Majority of the population in India are unbanked and uninsured. Life Insurance is still availed by many to secure a future for their family when they seize to exist. But not many think about the financial burden on the family when one is down with medical expenses. This article talks about what is Mediclaim Policy, Why does one need Mediclaim Policy, Types of Mediclaim Policies, how can one choose the Mediclaim policy .

Mediclaim Policy

What is Mediclaim Policy

Medical expenses burn a hole in common man’s pocket. Medical insurance provides financial cover to individuals for any unforeseen health and medical care emergencies incase of hospitalization for 24 hours or more. A mediclaim policy reimburses a pre-defined percentage of expenses incurred.

- It needs hospitalization for at least a day to become effective. Only a few procedures like cataract are reimbursed without hospitalisation.

- Mediclaim policy only reimburses expenses or pays for expenses directly to your hospital including charges for doctors & nurses, OT charges, medicines, blood, oxygen, diagnostic materials and x-ray and so on for 30 days or so . Certain pre hospitalization and post hospitalization charges are reimbursed. You may in addition get assistance in availing emergency services and local ambulance services

- The Mediclaim is an annual contract that is renewed, and premiums rise as you grow older as you are more likely to fall sick.

- Many providers offer cash less mediclaim which means the insured can get treatment without payment of cash at specified hospitals where the insurance company has tie-ups with. They make the payment directly at the hospital subject to specified terms and conditions.

Why does one need Mediclaim Policy?

Aid for Emergency: One of the most crucial features of a medical policy is that it covers sudden medical expenses in times of emergencies like accidents or sudden illnesses.

Cashless settlements: Several insurance companies offer cashless settlements wherein no penny has to be paid by the insured individual. A part of the bill might be borne by the insured if it consists of the inadmissible/non-payable items & amounts that are listed by the insurer.

OPD(Out Patient Department) expenses: The cost of diagnostic tests and consultation fees of individual doctors have roared. Some policies offer coverage beyond hospitalization expenses in their mediclaim policy with certain terms and conditions.

Tax Benefit: One can also claim Income Tax deduction under Section 80D for the premium paid. The amount paid towards medical insurance premium for self/spouse/children provides tax exemption for a maximum of Rs 25,000. There is an additional benefit of Rs 25,000 on mediclaim premium for parents (Rs 30,000 if parents are senior citizens).

Types of Mediclaim Policies:

- Individual Mediclaim : Individual Mediclaim is the most basic form of mediclaim policy where hospitalization expenses up to the sum assured limit can cover. The insurance premium of the policy is dependent on the sum assured value.

- Family Floater Mediclaim Policy :In Family Floater Mediclaim Policy, the amount assured floats i.e shared amongst the family members. The family generally includes Self, spouse and 2 dependent children. The sum assured is not fixed for each family member, but there is a upper limit for the total family cover.It gives the entire family a total cover, which could be utilized by one or more members falling ill. You could opt for this as a convenient alternative to taking separate policies for each member. For example, there is a Rs. 3 lakh Family Floater taken by husband and wife. If the husband has a surgery due to accident and it costs Rs 2 lakh, he would be able to use the family floater policy,infact the entire Rs. 3 lakh could be used by him. His wife or he himself can still use Rs 1 lakh. On the other hand, if they had taken separate policies of Rs 1.5 lakh each, the husband would have had to cough up Rs.1.5 lakh from his pocket towards surgery expenses

- Unit Linked Health Plans: Health insurance companies have now also introduced Unit Linked Health Plans, too. Such plans combine health insurance with an investment plan and pay back an amount at the end of the insurance term.

How to choose Mediclaim policy?

With innumerable policy options in the market, it is very difficult to choose the best providing extensive coverage at low price. Before deciding any medical policy these points need to be noted.and eventually draw a conclusion if you need an individual plan/ family floater plan or Unit linked plan.

Decide Members & motive for mediclaim

You have to decide the number of members to be insured. Depending upon the health conditions and past medical history of members you can decide the number of members that you want to insure. . Generally family-floater plans are comparatively easy in the pocket. But If one of your family members is older than 50 it would be sensible to look for an individual cover for such a member in addition to the family floater. You shouldn’t have a “high risk” member as part of your family floater, as if he/she has frequent claims, year-after-year, other members could be left without any cover, when they would need it.

Check diseases covered under Mediclaim Policy

What is worse than not having a mediclaim policy, Buying and not able to use it. Therefore before investing in a Mediclaim policy it is extremely important to see the diseases and sickness it covers. The general exclusion in a mediclaim policy are:

- Dental treatment, except in case of an accident

- Cosmetic and obesity related treatment

- Plastic Surgery or circumcision, except in cases of injury or illness

- Debility and General Run Down Conditions

- HIV/AIDS

- Pregnancy

- Medical condition acquired as a result of war; experimental, natural or domiciliary treatment

Decide the coverage amount for Mediclaim

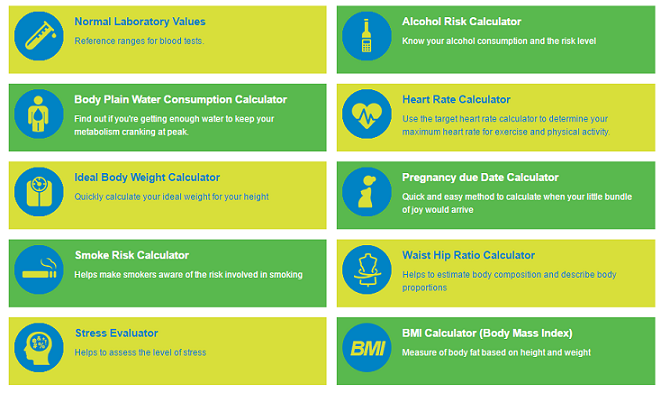

The coverage amount of your health insurance needs to be decided in accordance with the family health history, age of the members to be insured and the class of hospital you desire to choose. If your family has adverse health issues like heart diseases, paralysis or any hereditary diseases it is advisable to opt for higher sum insured. Incase you have already opted for the plan, you can revise the coverage amount at any point of time. You can check the risk using various tools on sites like CignaTTK to decide the cover amount.

Check Premium on coverage

Once you decide the coverage amount, it is advisable to check the premium to be paid to avail the sum assured.

Restriction on number of Claims:

Typically there should be no limit on the number of claims made provided the claims are within the insured limit.

Other Perks:

What if a person doesn’t claim any money for that particular year? Does he benefit anything when health is in his favour? You can check if the Mediclaim Policy offers

- ‘No Claim Bonus’ where you are entitled to a discounted premium if you made no insurance claims in the preceding year.

- Loyalty Benefit that entitles you to benefits if you have taken a policy with the same company for a minimum number of pre-specified years.

- You should also check if the company offers pre and post hospitalization expenses like including the cost of various tests etc.

Hospital Network:

During emergency one needs to reach hospital fast. Therefore, it is important to check if the insurance you are availing is compatible with the hospital near you which is in your budget. For example ,CignaTTK has an easy tool to check the hospitals near you where you just need to enter the state, city and pincode.

Claim Settlement

The claim settlement procedure should be quick and easy.

A small premium could save you and your family lot of financial troubles. Do you have a Mediclaim policy? How did you choose it?

One response to “Mediclaim Policy”

Mediclaim policy come with many clauses and limitations. Each one is different and it is hard to choose the one best for you. Your guidance in the blog helped me choose a mediclaim insurance insurance which was ideal for me and I cannot thank you enough