Cheques and demand draft are increasingly losing their place as instruments that are used for payments as, most individuals are today making payments through the RTGS, NEFT,IMPS mechanism. But still today many applications for jobs, examinations, admissions, services, high amount purchases, etc. require demand drafts rather than cheques. As Cheques can be dishonoured due to insufficient balance, but Demand Draft cannot be dishonoured. This article looks as steps to make a Demand Draft offline by filling form and online, What is Demand Draft,shows sample image of Demand Draft, What is Banker’s cheque. how to get Demand Draft cancelled, what happens when demand draft expires. How does Demand Draft differ from cheque, from Banker’s cheque.

Table of Contents

What is Demand Draft?

The Demand Draft is a pre-paid Negotiable Instrument, wherein the drawee bank undertakes to make payment in full when the instrument is presented by the payee for payment. The demand draft is made payable on a specified branch of a bank at a specified centre. In many transactions cheque is not usually accepted as the drawer and payee are unknown and there will be credit risk as cheque may bounce. So, in such cases Demand draft is accepted where the transfer of money is guaranteed. Demand draft is valid for period of 3 months.

- A Demand Draft is payable on demand

- A Demand Draft can NOT be paid to a bearer. In order to obtain payment, the beneficiary has to either present the instrument directly to the branch concerned or have it collected by his / her bank through the clearing mechanism.

- Demand draft is discussed in section 85(A) of the NI Act.Negotiable Instruments Act 1881

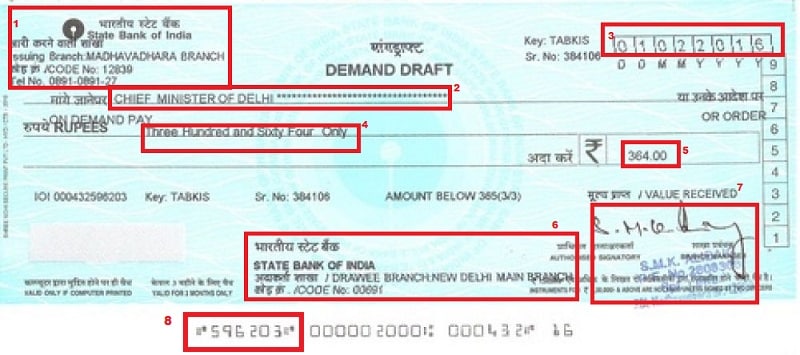

Sample Demand Draft

Sample demand draft is shown in image below. The various fields in DD are explained below. Sample demand draft is one sent Vizag engineer sends Kejriwal Rs 364 to save CM from embarrassment

| No | Explanation | Entry in the DD | Details |

| 1 | Bank branch at the top left | State Bank of India MADHAVADHARA Branch | The branch of bank issuing the DD |

| 2 | To Pay | Chief Minister of Delhi | Who gets the amount specified in the DD |

| 3 | Date | 01/02/2016 | Date of issue of DD (Validity period is 3 months) |

| 4 | Amount | Three hundred and sixty four only | The amount payable to the party in words |

| 5 | Amount | 364 | The amount payable to the party in figures |

| 6 | Branch, at bottom | State Bank of India | The branch of bank which pays the amount |

| 8 | DD number at the bottom | 596203 | Number of DD |

| 7 | on the right | Signatures | Signatures of the officers of branch issuing DD |

Charges to make Demand Draft

Though RBI advocated reasonability of service charges for demand drafts as early as February 2007, it did not prescribe any explicit thresholds or measures of reasonability . So each bank charges own rates for making demand draft.

For example SBI DD making charges for Above ₹ 10,000 upto ₹ 1,00,000 are ₹5 per ₹1000 or part thereof

- So to calculate find charges per 1000 = 5/1000=.005

- Use this to multiply with amount

- For DD of amount Rs 12000 charges are 12,000 * .005 = 60

- For DD of amount Rs 22,500 charges are 22,500 * .005 = 112.5

Charges of Demand Drafts of SBI and ICICI bank are given below. Interested readers can go through A note on demand draft charges levied by banks in India in 2010 (pdf) by students of Department of Mathematics of IIT(Mumbai).

RBI webpage has link to service charges of the banks.

