40,000 investors have lost funds to the tune of Rs 1000 crores in the Bangalore based IMA which unravelled as Ponzi Scheme in Jun 2019. An investment scheme that appeared to follow Islamic precepts, run by a religious man Mohammed Mansoor Khan, gave returns for years until it suddenly stopped. RBI had raised warnings against IMA in 2016 but they were ignored. Mohammed Mansoor Khan named politicians and developers as being benefactors of his largesse. He held them responsible for ruining his business. What is IMA Scam? Who is Mohammed Mansoor Khan? What happened? Are Politicians involved?

“Please give our money back. Even if you don’t want to give benefits it’s okay. There are many married women who have invested their complete family income for the sake of their daughters marriages,” says Parveen Sheikh on IMA’s Facebook page.

“I trusted you so much because you always spoke about god and I felt you are a true Muslim and will never cheat middle class people like us. Because of you I could not get school admissions for my two kids. I lost everything now,” Yashas Kumar a Shivajinagar resident said.

Table of Contents

The IMA Scam

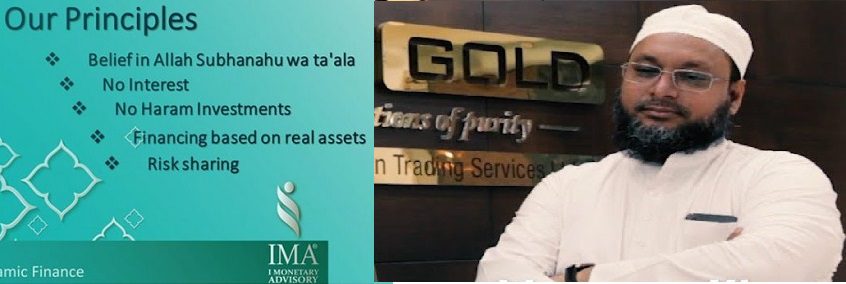

Established in 2006 IMA hit the big time around 2015 and managed to thrive despite warnings against its fraudulent schemes from the RBI, income tax investigations. In 13 years, thousands of investors, mostly Muslims, had invested in IMA Jewels with the assurance of high returns. Investors were ‘partners’ and didn’t get ‘interest’ but a share in ‘profit.’ At its peak, IMA doled out a monthly ‘profit’ of 7%. All payments were by cheque, increasing trust.

- IMA invited customers to invest money in multiples of Rs 50,000. Every month, investors were paid 1-3% of their investment and he could withdraw his principal anytime, after a 45-day notice.

- To attract investments from Muslims, who are forbidden by Islam to accept interest, he said this was a halal investment, returns would be from the profits his company made by trading in gold, silver and jewellery.

- Investors say they put in money after hearing of friends and relatives being paid regular returns

- The company was set up as a limited liability partnership, with investors becoming shareholders, instead of depositors

- In Aug 2016 Reserve Bank of India (RBI) had sounded a warning about parent I Monetary Advisory (IMA). It informed the Karnataka Police about the allegedly fraudulent practices of the Bengaluru-based private financial firm. The Karnataka police, however, gave the company a clean chit on the grounds that IMA was registered with the Registrar of Companies and was giving interest-free financial options for new business startups and that there were no complaints against the business.

- After demonetisation in November 2016 , income tax authorities searched the IMA office. The IT department is said to have informed the Enforcement Directorate (ED) about possible fraud at the firm, but this too didn’t seem to go anywhere.

- Toward the end of 2018, the RBI once again wrote to the Karnataka government. This time, it alerted the top bureaucracy about IMA investing funds raised from investors overseas, a violation of RBI guidelines.

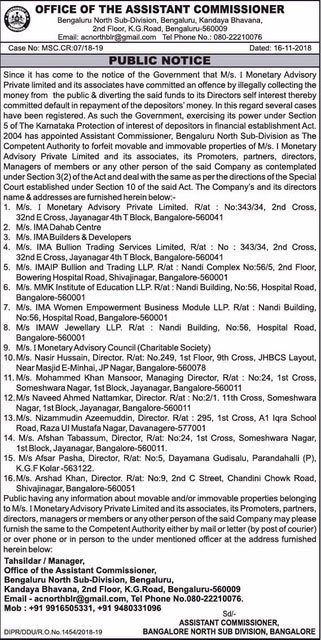

- The state government referred the matter to the police and the revenue department over violations of the Karnataka Protection of Interest of Depositors in Financial Establishment (KPID) Act, 2004. An assistant commissioner of the revenue department issued a public notice through newspapers, warning investors and asking them to approach the department with complaints. No one complained.

- IMA’s business began unravelling sometime in October 2018, according to an admission made by the absconding Mohammed Mansoor Khan himself in a social media video on June 23. “The downfall started in October itself but we did not let the investors know. We suffered losses in the range of Rs 2000 to 3500 crore and then there was a delay of payment in returns for one month.”

- Mohammed Mansoor Khan and IMA tried obtaining a Rs 600 crore loan to tide over the crisis by raising funds through banks and NBFC. He met state revenue minister RV Deshapande, seeking a no-objection certificate (NoC). The meeting was facilitated by MLA R Roshan Baig. Deshpande claimed that Baig had vouched for Khan as a ‘man of good character’ and a resident of his constituency. But the NOC was not given. “One IAS officer delayed the NOC because I did not pay an amount of Rs 10 crore in time,”Khan claimed in his June 23 video on social media.

- According to the revenue minister Deshpande no action was initiated against IMA after the November 2018 notice because there was no police report on the matter. There was no police report because IMA showed investors as being shareholders of the firm and as a consequence the Karnataka Protection of Interest of Depositors (KPID) in Financial Establishments Act, 2004 did not apply in the case, the revenue department has claimed.

