This article explains, What is the National Pension Scheme(NPS) What accounts are available in NPS? Who are the Fund managers? How can one withdraw from NPS? What are tax benefits on investing in NPS? How many subscribers it has?

Table of Contents

An Overview of NPS is given below

National Pension Scheme is a government-approved pension scheme for Indian citizens in the 18-60 age group for retirment. While central and state government employees have to subscribe to NPS (it’s compulsory for them), it’s optional for others. NPS is India’s answer to the US’ retirement scheme-401(K).

- Lock-in Period: One Invests till 60.

- Partial Withdrawal up to 25% after 3 years of account opening for specific grounds such as medical treatment, higher education of children, the marriage of children, home purchase etc. These withdrawals cannot be more than 25% of your contributions and are tax-free.

- Monthly Pension after retirement: After one becomes 60 years one can withdraw 60% from NPS and for the remaining 40% one has to buy a pension plan and one gets a monthly pension.

- Low Cost: Multiple reputed Fund Managers ex HDFC Pension Fund, SBI Pension Fund Fund Management Fee capped at 0.01%:

- Invests in or Asset Classes: Equity (E), Government Bond (G), Corporate Bond (C ), Alternative Investment (A)

- Investment Type: Active (Subscriber allocates), Auto (As per life cycle fund)

- Tier 1/Tier 2 NPS Accounts:

- Tier 1- Premature withdrawal not allowed. Tax deduction benefits up to Rs. 2 lakh per annum.

- Tier 2- It’s like Mutual Funds. Funds can be withdrawn at any time. Tier1 is necessary for Tier2 account.

- Eligibility Indian citizen in the 18-60 age bracket. NRIs can also open

- NPS Account Can be opened online at NSDL or Karvy Website

- NPS Mobile App is also available

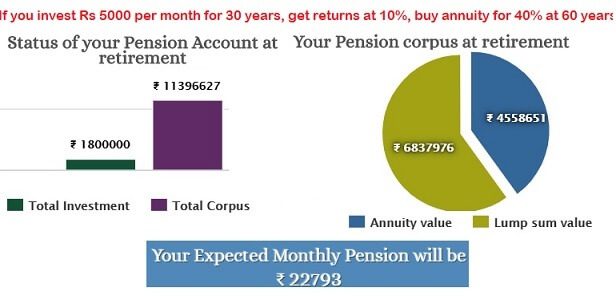

The image below shows that if a person starts investing at age of 30 years and invests Rs 5,000 per month in NPS and gets 10% returns then he would have invested 18 lakhs and his investments would grow to 1.39 crores. If he purchases a pension plan of Rs 45.58 lakhs(40% of the maturity amount), which earns returns at 6% then he would get a monthly pension of Rs 22,793.

National Pension Scheme (NPS)

What is Pension scheme?

Webster’s English dictionary defines the word pension as a fixed sum paid regularly, especially to a person retired from work.

A Pension Plan is a plan or a product, that promises you a pension i.e. a fixed regular income after you retire, for a certain period of time. You invest in the pension plan by paying a regular premium or amount. Your amount is invested so that it grows. When you retire, your invested amount would have grown to a certain amount. From this amount, called annuity It is in an annuity scheme, from which you draw down certain income on a regular basis. These plans are offered by

- Life insurance companies,

- Mutual funds

- Indian Government ex: National Pension Scheme or NPS

In NPS where is the money invested

One investing in NPS has to understand various asset classes available, choose how to decide among various asset classes, will he wants to be in control or wants the allocation done automatically and then choose a Fund Manager. The returns of various NPS schemes are discussed in our article Returns of NPS: Best NPS Pension Fund, Best Pension Fund Manager

One can invest in NPS even if one has PPF, EPF or another pension plan.

In NPS how your money is invested depends upon your

- Multiple investment options(equity,fixed income). The investment options are called asset classes and are based on risk, return. There are E, C and G Asset classes to choose from.

- Asset Class E: Investments in predominantly equity market instruments. The maximum investment in this class is 75% of the total contribution. Classified as High return, High risk

- Asset Class G: investments in Government securities and bonds. Classified as “Low return, Low risk”

- Asset Class C: investments in fixed income instruments other than Government securities. classified as “Medium return, Medium risk”

- Asset Class A: invests in alternative assets like Real Estate Investment Trusts (REITs) and Infrastructure Investment Trusts (InVITs). It is only offered in NPS Active Choice and the upper limit for investing in it is 5% of your investment.

- The E Asset class has higher potential returns than the G asset class, but it also carries the risk of investment losses. Investing entirely in the G asset class may not give you high returns but is a safer option.

- Choice: Active or Auto of how money is distributed among the asset classes :

- if the investor will himself manage the distribution it is called Active

- if the investor will let the distribution among various assets classes be determined Automatically based on his age called as Auto

- Pension Fund Manager: Once the investor decides the Auto or Active distribution then he needs to choose the fund which will invest on his behalf.

- The money is managed by fund managers appointed by the PFRDA.

- The accounts of government employees are managed by one of the three government fund managers, LIC Pension Plan, SBI Pension Plan and UTI Retirement Solutions.

What are the accounts available in NPS?

