SENSEX is regarded as the pulse of the domestic stock markets in India. In this article we shall see the history of Sensex the ups and downs of Sensex. We shall also see some of the biggest one day (intra day) falls. We shall also look at Foreign angle that of Foreign Institutional Investors (FIIs) and talk about Future prospects.

Table of Contents

Sensex

Most of the trading in the Indian stock market takes place on its two stock exchanges: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). The BSE has been in existence since 1875. The NSE, on the other hand, was founded in 1992 and started trading in 1994. BSE SENSEX, also called the BSE 30 or simply the SENSEX, is a free-float market capitalization-weighted stock market index of 30 well-established and financially sound companies listed on Bombay Stock Exchange (BSE). The 30 component companies are some of the largest and most actively traded stocks, are representative of various industrial sectors of the Indian economy. Published since January 1, 1986, the SENSEX is regarded as the pulse of the domestic stock markets in India. The base value of the SENSEX is taken as 100 on April 1, 1979, and its base year as 1978-79. Our article Stock Market Index: The Basics talks about . What is index? How is it calculated? Wikipedia Sensex is a good reference.

Why is Sensex rising?

Equity share prices have gone up in the past year partly because there are more buyers in the market. From pumping about Rs4,000 crore a month into mutual funds through systematic investment plans (SIPs) in January 2017, investors were putting in around Rs6,000 crore a month by end of 2017. Demonetization also led people to invest more in financial assets. Among various asset classes, financial assets outperformed. Gold and real estate didn’t return much. So there has been a generational change in…preference for financial assets,

Almost every new investor wants to invest in equity. It’s a frenzy. We advise new investors to invest in equity funds only if they have a 10-year horizon, but many are not convinced. Also, debt yields are rising, so bond funds have suffered; investing in equity and debt these days, have to be done cautiously,

Rising equity markets led to equity mutual funds giving good returns the past year. On average, diversified equity funds returned 30% last year. On a 5-year basis, equity funds returned 15%. Every time markets rise by 2,000 points, do sell some of their equity holdings and perhaps prepay your loans or just go on a holiday. Whatever you’ve wanted to buy and couldn’t afford, this is the time to buy. Ensure that you don’t allocate to equities more than your risk appetite.

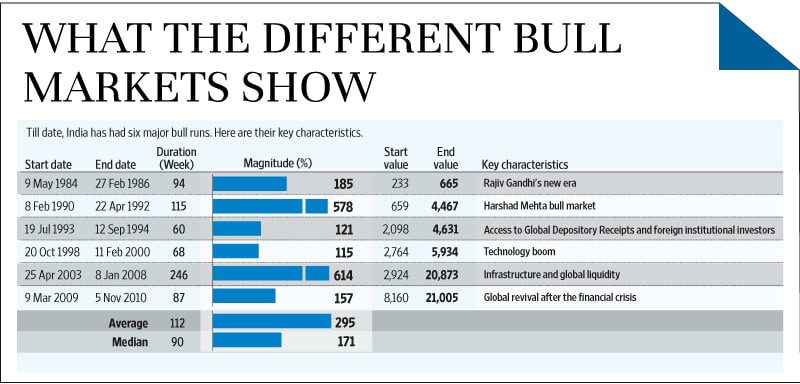

Reasons for Sensex Bull markets

First, it has been a year since the market took off post the ‘pause’ in the closing months of 2016, and history shows that bull markets seldom last more than two years post the pause. Secondly, the “champion” sector in the rally tends to rocket up in the final stages of a bull market; we are seeing such behaviour in the financial sector. Thirdly, the trailing P/E of the market as a whole rises sharply in the final phase. Over the past 12 months, the trailing P/E of the Sensex has risen from 17x to 24x. It is difficult to time the top of the market but to the extent that history is a guide, we seem to be in the final stages of this rally that began in September 2013.

In 1991 and 1999, the stocks markets rallied mainly due to liberalisation in early 1990s and tech mania in early 1999. From a level of around 2950 in April 2003 it went up 7 times to around 21200 in Jan, 2008. This rise was unprecedented. This created lots of wealth for a selected group of investors and even attracted some investors who had kept away from stock market all through their life. Just when experts started talking about the rise of Sensex to level of 25000 levels, global recession hit stock markets badly. In barely six months time, Sensex came down to 8000. And it is slowly crawling to 18,000+ levels. We are often told that Sensex gives double digit returns , the only asset class that beats inflation. Capital Mind in The Great Indian Stock Market Story was only 5 good years says Nearly all of the growth in India’s markets were between 2003 and end 2007. If you remove this period from the market, the rest has given substandard returns. Of course individual stocks have given great returns. But if you weren’t part of the great part of the story, you probably don’t like the markets too much.

