SGBs are government securities in grams of gold, issued by the Reserve Bank on behalf of the Government of India. Official information is at the RBI webpage RBI FAQ on Sovereign Gold Bond Scheme 2015. If you have an eight-year horizon, SGBs are the best choice as you get the interest income(which is taxable) but you save LTCG tax. You can buy the SGB bonds from your bank, sold through Stock Holding Corporation of India Limited (SHCIL), designated post offices, National Stock Exchange of India and BSE, either directly or through agents. You can apply for Sovereign Gold Bonds through your Demat accounts, like ICICI Direct, Zerodha, etc.

The Government has been launching Sovereign Gold Bonds to give an alternative to physical gold to Indians. What is the Sovereign Gold Bond? How does it work? The tax implications of Sovereign Gold Bond? When was Sovereign Gold Bonds released at what price? Comparison of Sovereign Gold Bonds with other Gold investment options like Physical Gold, ETF.

Table of Contents

Upcoming Sovereign Gold Bonds in 2022-23

SGB issuances happen according to the RBI schedule. RBI will issue two tranches of Sovereign Gold Bonds. The 2022-23-Series III will open for subscription during the December 19-December 23 period and the 2022-23-Series IV during March 06-10, 2023. For December 19-December 23 period RBI has fixed the price at Rs 5,409 per gram.

The Reserve Bank of India offers a discount of Rs 50 per gm on the original value to investors paying through the digital mode.

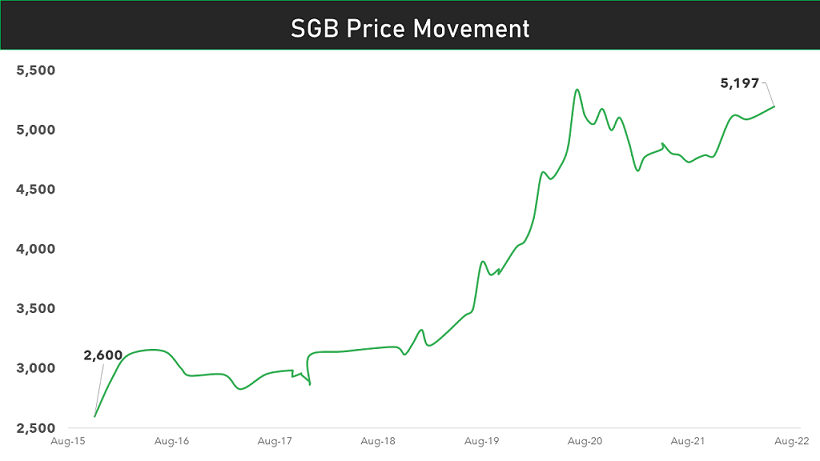

SGB Price movement is shown in the image below.

Gold prices are expected to rise due to weakness in dollar and lower US bond yield

