Not too long ago, having house insurance was something that was unheard of in India. However, the scenario has changed for the better. Since people have started becoming aware of the benefits as well as the security that a house insurance cover provides, many can be seen opting for home insurance these days.

Having said that, awareness pertaining to house insurance is still in a relatively nascent stage as compared to the western nations. This can be in part attributed to the fact that houses are primarily made of wood in the west. This leaves them very prone to fire prompting people to safeguard their homes with a household insurance. Despite this, there are several other benefits that a homeowner’s insurance offers apart from coverage from the fire. There is a dearth in awareness of such benefits as well as several misconceptions. Let’s take a look at some of them to ensure that we get our household insurance or home insurance basics right.

Does Home Insurance cover all your possessions?

To answer this, one must realize that there two types of home insurance covers that can be availed. Additionally, when it comes to home insurance, there are two types of covers available. They are structural insurance cover and content insurance cover respectively. A content insurance cover won’t cover any structural damages to your home in case of a natural calamity. While a structure-only policy will not cover your house valuables in the event of a robbery. It is always a good idea to select a home insurance provider that offers both types of protection. This will help you save on the premium instead of going with two different providers that will cost you a lot more. With this information you have your question answered and ensure that you choose the right policy for your house.

Does Home insurance include flood damage?

Like mentioned before, the nature and the degree of coverage depends on the type of cover availed. So if you have chosen a policy that covers structural damage, you would be covered for any damages caused to your house due to floods structurally. However, when it comes to floods there is a chance that your house contents such as TV, fridge, music systems or any electrical appliance for that matter can be damaged as well. Thus it again makes sense to go with a house policy that offers both types of coverage to protect from perils of such nature. The same situation can arise during calamities such as earthquakes and cyclones. However, some insurance providers tend to exclude certain natural calamities from the coverage due to high potential of risk. Thus, it is crucial to read the fine print before buying the policy.

Does Home insurance cover theft from your house?

Again, it all depends on the type of home insurance cover availed. With a content-based home insurance, the contents of your home will be safeguarded against theft. That said, it is again important to go through the exclusions list to ensure that there are no surprises during claims. An example of a home insurance policy is Reliance home insurance policy that covers your valuables like jewellery, both inside the home as well as while you are wearing them outside.

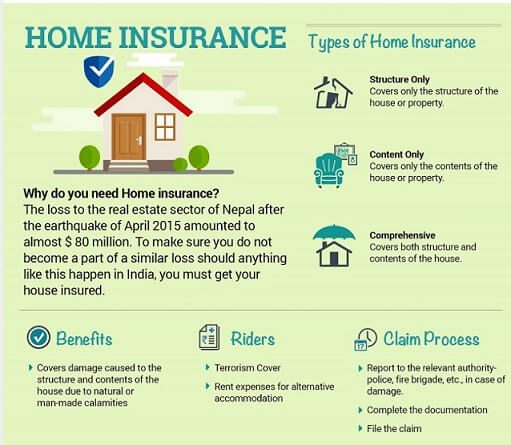

Image below gives overview of Home Insurance (Ref: Insurance policies to protect what’s important to you)

One response to “Home Insurance:Types, Basics,Claim”

Insurance claim solutions helps you to understand basics of Insurance Claim & settlement process insurance claim solutions.Read More https://www.claimyexcess.com/insurance-claim-solutions