Under NPS, two types of account would be available to people

- Tier I: contribute into the pension account with restrictions on withdrawal. A tax benefits are available for Tier 1 account only.

- Tier II: a voluntary saving account from which one is free to withdraw whenever he wishes. It is like Mutual Fund.

- An active Tier I account is must for the opening of Tier II.

- It is optional even for govt employees. The government and employers will make no contribution to this account.

- Swavalamban scheme or the NPS Lite:is the extension of the variant available to the government employees. The government contributes Rs 1,000 per year to the pension account in NPS Lite, making pension possible for the economically-disadvantaged. Under the scheme, Govt. will contribute Rs.1000 per year to each NPS account opened in the year 2010-11 and for the next three years, that is, 2011-12, 2012-13 and 2013-14. As a special case and in recognition of their faith in the NPS, all NPS accounts opened in 2009-10 will be entitled to the benefit of Government contribution if they fulfil the eligibility criteria prescribed under these guidelines.

Tax Benefits of National Pension Scheme

The NPS is currently under the EET (exempt, exempt, tax) which means it is tax free on contribution and accumulation but taxable on maturity. Hence, an NPS subscriber is taxed on withdrawal and also when he obtains annuity.

NPS tax benefits are available through 3 sections – 80CCD(1), 80CCD(2) and 80CCD(1B). All the tax benefits, annuity restrictions, exit and withdrawal rules are applicable to NPS Tier-I account only. NPS Tier-II account is like an open ended mutual fund. You can take out the money at any time. Our article NPS Tax Benefits and sections 80CCD(1), 80CCD(2) and 80CCD(1B) discusses Tax Benefits of NPS in detail.

Our article Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax talks about Whether it makes sense to invest in NPS for tax benefits.

| Section | Deduction allowed | Maximum Limit | Can be claimed by |

| 80CCD(1) | Employee contribution up to 10% of basic salary and DA | Upto 1.5 Lakhs including 80C. | Employees. For self-employed 10% of their annual income up to a maximum of Rs 1.5 Lakhs. |

| 80CCD(2) | Employer’s contribution up to 10% is basic salary and DA. | Upto 10% of basic salary and DA. | Only employees. |

| 80CCD(1B) | Additional tax benefit up to Rs. 50000 over and above the benefit under 80CCD(1). | Upto Rs. 50000 | Employee( Government or private) or self-employed or ordinary citizen. |

Therefore, the total tax benefits that can be claimed for NPS under Section 80CCD(1) + Section 80CCD(1B) equals to 2 Lakhs in a financial year.

If Employees have savings Rs. 1,50,000 under 80C excluding NPS Deductions, Then the Employee can show their NPS Deductions, under 80 CCD(1B), which is over the 1,50,000 Limit.

If the Employee have less than 1.5 Lakh savings in 80C and exceeds 50,000 towards NPS, then the Employee can split their NPS Amount to 80CCD(1) and 80CCD(IB).

Maturity of NPS

When to withdraw from National Pension Scheme?

The NPS Tier 1 account matures when the subscriber turns 60 years but can be extended until the age of 70.

Tier-I comes with partial withdrawal options, subject to conditions.

- When you attain the age of 60, you have to invest at least 40% in an annuity with IRDA and can withdraw only up to 60 per cent of the corpus.

- The nominee can withdraw the full amount only after the death of the subscriber.

One can withdraw from NPS online or by submitting the form at the Point of Presence(POP) centres of NPS.

Who provides Annuity on withdrawal or maturity under NPS?

Annuity, popularly called a monthly pension, is a series of payments made at successive periods (intervals) of time. For NPS it is bought at withdrawal or on reaching 60 years in Tier 1 Account. ASPs would be responsible for delivering a regular monthly pension on exit from the NPS. The Annuity Service Providers empaneled by PFRDA for subscribers of NPS are as under:

- Life Insurance Corporation of India

- SBI Life Insurance Co. Ltd.

- ICICI Prudential Life Insurance Co. Ltd.

- Bajaj Allianz Life Insurance Co. Ltd.

- Star Union Dai-ichi Life Insurance Co. Ltd.

- Reliance Life Insurance Co. Ltd.

Who manages the money invested in National Public Scheme – the fund managers?

The money is managed by fund managers appointed by the PFRDA. You have to opt for a fund manager while opening the account.

- LIC Pension Fund Limited

- SBI Pension Funds Pvt. Limited

- UTI Retirement Solutions Limited

- HDFC Pension Fund

- ICICI Prudential Pension Funds Management Co. Limited

- Kotak Mahindra Pension Fund Limited

- Reliance Capital Pension Fund Limited discontinued in 2019

- IDFC Pension Fund : Moved out of managing NPS scheme from 1 Nov 2012. It’s assets worth Rs 1,500 crore were moved to SBI Pension Fund.

The accounts of government employees are managed by one of the three government fund managers: LIC Pension Plan, SBI Pension Plan and UTI Retirement Solutions,

The money invested by others is managed by one of the following fund managers, ICICI Prudential Pension, IDFC Pension, Kotak Mahindra Pension, Reliance Capital Pension, SBI Pension Funds and UTI Retirement Solutions.