“Equity gives good returns in long term” but how long is long term – 5 years, 10 years. Jagoinvestor Worst 5 yr period in Stock markets – Are you happy with your Investments ? shows for Nifty (results are similar for Sensex) So is timing in the market important?

Rolling Returns of Sensex HDFCFund:Sensex rolling return calculator can calculate rolling returns of Sensex from any date between 03 Apr 1979.

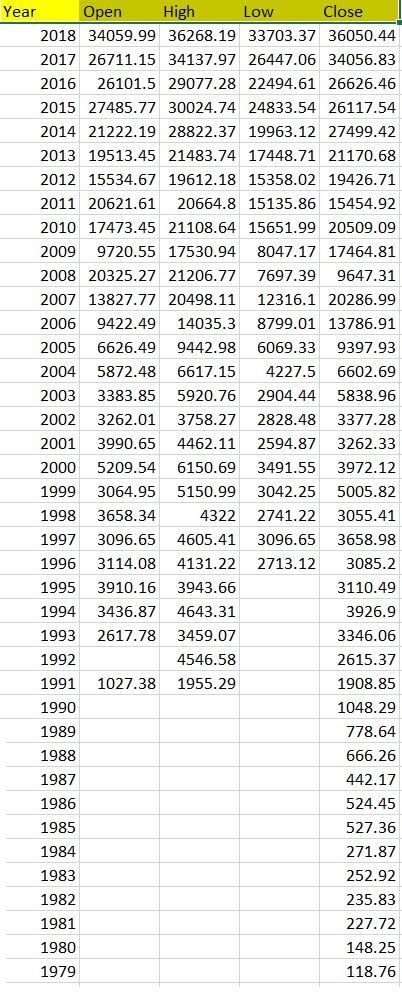

Sensex Yearly Data

The historical data of SENSEX and other BSE indices can be obtained from BSE Indices Historical Data

Sensex open and close for each year from 1991 to Jan 2018 is as follows:

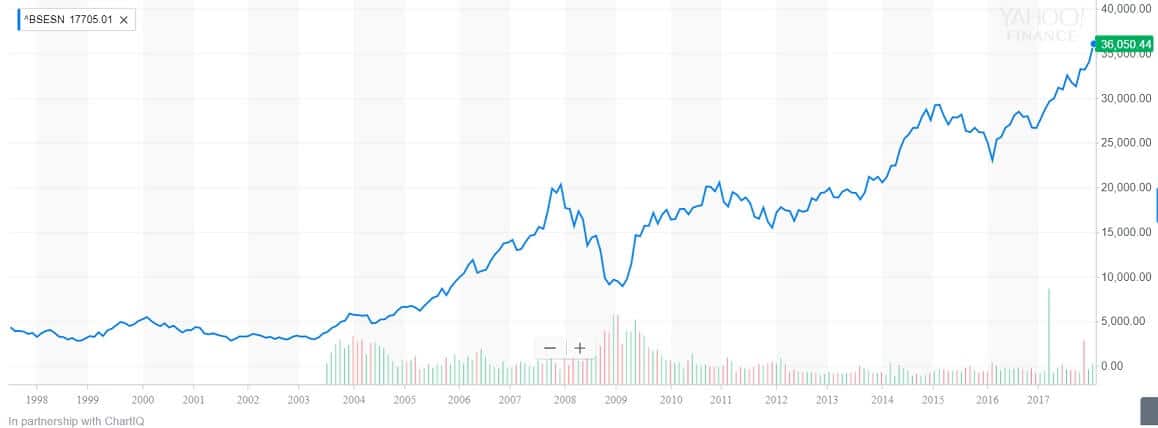

Data from 1997 to Aug 2015 when plotted by Yahoo Finance appears as follows from (Click on image to enlarge)

Sensex Milestones

The following is a timeline on the rise of the SENSEX through Indian stock market history from Wikipedia

- 36,000, 23 January 2018 – The SENSEX closed at 36,139.98, for its first close above the 36,000 level

- 35,000, 17 January 2018 – The SENSEX closed at 35,081.82, for its first close above the 35,000 level.

- 34,000, 26 December 2017 – The SENSEX closed at 34,010.62, for its first close above the 34,000 level.