Overview of Sovereign Gold Bonds

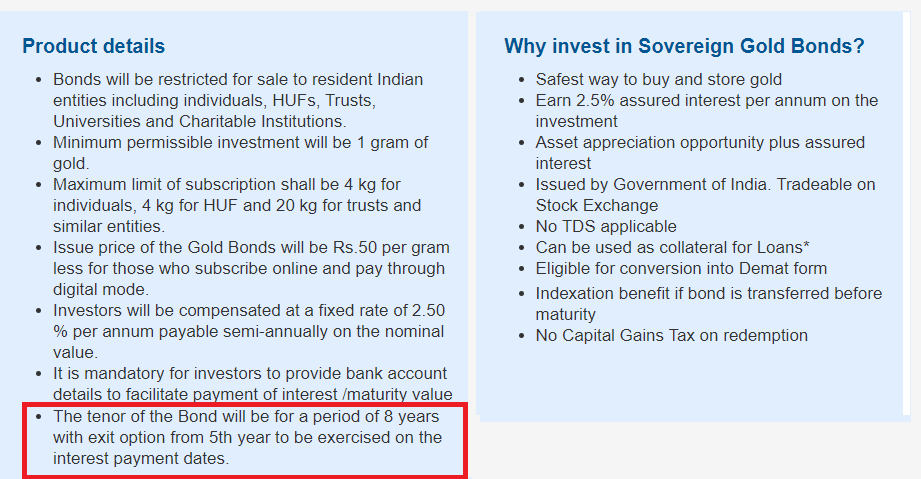

Features of Sovereign Gold Bonds are given below. Instead of buying 10 grams of gold as an investment, you buy 10-gram Sovereign Gold bond. The tenure of the bond is eight years. After eight years, when you redeem the bond you get the price of 10 grams of gold at that time. And the price of Gold is expected to rise. The price of Gold over the years is given below.

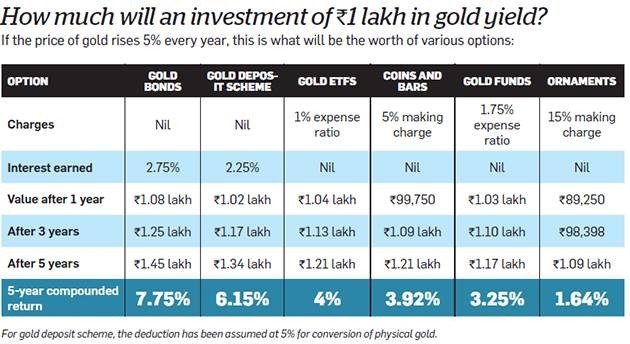

The difference between buying physical gold and bonds is that in SGB you will get 2.75/2.5 percent per annum on the investment value. Compounded over eight years, this is an extra gain of almost 25 percent. If we assume that gold prices will rise by 5%, the bonds will yield an annualized return of 7.75%.

For example, if you invest Rs 26,000 in these bonds and the price of gold becomes one and a half times in eight years, you would get back Rs 42,200, which is the gold appreciation (Rs 13,400) plus an extra Rs 6,493, which is a gain of 2.75 percent p.a. on the original Rs 26,000.

So you are better off than those who just buy physical gold.

Interest would be paid semi-annually. So if you buy Sovereign Gold Bonds worth Rs 52,000. Then annual interest at 2.5% works out to be 1300. You would be paid Rs 650 twice a year.

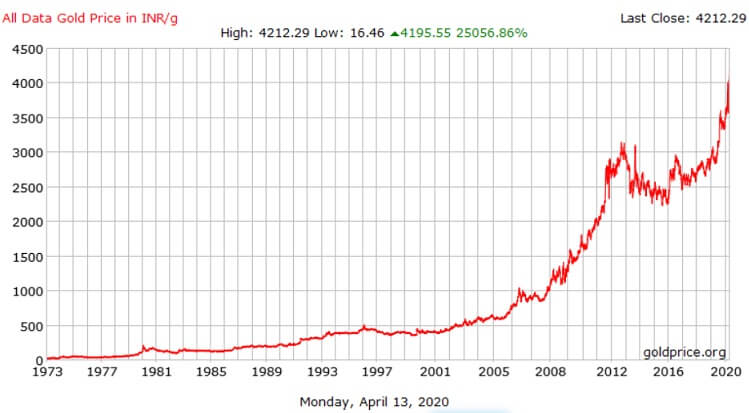

Gold price

The Gold price has been going up since 2015. The gold price had picked up in 2020 due to Covid 19. Large scale quantitative easing measures taken by various central banks have lifted gold higher. Investors demand safe havens due to fears of a global recession amid the negative economic impact of COVID 19 is expected to support the yellow metal. But moderate physical activities and a strong dollar may limit major gains. Given below is the chart of Gold price from 1973. To see prices of Gold from 1925 you can check out here. Experts recommend that Gold should be a part of your investment portfolio.