What are the charges and fees associated with National Pension Scheme?

Investors have to pay handling and administrative charges, fund management fees. Fund management fee are 0.0102% for Government employees and 0.25% of the invested amount for private sector. When the scheme was introduced in 2009, this charge was just 0.0009%. However, in Nov 2012 it was revised to 0.25% to make the scheme more sensible for the fund management houses.

The minimum contribution to NPS accounts

For All citizens model

| Tier I | Tier II | |

| Minimum Contribution at the time of account opening | Rs. 500 | Rs. 1000 |

| Minimum amount per contribution | Rs. 500 | Rs. 250 |

| Minimum total contribution in the year | Rs. 1000 | 0 |

| Minimum frequency of contributions | 1 per year | NA |

Who can invest in National Pension Scheme?

National Pension Scheme is compulsory for Government employees(NPS)?

Earlier Government of India used to provide a definite pension to employees after retirement which was based on employee length of service and average of emoluments(Basic Pay+ Dearness Pay+ Stagnation Increment + Non-practising Allowance) drawn during ten months immediately preceding the date of retirement.

From 1 Jan 2004 Government made it mandatory for new government employees (except armed forces) to contribute to National Pension Scheme with matching contribution by government. This is a move from a defined benefit pension to a defined contribution based pension system.

Can a Non-Government employee also invest in National Pension Scheme (NPS)?

Yes a non Government employee, between the age of 18 to 60 years, can also invest in National Pension scheme. He can join as as an individual investor or if his company(Corporate house) joins NPS.

For corporate NPS contribution will be in addition to Employee Provident Fund, or EPF, investments.

- If the employer is offering NPS, he will be making an equal contribution in the scheme from his side.

- The structure will be of Tier-1 type where premature withdrawal will not be allowed.

- Since December 2011 the employer’s contribution up to 10% of basic plus DA is eligible for deduction under Section 80CCE over and above the Rs 1 lakh limit of 80C.

- Employee contribution up to 10% of basic plus dearness allowance, or DA, is eligible for deduction under Section 80CCD within the Rs 1 lakh limit.

- Employer can claim tax benefit for its contribution by showing it as business expense in the profit and loss account.

Who regulates National Pension Scheme (NPS)?

The Nation Pension System (NPS) is regulated by the Pension Funds Regulatory Development Authority(PFRDA).

What is the Auto choice in NPS?

Here, The fraction of funds invested across three asset classes will be determined by a pre-defined portfolio based on the investor’s age, called as Life-cycle fund.

- At the lowest age of entry (18 years), the auto choice will entail an investment of 75% of pension wealth in “E” Class, 30% in “C” Class and 20% in “G” Class.

- These ratios of investment will remain fixed for all contributions until the participant reaches the age of 36.

- From age 36 onwards, the weight in “E” and “C” asset class will decrease annually and the weight in “G” class will increase annually till it reaches 10% in “E”, 10% in “C” and 80% in “G” class at age 55.

What is the difference between NPS Tier 1 account and Tier 2 Account?

Tier 1 account is mandatory for all central and state government employees.

To open Tier II account one needs Tier I account.

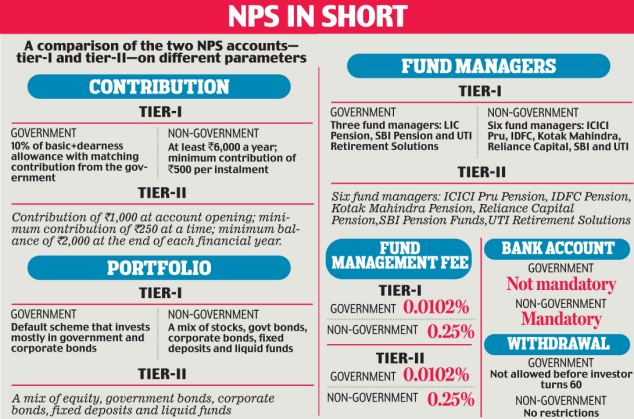

The Tier I account differs for government and non government employee in terms of contribution, fund management, withdrawal. The picture given below highlights the difference between different Tier I accounts and between Tier I and Tier II account from Daily mail When NPS gets new tax benefits, it becomes more attractive

Flexibility and Portability of National Pension Scheme ?

Investors have the flexibility to choose between fund managers, investment options, between Auto or Active choice. Such change can be made only once a year. NPS account can be operated from anywhere in the country irrespective of employment and geography.

How to open new NPS account?

You can open NPS account online through eNPS, mobile App or manually.

For manually one had to visit the nearest POP division.

Now eNPS has been introduced. Now you can register the NPS account online through eNPS. You can also pay online your NPS contribution , even though you have opened account manually.

What is e NPS?

e NPS is electronic National Pension Scheme at https://enps.nsdl.com/. By accessing the link you can

- Open Individual Pension Account under NPS (only Tier I / Tier I & Tier II)

- Making initial and subsequent contribution to your Tier I as well as Tier II account

Our article eNPS : Open NPS account online, contribute to NPS online explains it in detail

NPS Mobile App

NPS App gives your details of Subscribers account online. The Subscriber can access latest account details as is available on the CRA web site using user ID (PRAN) and password. The APP access your account details online and provides you with a user friendly interface to browse through your account information. It also enables you to maintain your latest contact details and password. It can be downloaded from Google PlayStore.