If you have salary account then you may have no demand draft making charges upto some amount. For example for salary account in HDFC bank drafts upto 1 lakh are free per day.

| Charges | SBI | ICICI Bank |

| DD- Issue |

|

|

| DD- Issue by deposit of cash | No Cash Handling charges will be levied in addition to charges as above for issuance of IOI (Demand drafts/ Bankers’ cheque) in case of cash transaction | Rs.4 per thousand rupees or part thereof, subject to a minimum of Rs.100 and maximum of Rs. 15000 |

| DD – Cancellation / Duplicate / Revalidation | ₹ 100 + ST | For Instrument value upto Rs.200 – Nil For Instrument value above Rs.200 – Rs.100 |

| PO-Issue |

|

Rs.50 for PO of upto Rs.10,000,

For PO above Rs.10,000- Rs.2.50 per thousand rupees or part thereof, subject to a minimum of Rs.75 and maximum of Rs.15000 For Senior Citizen, Student & Rural locations : For amounts upto Rs.10,000– Rs.40, For amounts above Rs.10,000 till Rs.50,000 – Rs.60, For amounts above Rs.50,000– Rs.2.50 per thousand rupees or part thereof (maximum of Rs.15,000) |

| PO – Issue by deposit of cash | No Cash Handling charges will be levied in addition to charges as above for issuance of IOI (Demand drafts/ Bankers’ cheque) in case of cash transaction | Rs.150 per PO for amounts up to Rs.50,000, For PO above Rs. 50,000 Rs.4 per thousand rupees or part thereof, subject to a minimum of Rs.150 and maximum of Rs.15000 |

| PO – Cancellation / Duplicate / Revalidation | ₹ 100 + ST | For Instrument value upto Rs.200 – Nil For Instrument value above Rs.200 – Rs.100 |

Overview of Steps to make Demand Draft

You can make the Demand draft by visiting the bank. If you have account in the bank then you can pay by cheque. Else you need to pay by cash. You can also make Demand Draft online. If you make the demand draft by visiting the bank then you will get Demand Draft within 30 mins. But if you order it online then it would take few days and would be delivered to your corresspondance address.

Whenever you receive the Demand Draft,

- please check details , payable, amount etc before leaving the bank.

- Keep the photo copy of the DD or picture or scan copy of DD.

How to make Demand Draft

1. Fill the form– Visit any bank and ask for a demand draft application form or fill the form online.

2. Form Details– You need to fill up the details like the mode in which you want to pay through cash or from your account using cheque. in whose favour the DD is to be made (beneficiary), the amount , the place where DD will be encashed, cheque number,your bank account number, your signature etc

3. Demand draft charges– The bank will provide the demand draft once you submit the form along with the money/cheque and the demand draft charges. The charges vary from bank to bank

4. Pan card details– If amount exceeds more than Rs 50,000 and you are paying my cheque then PAN card details needs to be submitted.

Make Demand Draft by filling Form at bank

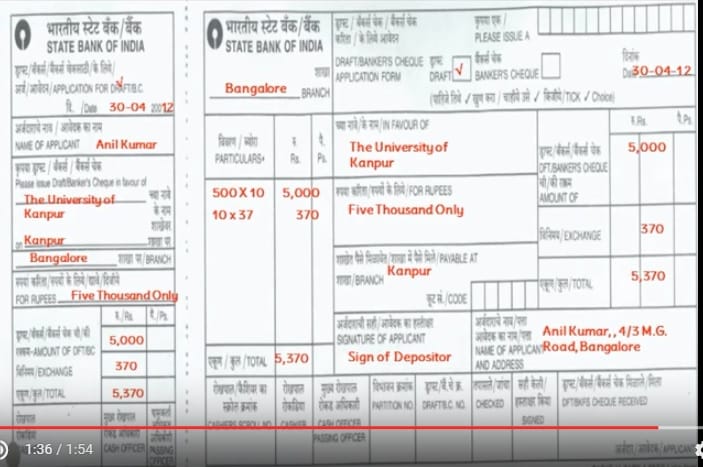

For the details given below, SBI form for Demand Draft from YouTube video is shown below.

- Name in whose favor DD is required or to whom you want to pay: The University of Kanpur

- City where DD is payable: Ahmedabad

- Draft amount: 5,000

- Branch name where DD is applied for Bangalore

- Amount of commission : Rs 370

- Name of applicant: Anil Kumar, 4/4 M G road Bangalore

Make Demand Draft online

You can fill details online and can decide to collect in person from your branch or delivered through courier. Through courier it may take 2-5 days. You may be charged for courier.