How to buy Sovereign Gold Bonds?

The investors are issued a Holding Certificate for the same. The Bonds are eligible for conversion into demat form.

How to buy Sovereign Gold Bonds on ICICIdirect

Login to website ICICIdirect.com using your login credentials.

Click on the “FD/Bonds” page to invest in Sovereign Gold Bonds online

How to buy Sovereign Gold Bonds through Zerodha

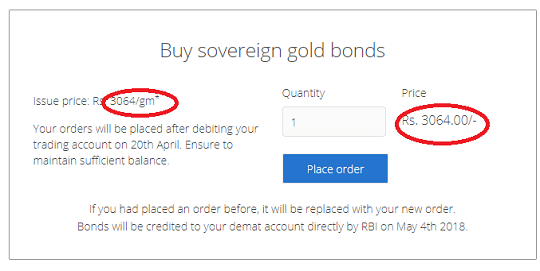

You need to log in Zerodha using your Kite credentials and enter the quantity you wish. Price of the bond depends on the issue price, as shown in the image below

Note: You need to have sufficient funds in your trading account on the day when the issue closes. Zerodha will not be funding your purchase

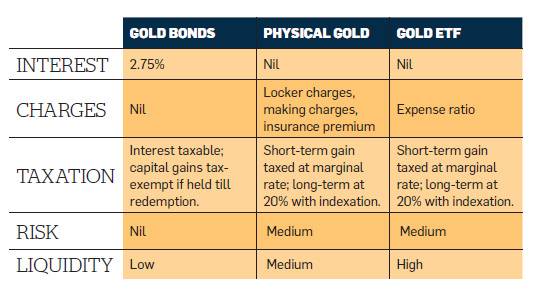

Comparing SGB with Physical gold & Gold ETFs

| Particulars | Physical Gold | Gold ETF | Sovereign Gold Bond |

| Returns/earnings | Lower than real return on gold due to making charges | Less than actual return on gold | More than actual return on gold |

| Safety | Risk of theft, wear/tear | High | High |

| Purity | Purity of Gold always remains a question | High as it is in Electronic Form | High as it is in Electronic Form |

| Tax | LTCG after 3 years | Long term capital gain post after 3 years | LTCG post 3 years. (No capital gain tax if redeemed after maturity) |

| As loan collateral | Accepted | Not accepted | Accepted |

| Tradability or exit formalities | Restrictive | Tradable on Stock Exchange | Can be traded and redeemed from the 5th year with government |

| Storage expenditures | High | Minimal | Minimal |

Why should I buy SGB rather than physical gold? What are the benefits?

Gold bond schemes provide an alternative investment option to physical gold and offer an additional interest unlike other schemes such as gold exchange-traded funds (ETFs). According to World Bank estimates, about 20,000 tonnes of gold is lying in Indian households.

There is a risk of capital loss if the market price of gold declines. However, you do not lose in terms of the units of gold that he has paid for.

- SGB is free from issues like making charges and purity in the case of gold in jewellery form.

- The SGB offers a superior alternative to holding gold in physical form. The risks and costs of storage are eliminated.

- The quantity of gold for which the investor pays is protected since he receives the ongoing market price at the time of redemption/ premature redemption.

- The bonds are held in the books of the RBI or in Demat form eliminating the risk of loss of scrip etc.

- The return is 2.5%(2.75%) over the price of gold at the time of investment, leading to compounding benefits.

- You can gift the bonds to a relative or friend on some occasion.

- You can use these securities as collateral for loans. The loan-to-value (LTV) ratio will be set equal to the ordinary gold loan mandated by the Reserve Bank from time to time.

RBI FAQ on Sovereign Gold Bond Scheme 2015

Overview of Sovereign Gold Bonds

SGBs are government securities in grams of gold, issued by Reserve Bank on behalf of the Government of India. The customers are issued Certificate of Holding on the date of issuance of the SGB. Certificate of Holding can be collected from the issuing banks/SHCIL offices/Post Offices/Designated stock exchanges/agents or obtained directly from RBI on email if email address is provided in the application form.

