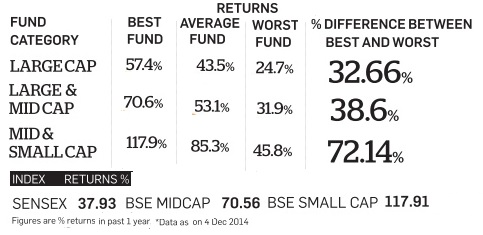

Does choice of mutual fund matters? What do you think would be the difference between funds with best returns and funds with worst returns? 5% 10% 20%? Is it same across categories in returns i,e difference between large cap, large & mid cap,mid-cap same? Well In the last one year difference between the best and worst Mutual Fund Matters is given below

The story is repeated across 5 year returns. From ET Wealth of Dec 8 2014, Leaders and Laggards based on 5 year returns are as follows. (Click on image to enlarge). our article Not All Mutual Funds Do Well -the Laggards talks how to find Mutual Funds that are not doing well.

Where can we get information about the best and worst funds?

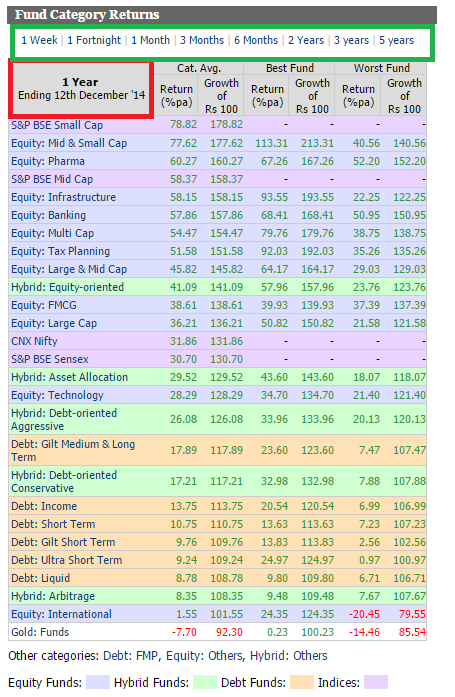

Valueresearchonline provides the information of average,best,worst returns across various time categories such as 1 week, 1 fortnight, 1 month, 3 months, 6 months,1 year, 2 years, 3 years, 5 years as shown in image below. The selected time frame is marked in red and other time frames in green.

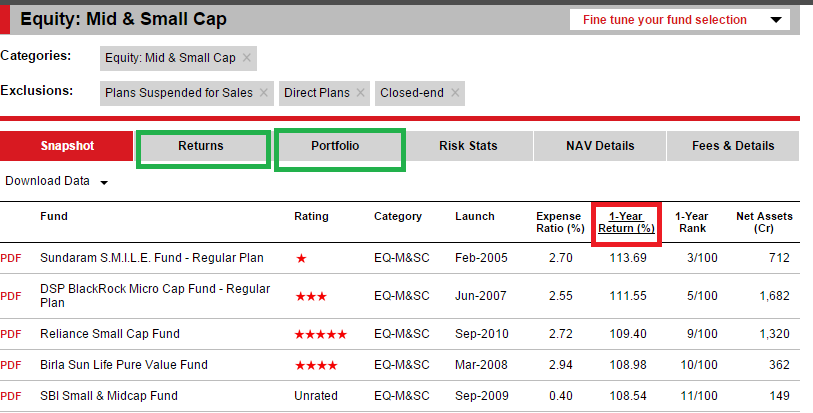

Clicking on each category will provide you link to all funds in the category which you can sort based on various parameters. For example clicking on Equity Mid & Small Cap takes me to webpage dedicated to funds belonging to Equity Mid & Small Cap . One can then select various tabs like Returns, Portfolio etc (highlighted in Green). One can also sort columns. For example in SnapShot Tab clicking on 1 Year Returns gives me following table (as on 16 Dec 2014) Click on image to enlarges

Reason for Good performance of Mutual Funds

Indian Stock market is on full swing. Sensex and Nifty are near all time high. A new government at the Centre and robust foreign fund inflows have been fuelling the rally in the domestic equity market. As an eventful year draws to a close, the foreign institutional investors have made a net investment of nearly Rs. 1.05 lakh crore so far in 2014 and a further Rs. 1.6 lakh crore into debt markets, resulting into a total of over Rs. 2.6 lakh crore (USD 43.4 billion). Due to the rally in the stock market, Mutual funds in Indian equities have had a good run in 2014. While Mutual funds that invested in large-cap stocks have delivered 40 per cent gains on average. But the funds that bet on midcap and small-cap stocks have given returns of nearly 80 per cent since last December. And funds that gave great returns dumped defensive themes such as IT and pharma and loaded up on cyclical themes such as financials, capital goods, auto and cement.

