On 8th November 2016, Prime Minister Narendra Modi demonetized the Indian economy and made high-value currency notes illegal. This move significantly impacted all sectors. This article explores Demonetization Impact on Life Insurance Industry.

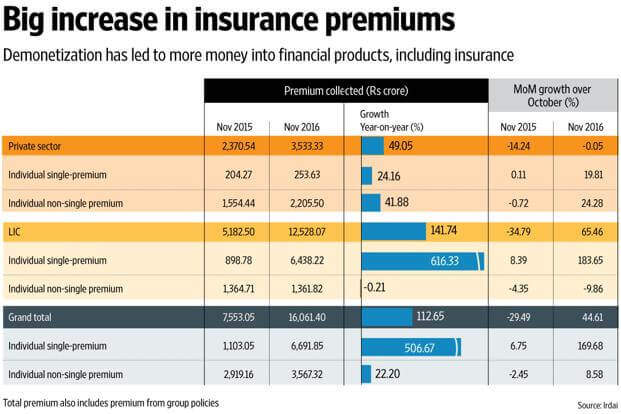

The demonetization bodes well for the insurance sector that saw a huge surge in premium received. According to data released by the Insurance Regulatory and Development Authority of India (IRDA), single premium collections for November 2016 were estimated at INR 6,692 crores. The increase was over 500% than the premiums collected in November 2015.

The amount for November 2016 was 170% higher than collections during the previous month, which is estimated at INR 2,481 crores. Furthermore, the first year regular and single premium amount saw an increase of 113% on a year-to-year basis. The insurance sector grew over 40% in November 2016; significantly higher than the 28% month-on-month growth rate. The given image from Livemint shows the big increase in insurance premium.

Demonetization Impact on Insurance

- Rerouting savings

Post-demonetization, the savings habits are witnessing a change that is clearly seen from the IRDAI numbers. Traditionally, Indians preferred saving their money in gold or real estate. However, demonetization has made both these sectors less attractive. Many individuals are now using life insurance to park their savings, which is resulting in an exponential growth for the sector.

- Increased corpus

The insurance sector has become cash-rich in the post-demonetization period. Over INR 12 trillion has been infused in the insurance sector and it is expected that a major component will be invested in financial instruments. Because money has been moved to the formal economy, an increase in the financial markets is expected. In addition to insurance, sectors like mutual funds are also expected to see growth. This trend would continue until the banking system witness higher liquidity. The increase in bank liquidity provides an opportunity to these institutions to sell insurance products from third-parties. According to data, banks sold two times third-party products in November 2016 when compared to other months.

- Push towards cashless economy

An important objective of the demonetization was to help people move towards a cashless economy. A large number of people have downloaded e-payment applications and e-wallets on their smartphones. This is also expected to bode well for insurers. The Indian life insurance market is estimated at $60 billion and growing at about 12% per annum. The general insurance segment is valued at $11.44 billion with a growth rate of approximately 17% per year. As digitalization becomes widely accepted, the life insurance companies will see a reduction in their operational expenses. These savings would be passed on to the customers through discounts on the premiums, better products, and improved services.

During the short-term, there will be an increase in the number of individuals who opt to pay insurance premium online. For example, people widely used cash to pay for hospitalization expenses. However, cashless settlements are assisting individuals to overcome the need for cash to meet these expenses.

Unified payment interface (UPI), Jan Dhan accounts and Aadhar integration helped lay the foundation towards a cashless economy. Post-demonetization, individuals further understand the benefits of digitalization. Insurance services would now be available to more individuals through Jan Dhan accounts. It is expected to increase insurance penetration and reduced premiums in the longer period.

The changing demographics and increased digitalization have resulted in consumers being more comfortable in accepting advanced technologies. More transparency, availability of detailed information, standard sales, and customized solutions are assisting people to make informed decisions.

Related Articles:

- Black Money : What is Benami Property and Benami Act?

- How to Exchange Rs 500 and Rs 1000 Notes ?

- New Rs 500 and Rs 2000 notes : Features,Comparison

- Ban on 500 and 1000 rupee notes fight against corruption, PM speech

- Income Declaration Scheme: Features,How to Declare undisclosed income