Warren Buffett is one of the most successful investors of all time, known for his disciplined approach to investing and his ability to identify undervalued companies. In this blog post, Quiz on Warren Buffet’s Annual letters, Quotes, we’ve compiled a series of quiz questions that cover some of the key themes and insights from Warren Buffett’s annual letters to shareholders. From the importance of maintaining a strong corporate culture to the value of buying stocks with a “margin of safety,” these quiz questions will test your knowledge and see if you have what it takes to think like the Oracle of Omaha.

Warren Buffett has been writing annual letters for many decades, and they have become a highly anticipated event for investors, analysts, and business leaders around the world. In these letters, Buffett shares his thoughts on the performance of his company, as well as his views on the broader economy and the business world.

www.berkshirehathaway.com/letters/letters.html has Warren Buffett’s annual letters from 1977

Quiz on Warren Buffett Annual Letters

- In his 1985 letter to shareholders, what does Warren Buffett describe as the “margin of safety” when it comes to buying stocks?

- In which year did Warren Buffett write about the risks of using leverage to invest in the stock market?

- In his 2011 letter to shareholders, what does Warren Buffett discuss as the key driver of long-term success in business?

- What is the name of Warren Buffett’s company, which he has discussed extensively in his annual letters to shareholders?

- In his 2020 letter to shareholders, what does Warren Buffett describe as one of the risks facing investors in the current economic climate?

- In which year did Warren Buffett write about the importance of buying stocks with a “margin of safety”?

- In his 2019 letter to shareholders, what did Warren Buffett say about the value of a company’s brand?

- In his 2018 letter to shareholders, Warren Buffett discussed the importance of what in determining the success of a company’s CEO?

- In his 2007 letter to shareholders, Warren Buffett used a metaphor involving what animal to illustrate the importance of diversification in investing?

- In which year did Warren Buffett write about the importance of maintaining a strong corporate culture, saying that “culture counts”?

Answers to Quiz on Warren Buffett Annual Letters

- According to Warren Buffett’s 1985 letter to shareholders, the “margin of safety” refers to the gap between the value of a company and the price at which it is selling.

- Warren Buffett wrote about the risks of using leverage to invest in the stock market in his 2008 letter to shareholders, which was written in the midst of the financial crisis.

- In his 2011 letter to shareholders, Warren Buffett discusses the importance of having a strong corporate culture as the key driver of long-term success in business.

- Warren Buffett’s company is named Berkshire Hathaway.

- In his 2020 letter to shareholders, Warren Buffett describes inflation as one of the risks facing investors in the current economic climate.

- Warren Buffett wrote about the importance of buying stocks with a “margin of safety” in his 1985 letter to shareholders.

- In his 2019 letter to shareholders, Warren Buffett said that “a company’s economic moat, its ability to earn sustainable competitive advantages over time, is essential to long-term business success.”

- In his 2018 letter to shareholders, Warren Buffett discussed the importance of a CEO’s integrity and character in determining their success.

- In his 2007 letter to shareholders, Warren Buffett used the metaphor of a “fat tail” to illustrate the importance of diversification in investing.

- Warren Buffett wrote about the importance of maintaining a strong corporate culture, saying that “culture counts,” in his 2011 letter to shareholders.

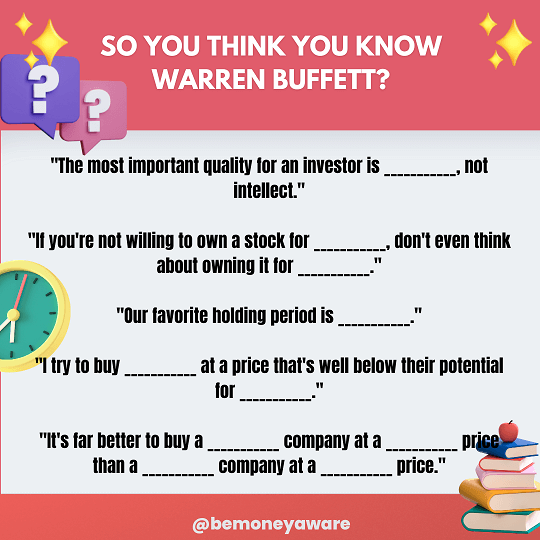

Complete the Warren Buffett Quotes

- “temperament”

- “10 years”, “10 minutes”

- “forever”

- “great businesses”, “profit growth”

- “great”, “fair”, “fair”, “great”

Related articles:

- Warren Buffett, Berkshire Hathaway, Annual Letters

- Warren Buffett Annual Letter 2022: Key Take away

- Michael Jackson and Money Lessons

- President Obama and Money

- Obamas Financial Struggle

- Reliance : Dhirubhai Ambani,KokilaBen DhiruBhai Ambani