- Price: The price of bonds will be fixed in rupees on the basis of a simple average of closing price of gold of 999 purity published by the India Bullion and Jewellers Association for the week (Monday to Friday) preceding the subscription period. The issue price of the gold bonds will be Rs 50 per gram less than the nominal value.

- Interest: The bonds would earn an interest of 2.50/2.75 per cent per annum, credited every six months to your bank account.Last interest will be paid on maturity along with the principal.

- Tenor: The tenor of the bond will be for a period of 8 years with exit option from fifth year to be exercised on the interest payment dates.

- Minimum investment: The Bonds are issued in denominations of one gram of gold and in multiples thereof. Minimum investment in the Bond from Fourth Tranche is 1 gm. Earlier it was two grams with a maximum buying limit of 500 grams per person per fiscal year (April – March). In case of joint holding, the limit applies to the first applicant. The government has raised the annual investment limit per person from 500 gm to 4 kg, while for trusts and similar entities, it has been raised to 20 kg from tranche sold in Oct-Dec 2017

- Where to buy: The bonds will be sold through post offices, banks, Stock Holding Corporation of India (SHCIL), and recognised stock exchanges — National Stock Exchange (NSE) and BSE.

- Payment options: Payment for the bonds will be through cash payment (upto a maximum of Rs 20,000) or demand draft or cheque or electronic banking.

- Joint holders: From the third tranche the government has raised the annual investment limit per person from 500 gm to 4 kg, while for trusts and similar entities, it has been raised to 20 kg

- Eligibility: The bonds will be restricted for sale to resident Indian entities including individuals, HUFs, trusts, universities and charitable institutions.

- Loan against SGB: Bonds can be used as collateral for loans. The loan-to-value (LTV) ratio is to be set equal to ordinary gold loan mandated by the Reserve Bank from time to time.

- Nomination. Nomination facility is available as per the provisions of the Government Securities Act 2006 and Government Securities Regulations, 2007. A nomination form is available along with Application form.

- Tax treatment:

- The interest on gold bonds shall be taxable as per the provision of Income Tax Act, 1961 (43 of 1961).

- TDS is not applicable on the bond. However, it is the responsibility of the bondholder to comply with the tax laws

- The capital gains tax arising on redemption of SGB to an individual has been exempted. The indexation benefits will be provided to long term capital gains arising to any person on the transfer of bond

- However, if the bond is sold, any gains would be considered as capital gains as in case of physical gold and taxed accordingly. If the bonds are sold within 3 years of purchasing its short-term capital gains and is taxed at marginal tax rate. In case the sale is after 3 years its long-term capital gains and is taxed at 20%, with indexation benefit.

- With the introduction of GST, investment in sovereign gold bonds has become more attractive than buying physical gold. Before 1 Jul 2017, gold coins and bars were attracting VAT of 1% -1.2%. But now these will attract GST of 3% the same rate applicable to jewellery. There was 1% excise duty on gold jewellery until July 1, though there was no such tax on gold bars and coins.

History of Sovereign Gold Bonds

The Narendra Modi government launched the sovereign gold bond scheme in November 2015. The Sovereign Gold Funds launched are shown in the table below. Against the target of raising Rs 15,000 crore through the issue of gold bonds in the first year alone, the proceeds in 19 months total up to only Rs 5,400 crore.

