Thieves skim Rs 10lakh from cards of 200 Bengalureans in a week, said the headline of report in Times of India July 2017. Police suspect that gangs have placed advanced card skimmers, which can read debit and credit card data during usage, with pinhole cameras in ATMs across the city to copy card data and capture PINs. This article talks about ATM Card Fraud, How does ATM Card Skimming happens? What is ATM Card Skimming? Precautions on using ATM card, How to raise Cyber Complaint ?

Table of Contents

About ATM Card Fraud

Thieves skim Rs 10lakh from cards of 200 Bengalureans in a week, said the headline of report in Times of India July 2017. There is a surge in complaints of illegal withdrawals from across the city, mainly from ATMs in BTM Layout, Hennur, Geddalahalli, Indiranagar and a few in Mumbai and Thane.

Advertising professional Rajith Ravi from Cooke Town got a shock at 11.53 pm on Monday when his cell phone buzzed with messages indicating three withdrawals worth Rs 30,000 from his HDFC bank account from an ATM in Thane. “I opened my wallet but my debit card was inside. I didn’t know how someone withdrew my money without my card or PIN,” said Ravi, after lodging a complaint at the cybercrime police station at Bengaluru commissioner

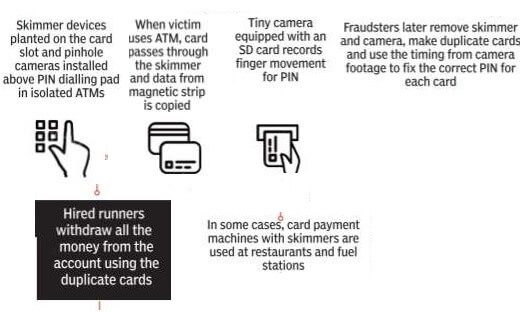

Skimmer devices & pin capturing devices planted in isolated ATM. Later Fraudsters make duplicate cards and recover PIN numbers. The cards with PIN numbers are used to withdraw money. The image below shows how ATM Fraud happens

ATM Card Skimming

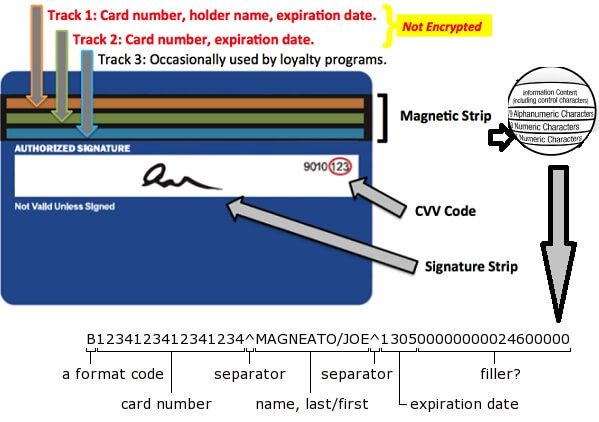

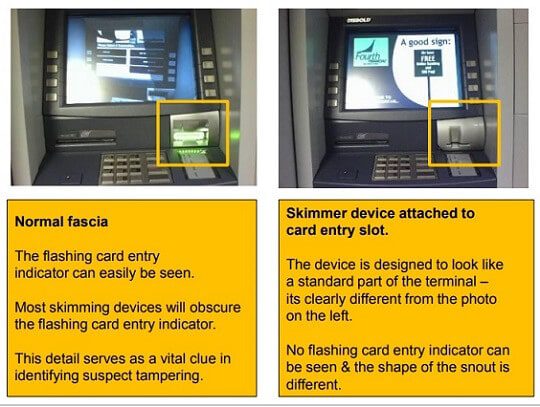

To capture data from the magnetic strip on the card, small devices are used and are often fastened in close proximity to, or over the top of the ATM’s factory-installed card reader. Such skimming attacks are here to stay and will continue to be a problem even for EMV chip cards. Example of ATM Card Skimmer from ATM awareness Guide(pdf) is shown in the image below. Krebs on Security has a well-documented page on credit card skimming and several pictures of credit card skimmers that demonstrate how difficult it is to detect the devices, which have become smaller and more difficult to detect over the years

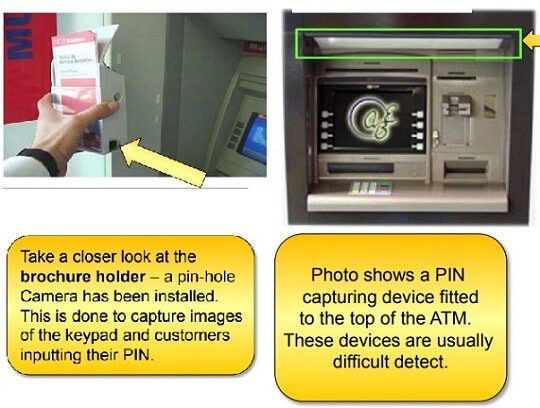

PIN Capturing

To use the card, one needs a PIN or Personal Identification Number. The PIN is not printed or embedded on the card but is manually entered by the cardholder. To steal the PIN thieves strategically put cameras and other imaging devices to ATMs which captures the PIN numbers. The PIN is then used with the fraudulent card and theives withdraws money from accounts.

Precautions on using ATM card

Register yourself for SMS alert whenever your account is accessed.

- Preferably use an ATM which is within bank premises or manned 24 hrs by a security guard.

- Avoid using ATMs which are in isolated places, dimly lit locations or on the streets.