Many banks also allow demand draft to be delivered to beneficiary address in India. For example HDFC says All the Demand Draft requests will be processed on the next working day. DDs will be couriered to the mailing address/ provided beneficiary address within 3 to 5 working days.

Following video shows how to make the DD online using SBI Internet Banking.

Can Demand Draft be made using Cash

Yes. One could buy a DD against cash. The DD issuing bank might seek the ID and address proof and if the amount of DD exceeds Rs.50,000, then PAN Card also would be mandatory. The DD commission for the DDs bought against cash may be higher than that for cheque DDs.

Cancellation of Demand Draft

Once you create (Demand Draft) DD, the amount will be deducted immediately from your account. If for any reason, you want to cancel the DD and want to get the deducted money back into your account, you must have to go to bank. There is no online facility in any banks in India to cancel the DD.

If you already have original DD, there can be two cases.

1- You got the DD by paying cash- If you got the DD by cash deposit, you need to submit original DD as well as receipt of cash payment. Amount will be refunded to you in cash immediately with some deduction of amount (around Rs 100-150).

2. If you paid the amount of DD from your account- In this case you just need to submit original DD with filled cancellation form. Amount will be credited back into your account with some cancellation charge of around Rs 150.

If you don’t have Original DD with you (you may have lost the DD in your home or it may get lost in postal service etc), then the process of refunding or cancelling the DD it tough work.

To cancel the DD and if you don’t have the original DD with you, you need to sign Indemnity bond in stamp paper for the bank. After that, most of the bank refund the amount with taking some time i.e within one week, but some bank will take time till expiry date of DD.

If Demand Draft gets expired

In India, a demand draft is valid for a period of 3 months from the date of issue. If it is not presented within three months the Demand draft will not be valid but money will not be automatically refunded. Then the purchaser of the draft should approach the branch concerned bank which issued the draft and submit an application for revalidation of the draft. Please note, the payee (the person named in the draft) cannot approach the bank for revalidation of the draft, or for that matter, any other person.

The draft will be revalidated by the bank branch after verifying their original records, and would extend validity period by another three months from the date of revalidation. A draft which has been revalidated once, cannot be further revalidated, which means that you have to present the draft to the bank within the revalidated period.

Banker’s Cheque

Currency ,cheques, demand drafts, Banker’s cheque, Payment order, Payable ‘At Par’ cheques (Interest/Dividend warrants, refund orders, gift cheques etc.), are used as paper payment methods. The statutory basis for these instruments are provided by the Negotiable Instruments Act, 1881 (NI Act). These are covered in RBI document: Payment Instruments in India

A Negotiable Instrument means a written document transferable by deliver. A negotiable instrument is a document guaranteeing the payment of a specific amount of money, either on demand, or at a set time, with the payer named on the document, so it may not be transferred from the holder or named party to another. Negotiable Instruments are crossed cheque, Bank Draft, Billl of Exchange, Promissory Notes.

Modern payment methods,non paper based are: NEFT, RTGS, IMPS, UPI,Mobile Banking, Digital Wallets etc.

What is Banker’s cheque? How is Banker’s cheque different from Demand Draft?

Banker’s cheque is another payment instrument similar to a demand draft. Banker’s Cheque is issued for transfer of money within the local boundaries, whereas the Demand Draft is issued for transferring money of the person residing in two different places. Bankers cheque can be cleared in any branch of the bank provided it comes under the local jurisdiction, but Demand Draft can be cleared at any branch of the same bank irrespective of the city.

So if you are from Bangalore and have to pay Demand draft in Bangalore you would be given Banker’s Cheque.

| BASIS FOR COMPARISON | BANKER’S CHEQUE | DEMAND DRAFT |

|---|---|---|

| Meaning | Banker’s Cheque or Payment Order is a cheque issued for making the payments within the same city. | Demand draft is a negotiable instrument used to transfer money from one person at one city to another person in another city. |

| Validation Period | Banker’s cheque is valid up to 3 months from the date of issue. | Demand draft is also valid up to 3 months from the date of issue. |

| Special feature | All banker’s cheque are pre-printed with “NOT NEGOTIABLE”. | Demand draft of Rs. 20000 or more should be issued with “A/c payee” crossing. |

| Clearance | It can be cleared in any branch of the same city. | It can be cleared at any branch of the same bank. |

Difference between Demand Draft and Cheque

There are three parties to the cheque- Drawer (maker of the cheque), Drawee (bank on which the cheque is drawn), Payee (to whom the amount of the cheque is payable).

