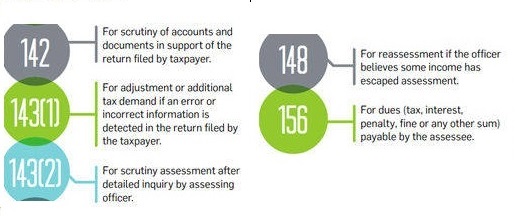

A notice from the Income Tax Department is every taxpayer’s worst nightmare. A tax payer can get notice from Income Tax Department for many reasons under various sections as shown in image below. We shall go through these sections in detail in this article. Ignoring a notice from the IT department can prove to be expensive. Fines are usually imposed on assessees who do not respond to IT notices – these can be as high as Rs.10,000!

Table of Contents

How would you get Income Tax Notices?

These intimations will be received through email to the Email address provided in filing income tax returns online. If return is processed by CPC Sender will be intimations@cpc.gov.in It will also be sent through post at the address associated with PAN number. To find the address associated with your PAN .

- Go to Income Tax efiling website https://incometaxindiaefiling.gov.in/

- Login with your User ID which is your PAN number and password. Then date of birth field and captcha appears

- Select Profile Settings -> PAN Details as shown in image below.

Notices sent by Income Tax Department

Income tax notice under Section 143(1) – Letter of Intimation

When is the notice served: Three types of notices can be sent under section 143 (1). Our article Understanding Income Tax Notice under section 143(1) talks about it in detail.

- Intimation where the notice is to be simply considered as final assessment of your returns since the CPC or assessing officer has found the return filed by you to be matching with his computation under section 143 (1).

- A refund notice ,where Income tax refunds you for extra tax paid, then you can look forward to the cheque.

- Demand Notice where the officer’s computation shows shortfall in your tax payment. The notice will ask you to pay up the tax due within 30 days.

Time limit for the notice to be served : up to 1 year after completion of relevant assessment year

- If details provided by the taxpayer and as verified by the Income Tax department match, then this notice will serve as final assessment of the return with nothing to be done on part of the taxpayer and the department. Just a printout of the same shall be taken and kept along with the income tax file.Take a printout of the same and file it with your income tax papers.

- If you are getting Refund, wait for the cheque or transfer into your account.

- If there is a tax demand then this intimation becomes Notice of Demand under section 156. The notice says “In case of Demand, this intimation may be treated as Notice of demand u/s 156 of the Income Tax Act, 1961. Accordingly, you are requested to pay the entire Demand within 30 days of receipt of this intimation“. For example, if Income as disclosed by taxpayer is Rs. 6,00,000 and tax duly deposited on same but the department computes his income as Rs. 6,50,000, then tax on Rs 50,000 needs to be paid. The taxpayer will have to pay such tax or if he thinks that the demand is wrong then he must prove his case and file rectification.

Income tax notice under Section 143 (2) or Scrutiny Notice

- When is the notice served: If you get notice under section 143(2) it means your return has been selected for detailed scrutiny by your Assessing Officer.

- Time limit for the notice to be served : This notice can be served Up to 6 months after completion of relevant assessment year.

- How to reply to notice :The notice might ask you to produce documents in support of deductions, exemptions, allowances, reliefs other claim of loss you have made and provide proof of all sources of income. So collate information like bank statements, major expenses, income and loan details,Section 143(2) enables the Assessing Officer (AO) to make a regular assessment after a detailed inquiry.

Income tax notice under Section 142 (1)

- When is the notice served: This notice is sent when income tax return has not been filed. You may be asked to produce documents in support of returns being filed for the inquiry.

- Time limit for the notice to be served: There is No time bar during which the notice needs to be sent.

- How to reply to notice : Typically, a notice under Section 142(1) lists the details required by the tax authorities and the date by which they should be submitted. For instance, the tax authorities might seek details of a major repair expenditure or a stay overseas while on deputation abroad. The notice might require you to appear before the tax authorities either personally or through an authorised representative (such as a tax consultant), to provide clarifications or explanations. File your returns within time specified in the notice. If any tax money is due you are expected to clear it.

Income tax notice under Section 148

- When is the notice served: The notice is issued under section 148 If the Assessing Officer believes some income might have escaped assessment asking you to file returns for the relevant assessment year. Alternately he might ask to file returns for the purpose of reassessment.

- Time limit for the notice to be served : In case income that has escaped assessment is Rs 1 lakh or less notice under section can be sent within 4 years of the end of the relevant assessment year. In case income escaped is more than Rs 1 lakh then such notice can be sent within 6 years.

- How to reply to notice : File returns for the relevant assessment year within time mentioned in the notice and submit documents as may be required. In case it is a reassessment, you might want to take help of a tax expert.