- Preferably use the same ATM machine so that you are familiar with it and may notice any ‘unwanted’ changes.

- Do not use the ATM where the card reader appears to be tampered with, broken, scratched, damaged, sticky with glue, has extra wiring or loose parts around the slot, difficulty in inserting the card etc. These could be signs of skimming machine having been installed.

Precautions for PIN

- Memorise your PIN. Do not write it down anywhere,and certainly never on the card itself

- Your card is for your own personal use. Do not share your PIN or card with anyone, not even your friends or family

- “Shoulder surfer” can peep at your PIN as you enter it. So stand close to the ATM machine and use your body and hand to shield the keypad as you enter the PIN

- Do not take help from strangers for using the ATM card or handling your cash

- Never count cash at the machine or in public. Wait until you are in your car or another secure place.

- Press the ‘Cancel’ key before moving away from the ATM. Remember to take your card and transaction slip with you

- If you take transaction slip, shred it immediately after use

- If your ATM card is lost or stolen, report it to your card-issuing bank immediately

- Change your PIN numbers as often as convenient.

How to report Cyber Crime

Cybercrime is a criminal activity which is carried on by the use of computers and the Internet. Some of the common cyber crimes are hacking, cyber stalking, denial of service attack(DoS), virus dissemination, software piracy, credit card fraud & phishing.

The law which governs the cyberspace that is the networks, computers, data storage devices (hard disks, USB disks etc.), websites, emails, cell phones, ATM machines is called Cyber Law. To combat offences related to cyber law the Information Technology Act, 2000 was enacted. The Indian Penal Code and other special laws have also been amended to take to take into purview various cybercrimes.

To tackle the issue of cyber crimes, CIDs (Criminal Investigation Departments) of various cities opened up Cyber Crime Cells in different cities.

The Information Technology Act of India states clearly that when a cyber crime has been committed, it has a global jurisdiction. and hence a complaint can be filed at any cyber cell.

A complaint can be filed by sending a letter, or online, via email or making a phone call or even an SMS can be sent to the official’s number it is advisable that the victim should meet the officials personally as not many cyber complaints are converted into FIR. For more information read WHAT IS CYBER CRIME AND HOW TO REPORT ONE?

Here are the steps to file a complaint with the cyber cell:

Step one: Write a formal complaint addressing it to the head of the cybercrime cell

Step two: Provide the following things with the application-

- Name

- Address

- Email address

- Telephone no.

- Server Logs/Reciepts/Messages

Step three: Provide more information related to your case

Cyber Crime Cells in India:

Some of the Cyber Crime Cells are given below

| BANGALORE CYBER CRIME POLICE STATION, CID ANNEXE BUILDING, CARLTON HOUSE, # 1, PALACE ROAD, BANGALORE – 560001. TELEPHONE: +91- 080- 22942475, +91- 080- 22943050 EMAIL: CYBERCRIMEPS@KSP.GOV.IN WEBSITE: http://www.cyberpolicebangalore.nic.in |

CHENNAI SIDCO ELECTRONICS COMPLEX, BLOCK NO. 3, FIRST FLOOR, GUINDY INDUSTRIAL ESTATE, CHENNAI -32 PH: 044 22502526 EMAIL: SPCYBERCBCID.TNPOL@NIC.IN WEBSITE:HTTP://CBCID.TN.NIC.IN |

| DELHI CENTRAL BUREAU OF INVESTIGATION, PLOT NO. 5-B, 6TH FLOOR, CGO COMPLEX, LODHI ROAD, NEW DELHI – 110003 PH:+91-11-4362203, +91-11-4392424 WEBSITE:HTTP://CBI.NIC.IN/ E-MAIL: CBICCIC@BOL.NET.IN |

MUMBAI CYBER CRIME INVESTIGATION CELL, ANNEX III, 1ST FLOOR, OFFICE OF THE COMMISSIONER OF POLICE, D.N.ROAD, MUMBAI – 400001 PH: +91-22- 24691233 WEB SITE: HTTP://WWW.CYBERCELLMUMBAI.GOV.IN E-MAIL ID: CYBERCELL.MUMBAI@MAHAPOLICE.GOV.IN |

| HYDERABAD IN CHARGE CYBER CRIME POLICE STATION, HYDERABAD CITY. EMAIL : CYBERCELL_HYD@HYD.APPOLICE.GOV.IN PH:04027852040 WEBSITE:HTTP://WWW.HYDERABADPOLICE.GOV.IN |

WEST BENGAL DIG CID IIIRD FLOOR ,BHAWANI BHAWAN ALIPORE, KOLKATA – 700 0027 PHONE NUMBERS – 033 2450 6100 FAX NUMBER – 033 2450 6174 EMAIL :MAIL@CIDWESTBENGAL.GOV.IN WEBSITE: HTTP://CIDWESTBENGAL.GOV.IN |

Related Articles

- List of Articles About Loans, Debt, Credit Cards, CIBIL Report

- All about ATM, how to Bank using ATM

- Withdraw money using credit card from ATM: How to, Charges

I have taken a home loan in 2004 and it is going to be cleared by the end of this year (Mar-18).

In April 2017 I have taken another home loan.

In AY 2018-19 I will show 1st house as self occupied and second house as let out.

When it comes to AY 2019-20 I will not have either income or loss on my first house since it is self occupied and there is no loan repayment.

Can I show income from house property only from my second house so that I can claim repayment of principle also under section 80-c.