In the case of demand draft there are two parties involved in it, one is drawer (bank or any financial institution), and the other is payee (to whom the amount is transferred).

| Description | CHEQUE | DEMAND DRAFT |

|---|---|---|

| Purpose | Make payment in a safe and easy mode | To transfer money from one place to another. |

| Who issues it | Cheques are issued by the customers of the bank | Bank itself issues the Demand Draft. |

| Meaning | Cheque is a negotiable instrument which contains an order to the bank, signed by the drawer, to pay a certain sum of money to a specified person. | Demand Draft is a negotiable instrument used for the transfer of money from one place to another. |

| Payment | Payable either to order or to bearer. | Always payable to order of a certain person. |

| Bank Charges | No | Yes |

| Drawer | Customer of the bank. | Bank itself. |

| Parties Involved | Three Parties- Drawer, Drawee, Payee.

Drawer (maker of the cheque), Drawee (bank on which the cheque is drawn), Payee (to whom the amount of the cheque is payable). |

Two Parties- Drawer, Payee.

one is drawer (bank or any financial institution), and the other is payee (to whom the amount is transferred). |

| Dishonour | Yes, due to insufficient balance or other similar reasons. | No |

Related Articles:

- Payment Banks,Types of Banks in India, History of Banking in India

- Interest on Saving Bank Account : Tax, 80TTA

- What do we want from Bank : Is Social Banking the way to go?

- What is Auto Sweep Bank Account?

- JAM Trinity: Jan Dhan Yojana, Aadhaar and Mobile number

- NACH: What is NACH? NACH OTM,How NACH will replace ECS

39 responses to “What is Demand Draft? How to make , Cancel a Demand Draft”

Thank you for writing this article.

Banker’s cheque is another payment instrument similar to a demand draft. Banker’s Cheque is issued for transfer of money within the local boundaries, whereas the Demand Draft is issued for transferring money of the person residing in two different places. Bankers cheque can be cleared in any branch of the bank provided it comes under the local jurisdiction, but Demand Draft can be cleared at any branch of the same bank irrespective of the city.

So if you are from Bangalore and have to pay Demand draft in Bangalore you would be given Banker’s Cheque.

I make a banker’s cheque of 15000/-..instead of cancelling can I make it as DD?

dear sir

i have lost my dd. so what is the process of cancellation dd and issue duplicate.

[…] What is Demand Draft? How to make, Cancel a Demand Draft […]

Can I deposit photo copy of demand draft or Xerox copy in bank

Indian Bank had issued a DD in my name of Rs5468000.00 on 24/7/2019 but was lost in post and never reached me. However I have photocopy of the DD. Can I get this money or it is lost for ever

[…] What is Demand Draft? How to make, Cancel a Demand Draft […]

[…] article What is Demand Draft? How to make, Cancel a Demand Draft explains it in […]

In DD of SBI there is no need to Mention My College’s Bank name there is Only need of Branch ??

Please verify it with the College.

WHAT IS THE SIGNIFICANCE OF THE RIGHT MOST COLUMN CONTAINING DIGITS 1 TO 9 ? WHY THE ISSUER PUNCHES A HOLE ON ONE OF THE DIGITS, WHAT DOES THAT DIGIT INDICATES?

There are two holes made on the DD, one on the left side and other one on the right side, it tells the amount of the DD. The right side hole signifies the first digit of the amount i.e. If amount is less than 1000 then digit number 1 is punched on the right side. On the left side the hole signifies the range under which DD falls i.e OT stands for under one thousand, TT stands for under ten thousand and so on.

Quite a helpful article.

Thanks for kind words

I got the dd for the education lone for the study but I’m not interested to going to college now I want to cancel the dd

I had made DD for RS.5000/- in f/o MHT, Mumbai in the month of may, 2016 for confirmation Seat in Engineering at facilitation centre in Pune . Now the draft has been returned by the institute & instructed to deposit RS. 5000/- in cash at an early date.