| Name of Series | Date of Issuance | Issue Price/gm | Amount Invested | Revenue(Rs) | Symbol | |

| Interest rate was 2.75% | ||||||

| 1 | 2015-16 | Nov 2015 | Rs 2,684 | 916 kg | 246 crore | SGBNOV23 |

| 2 | 2016 (“the Bonds”) | February 08, 2016 | Rs 2600 | 3,071 kg | 798 crore | SGBFEB24 |

| 3 | Apr 2016 | Rs 2916 | 1,128 kg | 329 crore | SGBMAR24 | |

| 4 | 2016 – Series I | August 5, 2016. | Rs 3119 | 2950 kg | 919 crore | SGBAUG24 |

| 5 | 2016 – Series II | September 23, 2016 | Rs 3,115 | 2370 kg | 820 crore | SGBSEP24 |

| Interest rate changed to 2.5% |

||||||

| 6 | 2016 – Series II | 24 Oct- 2 Nov 2016 | Rs 2,957 | 3550 kg | 1,067 crore | SGBNOV24 |

| 7 | 2016 -17– Series IV | March 17, 2017 | Rs 2,893 | SGBMAR25 | ||

| 8 | 2017 -18– Series I | May 12, 2017 | Rs 2,901 | |||

| 9 | 2017 -18– Series II | July 28, 2017 | Rs 2,830 | |||

| 10 | 2017 -18– Series II | July 28, 2017 | Rs 2,780 | |||

| 11 | 2017-18 Series III | November 27, 2017

|

2,964 | |||

| 12 | Rs 3,146 | |||||

| 13 | 2018-19 Series -I | May 04, 2018 | ||||

| 14 | 2018-19 Series II | November 05-09, 2018 | ||||

| 15 | 2018-19 Series III | December 24-28, 2018 | ||||

| 16 | 2018-19 Series IV | January 14-18, 2019 | ||||

| 17 | 2018-19 Series V | November 13, 2018 | ||||

| 18 | 2018-19 Series VI | June 11, 2019 | ||||

| 19 | 2019-20 Series II | July 16, 2019 | ||||

| 20 | 2019-20 Series III | August 14, 2019 | ||||

| 21 | 2019-20 Series IV | September 17, 2019 | ||||

| 2019-20 Series V | October 15, 2019 | |||||

| 2019-20 Series VI | October 29, 2019 | |||||

| 2019-20 Series VII | December 10, 2019 | |||||

| 2019-20 Series VIII | January 21, 2020 | |||||

| 2019-20 Series IX | February 11, 2020 | |||||

| 2019-20 Series X | March 11, 2020 | |||||

Price of Sovereign Gold Bonds

| S.No. | Tranche | Date of Subscription | Date of Issuance | Issue Price per unit |

| 1. | 2021-22 Series VII | October 25–29, 2021 | November 02, 2021 | 4,765 |

| 2. | 2021-22 Series VIII | November 29-December 03, 2021 | December 07, 2021 | 4,791 |

| 3. | 2021-22 Series IX | January 10-14, 2022 | January 18, 2022 | |

| 4. | 2021-22 Series X | February 28-March 04, 2022 | March 08, 2022 |

Earlier Series

| Tranche | Date of Subscription | Date of Issuance | IssuePrice per Unit |

|---|---|---|---|

| 2021-22 Series I | May 17-21, 2021 | May 25, 2021 | 4,777 |

| 2021-22 Series II | May 24-28, 2021 | June 1, 2021 | 4,842 |

| 2021-22 Series III | May 31-June 4, 2021 | June 8, 2021 | 4,889 |

| 2021-22 Series IV | June 12-16, 2021 | June 20, 2021 | 4,807 |

| 2021-22 Series V | August 9-13, 2021 | August 17, 2021 | 4,790 |

| 2021-22 Series VI | August 30-September 3, 2021 | September 7, 2021 | 4,732 |

On October 9, 2020 Government of India announced the Sovereign Gold Bond Scheme 2020-21, Series VII, VIII, IX, X. XI, and XII. The date of issuances is given in the calendar below. The issue price is announced near the subscription date. The price of the bond is fixed in rupee terms, on the basis of the previous week’s (Monday – Friday) simple average of the closing price of gold of 999 purity published by the India Bullion and Jewellers Association Ltd.