When you get notice

Never ignore a notice received from the tax authorities. Do not panic and be compliant. Non-compliance with the notice or failure to produce the required documents could lead to a penalty of Rs 10,000 in addition to tax and penal interest. It is a myth that tax authorities are out to harass taxpayers to extract additional tax from them.

Check details : Check the given details of notice i.e. your name, address, PAN number etc. It is possible that the notice was meant for someone who shares your name or date of birth. Go by the PAN even if there is a discrepancy in the name and address. The department issues notices according to PAN, not name. For electronic notices, check document identification number available on each communication with tax authorities.

Check sender’s details: A notice must have the name and designation of the officer, his signature, stamp, official address and should mention the income tax ward and circle.

Motive of the notice : Understand motive of the notice. Why the notice has been sent to you.

Preserve envelope: The envelope in which the notice is sent is an important piece of evidence. It will have the Speed Post number, which establishes when the notice was posted and served to you.

Make copies of notice: You can’t afford to lose the notice, so make photocopies and/or scan and store it on your computer.

Check the validity: Check is whether notice is issued within the time limit permitted by the IT Act. A notice under Section 143(3) for scrutiny assessment has to be served within six months of the end of the financial year in which the return was filed. If served later than this period, it will be deemed invalid. However, a notice served under Section 148 can reopen a case even up to six years from the end of the relevant assessment year if the Assessing Officer has reasons to suspect income evasion. If the amount in question is less than Rs 1 lakh, only up to four-year-old returns can be reopened for scrutiny.

Should you Seek help?

Should you seek help from an expert when you get a notice? If the notice is simply about a factual matter, such as an arithmetical error, TDS mismatch or deduction amount, a taxpayer may respond on his own. But when it is a serious issue, such as a notice for scrutiny or reassessment under Section 148, one should get a professional to respond. It would cost money, but it would ensure that the matter is skillfully handled. A chartered accountant will be better equipped to deal with the situation and provide apt responses. But do understand what is being asked, why and how you are responding.

In any case make sure you respond within the deadline. Send whatever documents you can get and request for more time. This will establish that your intention is to comply with the notice. For example A scrutiny notice may ask for several documents, including bank statements, pay-slips, rent receipts and brokerage statements. While it may not be possible to put all this together in the short time, it is important to convey your intent to the tax department.

After collating all the information and documents, prepare a cover letter listing all the documents provided. Make copies of the letter and documents. Ask for an acknowledgement on the copy of the letter. Preserve this as evidence of the documents given. In case of a notice under Section 143(2), where the details required are not specified, collate basic information, like bank statements, major expenses, income and loan details

Overview of Income Tax Notices and What to do

Following image from Finance Hospital says what to do when you get notice from Income Tax Department.

Related articles :

- Income Tax for Beginner, Income Tax For Beginner – Part II

- Challan 280: Payment of Income Tax

- Change of Assessing Officer and Jurisdiction for Income Tax

- How to Pay or Reject Outstanding Income Tax Demand under Section 143(1)

- Understanding Income Tax Notice under section 143(1)

- Request for Intimation for Income Tax

- Compliance Income Tax Return Filing Notice

- Notice for Adjusting Refund Against Outstanding Tax Demand, Section 245

- Defective return notice under section 139(9)

Have you received Income Tax notice? Under what section? How did you respond to it? What have been your experiences ?

sir on the demand raises by income tax department on the assessment year 2017-18 is actually computed double by you .so its my humble request that please correct it and release my all the refund.my pan-card number is BMAPS3654P

We don’t work with Income tax department.

You need to reply to Income department as instructed by either accepting or rejecting the demand.

It is explained in detail in our article

How to Pay or Reject Outstanding Income Tax Demand under Section 143(1)

This is really helpful, thanks.

respected sir yearly I am paying income tax about rs 40000// past 10 year he average now I am having catch nearly FIVE lakhs can I deposit in bank with pan no – KUMARAGURU

To Sir,

I filled my return for AY 2014-15 on 20/05/2015 and received notice under section 143(2)on 23/09/2016, so please tell me that is this valid notice or not ?

Thanks in advance

VALID ,SUCH NOTICE (SECTION 143(2)) CAN BE SERVED ON ASSESSEE WITHIN 6 MONTH FROM END OF FINANCIAL YEAR IN WHICH RETURN IS FURNISHED.SINCE RETURN IS SUBMITTED ON 20/05/2015,NOTICE UNDER SECTION 143(2) CAN BE SERVED UPTO 30/9/2016 .