Please advise, whether DD can be encashed & paid in cash. So that I can deposit it to my institute.

Sir i made a DD of 155000 for purchase of bullet through CSD canteen on 23 Feb 2017. DD made by my friend not by me. Due to exigencies of work in Army i can’t purchase bullet till date. When I reach bank for cancellation of DD, bank says to me to come with me friend who made DD. Their is a problem to availability of my friend bcoz he is posted out side station (Barmer) and we both never come on leave in same period due to busy routine of army. Please tell me procedure for how to renewal DD and further purchases of bullet if possible please tell the procedure to cancel the DD without friend. I am very sad . Please help and guide accordingly. I am waiting for ur reply

I got DD by paying cash in KVB. And now i want to cancel the DD and have to get back my money. in this case, i don’t have the receipt of cash payment. Is there anything i can do to get back my money? or its tough?

Do you have the receipt you got when you got the DD?

Please take that and approach the same branch.

I created a dd for admission in paramedical course now I don’t want to take admission that’s why I want to cancel dd. When go to bank they said that You have to release the dd then we cancel it. I should I do.

If you don’t need the DD you have to submit it to bank and then only will they cancel it.

There would be cancellation charges too

I make a DD of rs 8450/- and need to cancel it. What is the maximum time limit to cancel this draft. Within how many day i have to cancel it or their is no any time limit for the same.

I also want to know that i made DD from yes bank mysore branch but now i am in pune. Can i cancel that draft from pune yes bank branch or i have to visit mysore to cancel it out.

Can we cancle the draft of same bank from any branch ?

Is necessary to give DD to benificier

I have taken a did with 23,700/-rs and for charge I paid 119/-rs bt I need did of 23,730… How can I change the amount on dd? If I cancel it and again submit it with my required amount then again bank will b charge me among of 120/-appox… So wts the solution….?

I have a Demand draft is more than 10 months Can I cancle this draft.

Yes if you don’t need it.

a Demand Draft is not automatically cancelled.

DD validity is 3 months. Even if it exprires you need to go to the bank branch where you made the draft to get it cancelled

Yeah its possible. Just go to the bank and say give my money back you fuckers, and just like that problem solved.

i wants to make DD of app, amount 9-10 lack rupees by cash payment. I am from USA and i don’t have bank account in INDIA. Does it possible to get DD of same amount by cash deposit ?

Multiple small amount DD also excepted.

Can the particulars(esp name of payee)of dd be changed without change of dd number??

Can I make DD if i have not cheque and cash but I have money in my account but my account is in Pradhan mantri jan dhan yojna.

I went to cancel demand draft for rs5000/ .The branch ofstate bank of india chrged rs 230/ as c

ancellation cgarges where the other barnch of sbi informed that the charges are rs100/

please confirm the exact correct amount

Cancellation charges of SBI are Rs 115(100 Rs + service charge)

I have received a DD issued by citibank from ebay as refund for an item i purchased from their site.On top of the DD its clearly printed that its “A/C payee only”.Can someone tell me how should i proceed in order to redeem this DD?Do i need to visit any of Citibank’s branches in person in order to collect the payment or can i have the funds transferred directly to my bank a/c if i submit this draft to the bank where i have an account?

Go to ur bank and submit that u will get amt in ur bank ac ask staffabt the process

I have a demand draft of 18500 issued by Canara bank in 2011. Is there any means I can get the cash back?

It’s quite surprising to know that why do banks charge for cancellation of DD by the purchaser, while paying entire amount to the beneficiary on his submission for discount? It’s quite unjustifiable to collect money for cancellation when it is purchased for full value with a fee for purchasing…!!?? How does it make difference whether the DD is submitted to the bank for payment either by the purchaser or by the beneficiary noted thereon?

How can I change the name in a did without cancellation

Have you made the Demand Draft or you have got the Demand Draft?

Why do you want to get it changed?

If you have made the demand draft then you can approach the bank and bank may oblige depending on your relationship with the bank

The Branch Manager

Dear Sir,

Ref: Account No.————————–

Enclosed please find one Demand Draft No. ——– dated for Rs. issued in favor of

Please amend the name of the payee on the aforesaid Demand Draft as follows :-

Sorry for the inconvenience caused to you.

Thanking you,

Yours faithfully,