| Sr. No. | Tranche | Date of Subscription | Date of Issuance | Issue Price per unit |

| 1. | 2020-21 Series VII | October 12 – 16, 2020 | October 20, 2020 | Rs 5,051 |

| 2. | 2020-21 Series VIII | November 09 – 13, 2020 | November 18, 2020 | Rs 5,177 |

| 3. | 2020-21 Series IX | December 28 2020 – January 01, 2021 | January 05, 2021 | Rs 5,000 |

| 4. | 2020-21 Series X | January 11-15, 2021 | January 19, 2021 | Rs 5,104 |

| 5. | 2020-21 Series XI | February 01- 05, 2021 | February 09, 2021 | Rs 4,912 |

| 6. | 2020-21 Series XII | March 01- 05, 2021 | March 09, 2021 | Rs 4,662 |

Overview of Series I to Series VI are given below.

| S. No. | Tranche | Date of Subscription | Date of Issuance | Issue Price | After discount of Rs 50 |

| 1 | 2020-21 Series I | April 20-24, 2020 | 28-Apr-20 | 4,589 | 4,539 |

| 2 | 2020-21 Series II | May 11-15, 2020 | 19-May-20 | 4,590 | 4,540 |

| 3 | 2020-21 Series III | June 08-12, 2020 | 16-Jun-20 | 4,677 | 4,627 |

| 4 | 2020-21 Series IV | July 06-12, 2020 | 14-Jul-20 | 4,852 | 4,802 |

| 5 | 2020-21 Series V | August 03-07,2020 | 11-Aug-20 | 5,334 | 5,284 |

| 6 | 2020-21 Series VI | August 31-Sept 04, 2020 | 8-Sep-20 | 5,117 | 5067 |

Trading of Sovereign Gold Bonds

Trading in the sovereign gold bond scheme, 2015 which was announced by the government of india in October 2015, commenced on NSE from Monday 13, June 2016. This will give investors an opportunity to buy and sell these gold bonds.

- It is in the cash segment of NSE. Minimum investment size in the secondary market will be as low as 1 gm. Reference price for trading will be the gold with 0.999 purity and as published by IBJA.

- These SGBs will be traded under the “G” Group of equity cash segment of the BSE, along with other government securities available for trading and settled on T+2 basis in the demat account of the investors.

The Volume of Sovereign Gold Bonds traded on NSE is shown in the image below. As you can see the volume is very less. So you would have to hold SGB until Maturity.

Comparison of Sovereign Gold Bonds of different tranches

| S.No |

Feature |

Product features for previous three tranches |

Features for the New tranche |

|

1. |

Minimum Subscription | Two grams | One gram |

|

2. |

Maximum Subscription | 500 grams (per fiscal year) | Same as previous tranche. The government has raised the annual investment limit per person from 500 gm to 4 kg, while for trusts and similar entities, it has been raised to 20 kg for third tranche from Oct – Dec 2017. |

|

3. |

Denomination of Bonds | The bonds are in denomination of 2, 5, 10, 50, 100 grams of gold or other denominations. | The bonds are in denomination of 1, 2, 5, 10, 50, 100 grams of gold or other denominations. |

|

4. |

Interest | The interest on the Gold Bonds shall commence from the date of its issue and shall have a fixed rate of interest i.e. at 2.75/2.5 percent per annum on the amount of initial investment. |

Same as before |

|

5. |

the form of issue of Gold Bonds | The Bonds will be available in a certificate of holding | The Bonds will be available both in De-mat and certificate of holding |

|

6. |

Redemption Price of the Bond | Issuance and redemption price of Bond was fixed in Indian Rupees on the basis of the price of gold of 999 purity of previous week published by the India Bullion and Jewellers Association Limited. |