- 33,000, 25 October 2017 – The SENSEX closed at 33,042.50, for its first close above the 33,000 level.

- 32,000, 13 July 2017 – The SENSEX closed at 32,037.38, for its first close above the 32,000 level, on 13 July 2017.

- 31,000, 26 May 2017- The SENSEX crossed record 31,000 level for the first time on 26 May 2017 and reached its peak of 31,074.07, before closing slightly lower at 31,028.21.

- 26 April 2017 – The SENSEX closed at 30,133.35, for its first close above the 30,000 level.

- 30,000, 4 March 2015 – The Sensex breaches 30000 mark following steps taken by the Reserve Bank of India in cutting the repo rates.

- 29,272, 23 January 2015 – BSE Sensex today set a new high of 29,408 points and all-time closing high of 29,278.84, up 272.82 points

- 28,000, 5 November 2014 – The SENSEX crossed 28,000 mark, on 5 November 2014. One week later, on 12 November 2014, the index would close above the milestone for the first time. This is the seventh 1000-point milestone the index has crossed in 2014, breaking the six 1000-point record set in 2007.

- 27,000, 2 September 2014 – The SENSEX closed at 27,019.39, for its first close above the 27,000 level, on 2 September 2014. This is the sixth 1000-point milestone the index has crossed in 2014, tying a record set in 2007.

- 26,000, 7 July 2014- The SENSEX crossed record 26,000 level for the first time on 7 July 2014 and reached its peak of 26,123.55, before closing slightly lower at 26,100.08, in anticipation of strong reformatory budget by the new government.

- 25,000, 16 May 2014 – The SENSEX crossed record 25,000 level for the first time, on 16 May 2014 and reached its peak of 25,364.71 due to winning of the BJP led NDA government by a staggering record marginal difference of all times. However, it closed well below the 25,000 mark. Still, the index closed at its all-time high of 24,121.74, for its first close above 24,000 points. The SENSEX closed at 25,019.51, for its first close above the 25,000 milestone on 5 June 2014

- 24,000, 13 May 2014 – The SENSEX crossed record 24,000 level for the first time, on 13 May 2014 and reached its peak of 24,067.11 due to sustained capital inflows by foreign funds at the domestic bourses and widespread buying by retail investors after exit polls showing the BJP-led NDA forming the government lifted the key indices to new highs.However it closed at a little low at 23,905 points

- 12 May 2014 – The SENSEX closed at its record all-time high of 23,551, a rise of 2.42%(+556.77 points) intraday due to continued fund inflows on hopes of a stable government.

- 23,000, 9 May 2014 – The SENSEX crossed record 23,000 level for the first time, but close just short of the milestone level, on 9 May 2014. The index would close well above the 23,000 mark during the following session.

- 22,000, 24 March 2014 – The SENSEX on 10 March 2014 crossed the 22,000 mark for the first time during intra-day trading. However, it was on 24 March 2014 that the index finally closed above the milestone at 22,095.30.

- 13 March 2014 – The SENSEX closes higher than the Hang Seng Index, to become the major Asian stock market index with the highest value, for the first time ever.

- 19 February 2013 – SENSEX becomes S&P SENSEX as BSE ties up with Standard and Poor’s to use the S&P brand for Sensex and other indices.

- 21,000, 5 November 2010 – The SENSEX on 8 January 2008 crossed the 21,000 mark for the first time, reaching an intra-day peak of 21,078 points, before closing at 20,873. However, it was not until 5 November 2010 that the SENSEX closed at 21,004.96, for its first close above 21,000 points. This record would stand for nearly three years, until 30 October 2013, when the SENSEX closed at 21,033.97 points.

- 20,000, 11 December 2007 – The SENSEX on 29 October 2007 crossed the 20,000 mark for the first time during intra-day trading, but closed at 19,977.67 points. However, it was on 11 December 2007 that it finally closed at a figure above 20,000 points on the back of aggressive buying by funds.

- 19,000 15-Oct-07 The index gained the 1,000 points in just four trading days.

- 18,000 9-Oct-07 It took just 8 days to cross 18,000 points from the 17,000 mark.

- 17,000 26-Sep-07

- 16,000 19-Sep-07

- 15,000 July 6, 2007 SENSEX on July 6, 2007 crossed 15,000 mark.It took seven months for the Sensex to move from 14,000 to 15,000 points.