The APP gives better user experience and provides additional functionality such as

1. View current Holdings

2. Request for Transaction Statement for the year on your email ID.

3. Change contact details like Telephone, Mobile no. and email ID.

4. Change your Password / Secret Question

5. View your Account details.

6. Regenerate password using secret question.

7. View Last 5 contribution transactions carried out

8. Get notifications related to NPS.

Video of NPS Mobile App

This 3-minute official video shows features of NPS Mobile App

Difference between National Pension Scheme and Mutual Funds

Similarities between National Pension Scheme and Mutual Funds are as follows:

- It is like a mutual fund the pooled money is invested in different options: Both Mutual fund and NPS provides options wherein you could invest in equity or debt instruments and also in different company stocks indirectly.

- Professional management of your money.

- Returns are not guaranteed just like in a Mutual Fund.

Difference between NPS and Mutual funds are as follows

| Mutual Funds | NPS (Tier I account) |

| No limit depends on investor | Equity limit is restricted to 50% |

| The wide array of funds to choose from | Only in Funds selected by PFRDA |

| Can change fund anytime | Can change fund only once a year |

| No forced discipline unless through SIP | If the employee then automatically contribution gets deductedElse minimum contribution limit |

| Tax benefits only in ELSS | 80C benefit and if an employer contributes his contribution gets 80CCE |

| Can withdraw anytime | Restricted withdrawal |

| No pension benefit on maturity | Forced to take annuity on withdrawal or maturity of 60 years which generates pension |

Changes in NPS in 2016

- PFRDA, in its circular dated November 4, 2016, added two more options of life cycle funds under Auto Choice option viz. Aggressive Life Cycle Fund and Conservative Life Fund. These options are in addition to Existing life cycle fund (Moderate life cycle fund or LC 50), which shall still be the default fund. But Government subscribers shall not have these two options. For Government subscribers, the equity allocation is still capped at 15%.

- PFRDA has added a new asset class ‘A’ for Alternative Investments for private sector subscribers. This asset class is in addition to three existing asset classes i.e. Equity (E), Corporate Bonds (C) and Government Debt (G). Investment in Asset Class (A) shall comprise the following:

- Commercial mortgage based securities or Residential mortgage based securities

- Units issued by Real Estate Investment Trusts regulated by SEBI

- Asset backed securities regulated SEBI

- Units issued by Infrastructure Investment Trusts regulated by SEBI

- Alternative Investment Funds (AIF Category I and II) registered with SEBI

- DEFERRING PURCHASE OF ANNUITY : On retirement, NPS investors have to compulsorily buy an annuity with 40% of the corpus. PFRDA has now allowed investors to defer the purchase for up to three years. They can buy annuities till the age of 63 .

- 40% OF CORPUS MADE TAX FREE ON MATURITY : 2016-17 Budget had made 40% of the NPS corpus tax-free on maturity. This changed the NPS from an EET product to a quasi EET instrument where 60% of the corpus is taxable while 40% escapes tax. It has also made NPS better than pension plans offered by insurance companies, where the tax free withdrawal is restricted to 33%. However, there are several competing products such as EPF, PPF and ELSS funds that are fully tax free on withdrawal.

- DEFERRING WITHDRAWAL TILL 70

While 40% of the corpus will be put in annuity, the remaining 60% can be withdrawn. But, given the low fund management charges of the NPS, there is no need to take out the entire 60% at the time of retirement. NPS investors can now delay withdrawals till the age of 70. - EARLY WITHDRAWALS ALLOWED

NPS investors can now withdraw up to 25% of their own contribution for specific needs such as children’s higher education or marriage, construction or purchase of first house, treatment of critical illness for self, spouse, children or parents. - LOWER MINIMUM INVESTMENT OF Rs 1,000

PFRDA has lowered the minimum investment from Rs 6,000 to Rs 1,000 a year. - SHIFT FROM EPF/SUPERANNUATION FUND

The Government has also allowed investors covered by EPF and other superannuation funds to shift to the NPS

References: NSDL NPS Website , Pension Funds Regulatory Development Authority ,

Related Articles:

- Beginner to Investing

- Investing:Think about Liquidity,Safety,Returns,Risk,Tax

- Goals Based Financial Planning

- Choosing Tax Saving options : 80C and Others

- Taxation of investments : EEE, ETE, TEE..

In this article we have explained about NPS, how , what etc. In next article we shall explain how NPS compares with other investment option? how to open NPS account and how to operate it. Do you have an NPS account? Did your employee open it for you or you invested it yourself? What do you think of National Pension Scheme? How are you saving for retirement.

79 responses to “Understanding National Pension Scheme – NPS”

Cani get one subscribe to NPS and NPS Lite both.

No, you can’t.

Form asks to choose one from given category

Please Select your Category [ Please tick(√) ]

Government Sector

Corporate Sector

All Citizen Model

NPS Lite/Swavalamban

Having 2 NPS account is not allowed.