Same as before |

|

7. |

Period of subscription | Three tranche has been released in FY 2015-16 (i.e. November, January and March 2016) | Subscription date for the 4th Tranche has been fixed from 18-22nd July, 2016 and the Bonds were issued on the 5th August, 2016 |

|

8. |

Premature redemption facility | Premature redemption of Gold Bond may be permitted after fifth year from the date of issue of such Bond on the date on which interest is payable; |

Same as before |

|

9. |

Receiving Offices | Scheduled commercial banks, Stock Holding Corporation of India Ltd (SHCIL), designated post offices. | BSE and NSE are included as receiving offices, apart from the commercial banks, SHCIL, designated post offices . |

|

10. |

Commission for distribution | Paid at the rate of rupee one per hundred of the total subscription received by the receiving offices. | The existing commission at one percent has been retained for 4th tranche. |

|

11. |

Tax Benefits | The interest on the Gold Bond shall be taxable as per the provisions of the Income-tax Act, 1961 (43 of 1961) and the capital gains tax shall also remain the same as in the case of physical gold. | Capital gain tax arising on redemption of SGB to an individual has been exempted.

The indexation benefit will be provided to LTCG arising to any person on transfer of bonds. |

|

12. |

Tradability | The Gold Bonds shall be eligible for trading from such date as may be notified by the Reserve Bank of India. | The Gold Bonds issued on November 30, 2015 held in dematerialized form are eligible for trading on the Stock exchanges recognized by the Government of India w.e.f. 13.06.2016.

The date of commencement of trading in respect of Bonds issued in subsequent tranches will be notified later. |

What proof will I have of investment in Sovereign Gold Bonds?

You will be issued a Certificate of Holding on the date of issuance of the SGB. Certificate of Holding can be collected from the issuing banks/Post Offices/agents or obtained directly from RBI on email if email address is provided in the application form.

Exiting From Sovereign Gold Bonds

What do I have to do if I want to exit my investment in Sovereign Gold Bonds?

In case of premature redemption, you can approach the concerned bank/Post Office/agent thirty days before the coupon payment date. Request for premature redemption can only be entertained if the investor approaches the concerned bank/post office at least one day before the coupon payment date. The proceeds will be credited to the customer’s bank account provided at the time of applying for the bond.

What are the procedures involved during redemption of Sovereign Gold Bonds?

- You will be advised one month before maturity regarding the ensuing maturity of the bond.

- On the date of maturity, the maturity proceeds will be credited to the bank account as per the details on record.

- In case there are changes in any details, such as account number, email ids, then you must intimate the bank/PO promptly.

Is the price of Sovereign Gold Bonds on purchase fixed?

The price of the bond is fixed in rupee terms, on the basis of the previous week’s (Monday – Friday) simple average of closing price of gold of 999 purity published by the India Bullion and Jewellers Association Ltd. It tracks the price of Gold.

Is the price of Sovereign Gold Bonds on maturity fixed?

No. The value of gold, like most precious minerals, fluctuates based on the law of supply and demand. The price of the bond is fixed in rupee terms, on the basis of the previous week’s (Monday – Friday) simple average of closing price of gold of 999 purity published by the India Bullion and Jewellers Association Ltd. The same procedure would be followed for calculating the redemption price for the bonds.

Sovereign Gold Bond versus Gold ETF

You pay 1% on the fund per year, but if you sell and put the proceeds in gold bonds, you earn 2.75%, and the net gain is 3.75%. However, take note of the tax implications and don’t forget that gold bonds are less liquid than ETFs. They have a tenure of eight years with an exit option after the fifth year. Purchases have to be made within the stipulated time and there is also a 500 g buying restriction per financial year.

Comparison of Gold Bond with other gold schemes such as Physical Gold, Gold ETF is shown in the image below.

The image below shows how much will an investment of Rs 1 lakh in different investment options of Gold yield

Should you invest in Gold Bonds?