- 14000 December 5, 2006 SENSEX on December 5, 2006 crossed 14,000. It took 36 days for the Sensex to move from 13,000 to the 14,000 mark.

- 13,000 October 30, 2006 It touched a peak of 13,039.36 and finally closed at 13,024.26.It took 135 days for the Sensex to move from 12,000 to 13,000 and 123 days to move from 12,500 to 13,000.

- 12,000 April 20, 2006 SENSEX on April 20, 2006 crossed 12,000 and touched a peak of 12,004 points during mid-session at the BSE for the first time.

- 11,000 March 27, 2006 SENSEX on March 21, 2006 crossed 11,000 and touched a peak of 11,001 points during mid-session at the BSE for the first time. However, it was on March 27, 2006 that the SENSEX first closed at over 11,000 points.

- 10,000, 7 February 2006 – The SENSEX on 6 February 2006 touched 10,003 points during mid-session. The SENSEX finally closed above the 10,000 mark on 7 February 2006.

- 9000, 9 December 2005 – The SENSEX on 28 November 2005 crossed 9,000 and touched a peak of 9,000.32 points during mid-session at the Bombay Stock Exchange on the back of frantic buying spree by foreign institutional investors and well supported by local operators as well as retail investors. However, it was on 9 December 2005 that the SENSEX first closed at over 9,000 points.

- 8000, 8 September 2005 – On 8 September 2005, the Bombay Stock Exchange’s benchmark 30-share index – the SENSEX – crossed the 8,000 level following brisk buying by foreign and domestic funds in early trading.

- 7000, 21 June 2005 – On 20 June 2005, the news of the settlement between the Ambani brothers boosted investor sentiments and the scrips of RIL, Reliance Energy, Reliance Capital and IPCL made huge gains. This helped the SENSEX crossed 7,000 points for the first time.

- 6000, 11 February 2000 – On 11 February 2000, the information technology boom helped the SENSEX to cross the 6,000 mark and hit an all-time high of 6,006 points. This record would stand for nearly four years, until 2 January 2004, when the SENSEX closed at 6,026.59 points.

- 5000, 11 October 1999 – On 11 October 1999, the SENSEX crossed the 5,000 mark, as the Bharatiya Janata Party-led coalition won the majority in the 13th Lok Sabha election.

- 4000, 30 March 1992 – On 30 March 1992, the SENSEX crossed the 4,000 mark and closed at 4,091 on the expectations of a liberal export-import policy. It was then that the Harshad Mehta scam hit the markets and SENSEX witnessed unabated selling.

- 3000, 29 February 1992 – On 29 February 1992, the SENSEX surged past the 3,000 mark in the wake of the market-friendly Budget announced by Manmohan Singh.

- 2000, 15 January 1992 – On 15 January 1992, the SENSEX crossed the 2,000 mark and closed at 2,020 followed by the liberal economic policy initiatives undertaken by the then finance minister and Former Prime Minister of India Dr Manmohan Singh.

- 1000, 25 July 1990 – On 25 July 1990, the SENSEX touched the four-digit figure for the first time and closed at 1,001 in the wake of a good monsoon and excellent corporate results.

Sensex fall from 21000 to 8000

Sensex fell from 21,000 on Jan 21, 2008 to hit 7,697.39 and end at 8,509.56 on Oct 27, 2008. From Yahoo Finance Jan 2008 to Dec 2008 the chart of fall is as follows

| Jan 21, 2008 | Sensex saw its highest ever loss of 1,408 points at the end of the session on Monday. The Sensex recovered to close at 17,605.40 after it tumbled to the day’s low of 16,963.96 |

| Jan 22, 2008: | The Sensex saw its biggest intra-day fall on Tuesday when it hit a low of 15,332, down 2,273 points. However, it recovered losses and closed at a loss of 875 points at 16,730 |

| Mar 17, 2008 | Sensex below 15000 and ended at 14,810 |

| Jun 24, 2008 | Sensex went below 14000 and on Jun 27 2008 ended at 13,802 |

| Jul 1, 2008 | Sensex went below 13000 to end at 12,962. |

| Oct 6, 2008 | Sensex went below 12000 to end at 11,802. |

| Oct 8, 2008 | Sensex went below 11000 and ended on Oct 10 2008 at 10,527. |

| Oct 17, 2008 | Sensex went below 10000 to end at 9,975.35 |

| Oct 24, 2008 | Sensex went below 9000 to end at 8,701.07 |

| Oct 27, 2008 | Sensex touched 7,697.39 and ended at 8,509.56 |

Sensex’s trek back to 18000:

