Disasters strike unnoticed,usually without announcing their arrival. One can mitigate the effect of eventualities on your family finances by buying insurance. Insurance provides financial protection against unexpected events. By buying insurance one effectively transfers a portion of his risk to insurance company. Yes this protection comes at a price but just like wearing a helmet increases our chances of surviving a fall or a crash or a collision so does buying an insurance especially Life insurance when one is not around. This article is about understanding basics of Insurance -Life and Non Life or General. What is insurance, which insurance is compulsory? Who regulates insurance in India? Terms related to insurance,List of life and non life insurers. Examples of life insurance and private car insurance, tax benefits , exemptions related to insurance,Things to consider before buying an insurance plan.

Insurance is basically a contract,a policy, between us and the insurance company. The insurance company promises you to pay a certain agreed amount,sum assured, on happening of an uncertain event.When we buy insurance we transfer a portion of risk to the insurance company. This protection comes at a price,premium, but (hopefully) it’s at fraction of cost what we might find otherwise ourselves burdened with. Based on what we are protecting or insuring, Insurance can be basically divided into two categories:

- Life Insurance :Life insurance is a risk management tool meant to offer financial protection to dependents in the unfortunate event of your death. Its purpose is to enable one’s dependents to maintain their current life style and pursue their life goals.

- Non Life or General Insurance : Its all insurance that is not life insurance such as health insurance, auto insurance, home insurance, travel insurance. Got a risk of any kind , insurance will cover it for a price of course.

In india most of Life/General Insurance is optional except Third party liability policy which is compulsory for every motorized vehicle in India. If you own a car and you do not have a third-party liability insurance, it’s an illegal act. IRDA’s History of Insurance in India gives historical details on insurance in India.

Table of Contents

Insurance Regulatory and Development Authority (IRDA)

Insurance Regulatory and Development Authority (IRDA) is an autonomous apex statutory body which regulates and develops the insurance industry in India. It was constituted by a Parliament of India act called Insurance Regulatory and Development Authority Act, 1999.

| Bajaj Allianz Life Insurance Company Limited | Birla Sun Life Insurance Co. Ltd | HDFC Standard Life Insurance Co. Ltd |

| ICICI Prudential Life Insurance Co. Ltd | ING Vysya Life Insurance Company Ltd. | Life Insurance Corporation of India |

| Max Life Insurance Co. Ltd | Kotak Mahindra Old Mutual Life Insurance Limited | SBI Life Insurance Co. Ltd |

| Tata AIA Life Insurance Company Limited | Reliance Life Insurance Company Limited. | Aviva Life Insurance Company India Limited |

| Sahara India Life Insurance Co, Ltd | Shriram Life Insurance Co, Ltd. | Bharti AXA Life Insurance Company Ltd. |

| Met Life India Insurance Company Ltd | Future Generali India Life Insurance Company Limited | IDBI Federal Life Insurance |

| Canara HSBC Oriental Bank of Commerce Life Insurance Company Ltd. | AEGON Religare Life Insurance Company Limited. | DLF Pramerica Life Insurance Co. Ltd |

| Star Union Dai-ichi Life | IndiaFirst Life Insurance Company Limited | Edelweiss Tokio Life Insurance Co. Ltd |

Terms associated with Insurance Plan

Insurance is basically a legal contract between you and the insurance company except for Group Insurance which covers a group of individuals simultaneously. It is typically issued to an employer for the benefit of employees or to members of an association. Some words associated with Insurance are as follows:

Policy holder : The person who buys an insurance policy. Also referred to as the ‘insured’.

Policy : The legal document issued by an insurance company to a policyholder that states the terms and conditions of an insurance contract.

Policy tenure or Term : The period for which an insurance policy provides cover or the number of years you choose to insure yourself. Policy terms vary from a single year many years. Not all policies offer you a range of terms.

Premium: The amount paid by the insured to the insurer to buy cover or the amount of money you have to pay to continue your insurance coverage.The premium amount depends upon

- State of the thing being insured : for example in case of life, health insurance age of person, for car insurance age of vehicle.

- Policy selected

- Mode of premium payment:We can choose to pay premium monthly, quarterly, half yearly or annually. There are also Single premium policies where we pay premium once only.

- Term of the policy – how long the policy covers.

- Term of premium payment – how long do we pay premium.

Premium paying term – the number of years you pay premium on your policy. Usually the premium paying term is the same as the policy term. However, some policies offer you the option of selecting a premium paying term that is lower than the policy term.

Agent – They serve as an intermediary between the insurance company and the insured. AAgents are only responsible for the timely and accurate processing of forms, premiums, and paperwork.

Age limits – Most of the Insurance plans have stipulated minimum and maximum ages below and above which the Insurance Company will not accept applications or may not renew policies.

Beneficiary – Person(s) named in the policy as the recipient of insurance proceeds upon the death of the insured.

Assignee – Assignee is the person to whom the benefits under a life or Travel policy are assigned.