- At this point, Khan posted a YouTube video in which he threatened defamation proceedings against the official. “IMA is a limited liability partnership (LLP) company and it does not come under the ambit of KPID Act. This is an attempt to sabotage the image of the company,” he said, while assuring his investors that their money was in safe hands.

- Trouble for investors started from March 2019 when payouts shrank or halted; the company claimed polls had created a liquidity crunch

- 9 June 2019 His first audio clip surfaces. Says in the recording he should be dead by the time the public hears it. Accuses politicians and police officers of extorting money from him and forcing to him leave the country. Khan said his business was pushed to the brink by Congress MLA R Roshan Baig’s refusal to return Rs 400 crore he had borrowed from him.

- When investors rushed to IMA officers after hearing a clip of the founder saying he would commit suicide, they were faced with shuttered premises

- 40,000 investors have lost funds to the tune of Rs 1000 crore through investments in the range of one or two lakh rupees to Rs 10 to 25 lakhs and more.

- 11 June 2019: State forms 20-member Special Investigation Team, led by senior IPS officer BR Ravikante Gowda

- SIT of the Bangalore police has recovered jewelry worth Rs 11.72 crore from IMA Jewel stores.

- The SIT as also arrested seven directors of IMA and obtained an Interpol blue corner notice against Mansoor Khan who is suspected to be in a country in the middle east

- 23 June 2019: Khan posts video, says he wanted to come back on June 16 but couldn’t. Promises to repay all

- 15 July 2019: Releases video, claims he’s facing health issues, including heart problems. Claims he will return to India in next 24 hours, seeks help from judiciary and police in distributing money to investors

- The SIT team through their sources found him in Dubai. The officers flew to UAE and pretended to be dry fruit merchants. They finally met Mohammed Mansoor Khan and persuaded him to return to India and submit himself. How four ‘merchants’ tracked IMA owner

- 19 July 2019 : Mohammed Mansoor Khan arrives at Delhi airport from Dubai and is arrested

- After Mansoor Khan’s return from Dubai, Enforcement Directorate (ED) has taken IMA founder in their custody from Delhi airport. Presently, the matter is being heard under a Bengaluru Court.

Role of Politicians in IMA Scam

One of the major factors for IMA staying afloat has also been the proximity of Mohammed Mansoor Khan to key politicians in Karnataka.

Khan has sent an audio message addressed to the former Bengaluru police commissioner T Suneel Kumar and a video message addressed to the new police commissioner Alok Kumar. In his mesages to the top police officials Mansoor Khan has blamed extortion by unnamed politicians for the downfall of his business and has promised to return to India and come clean on names if his safety is assured by the police.

Roshan Baig , the Congress MLA, from Shivajinagar who was the minister for infrastructure, urban development, information and Haj in the Congress government (2013-2018) – has been closely associated with IMA and its founder Mohammed Mansoor Khan for many years.

At the instance of Baig the IMA group in 2015 adopted a government school in Shivajinagar, school where Baig studied, and renovated it at a reported cost of Rs 16 crore. The renovated building was inaugurated in June 2017 by the then Karnataka chief minister Siddaramaiah, Roshan Baig and then education minister Tanveer Sait.

Another politician who has had links with IMA’s Mansoor Khan is the Congress leader Zameer Ahmed Khan – minister for infrastructure and Haj in the current Congress-JDS government. Zameer is reported to have met Mansoor Khan on May 28 a few days before the IMA founder disappeared. An election affidavit filed by the minister also shows that he sold a property to Mansoor Khan in 2017-18 for Rs 9.38 crore.

Baig has denied the allegations and has said that his association with IMA was restricted to developing the V K Obaidullah government school in his constituency. “After my recent political fallouts, some of my adversaries have made a full-fledged attempt at assassinating my character by orchestrating a series of events using underhand methods. The entire hit job has been carried out using a baseless, un-investigated audio recording,” Baig said.

One publicly documented instance where Mansoor Khan was allegedly subjected to extortion over the functioning of IMA occurred in 2017 when the IMA founder lodged a police complaint against the CEO of a private television channel Janashri TV alleging extortion. In his April 14, 2017 complaint to the Commercial Street police Khan alleged that he paid Lakshmi Prasad Vajpai the CEO of the channel Rs 10 crore into seven bank accounts and gold worth Rs 30 lakh to stop airing negative stories about the operations of the IMA group. The complaint also alleged that the channel executive later began demanding Rs 25 crore and a Toyota Fortuner to prevent broadcast of stories about the IMA Group.

YouTube Video with IMA’s founder messages

The YouTube video has various messages believed to be founder of IMA

What are Ponzi Schemes?

Ponzi schemes promise high returns or payouts, they keep their word(initially) to trap the first set of victims, then many people join to keep the fund flow ticking. There may or may not be a business of product or service sales involved in the programme. Then when many people join, it is unable to keep the returns. There are Multi-Level Schemes or Pyramid schemes where early subscribes bring in other friends and family members. It essentially entails fleecing Peter to pay the duped Paul till the cover is blown, and the cycle grinds to a halt.

The name Ponzi scheme came from Charles Ponzi who defrauded hundreds with such a scheme as far back as the 1920s. Ponzi apparently had been inspired by the 1880s Ladies Deposit scam in which Sarah Howe served three years’ jail term.

Examples of Ponzi Schemes in India:

- Saradha chit fund scam: Unravelled in 2013

- EMU FARMS: Unravelled in: 2012

- SPEAKASIA ONLINE: Unravelled in: 2011

2 responses to “Understanding IMA Scam, Mohammed Mansoor Khan”

[…] Understanding IMA Scam, Mohammed Mansoor Khan […]

[…] Details in the article Understanding IMA Scam, Mohammed Mansoor Khan […]