After touching a low of 7,697.39 on Oct 27,2008 Sensex slowly recovered to touch 21,000 on Nov 5 2010. The chart of journey from 8k to 21k by Yahoo Finance Jan 2009 to Sep 2012 is as follows

Ref: Moneycontrol : Rise and Fall of Sensex

- 24 August 2015 — 1,624.51 points

- 21 January 2008 — 1,408.35 points

- 24 October 2008 –— 1,070.63 points

- 17 March 2008 — 951.03 points

- 3 March 2008 — 900.84 points

- 22 January 2008 — 875 points

- 6 July 2009 — 869.65 points

- 6 January 2015 — 854.86 points

- 11 February 2008 — 833.98 points

- 18 May 2006 — 826 points

- 11 February 2016 — 807.07 points

- 10 October 2008 — 800.51 points

- 13 March 2008 — 770.63 points

- 17 December 2007 — 769.48 points

- 16 August 2013 — 769.41 points

- 7 January 2009 — 749.05 points

- 31 March 2008 — 726.85 points

- 6 October 2008 — 724.62 points

- 5 May 2015 — 722 points

- 17 October 2007 — 717.43 points

- 15 September 2008 — 710.00 points

- 22 September 2011 — 704.00 points

- 11 November 2016 — 698.86 points

- 18 January 2008 — 687.82 points

- 21 November 2007 — 678.18 points

- 26 March 2015 — 654.25 points

- 3 September 2013 — 651.47 points

- 16 August 2007 — 642.70 points

- 17 August 2009 — 626.71 points

- 2 April 2007 — 617 points

- 1 August 2007 — 615 points

- 9 March 2015 — 604.17 points

- 27 June 2008 — 600.00 points

- 27 Aug 2013 — 590.05 points

- 28 April 1992 — 570 points

- 17 May 2004 — 565 points

- 24 February 2011 — 545.92 points

- 22 September 2015 — 541.14 points

- 16 December 2014 — 538.12 points

- 4 January 2016 — 537.55 points.

- 20 June 2013 — 526.41 points

- 8 July 2014 — 517.97 points

- 30 January 2015 — 498.82 points

- 9 February 2015 — 490.52 points

- 27 February 2012 — 477.82 points

- 15 May 2006 — 463 points

- 22 May 2006 — 457 points

- 31 May 2013 — 455.10 points

- 18 Nov 2013 — 451.32 points

- 19 May 2006 — 453 points

- 6 August 2013 — 449.22 points

- 16 November 2010 — 444.55 points

- 4 February 2011 — 441.92 points

- 12 November 2010 — 432 points

- 13 May 2013 — 430.65 points

- 07 Jan 2016 — 554.50 points

CapitalMind Best month for nifty since May 2009 has a very colorful chart with monthly returns since 1979. One of the reasons for the rise, fall, rise of the Stock markets is Foreign Institutional Investors (FII), so let’s learn a little more about them

Foreign Institutional Investors (FII)

FIIs (Foreign Institutional investors) refers to entities (banks, insurance companies, mutual funds etc) registered in a country other than in which they are investing. For e.g. a US Mutual Fund which invests in the Indian Stock Market. FIIs usually pool large sums of money and invest those in securities, real property and other investment assets. As bulk of their investments are in the stock market, they affects the stock market movement significantly.

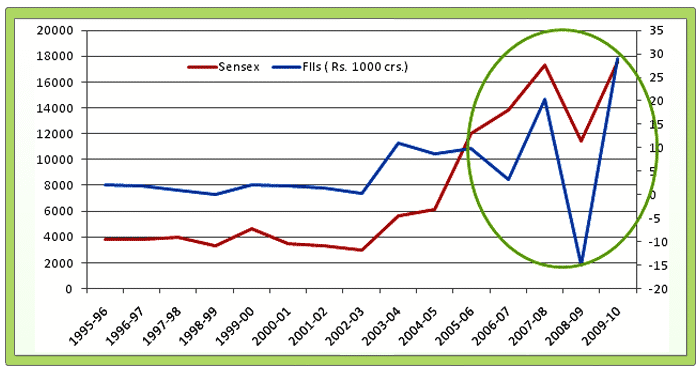

FIIs are on the lookout for investment opportunities which could give them better rates of return. Emerging markets like India, China, Brazil have been growing at a greater pace than other developed countries and subsequently offer better opportunities for the FIIs. But FII also have the potential to create chaos in the stock market. FIIs tend to exit the stock markets prompted by profit booking or negative events like liquidity concerns, fears of a crisis etc as we saw in 2008. With the Sub Prime Crisis in US, liquidity crunch or a preference to sit on cash led to a situation where many FIIs booked profits and pulled out their money. As more and more money was pulled out, it further depleted the investor confidence and the stock market tumbled to 8000 levels. Chart from Moneyworks4me Understand the FIIs movement & earn profits in the Stock Market shows correlation between FDI and stock market