Claim – An insurance claim is the actual application for benefits provided by an insurance company. Policy holders must first file an insurance claim before any money can be disbursed to the hospital or repair shop or other contracted service. The insurance company may or may not approve the claim, based on its own assessment of the circumstances. Usually, this process is handled by a service provider to the insurance company. This service provider is called a “Third Party Administrator”.

Riders: Additional covers that can be added to a life policy, for a cost For example – If Akshay, has taken a policy which offers a sum assured of Rs. 10 lakhs and has taken an accidental death benefit rider of an additional Rs. 10 lakhs. In the event of death of the policy holder due to an accident during the tenure of the policy, the nominee would get Rs. 20 lakhs as the death benefit.

Grace Period – Policy holders are expected to pay premium on due dates, a period is 15-30 days is allowed as grace to make payment of premium, this period is called grace period.

Lapsed Policy – A policy which has terminated and is no longer in force due to non-payment of the premium.

Reinstatement – The restoration of a lapsed policy to in-force status. Reinstatement can only occur after the expiration of the grace period. The company may require evidence of insurability (and, if health status has changed, deny reinstatement), and will always require payment of the total amount of past due premium.

Nomination – An act by which the policy holders authorizes another person to receive the policy moneys. The person so authorized is called Nominee.

Guaranteed Policies – These are policies where the payment stays fixed.

Let’s look at example of simplest Life Insurance policy Term Plan and Car insurance.Note: We have no tieups with LIC or TATA AIG and we are not recommending the companies. The policy was picked randomly.

Example of Life Insurance : Term Plan

A term plan is a pure protection plan. It covers only the risk of dying of person who has taken the plan,policy holder, from the insurance company, insurer. Further, rising aspirations have led to an increase in liabilities, such as home loans/mortgages. Hence, protection is required not only for financial security but also to provide a safety net for meeting liabilities. Let’s look at LIC Amulya Jeevan – I overview

ELIGIBILITY CONDITIONS are

- Minimum age at entry – 18 Year (Completed)

- Maximum age at entry – 60 years (nearest birthday)

- Maximum age at maturity – 70 years

- Policy term – 5 to 35 years

- Minimum Sum Assured – Rs.25,00,000/-

- Maximum Sum Assured – No upper limit ,Sum Assured shall be in multiples of Rs.1,00,000/-)

MODE OF PAYMENT OF PREMIUMS : Premiums may be paid Yearly, Half-yearly or by Single Premium mode.

PREMIUM RATES : The table below provide specimen tabular premium for various age-term combinations for Rs. 1000/- Sum Assured for premium paid annually. For example if person of age 35 (column 1) takes LIC Amulaya Jeevan Policy for 10 years ( 3 column) for 1000 rupees, he will have to pay 2.64 Rs. If he takes policy for 1,00,000 then his premium will be (2.64 * 1,00,000)/1,000 = 264 Rs. If he takes for 10 lakhs (10,00,000) then his premium will be (2.64 * 10,00,000)/1,000 = 2,640 Rs

| Age (yrs.) |

Term of the Policy (years) | ||||||

| 5 | 10 | 15 | 20 | 25 | 30 |

35

|

|

| 20 | 1.97 | 1.97 | 1.97 | 1.97 | 2.05 | 2.18 | 2.38 |

| 25 | 2.07 | 2.07 | 2.08 | 2.18 | 2.35 | 2.61 | 2.94 |

| 30 | 2.13 | 2.19 | 2.36 | 2.57 | 2.92 | 3.36 | 3.88 |

| 35 | 2.43 | 2.64 | 2.94 | 3.40 | 3.97 | 4.65 | 5.47 |

| 40 | 3.04 | 3.43 | 4.07 | 4.81 | 5.70 | 6.77 | – |

Premium for For Sum Assured = Rs.50,00,000 , Policy Term = 25 years

- Age 30 = (2.92 * 50,00,000)/1000 = 14,600

- Age 35 = (3.97 * 50,00,000)/1000 = 19,850

- Age 40 = (5.70 * 50,00,000)/1000 = 28,500

Example of Vehicle Insurance : Car Insurance

Vehicle Insurance provides cover against risk related to your vehicle :

- theft or damage to it

- death of driver and passengers in the accident

- damage caused by your vehicle to another person or property.

Each vehicle has a Sum Assured called the Insured’s Declared Value (IDV) of the vehicle. This is the value of the car at the beginning of the policy calculated on the basis of the manufacturer’s listed selling price of the brand and model after deducting depreciation. Electronic items, theft kit, LPG/CNG kit, etc. can be added to the sum insured over and above the IDV. In this plan, premium needs to be paid every year to renew the plan. If there has been no claim in the previous year from this insurer or any, a No Claim Bonus is also payable.

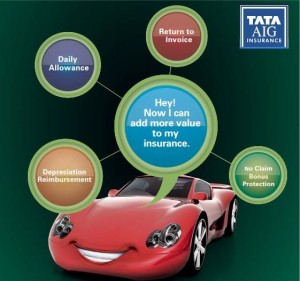

Let’s look at Tata AIG’s Auto Secure insurance plan for private cars. It is comprehensive plan which offers complete protection for your car. It has 8 unique add-ons covers which also can be purchased to ensure greater protection. The plan can be purchased online. The Key Feature Document(KFD) (pdf) covers details of the Tata AIG policy, Policy Wordings (pdf) are the exact policy wordings.