The Government does not make any contribution to your NPS account. The Government of India may however, make contributions to the accounts of NPS account holders who opt for Swavalamban scheme subject to conditions stated in the Swavalamban scheme.

I want to exit prematurely after 5 years. Can you kindly tell me if i acn approach any pop-s for processing withdrawal or is there any specified pop associated with my employer? I called helpline, pop nos. To no avail.

[…] article National Pension Scheme covers NPS in detail including details of Swavalamban Yojana NPS Lite . Quoting from it […]

MY annual income is 3,60,000-00 i am 30 years now. If i were invest in NPS scheme i.e. Rs. 4,000 per month it will be the above 10% of my annual income in this case what will be the my tax relief. how much i can claim as per Section 80 CCD (1B) ?

For 80CCD(1B) there is no restriction on amount of salary.

Restriction of 10% of basic salary is if you want to invest through your employer.

Additional exemption up to Rs 50,000 in NPS is eligible for income tax deduction.

Introduced in Budget 2015, for FY 2015-16

Taxpayers in the highest tax bracket of 30 per cent can save Rs. 15,000 by investing Rs. 50,000 in the NPS. Those in the 20 per cent tax bracket can save aroundRs. 10,000, while people in the 10 per cent tax bracket can save Rs. 5,000 per year by investing in the NPS.

Our article How National Pension Scheme NPS Saves Tax discusses it in detail.

And article Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax talks about whether it makes sense to invest 50,000 in NPS to save tax.

AS i am govt. employee and suupose after attaining 60 yrs my total value of NPS is 60 Lakh. Now I will got 40% i.e. 24 Lakh cash and 40% i.e. 36 Lakh will be utilized for pension. I will got pension till my life. After my death what will be option for my wife.

Dear Concern

I want to start NPS , I am 35 , I have investment of 1.5 lac under 80C

Kindly guide what amount should I invest, my capacity tentative is 50000/-

Please guide what are the exact benefits and what are the risk involved.

I joined nps recently i would like to invest 2000 every month is there any auto debt option from my account availiable

Yes. NPS provides an ECS mandate facility to its subscribers to let them invest electronically by giving an auto debit mandate to their banks. Download the ECS Mandate form from the Point of Presence (PoP) website or collect the mandate form from the PoP with which you wish to register for making ECS payment. Units will be allotted at NAV based purchase price declared on the fourth day of ECS debit made on the subscriber’s bank account. In case the date falls on a non-business day, the immediate next business day will be taken into account for the purpose of determining the NAV

Sir, I am working in abroad. My age is now 51 years. I would like to joint pension scheme and I want to get pension after 60 years at least Rs. 30,000 per month. Now How much I invest per month/year and what is the procedure. Your kind response will be highly appreciated

i am a teacher in kendriya vidyalaya and am having GPF (old pension scheme). my priority for NPS is to save tax under 80CCD1B (which makes me eligible for 50,000/- over and above 1.5 lac of 80c). now, what i want to clarify is….. i have already crossed the 1.5 lac deposit vide my GPF and PPF accounts. do i need to open tier-1 account and deposit 50,000/- as an INDIVIDUAL (NON-GOVERNMENT)? AND can this deposit be claimed under section 80CCD1B? OR i have to mention section 80CCD1B while making deposit as i wont be depositing any amount in NPS under section 80c? NEED CLARIFICATION AT THE EARLIEST. REGARDS.

Sir,I am retiring in September 2017,at the age of 60.Can I be member?If yes than till what age I can contribute.What will be status of carpus? As such at glance age prescribed is 16-60 yrs.

National Pension Scheme is a government approved pension scheme for Indian citizens in the 18-60 age group. But why do you want to become member of NPS so late as you can contribute only till Sep 2017.

Dear Sir

I am 40 years , presently working in a private company. At the time of retirement on 60 years

Question 1: I need to have a pension of 70,000/- per month.

To get this much amount , how much shall I invest in NPS and under which fund (E,C,G).

Question 2: I have already crossed all my limits in tax savings in Section 80 D ( maximum 1.5 Lakhs). Can I still get the tax benefit ( deductions from the total taxable salary , like we get in home loans).

Please guide.

Kind Regards

Manoj SHARMA

Yes, You can get additional 50,000 as tax benefits u/s 80CCD(1B)

please inform if I can start NPS at 54 years of age

I will be 54 years on december 17. Will it be beneficial to start NPS now to save tax? Kindly advise for this financial year. I am employed in a private institution and have EPF benefit

Dear Sir,

Methinks, it would not be a wise decision to be enrolled into NPS scheme right at this age.Forget about tax-savings and go for mutual funds available in open market.

If i get Voluntry retirement After 20 years of service and I am recruit in 2004 i.e 2025 how will NPS pay me

Hi,

I am working for private company.

I already reached 1.5Lac for 80C including PF+PPF+LIC.

Can I open a NPS Account depositing 50,000/- per annum , so that I can avail extra 50K tax benifit excluding 80C’s 1.5 Lac over the total taxable income.

Thanks

Yes you can invest in NPS to claim extra 50,000.

Now you can open eNPS account online.