Quoting from Investopedia :An Introduction To The Indian Stock Market India started permitting outside investments only in the 1990s. Foreign investments are classified into two categories:

- Foreign direct investment (FDI) :All investments in which an investor takes part in the day-to-day management and operations of the company, are treated as FDI

- Foreign portfolio investment (FPI). , whereas investments in shares without any control over management and operations, are treated as FPI.

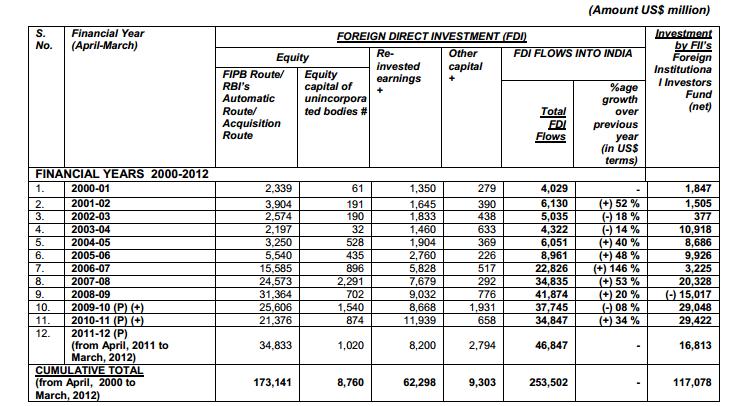

For making portfolio investment in India, one should be registered either as a foreign institutional investor (FII) or as one of the sub-accounts of one of the registered FIIs. Both registrations are granted by the market regulator, SEBI. The government of India prescribes the FDI limit and different ceilings have been prescribed for different sectors. Over a period of time, the government has been progressively increasing the ceilings. As per Statistics of FDI investments in India (pdf) the figures are as below:

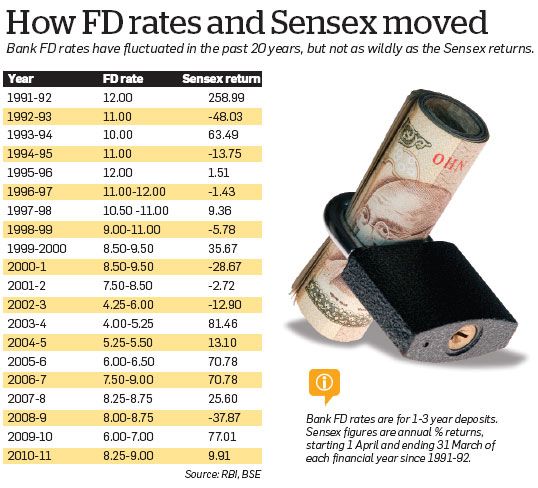

Comparing FD and Sensex

In our article Comparison of Fixed Deposits and Sensex Returns we presented varied views on the comparison of Fixed Deposits and Sensex Returns. Comparison of Fixed Deposit rates and Sensex is shown below:

Related Posts :

- Prices of Gold, Silver

- Understanding Returns: Absolute return, CAGR, IRR etc

- Stock Market Index: The Basics

- Comparison of Fixed Deposits and Sensex Returns

So once the issues are resolved, as Govt showed by reform measures in Sep 2012, will the markets grow fast, at the same pace as they did in 2003-07 phase? How much return will Stock market give in future?

3 responses to “Ups and Downs of Sensex, Reasons for Bull Runs”

A journey of a thousand miles must begin with a single step. –Lao Tzu

Very nice article indeed , thanks for putting together multiple sources and giving a broad picture.. so point is we dont know how long is a “long term” investment fruitful in equity, as per your above chart on nifty returns. some one with a 10 yr view investing in 2002 will be disappointed today…

Thanks Sorabh for encouraging words. You got the aim of the article: Invest in equity with eyes open. As you rightly said some one with a 10 yr view investing in 2002 will be disappointed today but somein with 5 years in stock market would have made lots of money.