Precious moments need to be cherished, without the worry of financial constraints. Now you don’t have to wait to fulfil your dreams. Be it renovating your home, going on your dream vacation or buying your special someone that coveted gift, count on us to make it happen scream the advertisement of Personal Loans. With simplified documentation and speedy approvals, availing personal loans is easy. Hence Personal loans are popular. This article talks about Pros and Cons of taking personal loans, asks you the question Is it really necessary to take Personal Loan, Consequences of a default of Personal Loan.

Our article Personal Loans Basics talks about Personal loan in detail. . As per survey on our site after Home loan most of people have taken personal loan. But don’t take a personal loan just because you can. Before you borrow, consider how the repayment will affect your finances.

Pros and Cons of taking Personal Loans

Personal Loan is usually taken by borrowers who are looking for quick money without having to risk anything as collateral security. From funding a holiday trip, marriage, home renovation, buying cars, any assets etc . Basically personal loans can be utilized for any purpose other than buying a house. There is no restriction to what you can do with the money received as personal loan.

| No Collateral

Personal Loans have no collateral facility i.e to avail personal loans you do not need to back up the loan with any asset. Therefore in case of non- payment there will not be any seizing of the asset.

|

High Interest rates

Personal loans have high interest rates ranging anywhere between 11.5%-20% plus service tax depending on the bank you choose. So basically the monthly EMIs will be high no matter whichever bank you choose.

|

| No Questions asked about money usage

The banks do not conduct any check of how and when the funds have been used by the borrower. |

Hidden Fees

Personal Loans also have additional processing fees, prepayment fees or cancellation charges that are levied when applicable. |

| Easy to Avail Personal Loans: Online, Door Step Service

Personal loans can now be availed at our door-step due to the customer-centric approach of the bank. All we need to do is fill our essential details online and our work will be done. They will contact us, pick our documents from our door-step and the loan will be processed and granted in less than a month. Sometimes it is as quick as within a week.

|

No part prepayments

Prepayment of personal loan can be done as a whole but usually with prepayment penalty. Banks generally do not allow part prepayment of any personal loan. Moreover, there is a prepayment penalty of 2-5 per cent on the outstanding amount, which has to be paid to the bank while making any prepayments.

|

If you have decided that you require a personal loan for your need it is important to find the best deal in the market. You can compare loans from various banks, their interest rate, fees and documentation. You should also check their hidden fees and other perks that might be offered. Once you decide which bank is apt for you loan you can submit the application for a personal loan. Typically Eligibility Criteria for taking Personal Loan are as follows. You can check bank site such as IndusInd Bank for details on how to avail Personal Loans.

| Criterion

|

Salaried | Professional | Self- Employed |

| Age | Minimum: 21

Maximum: 60 |

Minimum: 21-25

Maximum: 60 |

Minimum: 21-25

Maximum: 60 |

| Income |

Rs.10000-25000 (Minimum differs with each bank)

|

Rs.15000-40000 (Minimum differs with each bank) |

Rs.10000-40000 (Minimum differs with each bank) |

| Work Experience | At least 2 years.

(1 year minimum with current employer)

|

2-4 Years.

Differs with banks) |

2-5 Years

(Differs with banks) |

Is it really necessary to take Personal Loan?

Are we fulfilling Need or greed?

We may feel a compelling need to buy something but is the purchase really necessary. We may be in desperate need for a break but is taking a loan for funding your holiday the answer. Vacations are to relax and not complicate your life. Life after vacation is same old dull, boring life but with personal loan used for funding the vacation you have added burden of EMI. Personal loans taken for genuine needs like marriage, hospitalization or for education makes senses. But if you want to take personal loan to help a friend(helping a friend without a written contract, is a clear path to a financial crisis, you might end up without money and friend.), invest in stocks or commodities in order to generate a higher return by speculating, then it is highly not recommended.

Unless you’re in a position to pay off a loan immediately after your return, think twice taking a loan.

Can I afford the EMI?

Before seeking any sort of loan, you need to answer. Can I afford the EMI. Personal loans have a rigid repayment schedule. What if you are to be out of a job in the future? This means that you will have to face extra pressure to find a new job quickly. If you are unsure of ability to service the EMI, you should rethink your decision to take a loan.

Loan affects your credit history

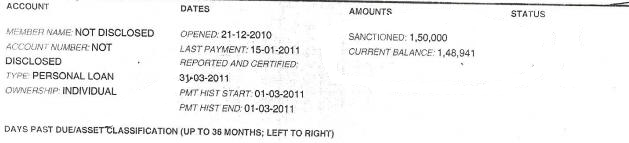

Remember Any loan, including credit card, that you take affects your credit history, which affects your future capability of paying loans. Our article Understanding CIBIL CIR report explains CIBIL CIR report in detail. Part of Cibil Report showing personal loan is shown in image below

Consequences of a Default of Personal Loan

After considering various perks and drawbacks of a personal loan, when you finally decide to take one, it is equally important to know your rights and punishments in case of a default. You can take the following steps in case of a personal loan default:

- Have a discussion You can have a word with your bank giving genuine reasons and stating the emergency scenario for the default in payment. If the reason is worthy enough you are generally granted additional time for your payment.

- Reschedule your Loan If the bank feels that the amount of EMI borne by you every month is higher than what you can afford, it increases the tenure of your loan thus leading to a reduction in your EMIs. But this will lead to extra interest payment in the long run.

- Temporary Non- Payment In case of any reason leading to temporary financial crunch, you can opt for non-payment of EMIs for a pre-decided time. Penalty will be charged for the months for which payment was not made.

- One Time Loan Settlement

If you financial situation is presently bad, but you expect monetary inflow in a short period of time, you can opt for one time settlement of loan wherein you can pay off the entire amount in one go. When banks feel they have recovered some amount which they wouldn’t have been able to recover if you would have turned insolvent, they generally waive a decent amount/pre-payment charges off from your loan. If your financial situation is really bad, then you may need to file for bankruptcy to free yourself from the loan commitment.

Personal loans are very appealing but defaults can take your credit score on a toss. Any bank in the future will refrain to grant you any loans. The next time you have to spend, choose wisely and refrain from seeking a loan just because you can.

2 responses to “Personal Loan: Pros and Cons, What if you Default”

I require rs. 10 lacks urgently.

I am Mr. Joe Soto, a private lender. I give out loans with an interest rate of 3% per year, totaling 1000.00 to 10,000,000.00 as the supply of credit. 100% financing of the project with secured and unsecured loans. We are assured in serving financial services to our numerous customers all over the world. With our flexible lending packages loans can be processed and transferred to the agent for the borrower in the shortest possible time. We operate under clear and understandable terms and we offer loans of all kinds to interested clients, companies, enterprises, and all types of business organizations, private individuals and real estate investors. Simply fill out the form below and return to us as we expect your rapid and direct response. EMAIL: joe.sotomortgagelending@hotmail.com