Open Individual Pension Account under NPS (only Tier I / Tier I & Tier II)

Making initial and subsequent contribution to your Tier I as well as Tier II account

Our article eNPS : Open NPS account online, contribute to NPS online explains it in detail

Sir, I am Govt. employee and applied for PRAN kit 3 years back as required for NPS scheme, but still now received no. So, after 3-4 years if get PRAKN kit no. and I do not want to deposit previous amount as myself and not from Govt. also. Because the old amount may be large and difficult to manage it with other home loan deductions amount from salary. Is there any provision to avoid such circumstances for relaxation or non deduction of previous amount and start with new and current deduction amount.

I AM EMPLOYED IN A PRIVATE COMPANY WHERE I SUBSCRIBE TO PPF. CAN I SUBSCRIBE TO BOTH PPF AND NPS. PL ADVICE

In Private company you would have subscribed to EPF. In addition you can subscribe to PPF and NPS and any other scheme.

Maximum tax benefits that you can claim is 1.5 lakh under 80C in total

EPF/PPF/NSC/ELSS all comes under 80c and has a limit of 1.50 lacs per year.

NPS will allow you to avail extra tax benefit of rs 50000 in addition to above 1.50 lacs. (this benefit is only for NPS)

As an investor you can invest into any scheme or combination of schemes.

Hello sir

I want pension of 10 lacs per anum after retirement and my age is 32 years so how money i should invest monthly from today?

Invest 6000 per month i.e. 72000 per year for next 28 years so that your can expect total pension of around 1.65 crore considering 12% returns.

You will need to invest entire amount in annuity so that you can expect 1 lacs per month pension.

BUT keep in mind one thing that it will be 10 lacs rs of year 2044, so hopefully you have already considering inflation accordingly.

After investing 5 years, One should 10 percentage partial withdrawal of the previous financial year without any age limit. No taxes from mutualfund investment after one year for equity and 3 year in bond fund. No other taxes for withdrawal from mutualfund. because it is the withdrawal of our savings. but if we invest in NPS, it undergo many charges and tax implications. The pension we receive from our investment is also considers of our income and imposes tax after retirement. It proves the best investment option is mutualfund. The frame of NPS should undergo some changes. It should be an investment hub. Not imposes charges from return. It should allow investors to continue investment and partial withdrawal till their death after nomination of legal heirs. The huge fund of NPS will led nation to prosperity. Investment habit will increase among people. Dont allow reinvest hardly eaarned money of people to less returned annuity of LIC or other companies. Allow us to continue to invest in the funds of NPS. Do you agree?

just one thought:

how many people are serious about pension or a very long term saving ? Govt would like to encourage habit of pension scheme/fund similar to our erliar generation so that we have something in our second half (considering our food habits, I see chances of complex health issues in second half).

BTW, ELSS is best in category in terms of returns and is easy to manage.

I do both ELSS + PF + NPS.. whereas PF can be used as hard-cash but NPS will be only for pension and ELSS will help me fulfilling my interim and long term goals like children education, new house etc.

Sir I am Central Govt Servent, sir I would like to submitte the few points

1. Sir if I am quiting my job before attending the age of 60 years, what is provision the same

2. Sir that is an important point that if l am complete my service up to 60 years or quiting before, the total amount receive from the NPS, what that is taxable or not that time.

Sir, retirement and quiting from NPS are 2 different things. Let me explain you in detail:

I will have EPF (total amount of EPF + GPF + interest till date) plus gratuity plus money from leaves – all these 3 I can use after retirement to fulfill my goals.

Now lets say I will retire on age of 55 and I still have 5 years to complete my NPS tenure than I can withdraw around 20% of the amount and can keep rest 80% in annuities so that my pension gets started in addition to govt pension.

I will suggest you to check with your accounts department for norms for govt sector NPS but I am very sure that you can withdraw at least 20% of total NPS amount and add that to your EPF/GPF, gratuity and leaves amount. Remaining 80% from NPS will give you another pension (in case you have one from central govt).

In case you will complete your service till 60 then NPS matures and you will be able to withdraw around 60% of total NPS amount and will need to buy annuity of remaining 40% —- this is best option since you get to withdraw 60% amount.

Happy investing and happy retirement !!!

Paid 1k online in national pension scheme, it’s been 1 years I have paid, still I didn’t get any receipt for what I have paid

you can add NPS app to the above article….

https://play.google.com/store/apps/details?id=nps.nps&hl=en

https://enps.nsdl.com/eNPS/LandingPage.html

Biggest drawback:- Everything is Delay……when u subscribe immediately money is deducted from ur a/c but it takes 5 to 7 days for Nps ac holding to be credited .On maturity it takes few months to process and get ur money back..All paper works to be done once more like KYC,advanced revenue stamped receipt and so many other thing.You have to first apply on line then take print out and attach so many documents.then hand it over to ur POP who will send it to their head office from where it will go to CRA/NPS or wherever.there it will be processed.In todays world of Computers and NET..what a waste of time and energy…God helps who want money immediately on maturity….

Hasn’t eNPS solved that problem?

