000(from 1 Jan 2021, earlier was 2000), you will be asked to Input your Debit Card/Credit Card PIN and if the amount size is less than Rs 5000(from 1 Jan 2021, earlier was 2000), you need not input your Card PIN.

If I have more than one contactless card will I be charged from both the cards?

No, as contactless readers will only communicate with one card at a time. If the shop’s reader finds more than one contactless card in your wallet or purse, you will be asked to select one card. The card reader is designed to reject a payment where it can see that there is more than one contactless card present, a red light will be shown on the reader to tell you the payment has not complete and the terminal will say ‘please present one card only’. To prevent this from happening, make sure that you only use the card that you wish to pay with.

Will I be charged if I walk past the contact card reader machine?

No, the cashier will have to put in the amount in the terminal to activate the reader before the card can be tapped. Also, the card must be held within 4 cms of the contactless reader.

Can I be charged more than once for the same transaction if I pay using a contactless card?

No, Once your card is used to pay for a transaction, the transaction is cleared from the POS machine. The machine can read only one card at a time for each transaction. You may be asked to try your contactless card again if the first attempt to pay was unsuccessful but you only pay for a transaction once.

What happens if my Contactless Card is stolen?

If your card is stolen or lost, someone might be able to use it to make contactless purchases. This makes it even more important to report your card to your provider and get it blocked as soon as you notice it’s missing.

How can I get a Contactless card?

Get in touch with your bank/financial institution to see if contactless Credit/Debit card is an option for you.

But I saw a video showing ContactLess card are not safe?

A video tweeted by business tycoon Anand Mahindra on Jul 27, 2018, raised questions about the security of the contactless card. The video shows a man secretly tapping the pocket of another man and completing a transaction. The man from whose pocket the card is ‘tapped’ stands unaware of what has happened. The man shooting the act asks people to be ‘beware’ of such a fraud. Looking at the video it can be concluded that it has not been shot in India.

TR Ramachandran, country head, Visa South Asia in his reply to Mahindra’s tweet said, “It can’t really happen. Such a trick would be liable for prosecution.” Ramachandran also attached a video in his tweet, separating myths from the reality of the contact-less cards, which you can see here.

Is this really possible? Scary stuff. On the other hand, the next time a cashier gives me grief and asks for my pin code I would be happy to turn and show my rear…😃 pic.twitter.com/ILXHxqI5Sq

— anand mahindra (@anandmahindra) July 27, 2018

How does ContactLess Card work?

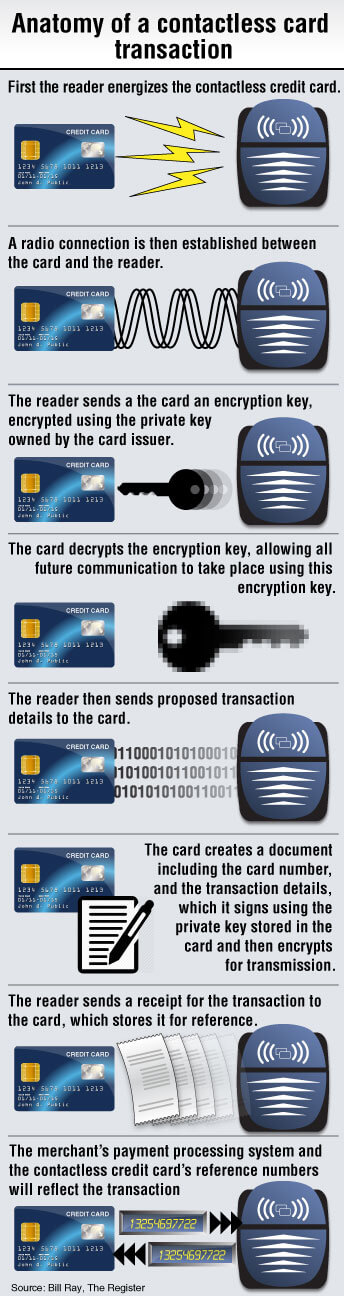

Contactless credit/debit cards have a chip inside them that emits radio waves and an antenna connect with a contactless reader. This is known as radio frequency identification (RFID) technology. To pay for something with a contactless credit card, you hold the card near a payment terminal (known as an RFID reader) and it picks up the signal, communicates with the card.

To process the payment it uses public-key cryptography, typically RSA cryptography. Each card contains a unique public and private key pair that is used during authentication. The payment terminal will say if the payment was successful or not. Infographic from A breakdown of contactless payments explains the process.

Are there other methods of contactless payments?

Contactless payment systems are credit cards and debit cards, key fobs or key chains, smart cards, or other devices, including smartphones and other mobile devices, that use radio-frequency identification (RFID) or near field communication (NFC, e.g. Samsung Pay, Apple Pay, Google Pay, Fitbit Pay, or any bank mobile application that support Contactless) for making secure payments

Related Articles:

- Choosing the best credit card: Annual Fee, Reward points,Cashback, APR

- What is Unified Payment Interface or UPI?How to use it?

- Go Cashless:Digital Wallets, NEFT,IMPS,UPI, Debit Cards,Credit Cards

- How Credit/Debit card is Verified when it is Swiped?

- Rupay card: Difference from Visa, Master, One Nation One Card

- How India pays: Cash, Cheque,NEFT,Cards etc

- Compound interest: How it can be your friend or your enemy

- HOW TO WRITE A CHEQUE

4 responses to “Contactless Card: Pay Without Pin while using Credit and Debit Card”

can you pay with a debit card without putting in your pin

Yes, you can.

Did you try and did you face any problems?

Amazing blog. You are doing such a great job by providing such informative content. Everybody needs to know about the contactless card, what is it, how to use it, and, more. You must check steps for regions card activation.

[…] Contactless Card: Pay Without Pin on using Credit and Debit Card […]