YES ITS VALID

CA GAGAN GUPTA

9899511905

I am a government employee.I did trading in shares(intraday)in AY 2014-15. After filing my document in response to scrutiny notice under section 143(2), AO is asking me to show the permission from my department for doing trading in shares, about which i was not aware.If I am not able to provide him the permission what action AO might take against me,please reply

Dear Sir,

Our assessee company is in receipt of demand rdwer under sction 271(1)(c) but the department has not sent notice under section 156.

How to file appeal in this case?

Will the demand order be null since the same is not accompanied by 156 notice?

Please reply

Thanks

On the Govt. Income Tax site in pending actions->Details of defective returns, I can see e-file in response to Notice u/s 139(9)

Error code: 38.

Error Description: Tax liabiltiy is shown

Probable Resolution: Tax payer should pay the balance tax and reupload the xml

Notice date is 29/8/2016.

How and where can I pay the balance tax which is approx. Rs. 1200 only. I have filled the xml file myself but I don’t know where to pay this balance tax and how and from where should this tax payment details be filled in the new xml.

Everywhere they are options to pay advance tax but no tax for previous year.

I had already submitted my ITR once by the due date earlier but it was defective as there was tax liability.

Whats the way forward now ?

Please go through our article Defective return notice under section 139(9) for more details.

I have received a message from income tax on mobile to contact but there is no section and I have not filed any return’s bcoz I m working abroad .so how can I check from pan card what they require from me

Please help me or should I go to income tax office for it

https://taxofindia.wordpress.com/2016/09/18/assistance-in-handling-income-tax-notice/

Good morning sir,

I receive notice under section 156 to pay taxes but my TDS. Deducted by employer and 26 AS show’s that tax already paid. How. To response to the notice

Along with notice you would have got calculation sheet as why there is a demand.

Try to understand it.

If it’s ok you can email the notice to us at bemoneyaware@gmail.com.

According to said section you have to deposit the amount demanded within 30 days from the date of receipt of notice. Other wise you will be deemed to be an assessee in default.

The consequences of such default are: INTEREST U/S 220: This interest is in addition to interest u/s 234A, 234B, 234C. Interest at the rate of 1% p.m. or part of month is to be paid after the expiry of said 30 days.

PENALTY U/S 221: The Assessing Officer can levy a penalty of an amount not exceeding the amount demanded.

non filing of income tax return- reg

the income tax department has received information on financial transactions/activities relating to you. a list of some of the information for financial year 2013-14 is provided below. as per records, you do not appear to have income tax returns for assessment year(s) 2014-15.

what is the section of return filing

Dear sir

if you have not furnished the ROI within time prescribed under section 139(1) than AO can issue notice under section 142(1)(1) requiring assesseeto furnish the ROI within time specified in notice .failure to comply with notice can lead to best judgement assessment under section 144.notice under section 142(1)(1) can also be issued after the end of relevant assessment year

Sometimes your blog is loading slowly, better find a better host.â€,:-`

Dear Sir,

I have filed income tax return Fy 2013-14 and at current time i have received Notice u/s 142(1).

As per income,i have shown salary income and commission.income tax officer require copy of salary certificate and commission income.

please give me a suggestion

Sir,

Kindly help me in this case. Please advise me.

I was a regular income tax assessee since 2003 to 2008. From 2009 onwards I have stopped all my business and thereby no income. So I stopped filing income tax return for the following years.

1. 2009-2010

2. 2010-2011

3. 2011-2012

4. 2012-2013

I have received a notice u/s 148 of income tax Act 1961 on 30/03/2014. This notice was sent to a wrong address and it was accepted by other family member who was not legally authorized agent on my behalf (Wife).

I have already filed return on 06/11/2015 and I have send a reply letter stating that the address mentioned in the letter is not correct.

Can I send a notice to the AO to challenge the effectiveness of the service of notice u/s 148?, with asking reasons for sending the same?

I f I will not respond properly before attending fro scrutiny it will attract the claim of 292BB. So please tell me what should I do right now?

PRADEEP KUMAR

Its better to contact a CA or a tax lawyer.

sir,

plz, help how to face incometax authority asper sec206(4), tds demand out standing.

I RECEIVED DEMAND NOTICE UNDER SEC.245. I AGREED. I REMITTED THE TAX DUE OF Rs. 2130/- BY NET BANKING. AM I TO FILE A REVISED RETURN? WHAT ELSE MUST I DO? PLEASE SUGGEST.

You dont need to revise your return or not to do anything else.

Gud evng Sir,

Pl some replies of section 142(1) 143(1) 143(2) and 148 of Income tax act,1961 replies pl pl send the replies above said my mail id

thank you sir

Gud evng Sir,

Pl some replies of section 142(1) 143(1) 143(2) and 148 of Income tax act,1961 replies pl pl send the replies above said my mail id

thank you sir