Sir i waz govt employee, now i m doing vegetables shop for my income but my wife is good salaried she and i want to take pension scheme can my same PRAN NO BE USED HERE OR WE GET NEW PRAN NO…NOW I WANT VERY VERY SOON PENSION PLAN THROUGH SAME PRAN NO…PLZ HELP ME

I am a corporate employee. Do I need to open account only with my employer ? Or am I eligible to open all citizen normal account also ?

Any citizen of India, whether resident or non-resident, subject to the following conditions:

Individuals who are aged between 18 – 60 years as on the date of submission of his/her

application to the POP/ POP-SP. The citizens can join NPS either as individuals or as an

employee-employer group(s) (corporates) subject to submission of all required

information and Know your customer (KYC) documentation. After attaining 60 years of

age, you will not be permitted to make further contributions to the NPS accounts.

You can discuss with your employer if your salary package can be modified to invest in NPS account.

Else open NPS account in individual capacity

Opening NPS account through employer:

The government gives special tax exemption for contribution towards the National Pension System (NPS) by employers on behalf of employees under the corporate model.

Under this, both employee and employer’s contributions are eligible for income tax deduction.

While the employee contribution up to 10% of basic plus dearness allowance, or DA, is eligible for deduction under Section 80CCD within the Rs 1 lakh limit, the employer’s contribution up to 10% of basic plus DA is eligible for deduction under Section 80CCE over and above the Rs 1 lakh limit.

Even the employer can claim tax benefit for its contribution by showing it as business expense in the profit and loss account.

All your employer has to do is register and contribute to your NPS investments. It must already be doing so by contributing to the Employee Provident Fund, a mandatory retirement savings option that companies have to offer their employees.

The NPS contribution will be in addition to your Employee Provident Fund, or EPF, investments. Does this mean your employer will take have to the extra burden? No. It can simply deduct the contribution from your salary. You gain by funnelling a big part of your salary into your retirement fund and saving tax.

Good Insight. What would have in the scenario – the employee leaves the job for better opportunity. Does he required to withdraw the 20% amount, or the NPS account can be transferred seamlessly to the another employer who may have the NPS system in place with a different fund manager

Good Insight. What would happen in the scenario – the employee leaves the job for better opportunity. Does he required to withdraw the 20% amount, or the NPS account can be transferred seamlessly to the another employer who may have the NPS system in place with a different fund manager

Good Insight. What would happen in the scenario – the employee leaves the job for better opportunity, is he required to withdraw the 20% amount, or the NPS account can be transferred seamlessly to the another employer who may have the NPS system in place with a different fund manager

Hi,

Can a family pensioner join NPS? If yes, can he/she avail tax benefits under 80CCD?

Subscriber should be between 18 – 60 years of age as on the date of submission of application. Do you meet this criteria?

Can Govt. Empolyee put additional amount other than deducted by Employer In NPS account ? If yes how TIER I or Tier II under same PRAN NO.

Is there any additional tax benefit for putting additional money ?

Similar situation with me i was govt employee but i resined NOW DOINGS small bussiness, now i want pension scheme under the same PRAN NO ..Dinesh kumar 9041358349

i also get tha nps nomber but not gate prankit so what is the prossas of gat pran kit pls give me answer

Hi,

1) How do the employer contribute to my NPS?

2) Is it optional for them to contribute for my NPS?

3) If only the employer contributes to my NPS will I get tax exemption of up to 10 % of Basic + DA from my salary?

4) What can I do to make my employer contribute to my NPS?

Please reply!

Do NRI can open NPS Tier 1 account. What are the benefit for NRI.

What’s the use of taking annuity scheme upon retirement. What’s the use of such scheme which does not give you your hard earned money when u need it most after retirement. What if someone is hospitalised after retirement and need money

its pension product… Individual has to make provision for contingency, separately.

In case of emergency, 60 % amount could be used whereas 40 % amount to be used for buying annuity.. basic purpose of NPS .. to have regular income after retirement…

it looks Nobel product… else person would spend all 100 % money and no money in old age(if children reluctant to take care)

I want to whether NPS & Swawlamban Pension Yojana is same or different. My age is 43 yrs. & my wife is housewife can i open pension a/c for both. Is it possible? If Rs. 500/- each per month made what will be return? Plz let me know

Yes and No.

Swavalamban Yojana was a government-backed pension scheme targeted at the unorganised sector in India. It was applicable to all citizens in the unorganised sector who joined the National Pension Scheme (NPS) administered by the Pension Fund Regulatory and Development Authority (PFRDA) Act 2013.

Under the scheme, the Government of India contributed ₹1000 per year to each NPS account opened in the year 2010-11 and for the next three years, that is, 2011-12, 2012-13 and 2013-14. The benefit was available only to people who joined the NPS with a minimum contribution of ₹1000 (US$15) and maximum contribution of ₹12000 ) per annum.

The scheme was announced by the Finance Minister in Budget 2010-11. It was funded by grants from the Government of India.