Key Features of Tata AIG Private Car Insurance Policy

- Direct Cashless Claim settlement in network garages across India

- Free car pick-up

- Upto 6 months accident repair warranty

- Claim settlement in 7 days

- 8 unique Add-On covers which can be purchased optionally

Schedule of depreciation for fixing IDV of the Vehicle for insurance

| Age of Vehicle | % of Depreciation |

| Not exceeding 6 months | Nil |

| Exceeding 6 months but not exceeding 1 year | 15% |

| Exceeding 1 year but not exceeding 2 year | 20% |

| Exceeding 2 year but not exceeding 3 year | 30% |

| Exceeding 3 year but not exceeding 4 year | 40% |

| Exceeding 4 year but not exceeding 5 year | 50% |

| Exceeding 5 year but not exceeding 10 year | 40% |

| IDV of vehicles greater than 5 year and of obsolete models is to be determined on the basis of an understanding between the insurer and the insured | |

Add On Coverage – This plan offers additional coverage with some add on features given below, for more details check out Tata AIG’s Auto Secure webpage

- Depreciation Reimbursement- This cover offers full claim without any deduction for depreciation on the value of parts replaced. The cover is available for vehicles up to 3 years old and operates for maximum 2 claims during the policy period.

- Return to Invoice : This cover pays the difference between the ‘claim amount receivable’ under the policy and the ‘purchase price of vehicle’ as per invoice in case the vehicle is declared a Total Loss or a Constructive Total Loss.

- Daily Allowance: This cover pays a fixed sum towards hiring a transport while the vehicle is under repair for a valid claim and the repair time is more than 3 days.

- No Claim Bonus Protection: Normally in case of a claim, the ‘No Claim Bonus (NCB)’ component of your car insurance policy gets impacted. However under this cover, the existing NCB can be retained. Such a retention of NCB will be applicable in case of certain claims if the bonus accumulated is 25% or more and there is no claim in the preceding 2 years. NCB Protection is available only if vehicle is renewed with Tata AIG.

Tax and Insurance

Section 80C : Deduction is available amounting to Rs. 1,00,000 which can be invested in life insurance premiums, pension superannuation fund, employee provident fund, equity linked mutual fund schemes (ELSS), National Savings Certificates and public provident fund. The benefit for life insurance premium under section 80 C is restricted to 20% of the actual capital sum assured. Surrender of Plan before premium has been paid for two years will result in reversal tax benefit

Section 80CCC: Deduction in respect of contribution to pension funds

- Maximum Rs. 1,00,000

- Surrender/Withdrawal will be subjected to tax.

- Pension received will be subject to tax.

Section 80 CCE : Under Section 80CCE, the overall limit for deduction u/s 80C, u/s 80CCC and u/s 80CCD is Rs. 1,00,000/-.

Section 80D: Deduction in respect of medical insurance premium

- Individual or HUF whether resident or non resident

- Premium can be paid by any mode other than cash

- Premium paid out of income chargeable to tax..

- For individuals less than 65 years the maximum deduction is Rs.15,000/- and for senior citizens age 65 years and above the deduction is Rs. 20,000/-.

- Additional deduction allowed for individuals for taking health insurance for parents as under:Where parents are aged below 65 years Rs. 15,000/- Where parents are aged 65 years & above Rs. 20,000/-

Exemption from the proceeds

Commuted pension: 10(10A)(iii): One-third of the Value at vesting date would be tax-free

Section 10(10D)

- Any sum received from insurance policy as death benefits

- Sum received as maturity proceeds: An Insurance policy issued on or after the 1st day of April 2003 but on or before the 31st day of March, 2012 in respect of which the premium payable for any of the years during the term of the policy exceeds 20 % of the actual capital sum assured will not be eligible for Sec 10(10D) benefit. Further any sum ( not including the premium paid ) received other under an insurance policy issued on or after the 1st day of April 2012 in respect of which the premium payable for any of the years during the term of the policy exceeds 10% of the actual capital sum assured will no longer be exempted under this section .

- Single premium policies will be taxed as income in the year it is received assuming the premium exceeds 20% of the sum assured.

Things to consider before buying an insurance plan

- Why are you buying an insurance plan – for insurance, investment, tax saving?

- Cover or Sum Assured : How much do you get insured for?

- Tenure : How long the policy should be?

- How to buy: Agent, Offline or Online.

- Add Ons or Riders: Do they make sense? Are they expensive than buying separate plans?

- Claim : How to claim?

Insurance is popularly bought for tax saving purpose and investment by people.The primary purpose of an insurance policy is to provide financial protection against uncertainties . Buy insurance for right reasons and research, compare before deciding one.

One response to “Basics of Insurance”

[…] Basics of Insurance […]