Last week (Dec 7-Dec 12) the crash in crude oil prices brought Equity markets on a slippery slope . The slide in consumer price inflation in India is a positive but the sharp contraction in industrial production has been a shocker. Investors are wondering if the long-awaited correction is finally here. As a thumb-rule, correction is when markets fall at least 10 per cent and bear run starts when decline is more than 20 per cent.

Which are the best funds to invest?

Googling will give many choices but remember There is risk involved in investing in equity mutual funds. Infact risk is in every investment including Bank Fixed Deposits. (Actually Everything is risky, from choosing a life partner to taking the road . But we seem somewhat adamant when it comes to investing). Please remember that when markets perform well, smaller stocks make big gains than the front-lines. But during times of uncertainty, greater losses are seen in mid and small-cap stocks. Also During a bull run most funds perform well. Warren Buffett, famously observed YOU only find out who is swimming naked when the tide goes out . We must also realise that any given fund may not be the best performer all the time. And one must also check a fund’s performance during a bear phase also. So don’t chase the toppers but stick to a fund for its consistency. Consistently run fund will not be among the top funds all the time (it will usually be,technically, in the second quartile most of the time). Invest in mutual funds for the longer term but do review the performance of the funds in which you have invested at least once a year.

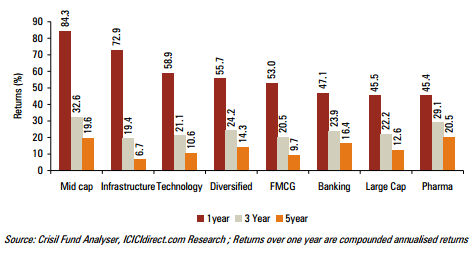

The returns of the funds across various categories,Mid Cap, Diversified,Large Cap, Sector funds across various time periods are shown in image below

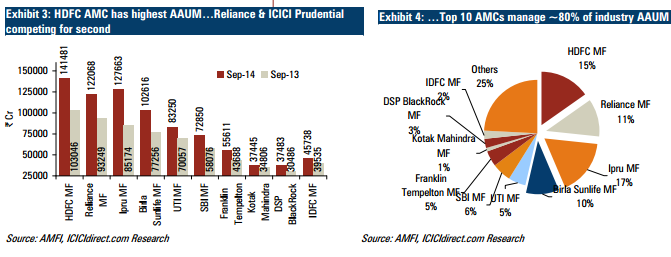

Top 10 Mutual Fund companies,Asset Management Companies (AMC) manage 80% of the funds in Mutual Fund Industry with HDFC being the leader and Reliance and ICICI competing for second place as shown in image below.

Reference : ICICIDirect Mutual Fund Review

Related Articles :

- Why Mutual Funds in India are not popular

- How to Choose Mutual Fund : Ratings, Fund House,Size

- Growth and Dividend Option in Mutual Funds

- Investing in Equities: Stocks vs Mutual Funds

- Rantings of a Mutual Fund Investor

- Mutual Fund Manager’s Limitations

Risk, return and diversification are fundamental ideas that each investor has to learn. One way of protection is diversification. All companies, all mutual funds don’t go bad at the same time. We all know that here is no guarantee in finance. There is not much in trying to forecast the future. Even the best Mutual Funds can give less returns, and great markets can fall. To invest means accepting that returns will always come with risks, and that diversification is more sensible than mindless speculation about the future. So which funds do you invest in and how do you choose your find. Do you diversify? Do you track the performance of the funds? When do you decide that this fund needs to be added or removed

3 responses to “Best and Worst Mutual Funds : Difference in returns”

It is surprising how choice of mutual fund can affect the returns. Market is full of inefficient mutual funds and you to study the options carefully before investing. The author has given the link where you can find mutual funds with best returns. He has also given many open sources of data which will help me to take better investment decisions.

Good article. In my opinion the best mutual fund to invest in depends on the investor’s risk appetite. So an equity based mutual fund might be the best option for some investors where as a Debt or fixed income fund could be the ideal option for a risk averse investor.

Yes Infact that is the best approach. Infact Outlook has come out with list of Mutual Funds based on Investor Type. Our article Choosing Mutual Funds based on Investor Type explains it in detail.