This scheme has been replaced with Atal Pension Yojana, in which all subscribing workers below the age of 40 are eligible for pension of up to ₹5000 per month on attainment of 60 years of age

You can open account for yourself and your wife. But only those who are upto 40 years of age can join Atal Pension Yojna

The government has decided to extend the co-contributory scheme under Atal Pension Yojana (APY) till March 2016. Under APY, the government contributes 50% of the subscriber’s contribution, up to Rs 1,000 per annum, for a period of five years to those who joined the scheme before December 31, 2015

For FY 2015-16 (assessment year 2016-17)

A new section 80CCD(1B) has been introduced to provide for additional deduction for amount contributed to NPS of up to Rs 50,000.

As per above NPS where to invest lumpsum for current year & monthly in future please guide me . can we invest in SBI life pension plan or ICICI or Hdfc for the same income tax exemption is there for RS . 50000 as mentioned above income tax rule.Clarify the same.

Regards,

Sathyanand

nocomment

Let me know whether a self employed/one employed on contract basis can join NPS.

Let me know the office to be contacted for clarification of doubts.

You can call NPS at Toll Free Number : 1800222080

You can check Contact Details at https://www.npscra.nsdl.co.in/contact-us.php

nice

my basic and da is 30000 per month i want to invest in nps RS 50000 for tax saving . should i take benefit this scheme i am working in private ltd company .

From Apr 1 2015 one can do additional saving of Rs 50,000 under section 80 CCD(1B). Tax saved in 20% slab is Rs 14,832.

henever you withdraw money from the NPS, the returns will be taxed as capital gains. The pension you receive every month would also be taxable. Question is will NPS with only 50% in equity give you the same return as equity fund?

We have covered this in depth in our article Should you Invest in NPS the National Pension Scheme for additional 50,000 and save tax. Please let us know your thoughts on it.

[…] by the time you read this, you would have understood National Pension Scheme or NPS much more clearly. Right now, I don’t. I don’t think many do. But today we’ll try to untangle […]

I want to know that to avail tax benefit in 80CCE in which tier(1/2) I have to contribute 50000 rupees?.If it is in tier 1 then how to approach employer to avail this tax exemption?

Hi…. after ~3 years of service in central govt, I have tendered my resignation. My queries are as follows:

1. what amount so far have been accumulated in my NPS including govt contribution will be mine or not? if not, what and how it will be calculated?

2. the same account will I be able to carry on as an individual or not? if yes, what will be the procedure?

Hi,

At the time of retirement, will I be able to withdraw the entire corpus or will I need to take annuity compulsorily ?

I am going to retire In FEB 2016 ,In a 30% Income Tax bracket. My 80 C limit get exhausted by My PF and PPF deposits.

Should I open NPS account to take benefit of 80 CCD (1B) by depisting Rs 50000=00 at this age of mine only for one year .Pl advise.

I am 45 Should I invest in National Pension System.? I can afford Rs 2000/ P.m. to invest at NPS. Can anyone guide me.

[…] article National Pension Scheme covers NPS in detail including details of Swavalamban Yojana NPS Lite . Quoting from it […]

[…] Institutional Architecture of NPS would be utilised to enrol subscribers under APY. Our article National Pension Scheme covers NPS in detail including details of Swavalamban Yojana NPS Lite . Quoting from it . […]

Can one subscribe to NPS and NPS Lite both?

It’s all nice in schemes. In practice nothing really works. After working as a teacher all through my life I’ll retire with a monthly pension of Rs3000! That’s the reality. The rest is fiction, myth, Ramayna, Bible, or whatever you choose to call.

I can understand your plight matheikal. I agree with you. I am reminded of dialogue “Show me the money”..all said and done reality does not match the returns promised in the glossy broucher. I have tried to take pension etc as bonus and think of taking care for myself in my old age.

For central govt employees like me the yearly return on NPS is more than 13% since inception.

This is because markets have done poorly and CG employees have a 15% cap on equity allocation.

So if a person has well diversified assets (equity and debt) there is pretty good chance of getting a large nest egg.

NPS is good scheme. The modalities are still not in place. It can certainly form part of a retirement portfolio.

With good returns by NPS people are relooking at the NPS. You are right that if a person has well diversified assets (equity and debt)

there is pretty good chance of getting a large nest egg. Then NPS is a good scheme.

I am not a fan of NPS due to long term,liquidity and taxation on maturity aspects of NPS.

It’s all nice in schemes. In practice nothing really works. After working as a teacher all through my life I’ll retire with a monthly pension of Rs3000! That’s the reality. The rest is fiction, myth, Ramayna, Bible, or whatever you choose to call.

I can understand your plight matheikal. I agree with you. I am reminded of dialogue “Show me the money”..all said and done reality does not match the returns promised in the glossy broucher. I have tried to take pension etc as bonus and think of taking care for myself in my old age.

For central govt employees like me the yearly return on NPS is more than 13% since inception.

This is because markets have done poorly and CG employees have a 15% cap on equity allocation.

So if a person has well diversified assets (equity and debt) there is pretty good chance of getting a large nest egg.

NPS is good scheme. The modalities are still not in place. It can certainly form part of a retirement portfolio.

With good returns by NPS people are relooking at the NPS. You are right that if a person has well diversified assets (equity and debt)

there is pretty good chance of getting a large nest egg. Then NPS is a good scheme.

I am not a fan of NPS due to long term,liquidity and taxation on maturity aspects of NPS.