Are you one of them, who considers gold as a necessary investment? Are you planning to invest in gold bars or gold coins? Do you buy gold for pure investment purpose? Then you are not bothered about the liquidity and is ok with the interest rate offered then one can look at investing in these bonds. You should invest. You will get the same return plus interest with peace of mind.

Related Articles:

- Understanding Gold:Purity,Color,Hallmark

- How Gold Ornament is Priced?

- Ways to invest in Gold

- Which Gold ETF to choose?

- Prices of Gold, Silver

- Gold : Infographics

Do you invest in Gold? Does it make sense to buy Sovereign Gold Bond? Did you invest in any of the tranches of Sovereign Gold Bonds? Are you planning to invest now?

16 responses to “All about Sovereign Gold Bonds : Gold price history, comparison with Gold ETF, Physical Gold”

Hi thanks for the info. I would like to add few points. There is a facility to add nominee in SGB. If you wish to sell the bond before maturity period you can sell it off in the secondary market, which is the stock market. For that you will need to hold the bond units in your demat account. Here long term capital gain is taxable and short term capital gain will be taxable as per your tax bracket. If it is ltcg than it will have indexation benefit. With so many benefits I think it is better to do investment in the Sovereign Gold Bond.

Thanks for the input.

Hey! Thanks for sharing and well explained about investment in Sovereign Gold Bond scheme.

[…] • Articles to Understand Income Tax, How to Fill ITR,Income Tax Notice… • Articles for Learning Investing , Basics,Investing in PPF,Stocks,Mutual Funds,Post Office,FD Site: http://bemoneyaware.com/sovereign-gold-bonds-should-you-invest/ […]

i had applied for gold bond tranche1 without demat account. ie physical form . Now i would like to convert to demat form as i would like to avail a loan against the bond. Kindly advise how to convert my bond into demat form.

Nice article but as per my view trading in Gold is better than Gold Bonds if we have certain strategies. As bonds gives only 2.75% of interest we can get more than that by gold trading. Gold trading also didn’t have certain time bound as gold bonds have we can gain immediate returns when ever we want by trading. I used to trade in Gold by taking the service from SquareIndia Advisory Pvt Ltd which helped me to get better returns what ever the market conditions may be. This can only happened by their experience and brief analysis. They also provided me with Live and Local Bullion Rates. So, i would like to suggest SquareIndia Advisory Pvt Ltd.

1) What are the reasons for the different tranches of gold bonds being traded on BSE at different rates? As i see the first tranche trading at a premium to to the other 2 ?

2) Further bonds which are bought on stock exchanges will continue to have the same benefit as when it is issued by RBI? What we would be the period of holding of such purchased bonds ?

I have applied to this scheme for fourth trench through Sharekhan Dmat. Amount was deducted on same day. But till date, I have no credit of Gold bond in my Dmat. As i read earlier, the allotment date was 5th Auguts. Can anybody guide me, When bonds will be credited.

Did you check your Demat?

HI,

I have also applied for SGB in July using zerodha online trading platform. I got an email from RBI acknowledging the purchase and it said 5th Aug is the settlement date. Till date I have not received the bonds in my demat. I am checking my demat account with CDSL everyday for this.

I checked with other sites and found the same complain that bonds have not been credited into demat account.

Need to wait a bit longer.

i am confused about this scheme but go through this i understand it easily.very good & thanks.

Very well explained.

Very well explained.

i applied for gold bond 4 trench through vijaya bank the amount got deducted from my a/c i got the subscription certificate to my email id but till now i did’nt get the allotment certificate do any one have idea when rbi will allocate the gold bond certificate?

The customers will be issued Certificate of Holding on the date of issuance of the SGB. Certificate of Holding can be collected from the issuing banks/SHCIL offices/Post Offices/ National Stock Exchange of India Ltd. and Bombay Stock Exchange Ltd. /agents or obtained directly from RBI on email, if email address is provided in the application form.

Yes there has been delay in getting allotment letters and demat. Ref Times of India article of 22 Aug