Annexure K of EPF is a document that contains details of the EPF account. It is useful during the transfer of EPF from or to exempted private trusts. This article talks what is Annexure K, It’s usefulness. How to get it?

Table of Contents

Annexure K

Annexure K is an internal document sent between regional EPF offices during the transfer of the EPF accounts. Changing Jobs:Take Care Of Bank Account,Tax Liability explains in detail what you need to do when you change jobs

Exempted organizations are the organization in which the private PF trusts maintain their workers’ PF money and account themselves. They are called exempted establishments because they are exempted from filing PF returns.

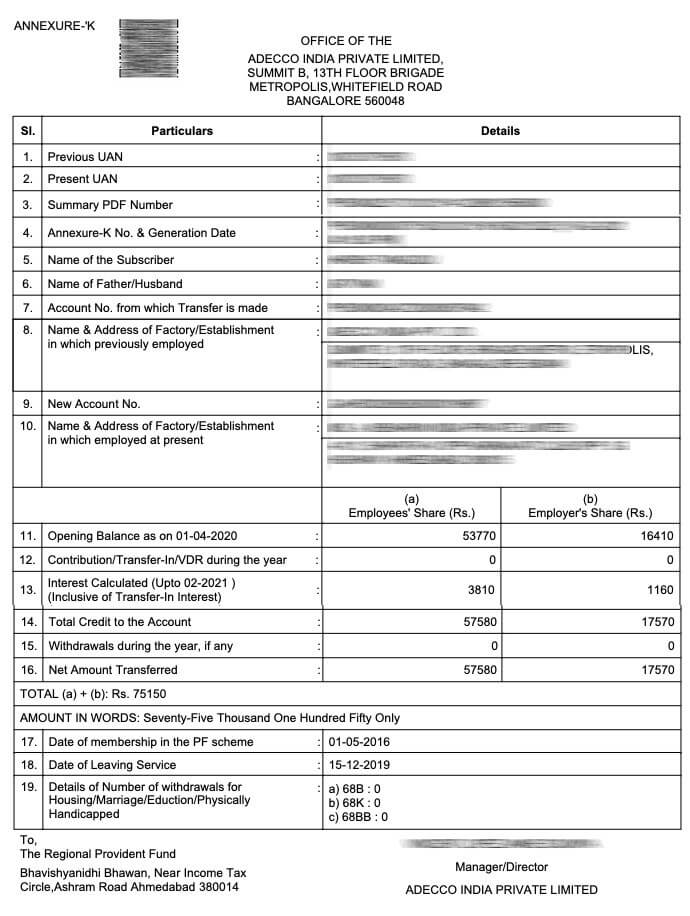

Sample Annexure-K is shown below.

Exempted and Unexempted EPF, EPF Trust

When you transfer your PF amount from a normal establishment(unexempted establishment) to a PF trust(exempted establishment), then the new employer i.e exempted one will ask you to submit the annexure K.

The private PF trusts maintain their workers’ PF money and account themselves. They are called exempted establishments because they don’t have to file PF returns. You cannot withdraw PF from the exempted establishment on the UAN member portal. To withdraw PF from exempted establishments visit your HR department

Our article EPF Trust, Exempted EPF, UAN, Transfer, Passbook covers the EPF Trust in detail

| Exempted Establishment | Unexempted Establishment |

| Companies that maintain their own EPF trust | Companies where PF is managed by the EPFO(Employee provident fund organization) |

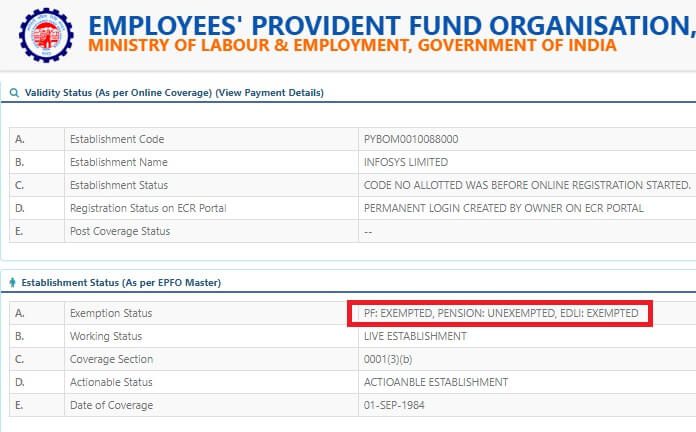

To know if your company is exempted or unexempted

- Go to http://www.epfindia.gov.in/

- Click on Our Services->Employers

- Click on Establishment Search

- Find your organization by entering the Establishment name/code

Now click on view details and under establishment status you can know whether that establishment is exempted or not.

Getting Annexure K of Employer which is Unexempted by Logging

If you are working in a company that does not have its own EPF Trust, Unexempted Organizations, you can get the Annexure-K by logging in to UAN website.

Go to online services on the menu bar and click on download Annexure K.

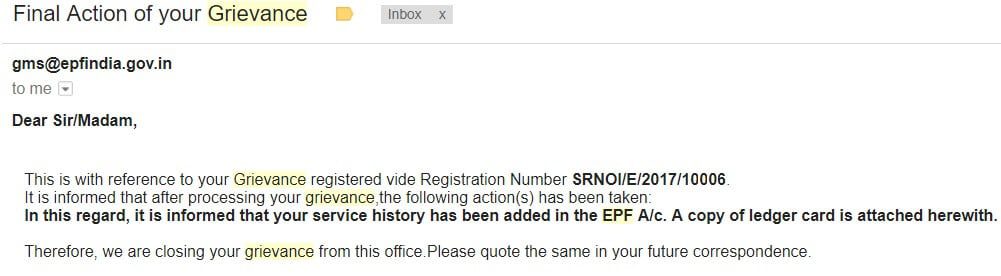

Getting Annexure K of Employer which is Unexempted by Raising Grievance

- Click on the Register Grievance to register EPF complaints. To lodge the complaint you must have your EPF UAN number. This has been made mandatory from 1 January 2016.

- Our article How to register EPF complaints at EPF Grievance website online explains the process in detail.

Reply to EPF grievance

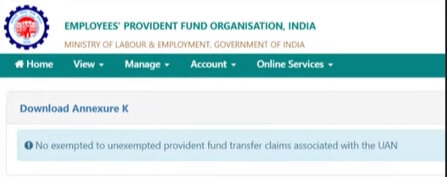

I cannot see the Annexure K

You will see Annexure K only if you transfer PF from exempted to the unexempted establishment. Else after logging in to the UAN portal you will see the following message.

Related Articles:

All About EPF,EPS,EDLIS, Employee Provident Fund

4 responses to “What is Annexure K of EPF? How is it related to EPS transfer?”

EPF account transferred before 5 years, but still not able to see, Annexure K online, do i really need to visit EPFO office, which is far 1000 km from my current location? Can i get it at home, without visiting the EPFO office?

IS EPF Annexure K is different from EPS Annexure K

Good article but it doesn’t talk about Eps annexure k. Can you please help.

Please elaborate on EPS Annexure-K.